You Can’t Always Trend When You Want

- Abhilash Babu, Brendan Hoffman, Ari Levine, Yao Hua Ooi, Sarah Schroeder and Erik Stamelos

- The Journal of Portfolio Management, March 2020

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions

Trend Following, as an investing strategy has delivered strong performance during market chaos (e.g., Global Financial Crisis of 2007–2009), but the strategy has gone through a significant drawdown (save the last few months where things are perking up!). We have seen dismal returns in the recent decade relative to the historical record (this article refers to the period from 2010-2018).

In some sense, if trend-following strategies are designed to shine when markets are in chaos — but we’ve seen no real chaos from 2010-2018 — then we shouldn’t expect to see great performance from trend-following. This basic intuition is more formally explored in this paper, which is timely, because strategies thought to serve as “risk management” tools are slowly surfacing to the forefront of investor’s minds.

The authors study the following research questions:

- Has the efficacy of trend-following changed?

- What factors explain the divergence in recent performance and long-term results?

What are the Academic Insights?

The authors study 67 markets across four major asset classes (equity indexes, bonds markets, commodities, and currency pairs) with a dataset composed of daily futures prices going back as early as 1877. They review an equal-weighted composite of three signals: 1 month, 3 months and 12 months time-series momentum. Positions are sized according to their expected volatilities such that each market in the portfolio has the same risk ex-ante, both to maintain diversification across markets with different volatility profiles and to limit the amount of concentration risk. Positions are then scaled in aggregate such that the portfolio maintains a 10% ex-ante annualized volatility target. Some level of transaction costs are included.

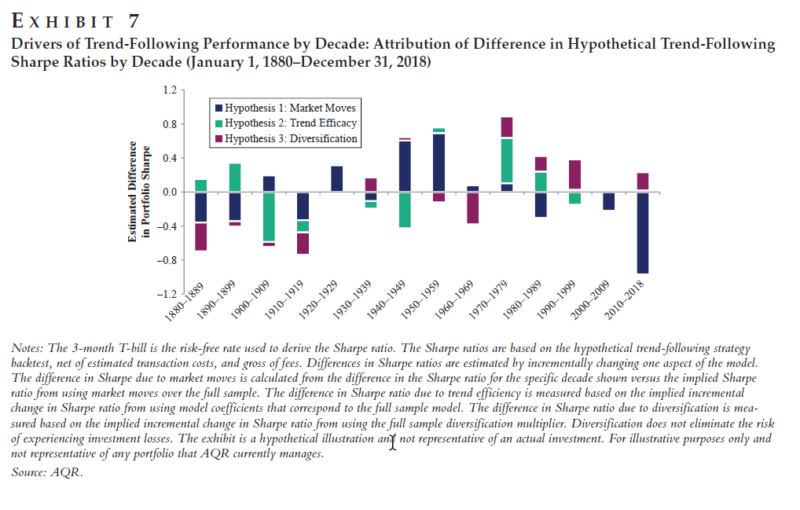

The authors propose a novel framework to decompose the drivers of trend-following performance and find the following:

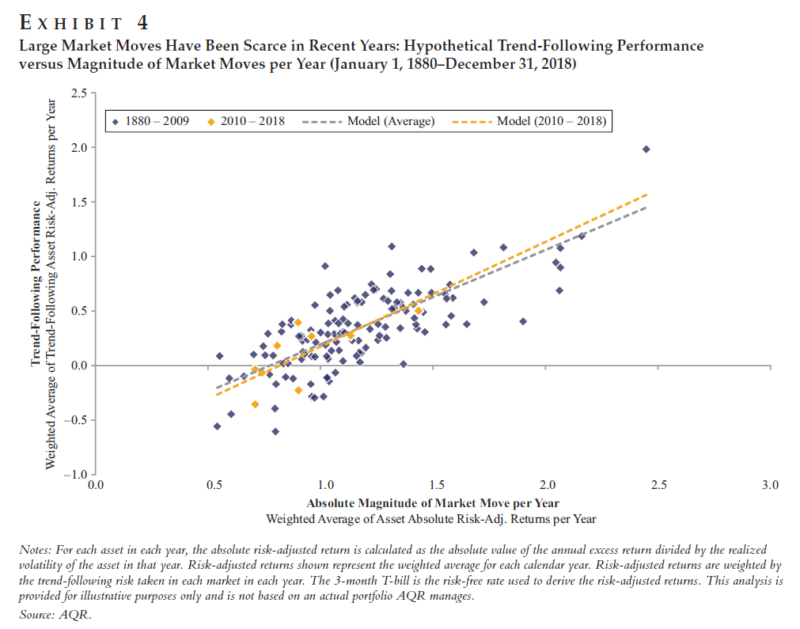

- NO, an application of the performance decomposition framework does not show a change in trend-following efficacy. In fact, as shown in Exhibit 4 of the paper, the fitted line based solely on the recent decade’s observations (shown in yellow) is substantially similar to the full sample average, which suggests that trend efficacy has not been impaired. If trend efficacy had degraded, we would shift down (lower αˆ T) or a shallower slope (smaller ˆ expect either a βT), which is not observed.

- A lack of large risk-adjusted market moves (positive or negative) is the main factor explaining the divergence in recent performance compared to long-term results. In fact, the study does not find evidence of a material change in trend-following strategies’ ability to translate market moves into trend-following performance, nor do we find evidence that trend followers have been less diversified.

Why does it matter?

This article is interesting on two fronts. 1) It provides a novel performance attribution tool for trend following strategies as well as 2) it helps to contextualize the recent diverge (lower performance) of trend following strategies from longer-term trends. The other interesting aspect of the paper is that it has been proven “correct” out of sample — now that trends are back, trend-following is leading the pack with respect to relative performance.

The Most Important Chart from the Paper

Abstract

In this article, the authors present a novel framework to decompose the drivers of trend-following performance into (1) the magnitude of market moves, (2) the strategy’s ability to profit from those market moves, and (3) the degree of diversification across markets. This framework allows them to examine why trend performance has been below the strategy’s long-term average return during the recent decade. The authors find that the lower performance of the strategy is explained by neither (2) nor (3): Trend following has continued to profit from market moves and benefit from diversification. Instead, the primary explanatory factor is (1), namely, that the average size of global market moves has been more muted than usual. The fact that trend-following strategies continue to translate market moves into profits in a diversified manner suggests that trend-following investing may see stronger performance in market environments characterized by more pronounced movements in global markets going forward.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.