- Mark Egan

- Journal of Finance, Winter 2019

- A version of this paper can be found here(1)

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Research documents price heterogeneity across mutual funds, mortgages, bonds, and other financial products. How is this possible? Broker intermediation plays a critical role in a consumer’s investment decision and search process. According to the Survey of Consumer Finances, in 2010, 56% of American households sought investment advice from a financial professional like brokers. Despite their prevalence, brokers, or commonly referred to as financial advisors, may not be acting in the best interests of their clients (or are they). In fact, brokers in the U.S. are not held to a fiduciary standard.

This paper investigates the following:

- Does price dispersion imply consumers are overpaying for investments?

- Do the incentives of brokers align with the incentives of consumers?

- Is it possible to rationalize the behavior of brokers and consumers in equilibrium by developing and estimating a broker intermediated search model?

What are the Academic Insights?

The author studies a new retail bond data set, one-year reverse convertible bonds (aka structured products) issued in the United States over the period 2008-2012. In the data set broker compensation comes in the form of a kick-back that is paid by the bond issuer to the broker. Because consumers do not pay the kick-back, conditional on the other product characteristics, consumers are indifferent over the commission/kickback. This unique feature of the data allows the author to separately identify the preferences of brokers and consumers. The author finds:

- YES, the market value of reverse convertibles exhibit substantial dispersion and consumers often fail to purchase the best available financial products and when better and worse products are available, consumers actually tend to purchase more of the worse product

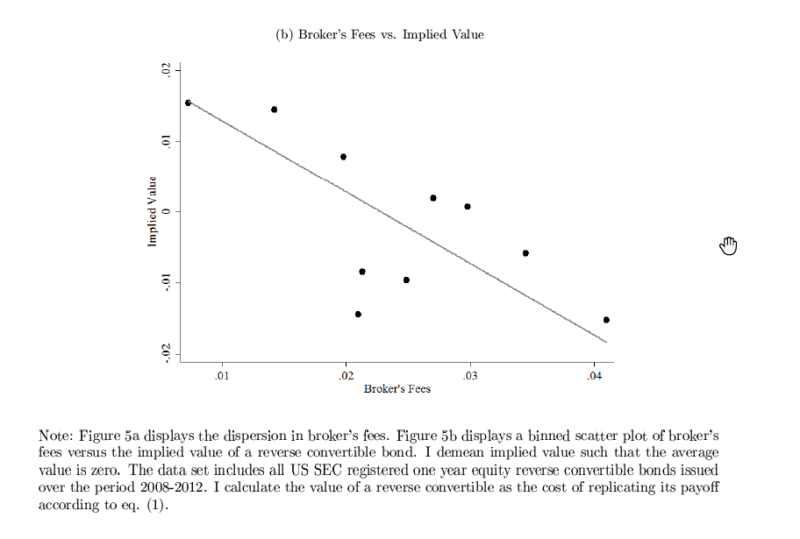

- NO, the incentives of brokers do not align with the incentives of consumers. All else equal, consumers collectively tend to purchase more products with higher commissions/kickbacks, and products with higher commissions have lower payouts on average

- The author investigates two partial equilibrium counterfactuals that quantitatively illustrate how conflicts of interest in the brokerage industry exacerbate existing informational and search frictions: a) consumers randomly search across products without the aid of brokers and b) brokers are forced to show consumers the best available products while keeping the product space fixed. In a), the returns of consumers would increase by a modest 5-21 basis points. In b), the returns of consumers would increase by 95-120bp if we were to align the incentives of brokers and consumers. The empirical results show that costly search/heterogeneous consumer sophistication, conflicts of interest, and most importantly the interaction of the two are first order in terms of determining investment outcomes for consumers.

Why does it matter?

This paper builds on the preceding work by studying financial distribution in a clean and novel setting. In the data set, the author observes all product characteristics as well as the fees paid to brokers. By directly comparing the dominated and superior products, the author can isolate the effect of broker’s fees on product issuance. Taken together with previous research this paper consolidates that the underlying economic frictions in the market for reverse convertibles apply to a much broader set of financial markets.

The Most Important Chart from the Paper:

Abstract

I study how brokers distort household investment decisions. Using a novel convertible bond data set, I find that consumers often purchase dominated bonds—cheap and expensive otherwise‐identical bonds coexist in the market. Brokers are incentivized to sell the dominated bonds, typically earning two times greater fees for selling them. I develop and estimate a broker‐intermediated search model that rationalizes this behavior. The estimates indicate that costly search is a key friction in financial markets, but the effects of search costs are compounded when brokers are incentivized to direct the search of consumers toward high‐fee inferior products.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.