Factor Investing from Concept to Implementation

- Eduard van Gelderen, Joop Huij, and Georgi Kyosev

- Working paper

- A version of this paper can be found here(1)

What are the research questions?

There is a substantial debate on the topic of factor investing and whether or not the “backtested” excess returns are actually achievable in practice. Much of the research on the topic suggests that practitioners in the field are unable to capture any of the so-called “factor premiums”. For example, the debate is covered here, here, and here.

Turns out there is another literature that suggests factor premiums are potentially exploitable by practitioners (see here, here, and here). This paper is a recent example and serves as a counterbalance to the research we typically see, which suggests that factor premia, while interesting, are not viable in the real world. Important to note, this paper focuses on the relative performance of factor funds versus traditional active funds and does not focus on a horserace between factor funds and passive index funds. (2)

The authors seeks to address the following questions:

- Do mutual funds focused on factors earn excess returns over their stock-picking counterparts?

- Do investors invested in these factor funds earn excess returns?

What are the Academic Insights?

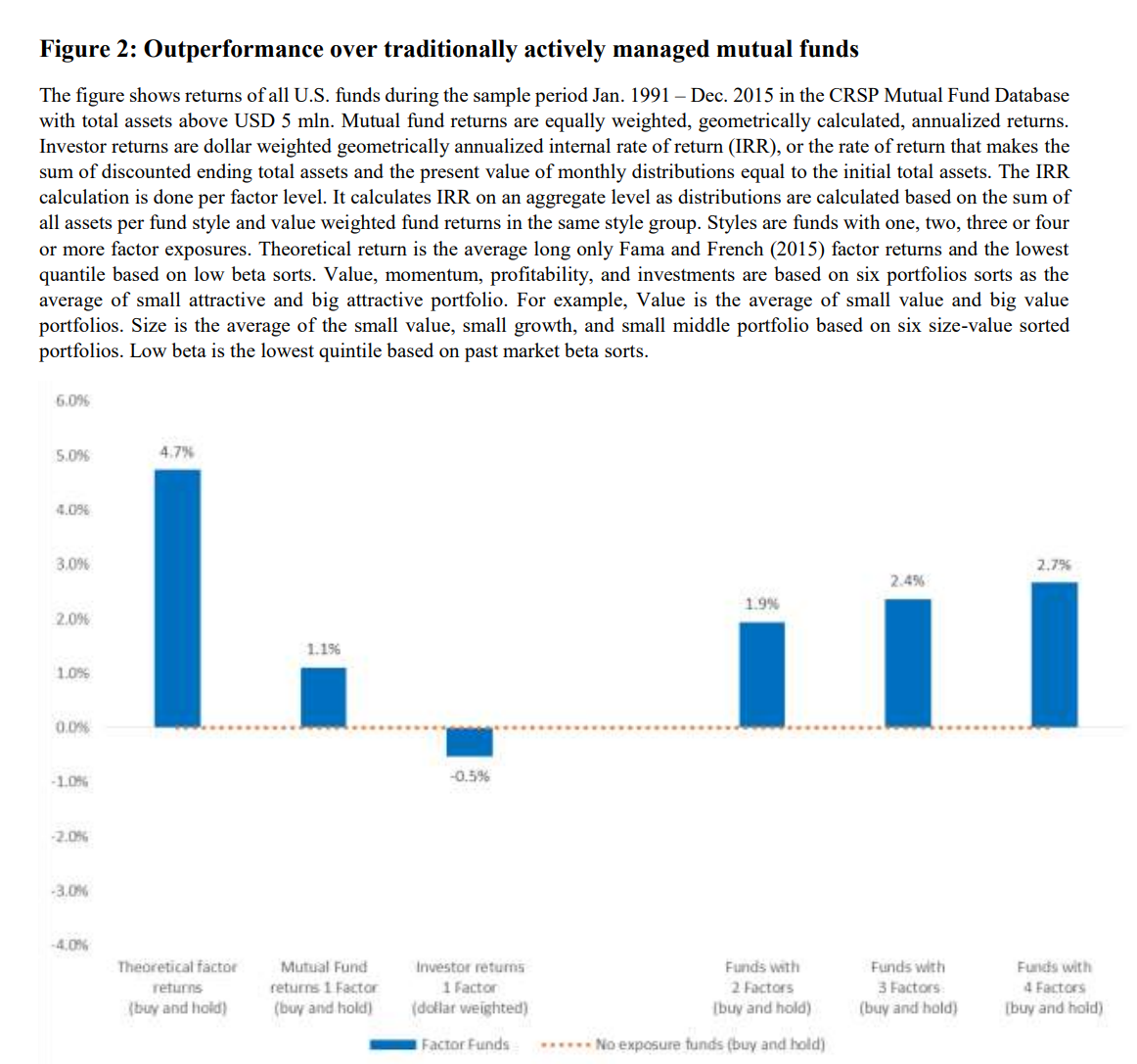

- YES. Factors funds do generate excess returns relative to their actively managed mutual fund counterparts. However, these returns are lower than the theoretical premiums identified in academic empirical asset pricing studies.

- NO. Investors seem to be performance chasers and not buy-and-hold investors, which degrades the theoretical performance they could achieve if they were long-term holders of the underlying factor funds. The authors suggest that investors buy multi-factor funds and focus on a buy-and-hold approach versus a factor performance chasing approach.

Why does it matter?

There is substantial debate regarding the best approach to active investing, where active investing is loosely defined as, “doing something different than a broad-based passive index.” The debate boils down to whether or not a discretionary stock-picker is more effective than a systematic stock-picker. The research currently discussed suggest that systematic factor-based funds, on average, are a more effective way to capture unique return profiles relative to discretionary stock pickers.

This evidence certainly reinforces our own confirmation bias on this topic. We have our own opinions on the debate and believe that discretionary stock-pickers generally “try too hard.” Of course, this statement does not preclude the fact that there are certainly some individuals with incredible insights that can do extremely well as a discretionary stock-picker. But these folks represent extreme observations and don’t tell us much about the average effect.

The most important chart from the paper

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

Mutual funds following factor investing strategies based on equity asset pricing anomalies, such as the

small cap , value, and momentum effects, earn significantly higher alphas than traditional actively managed mutual funds. A buy-and-hold strategy for a random factor fund yields 110 basis points per annum in excess of the return earned by the average traditional actively managed mutual fund. However, the actual returns that investors earn by investing in factor mutual funds are significantly lower because investors dynamically reallocate their funds both across factors and factor managers. Although factor funds have attracted significant fund flows over our sample period, it appears that fund flows have been driven by factor funds earning high past returns and not by the funds providing factor exposures. We argue that rather than timing factors and factor managers, investors would be better off by using a buy-and-hold strategy and selecting a multi-factor manager.

References[+]

| ↑1 | hat tip to Art Johnson for mentioning this paper! |

|---|---|

| ↑2 | Another important aspect to consider is the source is potentially conflicted (the authors are, in part, associated with a quantitative asset manager). This conflict of interest is arguably de minimus because the methodology is transparent and reproducible by third parties. |

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.