Macroeconomic Risks in Equity Factor Investing

- Noël Amenc, Mikheil Esakia, Felix Goltz, And Ben Luyten

- Journal of Portfolio Management

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

Although not a new topic, this article explores and documents the dependent relationship between factor returns and time-varying macroeconomic environments. It is well known that factor returns are cyclical and can be negative for long periods. It is common practice to implement factor investing by combining factors that are not perfectly correlated on an unconditional basis (Value and Momentum, for ex.) into a multifactor strategy in order to reduce risk and smooth returns. This is all well and good unless those uncorrelated factors are in reality, regime dependent. The authors find substantial differences in correlations across macro regimes suggesting the unconditional correlation is a poor estimate of how any pair of factors will actually behave under specific macroeconomic conditions.

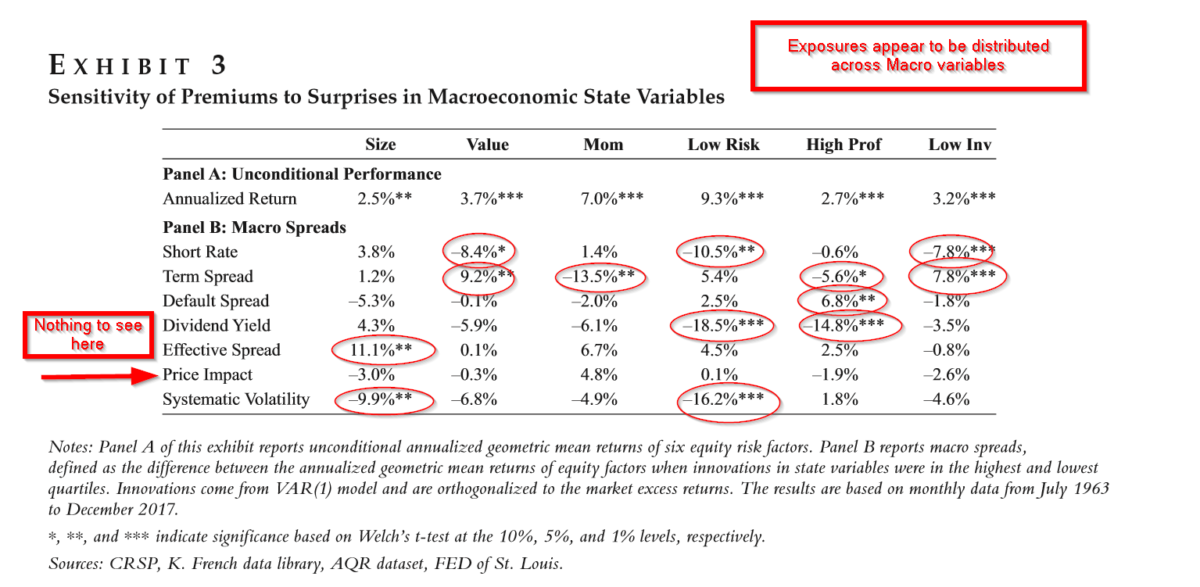

Using a well-reasoned set of criteria, six macro indicators were selected and were observed not as a “level” variable but as a surprise or unexpected change. Each variable was required to meet 3 criteria: it had to be a “fast-moving” variable in order to capture changes in expectations contemporaneously with factor returns; must contain information predictive of economic conditions; and must have been shown to be linked to equity factor returns previously. The final set included: the short interest rate, the term spread, the default spread, dividend yield for the market, market illiquidity (aggregate bid-ask spread), and market or price impact. Six factors were studied including size, value, momentum, low volatility, profitability, and investment.

- Are significant risks observed when macroeconomic exposures to equity factors are ignored?

- Does conventional diversification across factors or traditional asset allocation mitigate macroeconomic exposures to equity factors?

What are the Academic Insights?

- YES. As shown in Exhibit 3 below, all 6 factors were shown to have significant exposures to at least one and up to four of the macroeconomic variables. Price or market impact was the only macro variable unrelated to any of the factors tested. Changes in the term spread and the short rate appeared to dominate. Interestingly, value and investment exhibited the same exposures to changes in the short rate and term spread. The other macro variables had varying profiles with respect to factor returns. Changes in the term spread were also related to momentum and profitability, adding to a total of four significant sensitivities. The return spreads observed were also economically significant. For instance, as noted, interest rate conditions are important for both value and investment factors. The return spreads varied between almost 8% and 9% for the short rate and term spread. This was roughly 2-3 times the spread for the unconditional return. The difference arguably represents the risk (volatility) an investor would face for ignoring the macro exposures inherent in his/her value + investment factor portfolio. The economic rationales for the observed return spreads are consistent with each of the factors and the authors present an interesting discussion of these fundamentals in the paper.

- NO. Even though the factors exhibit differences in the type, direction and significance of their exposures to macro conditions, diversification efforts limited to combining factors together based on unconditional correlations ignores unintended macro exposures. Embedded in traditional equity allocations are these inherent exposures unaccounted for anywhere else. Taking the interest rate issue with value and investment factors as an example, note that the sensitivity to changes in the short rate and term spread in both factors, are likely to magnify losses when interest rate conditions deteriorate and the investor has an allocation to bonds. Diversification is likely to fail just when it is most needed. Traditional asset allocation approaches are unable to produce optimal allocations without similar transparency of macroeconomic sensitivities and in fact, may compound them.

Why does it matter?

I think the results speak for themselves. The authors do an excellent job highlighting the dangers that exist when factor exposures to macroeconomic conditions are not included in the allocation decision. Reliance on unconditional correlations without attention to regime dependencies that drive cyclicality in factor returns can lead to very poor risk management for investors.(1) Part 2 of this summary will be a deeper dive into insights the authors have so ably provided in this article. Stay tuned!

The most important chart from the paper

Abstract

There is a consensus that equity factors are cyclical and depend on macroeconomic conditions. To build well-diversified portfolios of factors, one needs to account for the fact that different factors may have similar dependencies on macroeconomic conditions. The authors provide a protocol for selecting relevant macroeconomic state variables that reflect changes in expectations about the aggregate economy. They show that returns of standard equity factors depend significantly on such state variables. Factor returns also depend on aggregate macroeconomic regimes reflecting good and bad times. These macroeconomic risks have strong portfolio implications. For example, some equity factors depend on interest rate risk. Investors who already have exposure to this risk through bond investments may increase loss risk when tilting to the wrong equity factors. The authors also show that standard multifactor allocations do not sufficiently address macroeconomic conditionality. Combining factors may not reduce macroeconomic risks even for factors with low correlation. Understanding macroeconomic risks is a prerequisite both for risk transparency and for improving diversification of equity factor investments.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.