I’m 34. I have some savings (long-term investments), earn a respectable living, and am comfortable—and happy—spending modestly relative to income. I have a simple balance sheet and no debt. I don’t ever want to fully retire, though I do hope, over time, to buy the freedom to work how and where I want. Yet despite my financial life’s simplicity, a few years ago my investment portfolio took a dark turn toward complexity. This is a short note—a confession, really—about my descent into complexity and my return to simplicity. Note: this is not a collection of reminiscences; it is a short and practical explanation of the mistakes I’ve made, what I now do with my investments, and why. There is abundant room for debate and disagreement on the topics I raise, and I write mainly for those with similar circumstances and goals. There is no “right way”, only tradeoffs. But for the first time in my adult life, I finally feel that I’m on a course to maximize the probability of achieving the long-term portfolio result I want.

(Note: what I do, and advocate here, may not be appropriate for others and is not investment advice.)

My Initial Love Affair with Complexity

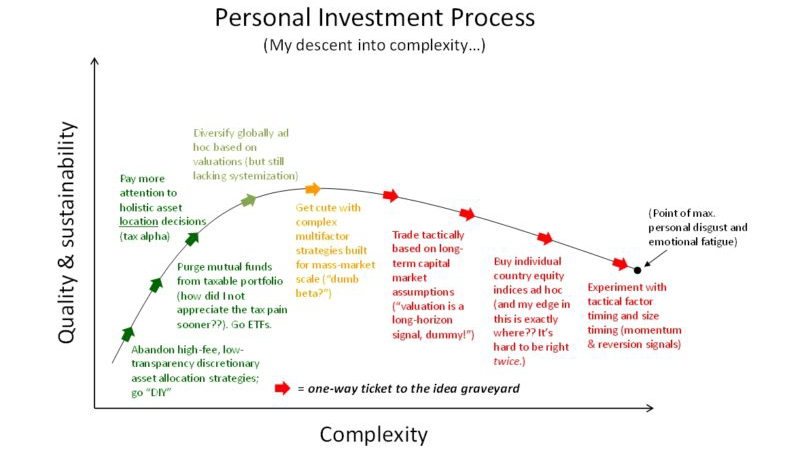

What’s going on in the picture below?

I drew the shape of this curve carefully. I started out in my 20s too simple, with blind faith in delegated discretionary asset allocation funds. It took me embarrassingly long to realize that active management (the pursuit of alpha) is hard and that there are no discretionary investors who will forever walk on water. And even if there are a few diamonds in the rough, what were my chances of finding them? Corollary: manager selection is hard. (Read more about the inherent headwinds that can plague delegated asset management here.) Eventually, I wised up and decided to go it alone (“DIY”). My first moves were good: kick tax-inefficient mutual funds out of my taxable account and replace them with my more tax-efficient assets (equity ETFs). But then DIY ran amok. A little complexity (of the right kind) can be good; a lot of complexity can doom an investment portfolio. And I fell for the siren song of complexity. The picture speaks for itself: I monkeyed with idea after idea in pursuit of the “perfect” approach to personal portfolio management until I had produced an unsustainable tangle of half-baked tactics. Why? Well, for someone specializing in investments by trade and by education, probably overconfidence bias.

My descent into complexity reflects two failures:

- A failure to comprehensively define my lifecycle goals and constraints

- A failure to recognize where I had an edge—and more importantly, where I did not.

I hit rock bottom at that black dot at the far right of the picture—dubbed the point of “maximum disgust”. After many iterations and a lot of pain, I was less confident in my investment program than when I’d first started DIY. So I started over. I sent my collection of bad ideas (red text in the picture) to the “idea graveyard”. (Most pros call it a research graveyard, but calling my tinkering “research” would unjustifiably flatter my efforts.) I set out to do what I should have done in the first place: clarify my lifetime financial goals, rigorously decide (based on history and theory) what I think about various financial assets (stocks, bonds, cash, etc.) and approaches to asset allocation, and then marry the two in a simple, systematic approach to investment decision-making (hat tip: Ray Dalio principle 13.2.a.). (Systemization, here, just means encoding what I learned and how I think it makes sense to invest into a rules-based framework, so that I don’t have to agonize over the same decisions over and over.)

