DIY Trend-Following Allocations: September 2022

By Ryan Kirlin|September 1st, 2022|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

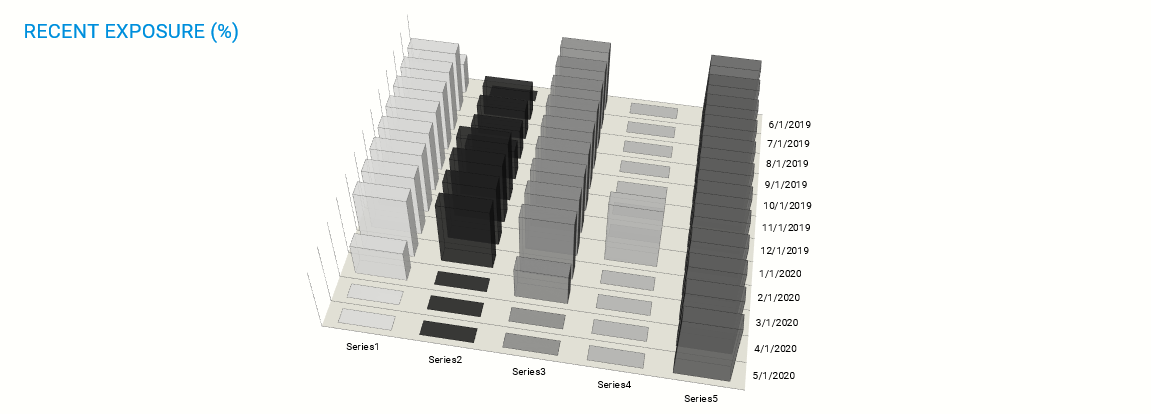

Current Exposures:

- No exposure to domestic equities.

- No exposure to international equities.

- No exposure to REITs.

- Full exposure to commodities.

- No exposure to intermediate-term bonds.

How You Sort Matters in Sorting Factor Portfolios

By Larry Swedroe|September 1st, 2022|Larry Swedroe, Factor Investing, Research Insights, Academic Research Insight|

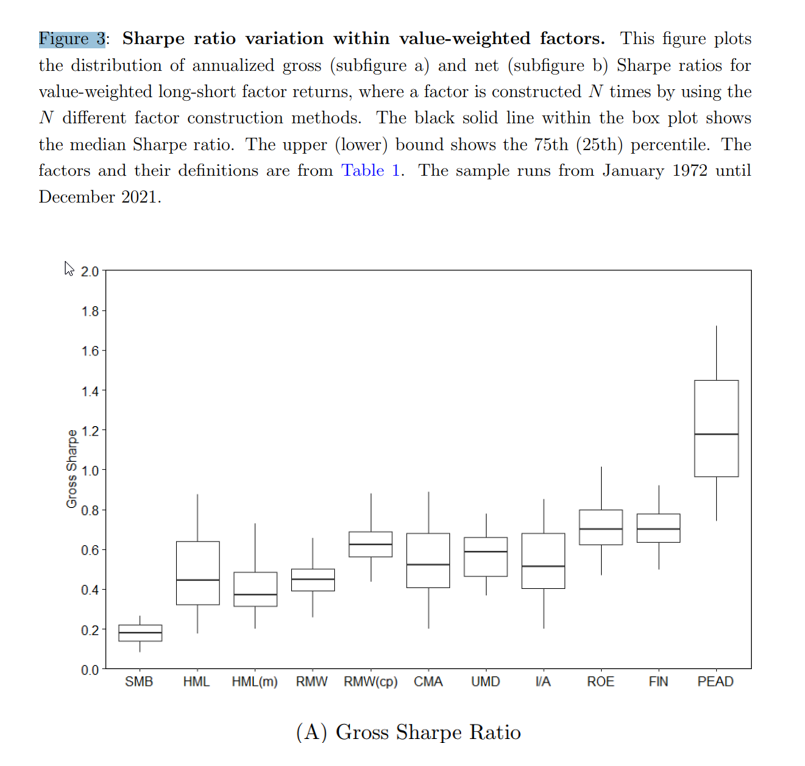

Non-standard errors capture uncertainty due to differences in research design choices. We establish substantial variation in the design choices made by researchers when constructing asset pricing factors. By purposely data mining over two thousand different versions of each factor, we find that Sharpe ratios exhibit substantial variation within a factor due to different construction choices, which results in sizable non-standard errors and allows for p-hacking. We provide simple suggestions that reduce the average non-standard error by 70%. Our study has important implications for model selection exercises.

