When Rationality Meets Passion: on the Financial Performance of Collectibles

- Philippe Masset and Jean-Philippe Weisskopf

- Journal of Alternative Investments, Fall 2018

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Based on a Knight Frank Research (2016) report, ultra-high-net-worth individuals (UHNWI) have been increasingly purchasing collectibles and, on average, hold 2% of their wealth in this asset class.

The authors investigate the following research question:

- Does it make sense to add art, wine and cars to a more traditional portfolio from a risk-adjusted performance perspective?

What are the Academic Insights?

The authors study the period from January 1998 to December 2016. They use data from Kidston ( K500 classic car index) for the car market, data from Liv-ex (Fine Wine 100 Index ) for the wine market and data from artprices.com for the art market.(1)

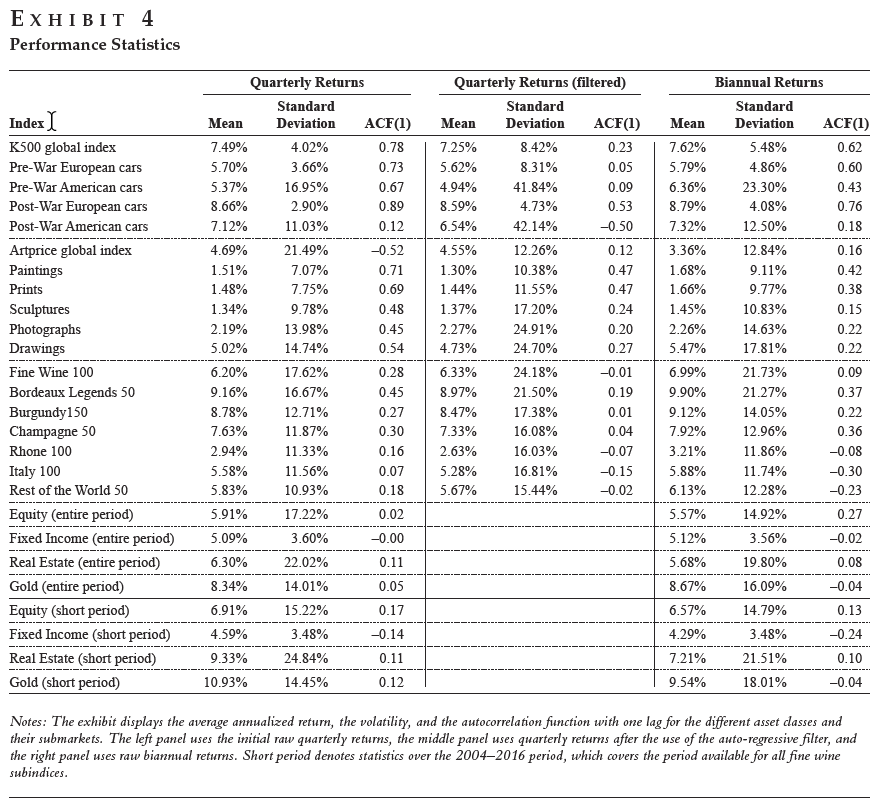

By comparing statistics with more traditional asset classes, they find the following:

- Classic cars and fine wines have delivered a stronger performance than US equities, fixed income, and real estate. Also, once adjusted to include illiquidity, risk is comparable to that of equities. In contrast, the art market lags financial and real assets

- When analyzed in a CAPM framework, only classic cars yield superior risk-adjusted performance, with post-war European cars outperforming other submarkets

- When looking at the period from the GFC ( march 2009-December 2016), only post-war European cars outperform in risk-adjusted terms

- While overall results indicate that collectibles generally do not deliver clear superior performance, when added to a portfolio ( for example an equal allocation of 10% or 30% of the three types of collectibles to a traditional portfolio) they provide diversification benefits and help investors reduce portfolio risk

Why does it matter?

This is an interesting study that adds to the limited literature on the role of collectibles in a traditional portfolio. Results are mixed and it is not possible to draw a clear conclusion. Collectibles do appear to have the potential to add diversification. However, additional considerations are: a) a potential advantage of collectibles is that is several countries they are exempt from wealth or capital gains taxes; b) the complexity of the markets coupled with inefficiencies may represent an advantage for connoisseurs; c) illiquidity is something to keep in mind as a potential drawback as well as high transaction costs, costs of storage, insurance etc., which have the potential to decrease expected returns.

The Most Important Chart from the Paper:

Abstract

This article examines prior evidence and proposes an empirical study of the performance of passion investments in comparison with financial and real assets over the past 20 years. Over this period, classic cars and fine wines (but not visual art) display better returns than U.S. equity, fixed income, and real estate. Volatilities are, overall, low but increase once returns are adjusted for the inherent illiquidity on collectible markets. In a CAPM framework, only classic cars yield significant risk-adjusted returns with an annualized alpha of 5%. At the same time, correlations and systematic risk are low for all collectibles. This diversification benefit is confirmed by a 7% portfolio risk reduction following the inclusion of collectibles in a traditional financial portfolio. The authors further document that the inherent segmentation of collectible classes extends the benefits of cross-asset to intra-asset class diversification. Finally, they find that collectibles have performed slightly less well since the Global Financial Crisis.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.