We did it. We democratized quant for one more year. Last year, we suffered through a 50% drawdown in attendance due to a perfectly timed snow storm. This year the weather cooperated with us and we were able to get everyone there.

Full access to presentation videos and the accompanying slides (when available) are available on the following recap website. (content is password-protected as per compliance requirements from some of the attendees).

The Dem Quant Kick-Off BBQ

We kicked things off the night before (Wednesday) at Alpha Architect’s Global Headquarters in Broomall, Pennsylvania.(1) This year we also were able to welcome people to an authentic Philly experience with cheesesteaks from Thunderbird, soft

Here’s a shot of some of the happy customers:

From Left to right: Rick “Fireball” Ferri, Troy “Not Winter” Springer, Corey “Don’t Hassle the Hoff” Hoffstein, Jamie “Don’t Call Me Cathie” Catherwood, Wes “I’m not short these guy’s and gals around me are tall” Gray, Mike “I never Phil up” PhilBrick, Nicole “I put the fun in PhD” Boyson, Josh “50 miles is easy” Russell, Annie “Ya Wanna Bet? BET” Duke, Raisa “The Roof” Velthuis, Antti “The Finnish Flash” Ilmanen

The next morning we kicked things off with a presentation from Ben Johnson on Trends Shaping the Asset Management Industry.

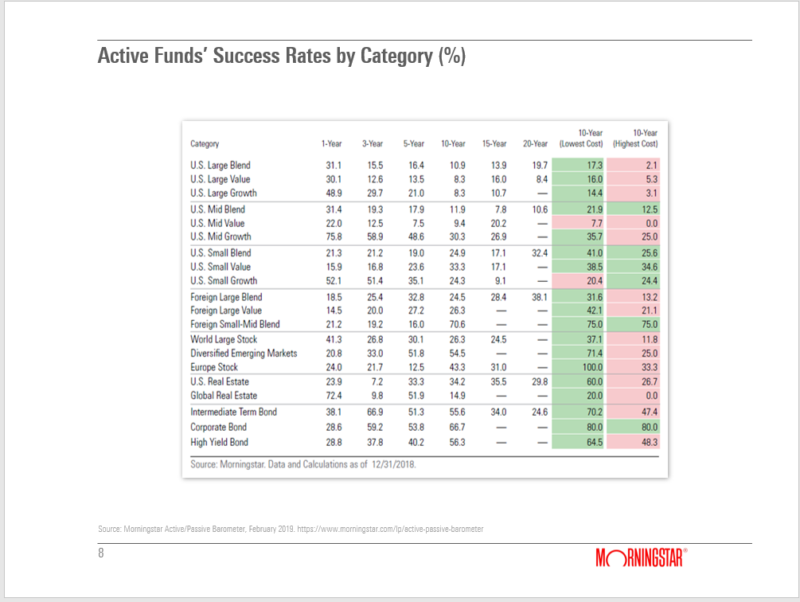

One slide from Ben started the avalanche of questions and audience participation that continued for the rest of the day:

This slide caused a lot of debate on something that’s been talked about a lot for the last few years, “Active vs Passive,” but it also brought some data to the debate to help us frame things.

Eric Balchunas (jokingly termed the CEO of Bloomberg by Wes) came up and expanded on Ben’s thought and added a few critiques. Some of what Eric discussed is in his most recent blog post. Eric and Ben made for good sparring partners, but no actual blood was

Next up was Antti Ilmanen of AQR to discuss Who Is On the Other Side? This presentation was a best effort to determine if factor investors have a natural trading counterpart in the marketplace.

Brought up to discuss Antti’s presentation was Corey HoffStein of NewFound Research. Corey summarized Antti’s work well and had interesting points to potentially improve the research. All of Corey’s work was enhanced by his use of Muppets. Corey truly was Democratizing Quant because I understand things best when told through stuffed animals.

We ended the discussion with Antti and Corey by pairing them up on a panel with two hardcore traders, Chris Hempstead of Deutsche Bank and Bryan Johanson of RBC. The panel was moderated by Villanova Professor Michael Pagano. The

This took us into our lunch presentation/keynote with Rich Evans,

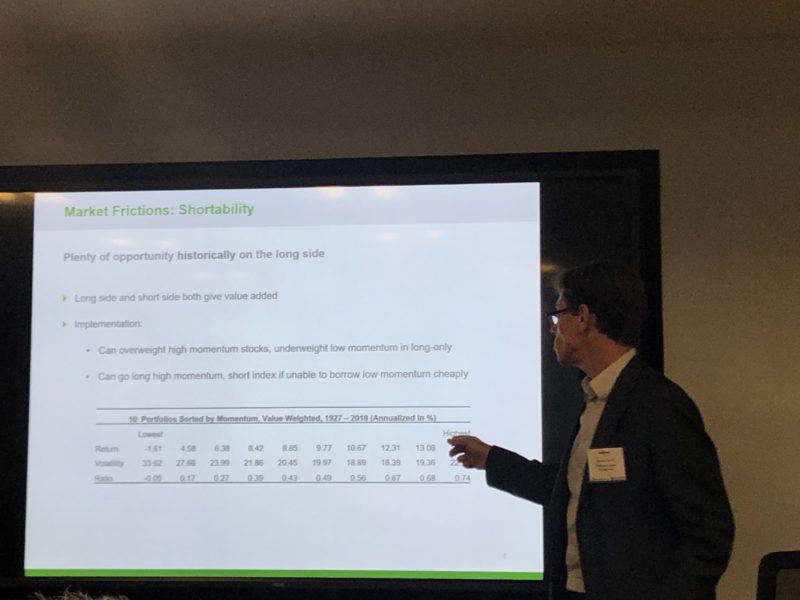

The next in line was Andy Berkin, PhD of Bridgeway Capital Management to present on What’s Up with Momentum? The purpose of the presentation was to describe momentum investing and when and why it may work (or not!). Andy’s dry sense of

Mikhail Samanov had little time to prepare his response as our partner Tommi Johnson, PhD had to cancel last minute. Being one of the leading experts on Momentum investing though, it was no sweat for him. Some of the data he has on momentum investing (dating back over 200 years!) was extremely interesting to see. Here’s one interesting chart he showed instead that highlights the similarity in

In that tough 3:30 time slot when everyone’s just about ready for a nap, we had a presentation that woke us all right up with some eye-popping statistics. Wei Liu and James Kolari presented on their cutting edge research A New Asset Pricing Technology: The

We then brought up the previous four presenters for a moderated panel led by “The Pride of Delco” Dr. Jack Vogel. The panel included Kolari, Liu, Ren, Samnov and Berkin. Jack took them through a discussion that enabled the audience to further ask questions on what they presented. No photos exist of this panel. You’ll just have to trust me that it happened.

After that, we had

For the final portion of the conference, we had

Annie answered these questions with a different view than many of us did before and we walked away ready to go beat our friends and family at the next poker game. We were all a little less sure about our investing beliefs than when we walked in the room

References[+]

| ↑1 | conveniently, we have no other headquarters. So this is also our national headquarters, our Pennsylvania headquarters, our Broomall Headquarters, and Katie and Wes Gray’s other line of business headquarters (parenting). |

|---|---|

| ↑2 | combination between academic due to having a PhD and practitioner due to working in the asset management industry |

About the Author: Ryan Kirlin

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.