March for the Fallen 2022: Detailed Logistics Outline and What to Expect

By Wesley Gray, PhD|August 30th, 2022|Training Section, MFTF Training Series|

We are about a month away from March for the Fallen (#MFTF).

Do Equity Markets Care About Income Inequality?

By Elisabetta Basilico, PhD, CFA|August 29th, 2022|ESG, Research Insights, Basilico and Johnsen, Academic Research Insight, Other Insights|

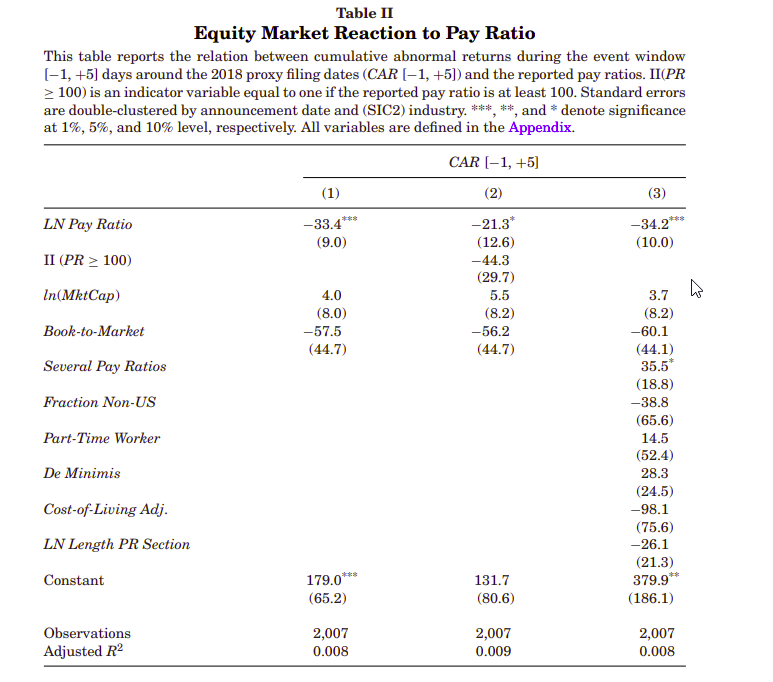

Do equity markets care about income inequality? We address this question by examining equity markets’ reaction and investors’ portfolio rebalancing in response to the first-time disclosure of the ratio of CEO to median worker pay by U.S. public companies in 2018. We find that firms’ disclosing higher pay ratios experience significantly lower abnormal announcement returns. Additional evidence suggests that equity markets “dislike” high pay dispersion rather than high CEO pay or low worker pay. Firms whose shareholders are more inequality-averse experience a more pronounced negative market response to high pay ratios compared to firms with less inequality-averse shareholders. Finally, we find that during 2018 more inequality-averse investors rebalance their portfolios away from high pay ratio stocks relative to other investors. Overall, our results suggest that equity markets are concerned about high within-firm pay dispersion, and investors’ attitude towards income inequality is a channel through which high pay ratios negatively affect firm value.

Can You Keep Your Track Record After an ETF Conversion?

By Pat Cleary|August 26th, 2022|ETF Operations, Research Insights, ETF Investing|

Here is the bottom line: converting into the ETF structure can bring a lot of benefits to the table, but porting your official track record over to an ETF can be challenging.

However, even if the facts and circumstances of your situation suggest that porting your official track record into an ETF is impossible, all is not lost. Retail consumers, institutional investors, platform providers, gate-keepers, and so forth, will likely be aware of your previous performance and reputation as an asset manager/advisor and they can often read between the lines. For example, if an advisor has been running the "ACME US Dividend Strategy" for 20 years, and this same advisor launches the "ACME US Dividend ETF" with the same investment process and investment objective, it doesn't take a rocket surgeon (or a brain scientist) to figure out that the ETF is probably a more tax-efficient version of the old strategy.

