After a

There were four key developments for the ETF industry in 2018:(2)

- SPY is dying

- iShares provided the blueprint for a solution to SPY’s woes

- Low-cost ETFs gathered the bulk of all ETF assets

- Invesco acquired Oppenheimer Funds

In this post, we’ll cover those four developments, then we’ll discuss what it all means for the ETF industry going forward.

1.) SPY is dying, but it can be saved (sort of)

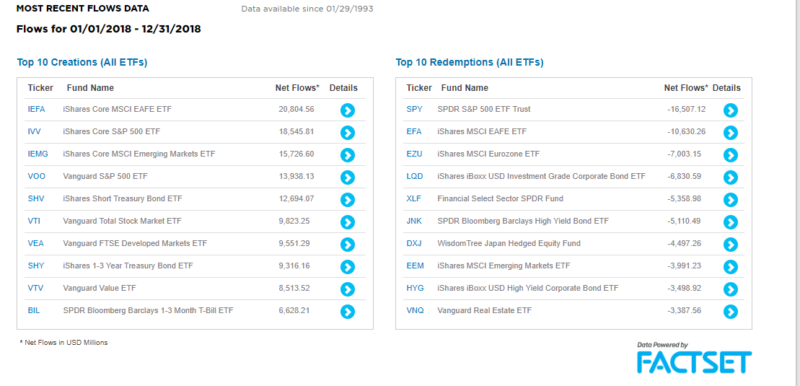

Here’s the chart of the top ten ETF Fund Flows for 2018:

From this, we can see that while 2018 was a good year for the ETF industry overall, SPY was hurting, and I only expect that pain to accelerate in 2019.

SPY’s edge is that has more trading volume than anything else on the planet. As it’s assets under management shrink, so too does its trading volume. If competing products have similar volume, cheaper expense ratios, and better structure…the game is over.(3) Right now SPY only has an advantage on one of those three (more volume/tighter spreads).

When exactly is that tipping point? That’s not clear to me. But the tipping point is on the near horizon if the trend continues with IVV + VOO picking up tens of billions per year and SPY losing tens of billions per year.

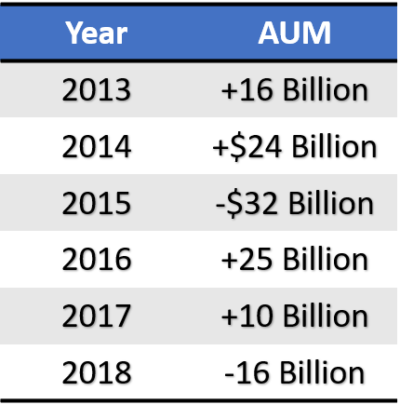

Here’s SPYs fund flows by year.

One year, a trend does not make. ~Yoda/Ronald O’Hanley, probably (State Street’s new CEO)

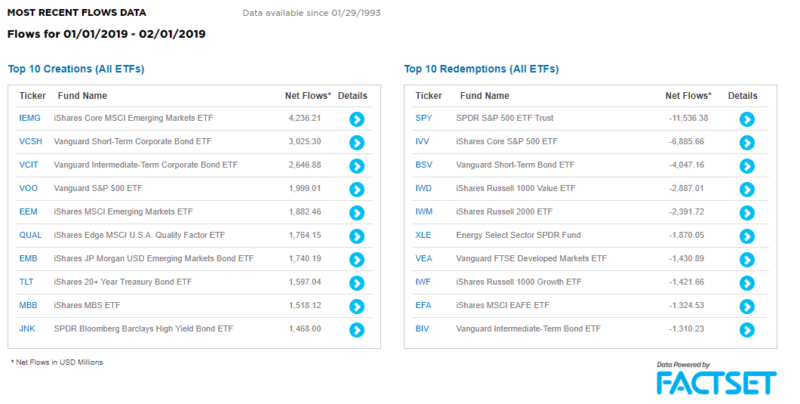

Here’s the top 10 fund flows year to

SPY with an additional ~$11 billion in outflows to start 2019. Ouch!

One counterpoint from this is that IVV also has ~$6 billion in outflows to start the year. But if you add that to their $18 billion in inflows for 2018, they’d still be +$12 billion in the last 13 months relative to SPY at -$28 billion. That’s a $40 billion spread. And the spread is actually what matters here as its the relative size of SPY that makes it the ideal trading tool and is its last remaining advantage over IVV and VOO.

