Diversification is a fundamental principle of prudent investing due to its ability to mitigate/minimize risks. In fact, it has been called the only free lunch in investing because, done properly, it can reduce risk without reducing expected returns. This led to the conclusion that investors should diversify by including international equities, including emerging markets, in their portfolios, preferably on a market-cap-weighted basis.

In his 2007 bestseller “The World Is Flat,” Thomas Friedman depicted a globalized marketplace where geographical divisions were becoming less relevant — a more connected/integrated economy results in a reduction in investment diversification benefits. If geographic diversification is becoming less important, because international equities are becoming less unique sources of risk, there are important implications for portfolio construction.

John Cotter, Stuart Gabriel and Richard Roll, authors of the April 2018 study, “Nowhere to Run, Nowhere to Hide: Asset Diversification in a Flat World,” sought to determine the level of economic integration based on the proportion of asset returns that can be explained by an identical set of global factors. They estimated the amount of return integration within and among equity, fixed income and real estate asset classes, as well as countries, defining their diversification index as 100 minus the level of integration (adjusted R-square).

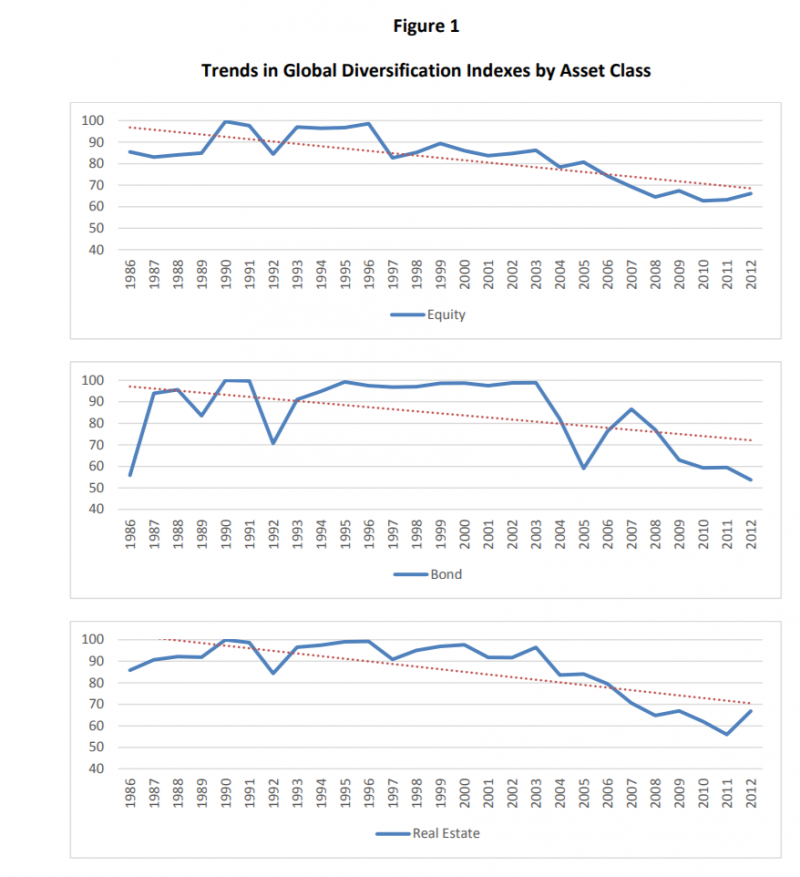

For each available country, the authors’ diversification index is computed from the average R-square in a multi-factor asset return model fitted using daily data within each year from 1986 through 2012. The global factors are 16 principal components (common factors from stock, bond and real estate markets) obtained from existing markets pre-1986 but updated each calendar year. The index takes on values between 0 and 100, where 0 indicates no diversification potential whereas 100 implies maximum diversification benefits. Figure 1, sourced from the original paper, highlights the key takeaway: The potential benefits of diversification are trending lower over time.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Here is a formal summary of their findings:

- There has been a substantial decline in diversification indexes over the period of the financial crisis and beyond, revealing a pronounced uptrend in integration within and among asset classes and countries.