My Highest Value Asset: Human Capital

So, after hitting “reset”, what had I learned? For starters, I realized I’d failed to account for the role of my human capital in my financial plan. My human capital—the present value of my future labor income savings—functions kind of like a high-quality inflation-protected bond. And when I put keystroke to spreadsheet to estimate it, I realized it’s proportionally large: maybe 1/2 to 3/4 of my total holistic wealth, depending on the assumptions I make about my income trajectory, how much I save, and how long in life I work. By comparison, my financial asset portfolio (accumulated savings) represents only 1/4-1/2 of my total assets. Another critical factor: my human capital is uncorrelated with global risky assets; in English, I don’t expect it to take a major hit (job loss or pay cut) in an economic downturn or market meltdown. (The optimal financial asset allocation depends crucially on this fact.)

The upshot: the lion’s share of my net worth is de facto a fixed income asset whose value is unaffected by the stock market rollercoaster. Thus my human capital / financial capital mix forces me into a deep “underweight” to growth assets, precisely when my “sequence risk” (a function of age and time horizon) most favors risk-taking. The logical conclusion, and my new starting point for strategic asset allocation, is that my financial asset portfolio should consist exclusively of high-risk, high-return assets. (Behavioral considerations aside for the moment.) And unless my circumstances change, it should remain risky-asset-heavy for at minimum the next couple decades, until the risk of big drawdowns around quasi-retirement become unacceptably large (…at which point downside hedging strategies, like trend-following, will have a role).

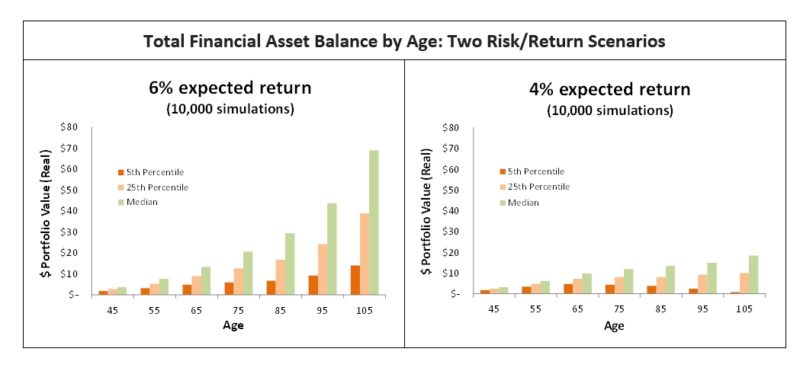

And no, I’m not just some gunslinger emotionally bulled-up on risk. A 100% risky asset portfolio terrifies me. But objective reality is this: conditional on my income remaining uncorrelated with global risky assets, and under any reasonable set of assumptions about market returns (level and path), income trajectory, and spending needs, I minimize my chance of ruin by maximizing risk (return) while young. Retirement planning scenarios can become complex quickly, but one way to explore the likelihood of long-term failure is via simulation; here are two stylized scenarios (10,000 simulated portfolio outcomes each) that use the same lifecycle income and spending profile and tweak only the return, risk, and drawdown assumptions used for the financial asset return modeling (…a 6% expected return scenario and a 4% scenario).

The relative outcomes (higher risk/return relative to lower risk/return):

- In the median case, I’d enter retirement with between 1.5x and 2x the financial assets

- In a 25th percentile downside case, I’d still have 1.2x-1.5x the assets around retirement

- In an extreme 5th percentile downside case, the higher risk/reward program produces 1.0x-1.3x the assets around retirement age—with considerably lower chance of ever hitting zero thereafter

- In an upside scenario (not shown), the higher risk/reward scenario dominates

This distribution of outcomes is the kind I like—huge potential upside, and simultaneously better, on average, on the downside. (Drawdown protection is critical, though, around retirement.)

