Pandemics: Long-Run Effects

- Òscar Jordà, Sanjay R. Singh, Alan M. Taylor

- CEPR Press

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

Markets are currently trying to ascertain our economic future in the middle of a pandemic where it is unclear what will happen. Will stopping the economy put us in a depression with long-lasting effects? Will the economy simply bounce back as if nothing happened? The uncertainly is as real as the cabin fever most of us have after spending 3+ weeks home with our kids! Uncertainty is the one thing that is unavoidable, but if one looks deep enough into the historical record we find that humans of the past have faced similar issues of the present (and probably the future). We can use this knowledge to potentially guide us in the present.

Thankfully, academic researchers are helping to shed some light on the subject of pandemic economics by looking at 15 pandemics stretching back to the Black Plague (1347-1352!). The focus is on European pandemics where data is more readily available.(1)

In this piece the authors tackle the following questions:

- How do pandemics affect economic activity in the mid-long term?

- How do pandemics affect activity versus other crazy events, such as wars?

What are the Academic Insights?

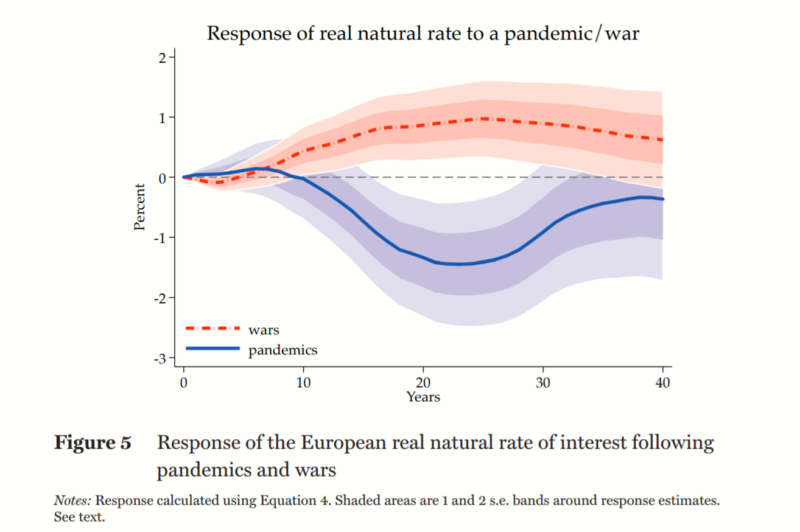

- Real rates of interest (adjusted for the natural rate) decline over a long-time period (i.e., 20yrs+), suggesting that pandemics have had large long-lasting effects on the economy. This drop in real interest rates is believed to be driven by an increased demand to save vs. consume and via lower demand for capital investment.(2)

- Wars tend to increase real rates of interest, which is driven by increased demand for capital (e.g., building tanks is costly!)

Why does it matter?

Real interest rates are thought to be set by supply and demand. Things can get complicated real quick, but if a pandemic kills demand and individuals increase their desire to save versus consume, real interest rates come down. Demand is critical for growing an economy. One can throw all the money in the world at a problem, but if consumer psychology shifts from “let’s buy mode” to “let’s save mode”, the dynamics can spiral out of control and the economy can find itself in — dare I say it — a Depression. On the other hand, low real interest rates allow governments to “cheaply” fund demand (i.e., huge work projects). We’ve certainly learned the importance of allowing the government to supplement demand during shocks in the economy, but now we are exploring a new experiment — what happens when you give a government an open checkbook to fund missing consumer demand in the economy? Is the cure worse than the disease? Who knows.

The most important chart from the paper

Abstract

How do major pandemics affect economic activity in the medium to longer term? Is it consistent with what economic theory prescribes? Since these are rare events, historical evidence over many centuries is required. We study rates of return on assets using a dataset stretching back to the 14th century, focusing on 15 major pandemics where more than 100,000 people died. In addition, we include major armed conflicts resulting in a similarly large death toll. Significant macroeconomic after-effects of the pandemics persist for about 40 years, with real rates of return substantially depressed. In contrast, we find that wars have no such effect, indeed the opposite. This is consistent with the destruction of capital that happens in wars, but not in pandemics. Using more sparse data, we find real wages somewhat elevated following pandemics. The findings are consistent with pandemics inducing labor scarcity and/or a shift to greater precautionary savings.

References[+]

| ↑1 | Obviously, there are lots of caveats here with respect to data integrity, applicability to the current situation, the fact these papers haven’t been through long-winded peer-reviews, and so forth. There is no such thing as perfect research and that certainly applies here. |

|---|---|

| ↑2 | The authors focus on the real rate of interest, which would be affected by the demand for investment and the desire to save/spend. In particular, they look at deviations from the natural rate of interest and use the pandemic as the “treatment” or shock to the system. |

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.