Relative Sentiment and Machine Learning for Tactical Asset Allocation

By Raymond Micaletti|June 15th, 2022|Relative Sentiment, Research Insights|

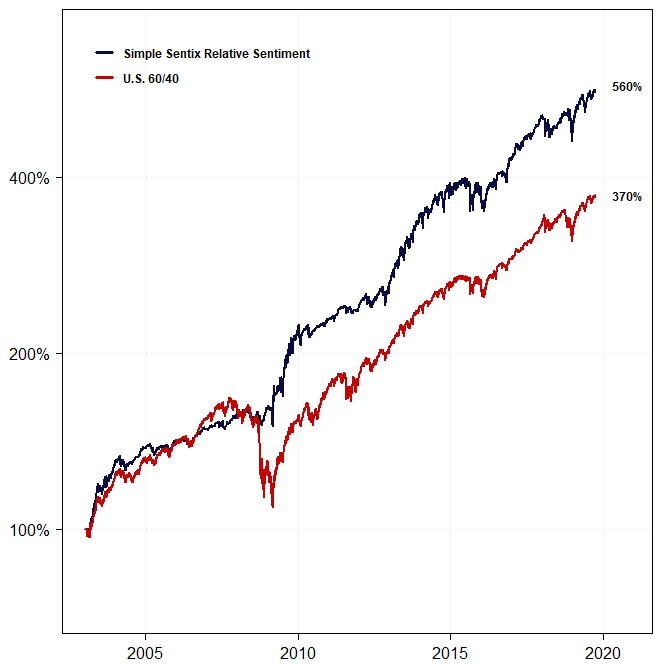

The application of machine learning models to Sentix relative sentiment data appears to extract more predictive information than our original, simplistic approach was capable of.

Factors Investing in Cryptocurrency

By Elisabetta Basilico, PhD, CFA|June 13th, 2022|Crypto, Factor Investing, Research Insights, Basilico and Johnsen, Academic Research Insight|

We find that three factors—cryptocurrency market, size, and momentum—capture the cross-sectional expected cryptocurrency returns. We consider a comprehensive list of price- and market-related return predictors in the stock market and construct their cryptocurrency counterparts. Ten cryptocurrency characteristics form successful long-short strategies that generate sizable and statistically significant excess returns, and we show that all of these strategies are accounted for by the cryptocurrency three-factor model. Lastly, we examine potential underlying mechanisms of the cryptocurrency size and momentum effects.

The Unintended Consequences of Single Factor Strategies

By Larry Swedroe|June 10th, 2022|Quality Investing, Larry Swedroe, Factor Investing, Research Insights, Value Investing Research, Momentum Investing Research|

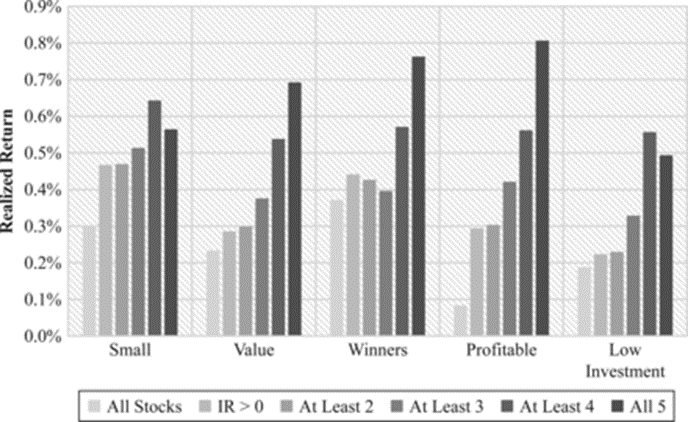

Since the 1992 publication of “The Cross-Section of Expected Stock Returns” by Eugene Fama and Kenneth French factor-based strategies and products have become an integral part of the global asset management landscape. While “top-down” allocation to factor premiums (such as size, value, momentum, quality, and low volatility) has become mainstream, questions remain about how to efficiently gain exposure to these premiums. Today, many generic factor products, often labeled as “smart beta”, completely disregard the impact of other factors when constructing portfolios with high exposures to any single factor. However, recent research, such as 2019 study “The Characteristics of Factor Investing” by David Blitz and Milan Vidojevic, has shown that single-factor portfolios, which invest in stocks with high scores on one particular factor, can be suboptimal because they ignore the possibility that these stocks may be unattractive from the perspective of other factors that have demonstrated that they also have higher expected returns.

