Model Portfolios

- Basu, Gates, Karir and Ang

- Journal of Wealth Management, Spring 2019

- A version of the paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Asset allocation is a very important decision for investors. Model portfolios are constructed with an optimized asset allocation process to help meet investor needs and preferences.

The authors investigate the following research question:

- How does one construct a model portfolio?

What are the Academic Insights?

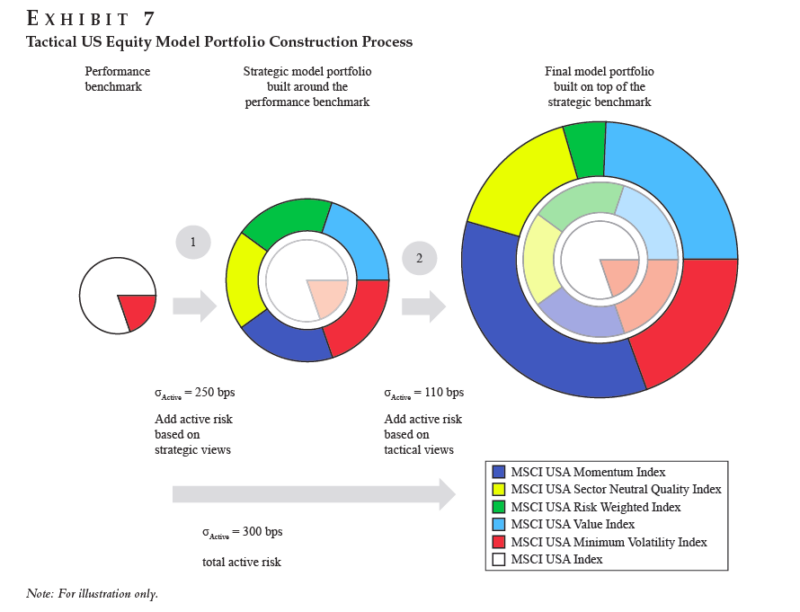

This article lays out a framework for how to construct an optimal portfolio. This framework has three stages:

- Define a performance benchmark (or reference portfolios)– This step has the purpose to reflect an investor’s risk appetite. Typical benchmarks are 20/80, 40/60 and 60/40 equity/bond blends. In an institutional setting, these benchmark portfolios are simple to communicate and the availability of index funds means they can be implemented at low costs. Thus, the value added by active management, tactical asset allocation, or more complex decisions can be clearly measured.

- Construct a strategic model portfolio. The strategic model is able to harvest rewarded sources of returns other than just market capitalization-weighted equities and bonds and serves as a home base allocation for the investor. The strategic model portfolio has the same expected volatility risk as the performance benchmark, but by including exposure to other rewarded market, style factors, or other sources of return as well as by using an optimization process(1), the strategic model has a higher long-term Sharpe ratio than does the benchmark portfolio.

- Include some tactical tilts. Some investors will stop at the strategic model portfolio- which is valid for a long term investor who takes strategic static exposures and rebalances regularly. A further optional step is to construct a final, tactical model, which rotates positions around the strategic model portfolio based on short- and medium-term return and risk insights. This approach may be appropriate for investors who have views on market conditions at 1-month to 24 month horizons over which they wish to adjust portfolio positions. Investment views can come from systematic or discretionary sources. The authors use a factor timing model (based on Hodges et al. 2017) as an example of tactical tilts that can be added to a strategic portfolio.

Why does it matter?

The authors present a repeatable framework for designing optimal model portfolios—transparent portfolios of passive and active vehicles- based on three steps. The separation into these three steps is useful for performance attribution, governance, and monitoring of model portfolio strategies.

The Most Important Chart

Abstract

Model portfolios are constructed using passive and active vehicles to help meet specific investment outcomes. We present a rigorous, repeatable framework for designing optimal model portfolios, which (1) selects a benchmark portfolio that reflects a target level of risk; (2) constructs a strategic model portfolio that reflects long-term capital market assumptions; and (3) potentially, but not necessarily, incorporates tactical views in a final model portfolio, rotating positions around the strategic model holdings to reflect short-term market views. Using the framework, we demonstrate the construction of model portfolios for multi-asset class and factor investing applications.

References[+]

| ↑1 | The authors use a mean-variance optimization framework but there are other utility functions that can be used and probably more relevant for individual investors, in a goals-based investing framework. In this case, the performance benchmark is influenced by investor concerns other than risk aversion, and utility functions incorporating behavioral aspects such as mental accounting and loss aversion should be used instead of mean–variance utility to construct the model strategic portfolio. |

|---|

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.