- The decline in diversification potential is widespread among country cohorts and has been precipitous in the post-2000 period.

- Internet diffusion is associated with significantly dampened diversification potential in both equity and REIT assets classes in both the pre- and post-2000 periods. The estimated internet effects are more pronounced in the more recent period, in the wake of increased internet diffusion.

- Diversification indexes for equity, sovereign debt, and REIT asset classes decline from a maximum level of 100 in the late 1990s to roughly half that level by 2012. A similar result is observed for a global index comprised of all three asset classes.

- The trend is downward with little evidence of differences in bull and bear markets, or during periods of high and low market volatility.

- Older and more established markets display a larger downtrend in the diversification indexes.

- The generalized downtrend in diversification potential is associated with higher levels of investment risk.

- Some countries, notably including many Middle Eastern and African nations, persistently display only weak integration with the global economy. While those areas may provide increments to portfolio diversification, they are often subject to substantial security, political and economic risks, along with higher transaction costs and lower liquidity.

- Consistent with the “world is flat” hypothesis, developmental factors, and, especially, internet technology and communications innovation, are associated with declines in diversification indexes among all asset classes.

- Global events also are associated with diminished investment diversification opportunity. These findings are robust to the inclusion of various factors, including credit risk as proxied by the TED (Treasury to euro) spread, the Malcolm Baker and Jeffrey Wurgler measure of investor sentiment, country-specific economic and political risk as computed from the International Country Risk Guide, equity market implied volatility (VIX), and market liquidity.(1)

- When global returns to an asset class are well integrated, the potential benefits of geographic diversification are meager. Diversification index levels and risk are strongly negatively correlated for each of the three asset classes, with correlation coefficients over the full sample period of -0.648 for equities, -0.462 for bonds and -0.735 for REITs.

- The strongest downtrend is for real estate, followed closely by equities.

The authors concluded that declines in diversification potential are associated with country economic development and internet diffusion. They added: “The results offer a cautionary note regarding asset class and geographic diversification of investment risk in an increasingly flat world.”

The evidence presented seems to make a compelling case. However, before you jump to any conclusions, let’s look at the issue and the evidence through a different lens.

Does it Really Matter If Correlations Are Rising?

It is certainly true that the recent financial crisis saw the correlation of all risky assets rise sharply. But, should that lead you to conclude the investment world is flat and the benefits of global diversification are mostly gone?

Let’s suppose that for whatever reason global equity markets have become more closely correlated. Would that make global diversification unappealing? It’s hard to see why that would be the case. Would it make sense for U.S. citizens to restrict their ownership of auto industry stocks to Ford and eliminate firms such as Toyota or Porsche from consideration? And how you think Japanese investors, who experienced a multi-decade bear market in domestic stocks beginning in 1990, would answer this question about the benefits of global diversification? Do you think they believe international diversification doesn’t make sense in this “new era”? And how do we know the U.S. market will not turn out to be the next Japan?(2)

Another important point is that even if correlations are rising, that doesn’t mean there isn’t a significant benefit from diversifying risks. What really matters is the size of the dispersion of returns. As the following table shows, since 2000, when correlations started to rise, there have been very wide dispersions of returns between the S&P 500 Index, the MSCI EAFE Index and the MSCI Emerging Markets Index. The wide dispersion of returns in almost every year demonstrates there are still large diversification benefits.

| A | B | C | D | E | |

| Year | S&P 500 (%) | MSCI EAFE (%) | MSCI Emerging Markets (%) | A-B (%) | A-C (%) |

