The price momentum and accruals (the difference between accounting earnings and cash flows—adjustments made for revenue that has been earned but not received, and costs that have been incurred but not paid) anomalies are two well-documented financial phenomena. Recent research has focused on whether there is a relationship between the two anomalies, an idea Jack previously wrote about in his article “Accruals Momentum as an Investment Strategy.”

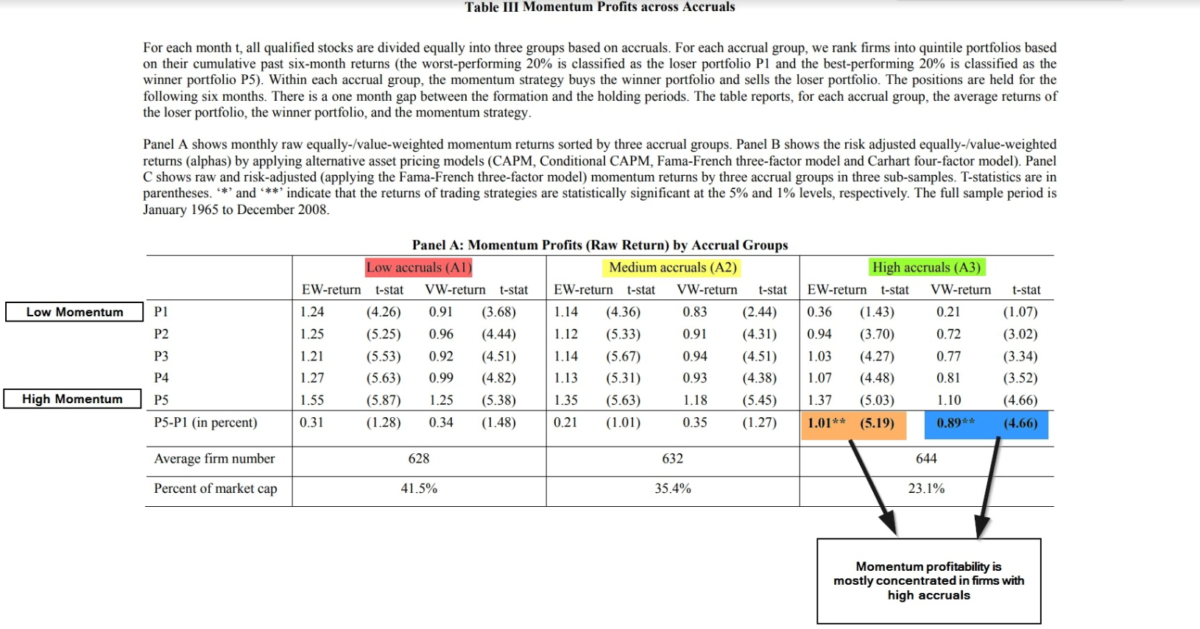

Ming Gu and Yangru Wu, authors of the paper “Accruals and Momentum,” published in the November 2019 issue of The Journal of Financial Research, established a link between momentum and accruals—momentum profitability is mostly concentrated in firms with high accruals. They cited prior research demonstrating that “high accrual firms generally have high sales growth, which decays after portfolio formation.” Their paper contributes to the literature on growth and momentum by linking sales growth to the continuation of losers and winners.

Key Findings For Factor Investors

Following is a summary of their findings:

- Momentum profitability is statistically significant and economically large among high-accrual firms but is nonexistent — or much weaker — for firms with low and medium levels of accruals—the strategies that sequentially sort on accruals and then on past six-month returns yield momentum profits that increase monotonically with accruals.

- The effect of accruals on momentum profits exists during both expansion and recession periods.

- Loser stocks with high accruals tend to experience significant decreases in industry-adjusted sales growth and the largest amount of income-decreasing special items in subsequent years.

- The downward payoff of loser stocks with high accruals largely drives the accrual-based momentum profit.

- Most of the momentum profit among high-accrual firms is attributable to the high discretionary accrual group. Post portfolio formation, the amount of income-decreasing special items is the largest for the loser firms with high accruals, indicating that loser stocks with high accruals are more likely to be manipulated in the preformation period and implies the downward payoff of loser stocks in the post-formation period.

- The effect of accruals on momentum is robust after controlling for exposure to common factors (beta, size, value, and momentum) and does not disappear in more recent years.

Gu and Wu noted that investors who fixate on reported earnings may be temporarily misled by managers who can use accruals to opportunistically manipulate earnings—inflate a firm’s earnings prospects rather than lower current earnings and defer them to the future. This induces misvaluation of stocks.