The point of this exercise was to show, probabilistically, that 100% high-risk/reward now and for the foreseeable future seems likely to win in the long run even in a pretty bad market outcome. What’s the catch? Oh, only some massive, confidence-shattering drawdowns along the way. No biggie. (?!?!) The existential risk here is, of course, a behavioral mistake at exactly the wrong time. Getting on board with the “100% high-risk/reward” plan would require that I fully exploit the only edges I have in investing: behavioral (pain tolerance) and structural (lack of accountability for short-term relative results). To that end, with this writing I ask you, friends, to “tie me to the mast”—force me into rational behavior by Ulysses Pact. No giving up along the way, and most certainly no selling out in a big drawdown.

Given the above, the first step I took as I emerged from the abyss of complexity was to commit to a 100% allocation to high-risk/high-reward assets in my new strategic mix. But which assets, specifically? To answer that question requires going back to first principles. Why should I expect, with confidence, that some financial asset would provide me—the demander of the asset—with a positive real return above cash over long periods of time? The answer is that any such asset must pass three tests (hat tip: GMO / Ben Inker): (1) Would I want to own the asset absent a risk premium? (2) Who’s on the other side of the trade? Put differently, is there a natural supplier of the asset whom we can expect to be willing to “pay” this risk premium to me consistently over time? And (3) What is the source of the returns (a coupon payment, a share of profits, capital appreciation, etc.)? To believe an asset will offer a real return above cash in the long run requires satisfactory answers to all three questions—and an empirical history demonstrating the expected result, on average, over time.

A deep-dive into each and every asset type is beyond my scope here, but the punchline is this: my view is that equity (upside participation in productive assets) offers the most compelling answers to our three key questions and thus has the strongest theoretical case for positive long-term real returns above cash.

- I certainly wouldn’t want to own volatile equities absent a risk premium (they cause much pain, generally around economic downturns when there’s a lot of pain to go around).

- The supplier—companies issuing stock at a valuation that gives me a return over cash—benefits from flexible, permanent financing.

- There is a clearly identifiable source of return (cash distributions to shareholders and participation in per capita economic growth).

Other financial assets aren’t as compelling. The case for default-free bonds and commodities is much more tenuous, theoretically and empirically. (Credit bonds are more complicated, embedding numerous types of risk). In fact, over multi-year periods equity returns through history have generally been higher and often more stable than returns to perceived “safe” assets (see this FRBSF paper for more). (None of this is to say that bonds and commodities can’t play a crucial role in portfolios—only that, if you’re returns-seeking like me, there arguably isn’t a consistent risk premium to harvest over time.)

So, for my 100% high-risk/reward portfolio, which asset(s) should be included? Equity. That’s it. And that’s even before we consider the potential tax advantages equity owners enjoy relative to most other asset types. (Geek’s note: one could make a case for levered risk parity as an alternative to 100% equities, but I’m not sold on risk parity as a practical solution for the lay investor. First, access is challenging for small-timers like me. The second challenge is fees. The third challenge is tax impact. Perhaps other challenges too.)

How Do I Implement a 100% Equity Portfolio?

