Lu Zhang and his colleagues made some waves with their new paper, “Replicating Anomalies.” (now published in the RFS — congrats!). We have a summary of the paper here. Lu Zhang, and his colleagues, Kewei Hou and Chen Xue, spent nearly 3 years carefully compiling and replicating 447 “anomalies” identified in the academic literature. The paper is so dense Ryan even created a blog post that outlines, “How to read the Lu Zhang paper,” for the non-PhD readers out there.

A WSJ article summarizes the main takeaway nicely:

Most of the supposed market anomalies academics have identified don’t exist, or are too small to matter.

The “Replicating Anomalies” paper will make you question your deepest held investment beliefs. For example, do you believe, like many investors do, that searching for high dividend-yielding stocks is a sound approach for generating higher returns? Think again. Zhang and his colleagues were unable to replicate the results from older papers suggesting that buying high dividend yields stocks may lead to higher returns. Scratch that one off the list…

In short, this research is a “must-read” for all investors looking to improve their understanding of the markets.

The paper is not without criticism. For example, several academics I interviewed (who asked to remain anonymous) believe that Prof. Zhang and his colleagues went overboard in highlighting that there is a “replication crisis” in finance. Their basic argument is that the, “Replicating Anomalies,” paper simply highlights that anomalies are concentrated in micro-cap and small-caps, a finding that was already well established (see Fama and French 2008). These critics suggest that the title should be, “Anomalies are Concentrated in Small-Caps,” or “Anomalies don’t work as well in non-small-caps.”

Criticism aside, I was so floored by Prof. Zhang’s knowledge of factor investing that we asked to sit down with him. Our conversation was quite involved and formed the basis for an incredibly intense 5,000+ word interview (full interview can be found here). However, I’ve boiled this long-winded exchange into the 5 most important takeaways:(1)

Point #1: The Market is Probably More Efficient Then You Think

Prof. Lu Zhang, Prof. Kewei Hou, and Prof. Chen Xue rebuild and backtest 447 so-called anomalies documented in the academic literature. On the face of it, 447 anomalies would seem to suggest the market is pretty easy to beat. However, anybody who’s been around long enough knows this isn’t true. The professors dug deeper.

The authors found that 54 percent of these anomalies cannot be replicated. But it gets worse…much worse. If one minimizes the effect that small-cap stocks have on the results, 85 percent of the anomalies cannot be replicated. Think about that: Among relatively liquid securities, only 15 percent of the strategies analyzed can be replicated.

| All Stocks | Liquid Stocks | |

| Replication Percentage | 54% | 85% |

Point #2: The Classic Factors, Value and Momentum, Survive Scrutiny

The news that a vast majority of anomalies don’t replicate is bad news for folks selling every factor under the sun (a common practice in the new ETF space!). But there is some good news from the Replicating Anomalies paper — a handful of factors — do replicate and the results are robust to scrutiny. Case in point: value and momentum.

Value, generally represented by portfolios of cheap stocks, holds up well in the analysis. Enterprise multiples and price-to-earnings generate some of the strongest results, however, the practitioner favorite — book-to-market — while able to be replicated, certainly doesn’t yield the strongest results.

Momentum, or strategies that hold onto winners, also hold up under the professors’ laboratory conditions. Important to note, the simplest momentum strategies, based on past returns, hold up the best relative to fancier momentum strategies (e.g., momentum strategies related to earnings surprises).

