How Global is Your Mutual Fund? International Diversification from Multinationals

- Irem Demirci, Miguel A. Ferreira, Pedro Matos, and Clemens Sialm

- Review of Financial Studies, 2021

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Did you know that the percentage of foreign sales of the FTSE 100 is 76% and 43% for the SP500? This study investigates the power of indirect international exposure, that is international exposure through holdings of domestic stocks.

The authors ask the following:

- What is the indirect international exposure of domestic mutual funds?

- Is the indirect international exposure associated with fund performance both cross sectionally and for the time series?

- Is there heterogeneity in the relation between fund performance and indirect international exposure?

What are the Academic Insights?

By studying a comprehensive sample of open-end equity mutual funds domiciled in 29 countries over the 2005-2015 period, the authors find:

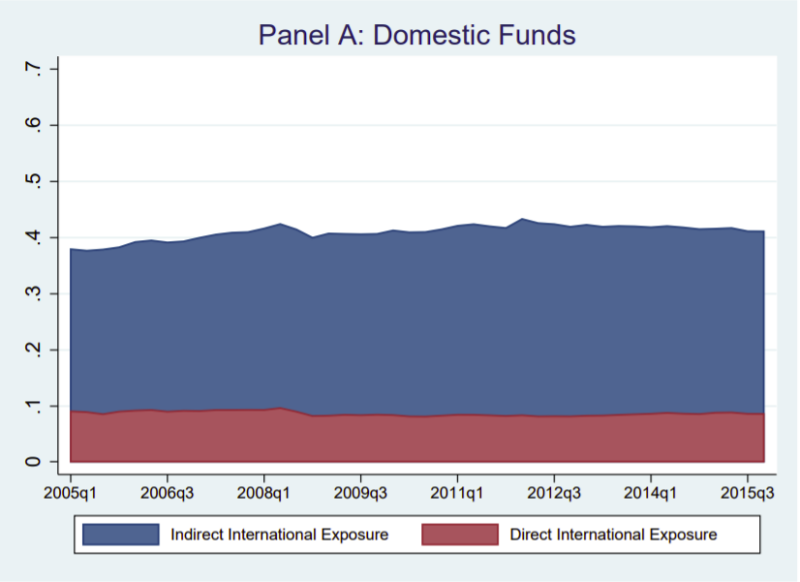

- Indirect international exposure constitutes a significant fraction of a fund’s total exposure to stock markets. For domestic funds, international stocks represent only 9% of a funds’ portfolio, but international exposure increases to about 41% when we take into account the fraction of foreign sales

- YES & YES

- Cross Sectional – Indirect international exposure has a positive effect on fund risk-adjusted performance in the cross section of domestic funds. On average, a one standard deviation increase in indirect international exposure (0.156) is associated with an 7.5 basis points increase in monthly four-factor alphas in the sample of domestic funds. In contrast, the results are mixed for direct international exposure, which has an ambiguous impact on fund performance. The authors perform a number of robustness tests such as controlling for benchmark-, country-, and time-fixed effects, and a comprehensive set of determinants of fund performance. The results are also robust when the authors use a larger sample that includes both domestic and international funds as well as across funds domiciled in different regions of the world.

- Time Series – Indirect international exposure has a positive effect on fund risk-adjusted performance in the time series of domestic funds. In fact, a one (within-fund) standard deviation increase in indirect international exposure (0.041) is associated with a 4.6 basis points increase in monthly four-factor alphas in the sample of domestic funds.

- YES- The performance benefits of indirect international exposure are larger in small fund families and are more pronounced when funds invest in small-cap and growth stocks. Additionally, the performance benefits are more significant for countries with smaller and less liquid stock markets, and with greater barriers to foreign investment.

Why does it matter?

This paper is important because it proposes a new and economically important determinant of fund performance – indirect international exposure – acquired by investing in domestic firms that are internationally diversified. In fact, it provides evidence that stock-specific characteristics (i.e., percentage of foreign revenues), apart from fund-specific characteristics, play a role in explaining fund performance.

The Most Important Chart from the Paper:

Abstract

We show that mutual funds worldwide provide substantial international exposure through their domestic holdings of multinationals. An average domestic fund’s international exposure increases by 32 percentage points when we consider international corporate diversification. We find that funds with higher indirect international exposure perform better in both the cross-section and the time series. This outperformance is more pronounced among small fund families, and funds that invest in small stocks, growth stocks, and less developed capital markets. Our findings support the hypothesis that international diversification from multinationals reduces the transaction and information costs of investing abroad and captures fund manager skill.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.