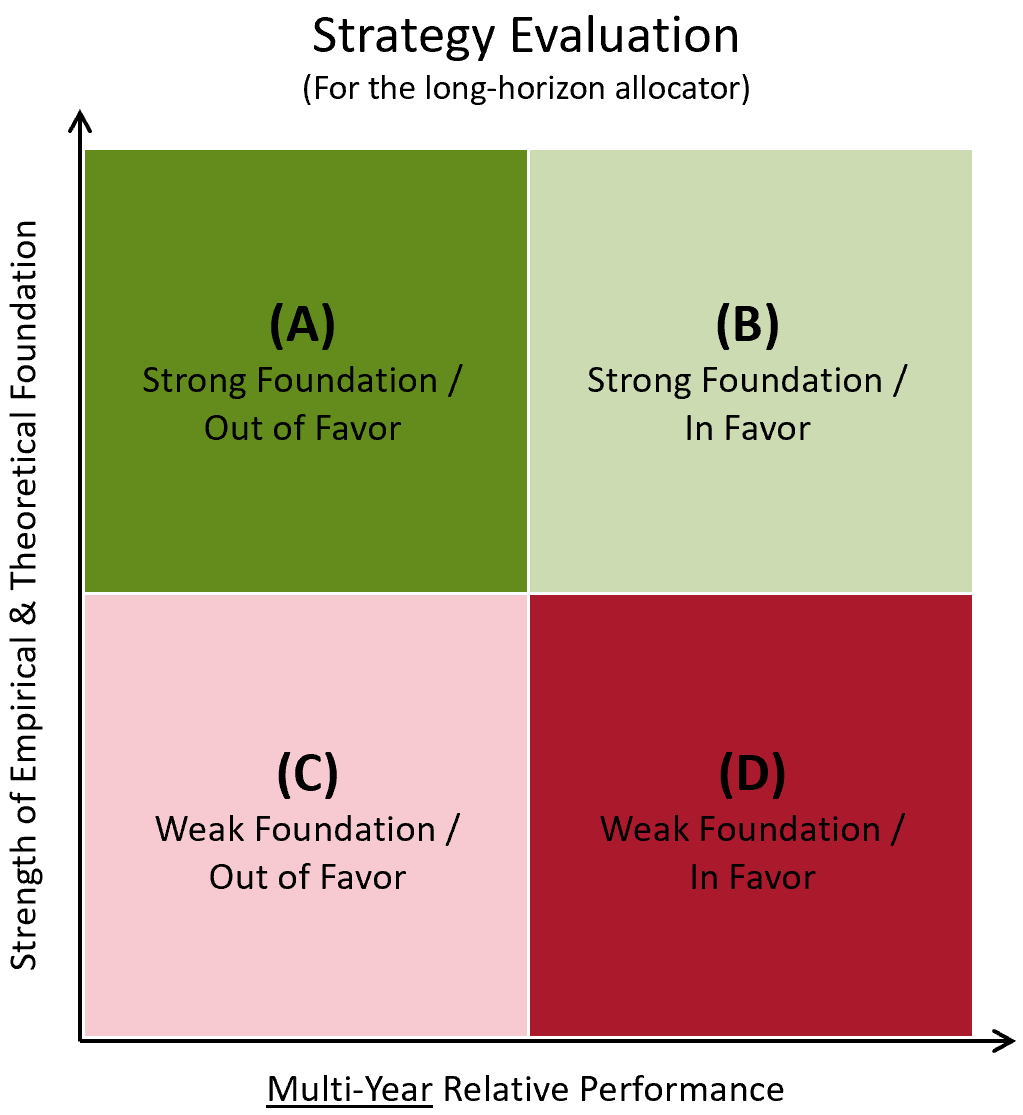

But how best to implement a 100% “equity” portfolio? Well, that depends on who you are. If you’re small and taxable, like me, that means no private equity and no venture capital (lack of access to top managers; high complexity; potential tax-inefficiency). Realistically, my universe is public common stock in public corporations. But what now? U.S. stocks? Foreign stocks? Both? Large-caps? Small-caps? What about “factors”? Factor timing? Active or passive? Is there any such thing as “passive”? In my first attempt at a “DIY” portfolio years ago, I descended into complexity (and paid a high mental/emotional price! – recall my chart upfront). Fool me twice, though, and shame on me. No more gimmicks. No more useless tinkering around the edges. No more half-baked solutions. And definitely no more trying to outsmart anyone. As I now tackle the question anew, I realize what’s needed is utterly simple (though not easy!): define the objective as specifically as possible, build the portfolio with sustainable strategies (see below) that best support your goals, and then “bind yourself to the mast” (i.e., ensure you avoid a behavioral mistake). I wish I’d started this process the first time around with the following framework in mind, which came to me upon reflection and which I now take to be the only reasonable starting point for long-horizon strategic asset allocation:

Seek only “A” and “B” strategies. “C” strategies might work out okay for a while if you get some mean-reversion in styles, but they’re suboptimal and don’t have a place in the long-horizon allocator’s portfolio. “D” strategies are Dangerous. The last thing you want to do is hitch your wagon to an approach that theory and history suggest should underperform over the long-run but that’s had a strong recent-year run. When you find a compelling mix of “A” and “B” strategies, though, go in hard—and marry it. (Good long-term strategies will jump back and forth between buckets “A” and “B” over time; that is to be expected.) “A” strategies should be the primary focus, though, if you’re hitting the portfolio reset button. They also don’t come around all the time; you can’t always find the theoretically and empirically best strategies “on sale” after a recent-year slump. These “A” strategies, when they do appear, should be welcomed! Not merely tolerated.

