I’m constantly hearing from financial advisors who are getting nowhere on LinkedIn, despite having invested considerable time and money. In this post, I’ll provide some guidance on how to avoid sounding like the typical (boring) financial advisor on LinkedIn.

Look at LinkedIn as your client

Imagine this scenario, financial advisors.

Your client tells you they don’t like communicating over text, they don’t like investing in high volatility stocks, and they have no plans to send their kids to college.

The next day you draw up a plan to invest $500k of their money in a 529 plan, and then text them to set up a meeting and discuss.

You would never treat your client like this. So why is it that you expect LinkedIn to magically deliver qualified leads to your doorstep, without having any sense of what LinkedIn needs and wants you to do?

If you want to get somewhere on the platform, you have to treat LinkedIn like it’s your client. And in return, LinkedIn will reward you by increasing your posts’ visibility.

Let’s look at what LinkedIn wants. They want to make money off of advertising revenues, so the more traffic you can create on their site, the better. The more people you can get to engage with your posts, the better.

Things that generate little to no engagement:

- Virtue signaling by telling some story about how you saved a stray cat on the way to work.

- Making yourself look smarter than everyone by publishing a market graph.

- Pushing out promotional pieces to talk about how great it is you are a fiduciary.

- Sharing the same old WSJ article that 50 other advisors already posted.

This will get you some views from the people already connected to you, but it’s entirely self-serving. It won’t attract new people, go viral, or result in hot debates that prompt lots of comments and likes.

The ideal scenario is that when you post something, you elicit comments from your followers. These comments should be 3-4 sentences in length because this is reflective of a discussion rather than just a quick “Whoo-hoo! Great point!” You want people to respond back to the comments on the thread, and even give the comments a like. All of this says to LinkedIn that you are the host of a lively debate and ding ding ding! LinkedIn’s “high engagement bell” will ring, and then they’ll boost this post up to more people within your first degree networks, and then more people hopefully comment, and then they boost it up more, and on and on. This is how posts go viral(1).

My point is you want to get people to talk about what you post, not just broadcast information and hope it strikes a $50MM business owner’s fancy. I’m about to show you an example of how this approach worked beautifully.

Increase number of implicit questions to raise response rate.

Seeeew, how do you get people to respond to your posts?

There has be at least one implicit question within the posting. The more questions the posting raises, the better.

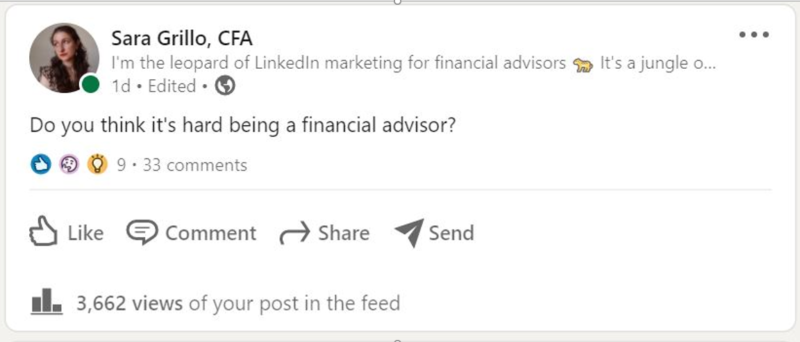

Here’s an example of a highly engaging LinkedIn post with many implicit questions.

There’s one explicit question, the one I asked. But in the process of thinking it through, there are several other questions raised by that. This is what makes the post thought-provoking.

Implicit questions:

- What do mean by “hard”? Physically or emotionally? Technically hard?

- Hard to succeed initially or hard to stay in the business?

- Why is it so hard? This is actually the reason question.

- What personal qualities will make it hard or easy?

- How do you get through the hard parts?

- Do you have to have a mentor?

- What are the benefits of it being so hard in the beginning?

- Does anyone find it easy?

And as you can see, a lot of people came out of the woodwork to chime in on this one. And that’s exactly what you want to create, the feeling that they just can’t resist putting their two cents in.

Now, this isn’t a good topic for a financial advisor to post about, because you don’t need attention from other financial advisors. You want it from your ideal client base. All the more case for creating a niche target group when you prospect. Get these discussions going about questions that your ideal client base likes discussing online.

Stop selling washing machines on LinkedIn messenger

A Wall Street Journal article talked about how Merrill Lynch banned its trainee reps from cold calling and is now urging them to use LinkedIn messenger and other means of prospecting instead. While I think it’s great Merrill finally caught on to the fact that private wealth services are extraordinarily difficult to sell over the phone, it strikes fear into my heart to think about 3,000 reps blasting out spammy sales pitches.

When you pitch yourself unwelcomely, it irritates the prospect, causes them to ghost you, and moreover makes you look like you are selling washing machines.

The most important thing you can do is recognize the objective of a LinkedIn message. It is not to impress the person or throttle out some invitation for coffee with the hopes they’ll say yes. This makes you appear low quality.

The objective of a financial advisor’s LinkedIn message is to get the prospect talking about what is important to them so that you can understand who they are as a person, what their attitudes are, and where they are in life. Even better if you can get them to talk about their problems, frustrations, or a life transition they are taking action on.

Yes, you will have to be patient and this may mean you might miss your meeting quota for the week. This may anger your boss. But you’re going to get way further in the long term if you focus on them not you.

This is a key point, so let me repeat that.

THEM NOT YOU

THEM NOT YOU

THeM nOt YoU

them not you

(them not you)

Ellos no tu (in spanish)

Loro no lei (in italian)

Example: You see they posted an article they wrote about German cuisine. You say, “Fascinating article on German cuisine. Sauerbraten or Bratwurst?”

See? Two sentences, both about THEM not YOU.

And pssssst – a little humor never hurts.

Yes, I know, it’s not that easy to do when you’re under sales pressure. But there are no shortcuts here. Get a list of 20 people and message them thoughtfully, with sincerity, and speak reflectively in a way that makes it seem like a genuine discussion rather than you sizing them up or interrogating them. Quality not quantity. You’ll see over time this approach works better.

But Sara, you say, how do I then pitch my services and get a meeting? I’ve got bills to pay, Sara!

Guess what.

This is all taking place on LinkedIn, and each of your messages is a direct link to a whole profile page all about YOU. I have a whole post guiding financial advisors to optimize their LinkedIn profile page. If somehow your target audience misses the title, there’s the About section. Seeing that financial advisors can’t hold back from expressing all your fiduciary virtues on every single inch of the page, I highly doubt there’s any lack of awareness about what you do. Trust me, when they’re talking to you over messenger, they know they’re talking to a financial advisor.

You can only pitch the meeting when it makes logical sense to the prospect, meaning that they have articulated some kind of need, either explicitly or implicitly. It’s a process that must be led up to and steps can’t be skipped. This is called a LinkedIn messaging transition.

Sara’s upshot

I’m ending this article now because it’s getting late and I have to go put my kids to bed. Thanks for reading.

Not sounding like a washing machine salesperson will separate you from 99% of other financial advisors on LinkedIn. Follow my blog on www.saragrillo.com or read my book on LinkedIn messenger for financial advisors for helpful tips.

About the Author: Sara Grillo

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.