Why Do Investors Hold Socially Responsible Mutual Funds?

- Arno Riedl, Paul Smeets

- Journal of Finance

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the research questions?

There was really only one question investigated in this research:

Are social preferences and values the main drivers of an SRI investors’ choice of SRI mutual funds?

Although it seems a fairly straightforward question, ferreting out the answers is complicated (see here for an example). It turns out that measures of social preferences may be contaminated by a lack of independence, concerns about one’s social image, and strategic reputation. Therefore, some ingenuity in terms of empirical design is required for reliability purposes. In this research, the analysis was conducted on 3 independent data sources including data from the administrative side of a large mutual fund (offering SRI and non-SRI funds), incentivized behavioral experiments, and direct investor surveys.

The data was limited to Dutch investors. The integration of these 3 sources resulted in quite a unique data set that offered researchers the means to link the choices made by non-SRI (that is, conventional) and SRI investors to answers provided by responses to survey questions and to the behavior observed in controlled social experiments. Although there is nothing wrong with using secondary sources of information, this dataset is a far cry from the usual data “suspects” we see in most of the research published in finance. More importantly, it provides a methodology that is uniquely suited to the question posed and could be applied to investors in other countries.

What are the Academic Insights?

- YES, THERE IS A STRONG AND ROBUST RELATIONSHIP. A review of the findings:

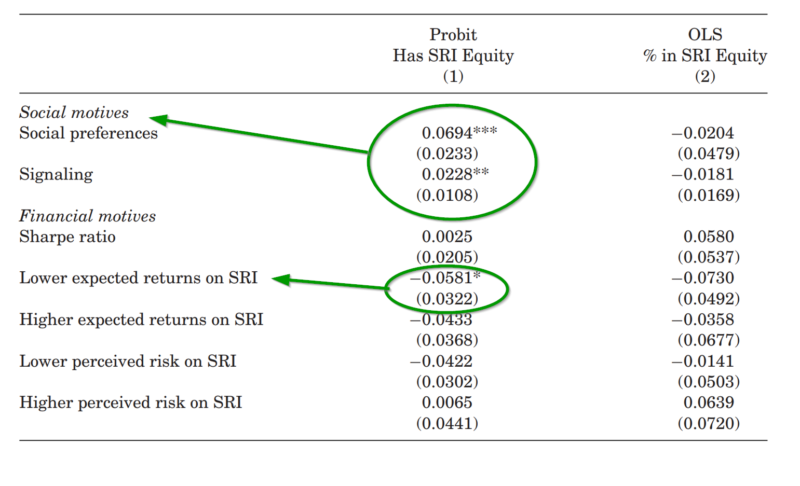

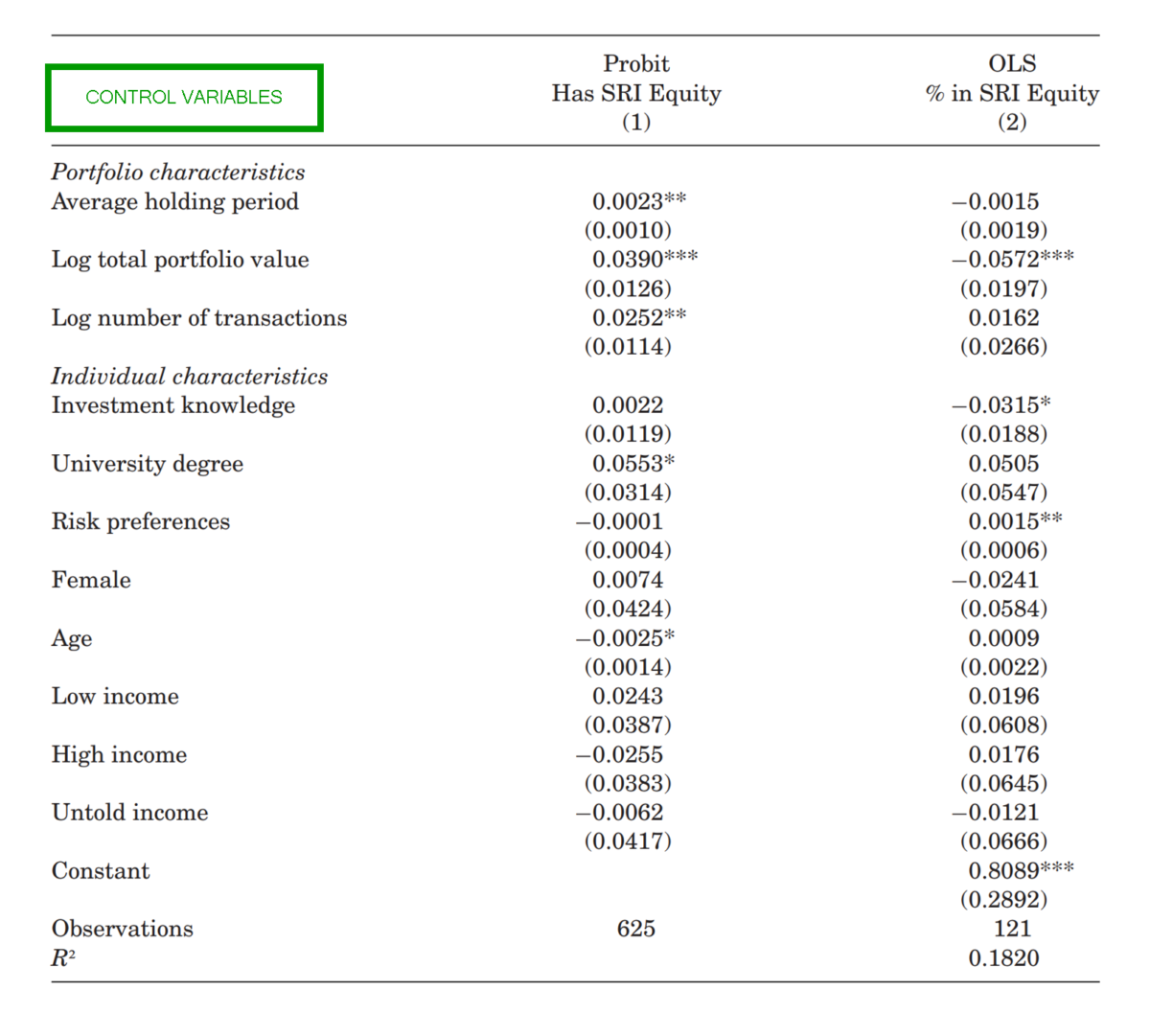

- It’s not about alpha and risk for most if not all SRI investors. The authors report that investor preferences for social responsibility is by far the dominating factor, even after controlling for risk preferences, trading activity, Sharpe ratios, the investors’ assessment of their own investment knowledge, level of education, the investors’ perception of the social impact of SRI, gender, age, and income. See Table III below.

- Financial motives play a role but only at the margin. While expectations of negative performance tends to reduce the overall probability of investing in an SR manner, SR investors are still willing to make the bet. Most SR investors do expect their SRI funds to underperform conventional mutual funds but are still willing to pay the significantly higher fees. The opposite case, however, does not appear to hold. If the expectation is that SRI funds will outperform, the investor is not more likely to hold an SRI fund.

- Donations to other charities are not a substitute for SRI investing as SR investors donate almost 41% more than non-SRI investors. The authors report that the SR investor donates 41% more to charity when compared to the non-SR investor.

- One curious result was that the strength of social preferences had little to no impact on the allocation of total dollars committed to SRI mutual funds. Apparently a strong preference is necessary to invest in an SRI product in the first place, but has little impact on the total allocation. Further, those SRI investors with a weak preference tend to minimize the percentage allocated to SRI mutual funds.

- One rather large caveat: The data sample is based on Dutch investors. Are the Dutch more pro-social, or more pro-environment? Can these results be replicated in other countries? The authors suggest that they could be comparable. Although they benchmarked the social preferences of the Dutch to publicly available data on other countries such as the US, Germany and the UK, it is really an empirical question.

Why does it matter?

The authors speculate that social preferences and their effects on investment decisions have implications for asset prices over the long term. Assuming SRI/ESG continues to grow at a rapid pace, SRI investors may have increasing upward pressure on the prices of SRI stocks and increasing downward pressure on non-SRI or ”sin” stocks. Which is a point that Larry Swedroe hit on in his recent post on the Impact of ESG scores on Asset Prices.

The most important chart from the paper

Abstract

To understand why investors hold socially responsible mutual funds, we link administrative data to survey responses and behavior in incentivized experiments. We find that both social preferences and social signaling explain socially responsible investment (SRI) decisions. Financial motives play less of a role. Socially responsible investors in our sample expect to earn lower returns on SRI funds than on conventional funds and pay higher management fees. This suggests that investors are willing to forgo financial performance in order to invest in accordance with their social preferences.

About the Author: Tommi Johnsen, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.