For the U.S.-based equity investor, there are some “A” strategies out there today. At the portfolio level, the case for international diversification has seldom looked stronger due to its structural risk-reduction benefits—and the sharp outperformance of U.S equities over the past decade frosts the cake. (See Bridgewater’s note on how “Geographic Diversification Can Be a Lifesaver” here; similar to stock portfolios, a naïve equal-country-weight program can help mitigate deep drawdowns.) Within equities, some of the most promising style factors—those with the strongest empirical and theoretical foundations, such “value” (cheap)—have had a long stretch of relative underperformance. On the flip side, there are some “D” approaches out there today, perhaps none more intriguing than plain-vanilla market capitalization weighting within equities. As Rob Arnott and Research Affiliates have shown, almost any naïve weighting scheme under the sun—including an average of fully random 30-stock equal-weighted portfolios—out-returns market cap weighting over time, and yet cap-weighted passive (basically large-cap growth) has crushed just about everything in recent years. (If ever there were a time to purge a “D” from your portfolio…)

Time to cut to the chase. What is my objective, specifically? To compound savings at the highest possible rate after taxes over the next 2-3 decades while attempting to avoid long-term impairment of capital. (More pithily: “compound your face off”.) How? By purging excess complexity and seeking a smarter simplicity—built around only sustainable “A” and “B” approaches that are consistent with the objective.

My program today—“A’s” and “B’s” all the way

Simple portfolio construction:

- 100% long-only global equities (“trend” for downside hedging in the distant future)

- “Anti-home bias”:

simple 40% U.S. / 60% international baseline strategic allocation

- Way more art than science

- Modest nonlinear valuation tilts toward cheaper regions (helps in the extremes)

- Maximize tax alpha

- Overweight international stock in tax-deferred accounts (higher dividend yields)

- Overweight EM stock, extra, in tax-deferred accounts (lower share of qualified dividends = bigger tax hit for EM dividends, on average)

Express regional equity exposures via “big muscle” moves:

- ETFs for tax-efficiency

- No discretionary strategies (systematic only); discretionary isn’t sustainable, for me

- No cap-weighted strategies (remember, market cap weighting is a “D”!)

- Own (marry) concentrated,

systematic long-only active factor strategies

- 50% cheap stuff / 50% winners (known in quant parlance as “value” and “momentum”)

- Equal-weighting

- Avoid product proliferation & streamline (don’t need more than a couple/few funds, total)

Why bet the house on a concentrated pairing of “cheap” and “winners”? Simple. They’re both “A” strategies individually—the very best kind (recall our matrix)—and they offer uniquely strong diversification when paired. The empirical foundation and intuition behind these factors’ excess returns are so strong that they could fail to “work” (outperform) for my entire investing life and, if I’m honest, I’d still have to conclude that there’s no higher probability way for me to compound capital after taxes. For an investor, is there a surer route to peace and patience? (Aside: leveraged “low beta” stocks are a contender for inclusion, but numerous practical challenges stand in the way for small-timers like me.)

Value and momentum approaches survive all replication studies I’ve seen, and most recently, a beast study from authors at AQR and Yale sheds new light on these anomalies’ strong out-of-sample performance both pre-initial-publication and post-publication. In some cases—such as international equity value and international equity momentum—post-publication risk-adjusted performance has been even stronger than performance in the original sample period studied. Equally valuable is that value and momentum styles, globally, remain as negatively correlated today as they’ve been practically since the dawn of time, preserving the strong diversification benefit from pairing the two—despite rising correlations (and loss of diversification) across most global risky asset classes (for example, cross-country equity correlations have risen steadily in recent decades). Today, you arguably get more diversification by owning concentrated US value and US momentum equities than you do owning US value and foreign value.