Financial Markets Responding to Climate Risks

By Larry Swedroe|August 25th, 2022|ESG, Larry Swedroe, Research Insights, Academic Research Insight|

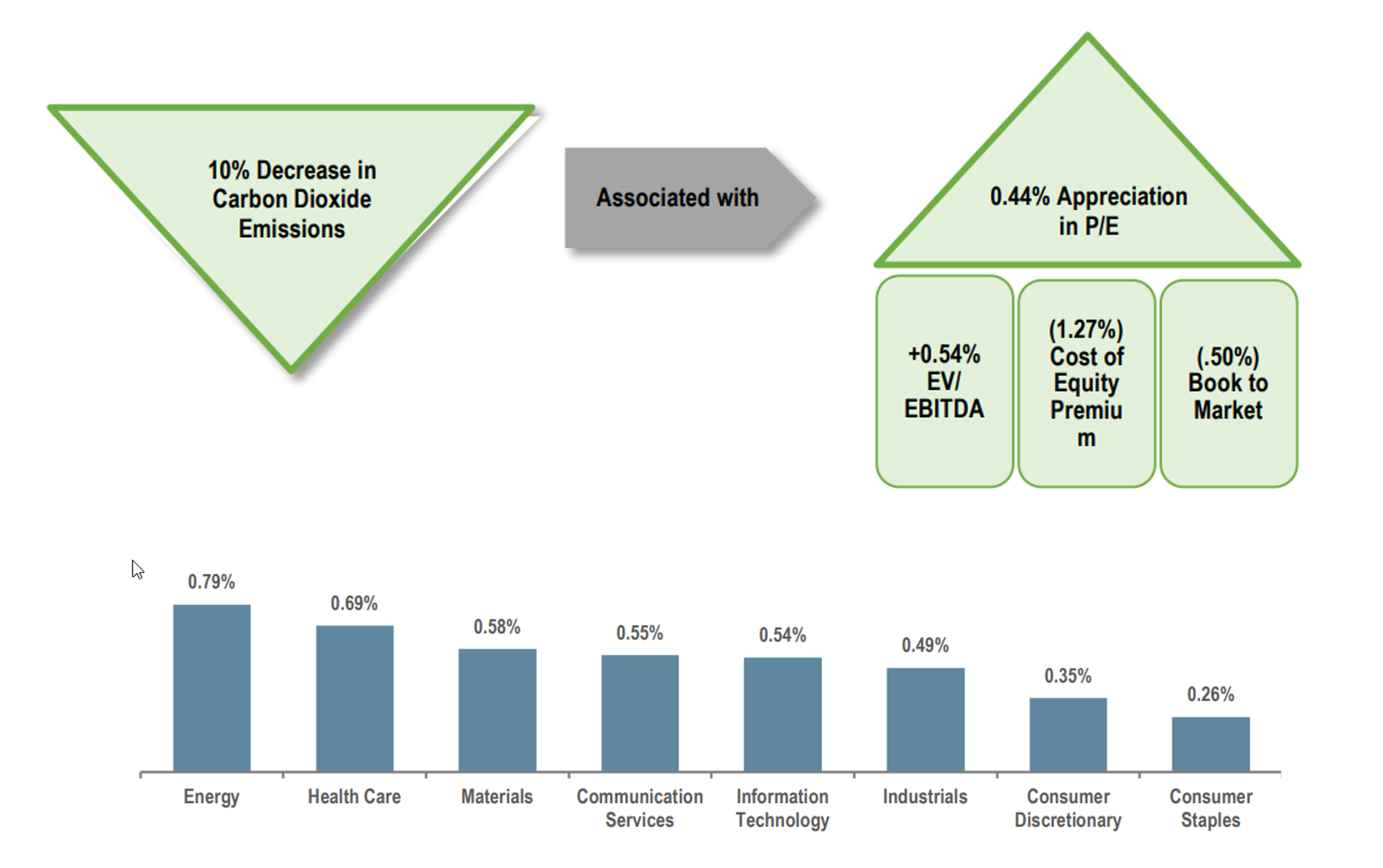

This paper provides new evidence showing that carbon transition risk is becoming increasingly material and is priced both in equity and debt markets. We find that there is a widespread price-earnings discount linked to corporate carbon emissions. This discount varies, however, by sector and trends differently in Europe than in the US. We also find that a small discount emerges for corporate bonds, although it is statistically significant only for small caps. Finally, we find evidence that the pricing discount also emerges, albeit to a smaller extent, for other greenhouse gas emissions.

