Why Do Enterprise Multiples Predict Expected Stock Returns?

- Steve Crawford, Wesley Gray and Jack Vogel

- Journal of Portfolio Management, forthcoming

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

One of the foundation concepts of the Alpha Architect investment philosophy is the utilization of Enterprise Multiples in the value discovery process. Enterprise multiples are often referred to as the “business buyer metric” and are a key valuation tool used by investment bankers and business buyers (see here). In addition, the empirical support for the metric is strong: Loughran and Wellman (2011) (Summarized Here) document the Enterprise Multiple effect (EM) in the United States, and Walkshäusl and Lobe (2015) (Summarized Here) highlight the evidence in international markets.

But “why” have enterprise multiples been historically more effective than other valuation metrics, such as book-to-market?

In this paper, the authors investigate the “why” questions:

- Why is EM a powerful predictor of expected average returns relative to traditional value measures such as book-to-market?

- Why haven’t market participants eliminated the opportunity?

What are the Academic Insights?

- By using the empirical framework presented in Piotroski and So (2012) to differentiate between the risk-based and the mispricing-based hypotheses (see here for a summary), the authors create two test portfolios: 1) long value firms and short glamour firms with high investor expectation errors and 2) long value firms and short glamour firms with low investor expectation errors. The risk-based hypothesis asserts no difference between the returns of these portfolios, while the mispricing-based theory predicts a positive spread in returns.

- The authors find strong evidence in favor of the mispricing-based hypothesis and weak evidence that the EM effect is a proxy for higher discount rates. Specifically, portfolios with high investor expectation errors earn higher returns than portfolios with low investor expectation errors. They also find that the EM effect is more significant during strong market sentiment, supporting the mispricing-based hypothesis.

- The authors perform several robustness tests, which confirm the above results.

- In terms of the future performance of this metric, the authors find that over 80 percent of the alpha associated with the best EM portfolio is generated by the short leg of the portfolio.

- The theory of limits to arbitrage suggests that if an arbitrageur’s cost to exploit the mispricing is too high, then the mispricing may not be a transitory phenomenon (Shleifer and Vishny,1997).

- To the extent that managing short positions is costly, and if costly market frictions continue to exist and investor expectation errors persist, the authors conclude that the EM effect may continue in the future.

Why does it matter?

The authors contribute to the literature on why enterprise multiples may be used as a proxy to select value stocks and why they are a good predictor of future expected stock returns. The evidence supports the hypothesis that excess returns are driven by mispricing, not increased systematic risk exposure. Despite this finding, the authors find that costly arbitrage may prevent the anomaly from being arbitraged away any time soon.

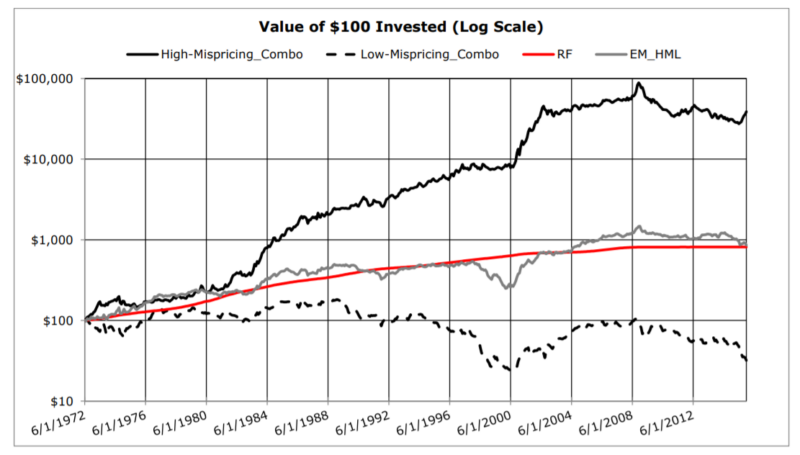

The Most Important Chart from the Paper

Plotted are the cumulative returns for four assets: (1) the risk-free asset, RF; (2) the hedge portfolio, EM_HML, constructed by taking a long position in the bottom quintile “low EM” value portfolio and a short position in the top quintile “high EM” glamour portfolio; (3) the low-mispricing portfolio, LowMispricing_Combo, using the combination measure of fundamental value; and (4) the high-mispricing portfolio, High-Mispricing_Combo, using the combination measure of fundamental value. The sample period is from July 1, 1972, to December 31, 2015

Abstract

The enterprise multiple (EM) effect has been documented across global stock markets. EM is a robust predictor of expected average returns and generates a stronger value effect than traditional value metrics. We find evidence the EM effect is primarily attributable to mispricing and cannot be explained by higher systematic risk. We document that earnings announcement returns, forecast errors, and forecast revisions all support the notion that the EM effect is driven by mispricing associated with predictable investor expectation errors. Finally, we show that the EM effect is stronger during times of strong market sentiment, which also supports the mispricing based hypothesis.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.