They concluded:

“Our findings indicate that due to the joint force of earnings overestimation and earnings manipulation, the downward payoff of loser stocks with high accruals largely drives the accrual-based momentum profit.”

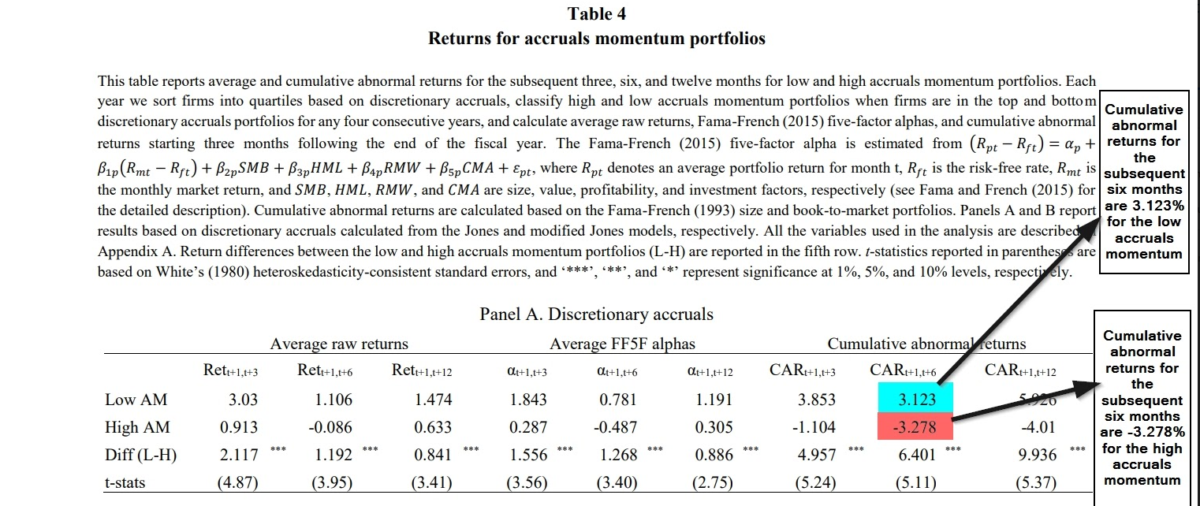

The above findings are consistent with those of Xiaoting Hao, Juwon Jang and Eunju Lee, authors of the study “High Accruals Momentum,” published in the April 2019 issue of Accounting & Finance. (Alpha Architect has an analysis of the paper here.) The authors examined the information content of high accruals momentum, defined as a string of high discretionary accruals for four consecutive years—evidence of consistently high accruals. Their database covered the period 1980-2016.

Following is a summary of their findings:

- On average, about 1 percent of firms exhibit high (income-increasing) accruals momentum and about 1.4 percent exhibit low (income-decreasing) accruals momentum.

- There is a significantly significant spread between the high and low accruals momentum firms. Firms with high accruals momentum have lower future returns, while firms with low accruals momentum have higher future returns. For example, cumulative abnormal returns for the subsequent six months are 3.123% for the low accruals momentum portfolio, while they are -3.278% for the high accruals momentum portfolio.

- High accruals momentum firms are smaller and have lower leverage ratios. Large firms are less likely to engage in earnings management due to higher media attention and costs related to internal control procedures on financial reporting. Moreover, firms with many lenders are less likely to manage earnings for a certain consecutive period given that such stakeholders play an important role in monitoring managers’ operational activities.

- There is a significant difference between the high and low accruals momentum groups for negative earnings surprises but not for positive earnings surprises.

- The predictive power of the high accruals momentum for future returns is strongly persistent even after the existing accruals anomaly disappears.

- High earnings (fundamental) momentum is not a substitute for high accruals momentum.

Summary on Accruals and Momentum

Consistent with Gu and Wu, their findings led them to conclude that “the high accruals momentum impact is more pronounced for low growth firms, suggesting that the overpricing of stocks with high accruals momentum is driven by managerial discretion to manage earnings.”

Summarizing, the evidence demonstrates that investors have been well served to either short or avoid (for long-only investors) high accruals momentum firms. It also demonstrates that limits to arbitrage allow anomalies, even behavioral-based ones such as the accruals anomaly, to persist well after the publication of the research uncovering them. (e.g., Patricia Dechow’s paper on the accruals anomaly was published in the July 1994 issue of the Journal of Accounting and Economics.)

About the Author: Larry Swedroe

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.