Is Passive Ownership Bigger than Estimated?

By Tommi Johnsen, PhD|August 22nd, 2022|Research Insights, Basilico and Johnsen, Academic Research Insight, Active and Passive Investing|

We estimate that passive investors held at least 37.8% of the US stock market in 2020. This estimate is based on the closing volumes of index additions and deletions on reconstitution days. 37.8% is more than double the widely accepted previous value of 15%, which represents the combined holdings of all index funds. What’s more, 37.8% is a lower bound. The true passive-ownership share for the US stock market must be higher. This result suggests that index membership is the single most important consideration when modeling investors’ portfolio choice. In addition, existing models studying the rise of passive investing give no hint that prior estimates for the passive-ownership share were 50% too small. The size of this oversight restricts how useful these models can be for policymakers.

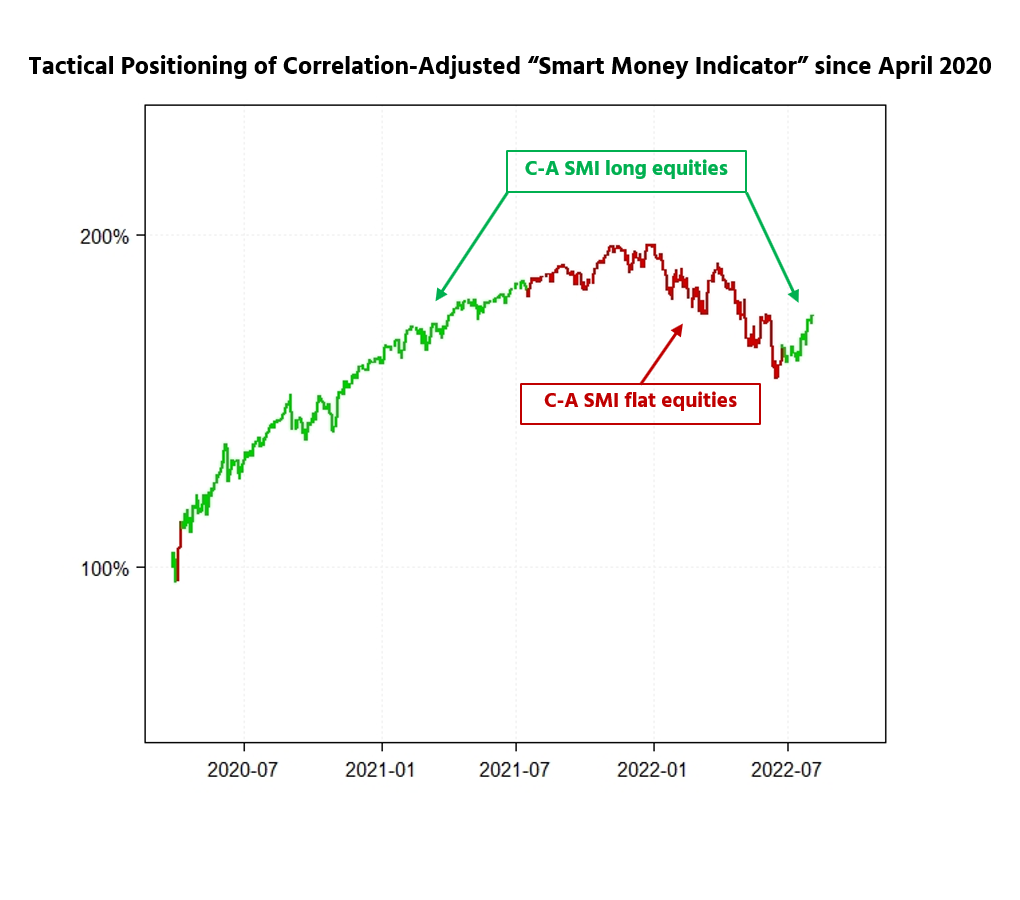

Is Relative Sentiment an Anomaly?