| 2000 | -9.1 | -14.2 | -30.6 | 5.1 | 21.5 |

| 2001 | -11.9 | -21.4 | -2.4 | 9.5 | -9.5 |

| 2002 | -22.1 | -15.9 | -6.0 | -6.2 | -16.1 |

| 2003 | 28.7 | 38.6 | 56.3 | -9.9 | -27.6 |

| 2004 | 10.9 | 20.2 | 26.0 | -9.3 | -15.1 |

| 2005 | 4.9 | 13.5 | 34.5 | -8.6 | -29.6 |

| 2006 | 15.8 | 26.3 | 32.6 | -10.5 | -16.8 |

| 2007 | 5.5 | 11.2 | 39.8 | -5.7 | -34.3 |

| 2008 | -37.0 | -43.4 | -53.2 | 6.4 | 16.2 |

| 2009 | 26.5 | 31.8 | 79.0 | -5.3 | -53.5 |

| 2010 | 15.1 | 7.8 | 19.2 | 7.3 | -4.2 |

| 2011 | 2.1 | -12.1 | -18.2 | 14.0 | 20.1 |

| 2012 | 16.0 | 17.3 | 18.6 | -1.3 | -2.6 |

| 2013 | 32.4 | 22.8 | -2.3 | 9.6 | 34.7 |

| 2014 | 13.7 | -4.9 | -1.8 | 18.6 | 15.5 |

| 2015 | 1.4 | -0.8 | -14.6 | 2.2 | 16.0 |

| 2016 | 12.0 | 1.0 | 11.6 | 11.0 | 0.4 |

| 2017 | 21.8 | 25.0 | 37.3 | -3.2 | 15.5 |

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Note that there were only three years out of the 18 when the difference in returns between the S&P 500 Index and the MSCI EAFE Index was less than 5 percent. On the other hand, there were nine years when it was at least 8 percent. And the average difference was 8 percent. There were also only three years when the return on the S&P 500 Index was within 3 percent of the return on the MSCI Emerging Markets Index. On the other hand, there were 14 where the gap was in double digits, seven when it was at least 20 percent, three when it was at least 30 percent, and the largest gap was more than 53 percent. The average difference was more than 19 percent.

The following table, showing the returns of various asset classes over the five-year period from 2003 through 2007, provides further powerful examples demonstrating that the investment world isn’t flat.

| Asset Class | 2003-2007 Annualized Return (%) |

| Russell 1000 Growth | 12.1 |

| Russell 1000 Value | 14.6 |

| MSCI EAFE Growth | 19.9 |

| MSCI EAFE Value | 21.3 |

| MSCI Emerging Markets | 37.0 |

| MSCI Emerging Markets Value | 39.5 |

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

This period was followed by the 10-year period from 2008 through 2017, with similarly wide dispersions in returns, this time favoring U.S. equities.

| Asset Class | 2008-2017 Annualized Return (%) |

| Russell 1000 Growth | 10.0 |

| Russell 1000 Value | 7.1 |

| MSCI EAFE Growth | 2.7 |

| MSCI EAFE Value | 0.6 |

| MSCI Emerging Markets | 1.7 |

| MSCI Emerging Markets Value | 0.9 |

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

The data presents pretty powerful evidence both that the investment world is far from flat, and that there are still significant benefits in international diversification. Clifford Asness, Roni Israelov and John Liew agree with that view. The trio authored the article “International Diversification Works (Eventually),” which appeared in the May/June 2011 edition of the Financial Analysts Journal. They note that while, “critics of international diversification observe that it does not protect investors against short-term market crashes because markets become more correlated during downturns … this observation misses the big picture. Over longer horizons, underlying economic growth matters more than short-lived panics with respect to returns, and international diversification does an excellent job of protecting investors.”

This is the same conclusion Marlena Lee of Dimensional Fund Advisors came to, as discussed in my post of November 1, 2010.