Point #3: Cheap, High-Quality Firms Generate the Highest Expected Returns

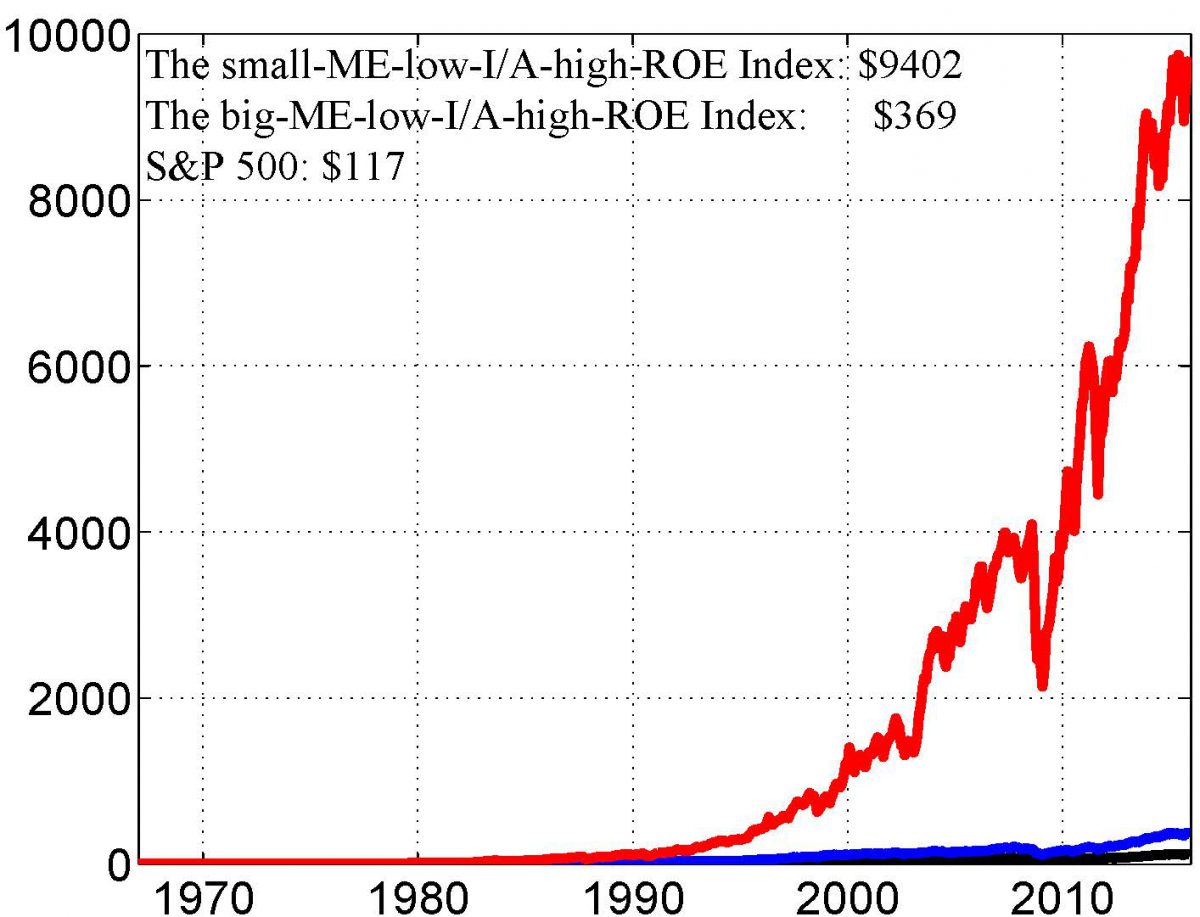

My first question when reading this paper was simple: what works best? I asked Prof. Zhang and got a fairly direct response: low investment firms with a high return on equity. After teasing out what that meant in practitioner terminology, it boiled down to buying baskets of small firms that are cheap (i.e., value) and have high returns on equity (quality). For many Buffett aficionados, this should come as no surprise. The Oracle of Omaha has often preached, “…price is what you pay, value is what you get. The chart below is from a paper by Lu.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Point #4: Portfolio Construction Matters. A Lot.

When forming a portfolio there are a lot of decisions to be made that go beyond the “factor” or process. For example, small-caps or large-caps? Equal-weight or market-cap weight the positions (akin to the S&P 500 Index)? How frequently should the portfolio be rebalanced? Monthly? Quarterly? Annually?

The unfortunate conclusion from the paper is that portfolio construction may end up driving more of your performance than the underlying factor. But these general rules seem to capture the big muscle movement takeaways from the massive research project:

- Small stocks are preferable to larger stocks

- Equal-weight is better than market-cap weighting

- Rebalancing more is better than rebalancing less

Note: All of these takeaways don’t consider transaction costs, which could alter the conclusions.

Point #5: Don’t Believe Everything You read.

This paper represents a large-scale replication effort to help the academic research profession summarize what works and what doesn’t. Of the 447 potential factors, a mere 15 percent pass an initial replication test. And these verified factors represent strategies investors have known about for decades. For example, buy cheap stocks, buy winners, buy quality, and so forth. In short, there isn’t much new on the scene these days, despite piles of academic research suggesting there are potential gold nuggets throughout the marketplace.

One obvious takeaway: don’t believe everything you read — to include research published in academic finance journals. Even PhDs can confuse themselves and make life more complicated than it really needs to be. And be skeptical of fund management companies that hire famous academic researchers with the hope of improving their offerings.

One must always the real question: Is this fancy professor being hired to help the process? Or is there hire a marketing ploy to sell a product?

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.