Visualizing the Robustness of the US Equity ETF Market

By Wesley Gray, PhD|June 8th, 2022|Research Insights, Active and Passive Investing|

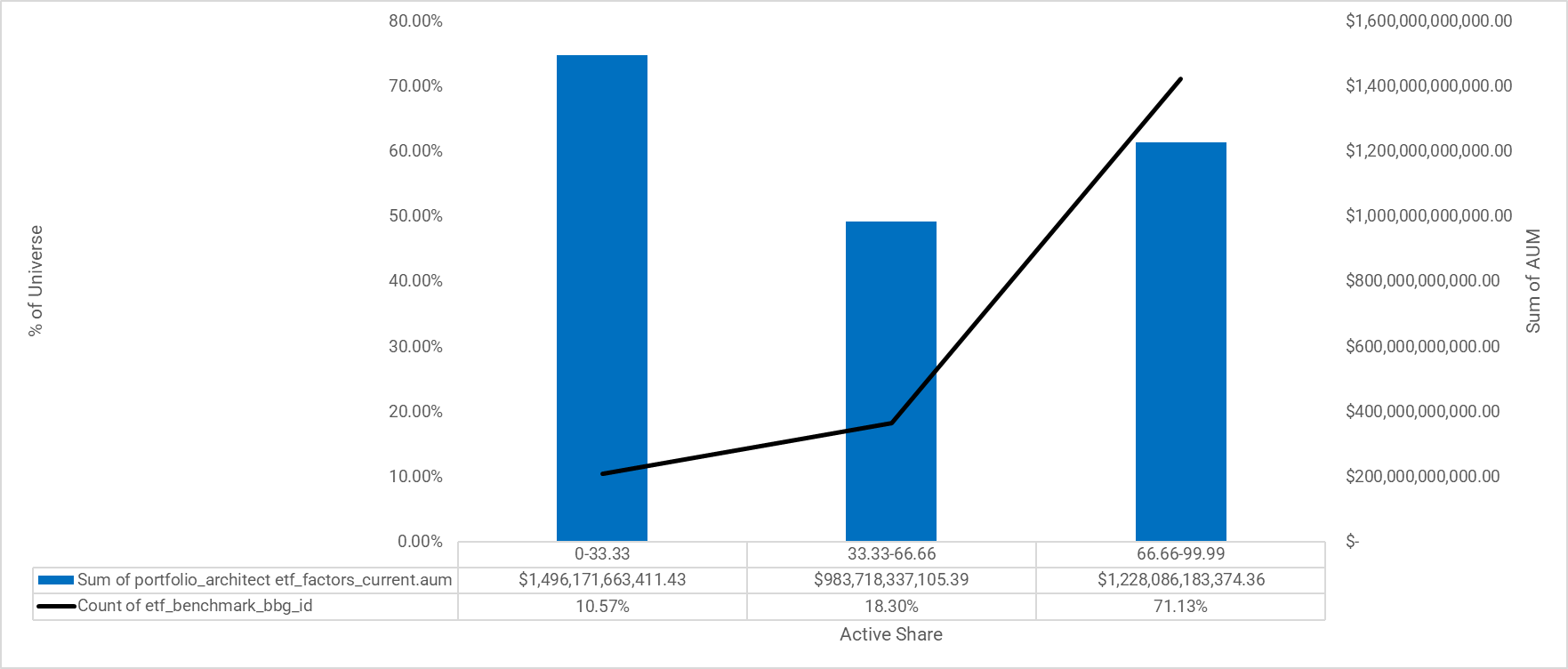

Market commentators sometimes suggest that the equity ETF market is just a bunch of "index funds" that all do essentially the same thing: deliver undifferentiated stock market exposure.

How true is that statement? Fortunately, we can test the hypothesis that the ETF market is roughly a few thousand different ways to capture the same basic risk/returns. To do so, we leverage our Portfolio Architect tool to quantify the active share of all US equity ETFs against the S&P 500 index (the king of indexes).

Global Factor Performance: June 2022

By Wesley Gray, PhD|June 7th, 2022|Index Updates, Factor Investing, Research Insights, Tool Updates, Tactical Asset Allocation Research|

The following factor performance modules have been updated on our Index website.(1)

Do Connections Pay Off in the Bitcoin Market?

By Tommi Johnsen, PhD|June 6th, 2022|Crypto, Research Insights, Basilico and Johnsen, Academic Research Insight|

This paper identifies the bitcoin investor network and studies the relationship between connections and returns. Using transaction data recorded in the bitcoin blockchain from 2015 to 2020, we reach three conclusions. First, connectedness is not strongly correlated with higher returns in the first four years. However, the correlation becomes strong and significant in 2019 and Second, returns also differ among those connected addresses. By dividing the connected addresses into ten decile groups based on their centrality, we find that the top 20% most connected addresses earn higher returns than their peers during most of our sample period. Third, eigenvector centrality is more related to higher returns than degree centrality for the top 20% most-connected addresses, implying that the quality of connections may matter more than quantity among those highly connected addresses.