By Raymond Micaletti|August 19th, 2022|Relative Sentiment, Research Insights, Tactical Asset Allocation Research|

Relative sentiment is an indicator that measures the positions, flows, and attitudes of institutional investors compared to those of individual investors–where institutions typically consist of large asset managers, insurance companies, pension funds, and endowments. In some instances, however–depending on the dataset and the asset class under consideration–institutions might also include hedge funds, CTAs, and other large speculators.

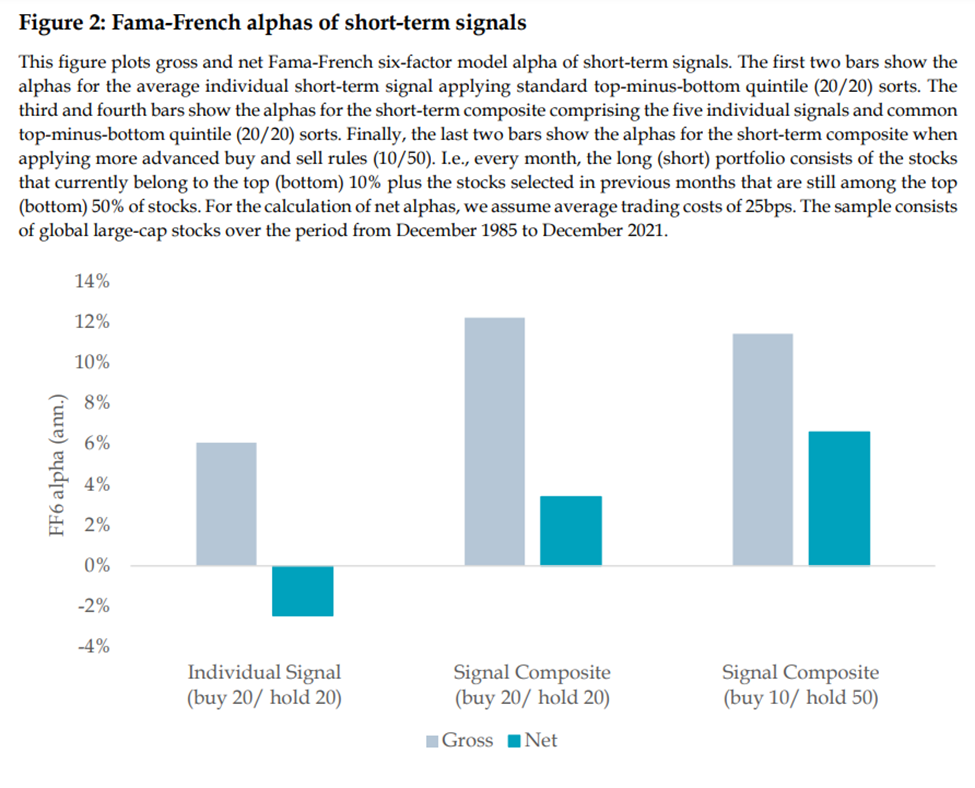

Alpha from Short-Term Signals

By Larry Swedroe|August 18th, 2022|Factor Investing, Research Insights, Academic Research Insight, Momentum Investing Research|

Short-term alpha signals are generally dismissed in traditional asset pricing models, primarily due to market friction concerns. However, this paper demonstrates that investors can obtain a significant net alpha by combining signals applied on a liquid global universe with simple buy/sell trading rules. The composite model consists of short-term reversal, short-term momentum, short-term analyst revisions, short-term risk, and monthly seasonality signals. The resulting alpha is present across regions, translates into long-only applications, is robust to incorporating implementation lags of several days, and is uncorrelated to traditional Fama-French factors.

Book Review: Your Essential Guide to Sustainable Investing

By Wesley Gray, PhD|August 16th, 2022|Larry Swedroe, Research Insights, Book Reviews, Other Insights|

I am grateful for this book because I am less confused about sustainable investing, and I am inspired to learn more about the topic. I commend Larry and Sam’s work for being technically accurate and complete, while accessible to a reader who isn’t an expert on the subject and is looking to learn more.