I’m a lover, not a hater though. So here’s my completely unsolicited advice to State Street on how to remedy the situation.

Solution: State Street should launch an S&P 500 ETF that undercuts IVV and VOO.

You have a new CEO. You’ve laid off senior management. This is the best opportunity to keep the major changes going and make a statement that State Street is back on the offensive. SPY would be the trading tool (as that’s all it is now anyway), and the new SPY ETF would be the investing tool.

I wrote this about six weeks ago:

An alternative plan to really shake things up is to launch an S&P 500 fund, only don’t use the S&P 500 index. Create your own index of 500 large cap U.S. Equities. Then you don’t have to pay S&P the index licensing fee. I’ll be the first to admit indexing is harder than it gets credit for, but State Street has the resources to make it happen. That will help the argument for undercutting IVV & VOO as they wouldn’t be stuck paying S&P basis points for the index rights.

And, this is exactly what SoFi is now doing. State Street might as well beat them to the punch their increased distribution and know how.

2.) iShares Provides a Blueprint for Success

No ETF pulled in more assets than iShares Core MSCI EAFE ETF (IEFA) in 2018, as investors looked to invest in the “undervalued” international developed markets. On the other hand, iShares MSCI EAFE (EFA) had the second most outflows.

What’s going on here?

iShares successfully pulled off, with the launch of IEFA as the low-cost replacement to EFA in 2012, what I’m suggesting State Street should do with its cheaper/free ETF. EFA was making iShares a lot of money so cutting the expense ratio was untenable. However, they needed to compete with the (at the time) new low-cost competitors Schwab and Vanguard. So they launched IEFA in 2012 to compete with the low-cost competitors and left EFA untouched.

If iShares can pull off this plan with EFA/IEFA, State Street can pull this off with SPY/ cheaper SPY. But just like with IEFA, it could take a long time (seven years in the case of EFA/IEFA) to successfully pull it off.

3.) Low-Cost Reigns Supreme

The most expensive fund in the top ten inflows for 2018 charges 15 basis points or .15%. This is a trend

I wrote a longer piece on why it is unsurprising that the majority of flows are going to low-cost ETFs, as that is the way it should be. In every industry, the majority of the flows go to the low-cost leader as they produce the products that can scale to a mass audience. And due to razor-thin pricing margins, they need the scale.

Low cost will reign supreme in term of

Invesco buys Oppenhiemer Funds

Five years ago it would have been radical to suggest an ETF company would buy a mutual fund company (small or large). And yet, just that almost happened this year when hybrid mutual fund/ETF firm Invesco PowerShares stepped into the M&A arena. Invesco didn’t acquire just any mutual fund company: we’re talking about the behemoth, Oppenheimer Funds (assets under management of $246 Billion). With this acquisition, the combined company of Invesco PowerShares now manages over $1 trillion. (4)

The acquisition by PowerShares shows a major shift in the asset management landscape. Since the creation of ETFs, it was either mutual fund companies buying rapidly growing ETF companies or mutual fund companies starting their own ETF business from within. This is the first major deal that goes this direction (predominantly ETF company buying a major mutual fund company). That’s…a big deal. It makes the possibilities for future M&A in the industry a lot different.

The ETF Industry Grows Up

2018 brought the ETF industry large scale acquisitions, consolidation, and increased scale relative to competing industries. These are clear signs of one thing: The ETF industry is arguably a mature industry.

A decade ago there

Going forward, we can expect large scale acquisitions are (more than ever) possible as the industry further consolidates and the successful firms look to further protect their businesses. There are differences between the airline industry and ETF industry that will mean it’s not a perfect comparison, but there may be more in common than different.

References[+]

| ↑1 | Data from MorningStar. Going back to 1999 |

|---|---|

| ↑2 | With so many Buzzfeed employees being laid off, I figured someone needed to step in and provide the internet superhighway with the fuel it runs on: Lists. |

| ↑3 | SPY is structured as a UIT, which is different than how IVV and VOO are structured. The difference is fairly marginal, but when you’re all doing the same exact thing marginals differences are the only things that matter. |

| ↑4 | https://www.oppenheimerfunds.com/advisors/article/invesco-and-massmutual-announce-strategic-combination-of-invesco-and-oppenheimerfunds |

About the Author: Ryan Kirlin

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.