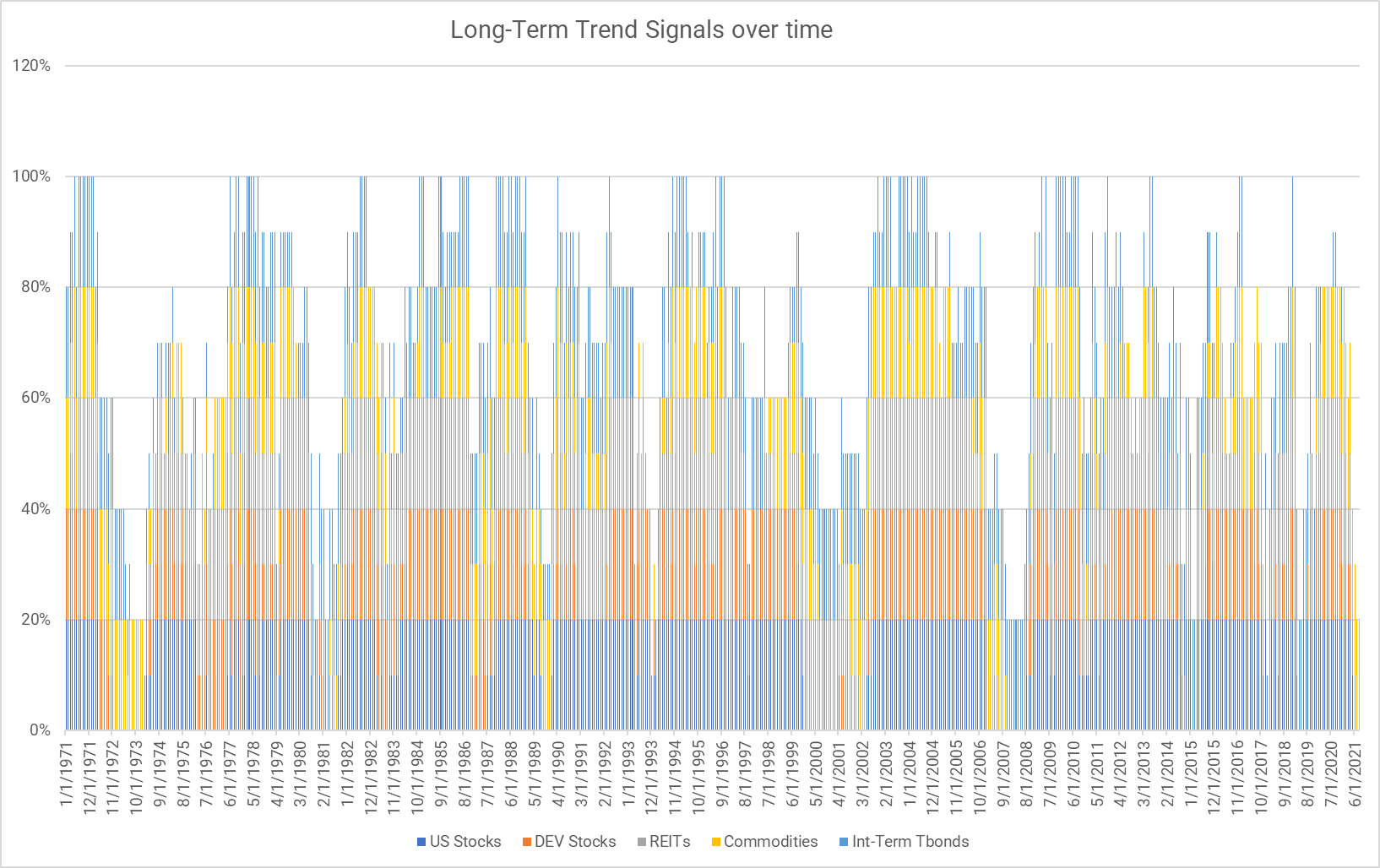

Trend Following Says Commodities…But Nothing Else!

The analysis above highlights that we are in a rare regime when commodities are the only long asset with a positive trend. The last time this happened we entered a long period of high inflation and poor real returns. Will this happen again? Who knows. But we do know that post-1973 we entered a world where, for several decades (at least up to around 2007), both bonds and commodities were an important component of a diversified portfolio. The recent past has arguably made investors complacent in their reliance on a stock/bond portfolio as an end-all-be-all solution. When history tells us that incorporating commodities into a portfolio probably makes sense from a diversification standpoint.