Now, you might object, when it comes to implementing factor strategies the devil is in the details, right? Not so fast. It’s certainly true that not all factor strategies are created equal; strategy construction matters—the choice of signal(s), the weighting scheme, the rebalance frequency, and the level of concentration. But the big-muscle move—where you’ll get the big compounding (in expectation)—is concentrating. For “value”, to maximize returns you’re probably better off owning the very cheapest sliver of the universe on almost any price-to-fundamental metric than owning a much bigger share of the universe on the “best” signal or multi-signal composite. That’s because the return premiums are largest in the extremes, and both value and momentum styles are fairly insensitive to the choice among signals (broad “parameter stability”). Simply buy the cheapest of the cheap and the strongest of the strong, in roughly equal proportions, and go home. (Open season for the quants out there to rip me to shreds here.) Bottom line: with factors, if your goal is to maximize returns, beware dilution (strategies watered-down and built for scale).

A common fear: “What if factors don’t work anymore?” “What if they’re dead?” “Won’t factor strategies suck?” Fair questions, but there’s an equally fair answer. What’s the downside? A factor “dying” would simply mean that its excess return (its “factor premium”) disappears. The downside is randomness. At worst, I figure I own a portfolio of random equal-weighted stocks, and I’ve already argued that random equal-weight portfolios handily beat market-cap-weighted portfolios—the common “passive” benchmark—over longer periods. To be worse-off than randomness, these long-run factor premiums would have to turn outright negative in the future. That would mean investors, in aggregate, stopped buying “cheap” and “winners” for the first time in history and instead started buying…expensive stocks and losers?? I’m not quite sure what that world would look like. The risk of a “false negative” (speculating that these factors are dead, and as a result, not owning them) seems much more insidious than the risk of a “false positive” (these factors are in fact dead, you invest, and you get a random equal-weight portfolio). Big potential upside with a perfectly acceptable downside? That is an asymmetry I like.

From simplicity to complexity—and back

So where has my journey ended? At a smarter and better simplicity. For the next 2-3 decades: 100% long-only global equities with heavy international diversification, expressed as concentrated value and momentum exposures. If you can come up with a program that should be expected, with credibly high probability, to produce a higher long-term compounded return after taxes—without taking truly insane risks with options or explicit leverage—I would truly love to hear from you. Why is this basic approach tough to implement? For starters, complexity sells; simplicity doesn’t. (And your portfolio will look pretty weird at times.)

Could anything rational cause me to abandon ship (to continue with the nautical theme) ahead of schedule, changes in life circumstances aside? I can think of one thing. If the ex-ante equity risk premium were to compress to unacceptably low levels across the globe, I might reconsider being long-only and fully invested. Everyone has a price, and there is probably a market valuation beyond which I, too, would balk at generic market beta (think Tech Bubble). At that point, it’ll be time for some “trend” (downside hedging)! But we’re nowhere near that point today on a global basis (if we U.S. investors can defeat home bias). The global equity risk premium versus cash or perceived “safe” assets is alive and well. And there are “A” strategies to lock in for the long run. As Alpha Architect’s visual factors tool shows, for instance, there is value in “value” today—the value spread between top-decile “cheap” and the broad market-cap-weighted index is in its 78th percentile since 1992 in the U.S. and its 85th percentile in developed markets ex-US, on an EBIT-to-enterprise-value yield basis.

Finally, thanks to those within the FinTwit community whose generous idea-sharing has saved me from my worst impulses. You know who you are.

Best regards,

Matt

—

Me today (with my long-only portfolio of tax-efficient, concentrated factor strategies):

Matt Tracey is an investment management professional in New York City. The opinions contained herein are his and not those of his employer and such opinions are subject to change without notice. The information provided here is a summary of Mr. Tracey’s personal experience and is not based on any other parties’ particularized financial situation, or need, and is not intended to be, and should not be construed as, a forecast, research, investment advice or a recommendation for any specific strategy, product or service. Individuals should consult with their own financial advisors to determine the most appropriate allocations for their financial situation, including their investment objectives, time frame, risk tolerance, savings and other investments. The information provided here is not intended as tax advice. Please consult your tax advisor for specific tax questions and concerns.

About the Author: Matt Tracey

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.