Short-term Momentum

By Larry Swedroe|June 3rd, 2022|Larry Swedroe, Factor Investing, Research Insights, Academic Research Insight, Momentum Investing Research|

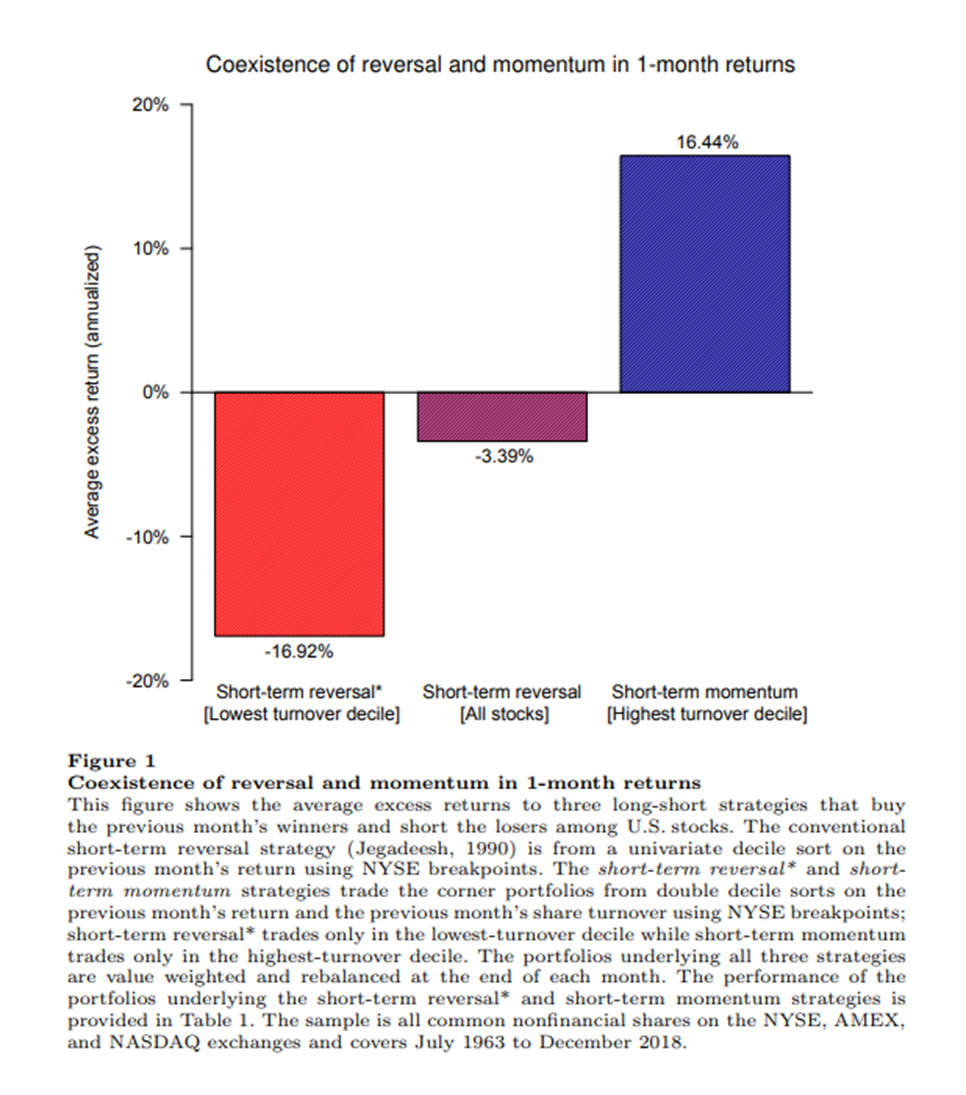

We document a striking pattern in U.S. and international stock returns: double sorting on the previous month’s return and share turnover reveals significant short-term reversal among low-turnover stocks, whereas high-turnover stocks exhibit short-term momentum. Short-term momentum is as profitable and as persistent as conventional price momentum. It survives transaction costs and is strongest among the largest, most liquid, and most extensively covered stocks. Our results are difficult to reconcile with models imposing strict rationality but are suggestive of an explanation based on some traders underappreciating the information conveyed by prices.

DIY Asset Allocation Weights: June 2022

By Ryan Kirlin|June 1st, 2022|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

No exposure to domestic equities. No exposure to international equities. Half exposure to REITs. Full exposure to commodities. No exposure to intermediate-term bonds.

Options Hedging & Leveraged ETFs in Market Swings

By Andrea Barbon|June 1st, 2022|Options, Research Insights, Academic Research Insight, Guest Posts, ETF Investing|

Earlier this year, GameStop stock rose like crazy in only a few hours with the effects of broker-dealer options hedging spurred by retail investor buying pressure. And from February to March 2020, options trading activity was also pointed to as a contributor to stock swings in the Covid-19 selloff. The market dropped 30% and then recovered quickly over the following weeks. It has been documented that the need for market makers to hedge their positions with options (given rapid changes in stock prices) can contribute to market and stock price swings. However, might there be other factors also at play in these types of stock and market fluctuations?

Is There a Gender Gap in Kickstarter Campaigns?

By Tommi Johnsen, PhD|May 31st, 2022|ESG, Research Insights, Basilico and Johnsen, Academic Research Insight|

This study focuses on the launch phase of the leading reward-based crowdfunding market—Kickstarter. It documents the behavior of male and female entrepreneurs in raising early stage capital. We find that women share as entrepreneurs in the platform (34.7%) does not equal to their share in the overall population, and they are concentrated in stereotyped sectors, both as entrepreneurs and as backers. We also find that women do not set lower funding goals than men, they enjoy higher rates of success than men, even after controlling for project categories and funding goals, and that backers of both genders have a tendency to fund entrepreneurs of their own gender. Our survey of Kickstarter backers finds evidence of taste-based discrimination by male backers.