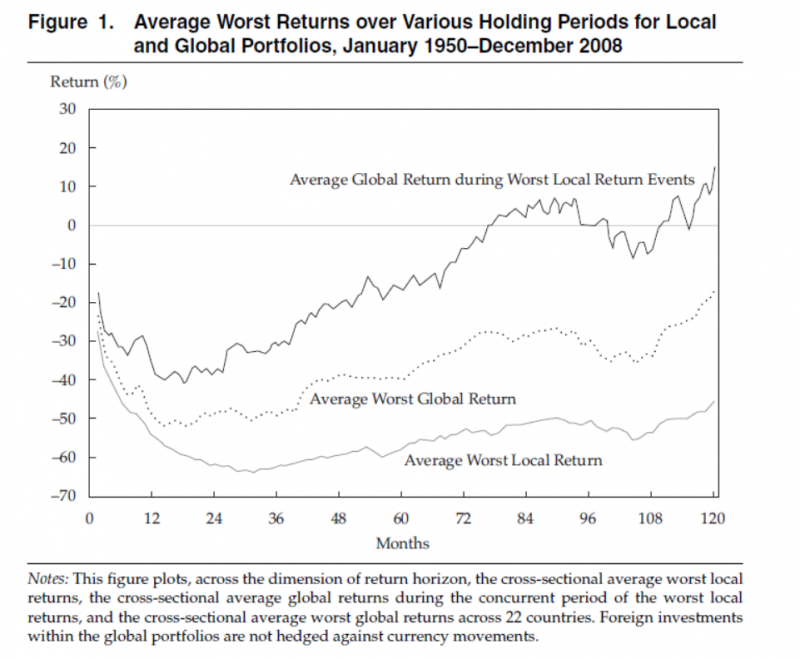

Asness and his co-authors analyzed diversification benefits from the perspectives of local investors in 22 countries for the period from 1950 through 2008. They looked at two portfolios, a local one as represented by the local stock market index and an unhedged (for currency risk) global portfolio, equally weighted for all 22 stock market indices.

The following is a summary of their findings:

- Simultaneous crashes can pose a problem for global diversification in the very short term by creating more severe tail events in global portfolios than in local portfolios. However, this difference is greatest at very short horizons and disappears after 3.5 years.

- Over periods as short as one month, the global portfolios’ worst cases were not much different from the local portfolios.

- Over longer horizons, the global portfolios’ worst cases were significantly better than those of the local portfolios, and the longer the horizon, the greater the diversification benefit (see the figure below from the paper).

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

- The average worst five-year return for the local portfolios was -57 percent (not all at the same time). When these local portfolios had their worst five-year losses, their global portfolio counterparts lost an average of 16 percent and the average worst five-year return for the global portfolios was -39 percent.

It is important that investors understand short-term returns tend to be more influenced by short-term changes in risk aversion (when systematic risks appear and investors all around the globe tend to panic and sell at the same time). On the other hand, long-term returns are driven more by economic performance. And long-term economic performance tends to be more variable across countries. Because we don’t know in advance which countries will suffer from protracted economic underperformance, international diversification protects investors.

Conclusion

While short-term crashes are scary, painful and occur with greater frequency than most investors believe, ultimately investors should care about long-term wealth creation and preservation. Thus, they should care about protecting against the risk that their home country will experience a long, persistent bear market. And global diversification provides the benefit of protection against such risks.

The conclusion that investors should draw is that while the increase in global integration has somewhat reduced the benefits of global diversification, the benefits are still large. In other words, while it may not be a free, three-course lunch, it’s still a hearty meal. And because this lunch doesn’t come with any calories, the logical conclusion remains the same as it has always been: You should eat as much of it as you can. Remember, the greatest diversification benefits with equity investments come from the asset classes of international small-cap stocks and emerging market stocks.

There is one more issue I need to address. The documented increased globalization and integration of markets means that while there are still diversification benefits, the uniqueness of the sources of risk provided by international equities has been reduced. That increases the importance and the benefits of alternative investments that do provide unique risk sources and that I have previously recommended investors consider: AQR’s Style Premia Alternative (QSPRX) and Alternative Risk Premia (QRPRX) funds, as well as three Stone Ridge funds — Reinsurance Risk Premium Interval Fund (SRRIX), Alternative Lending Risk Premium Fund (LENDX) and All Asset Variance Risk Premium Fund (AVRPX). (Full disclosure: My firm, Buckingham Strategic Wealth, recommends AQR and Stone Ridge funds in constructing client portfolios.)

References[+]

| ↑1 | See here for a post on an enhanced sentiment index approach. |

|---|---|

| ↑2 | The US is arguably an anomalous stock market |

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.