Is ESG Investing Counterproductive?

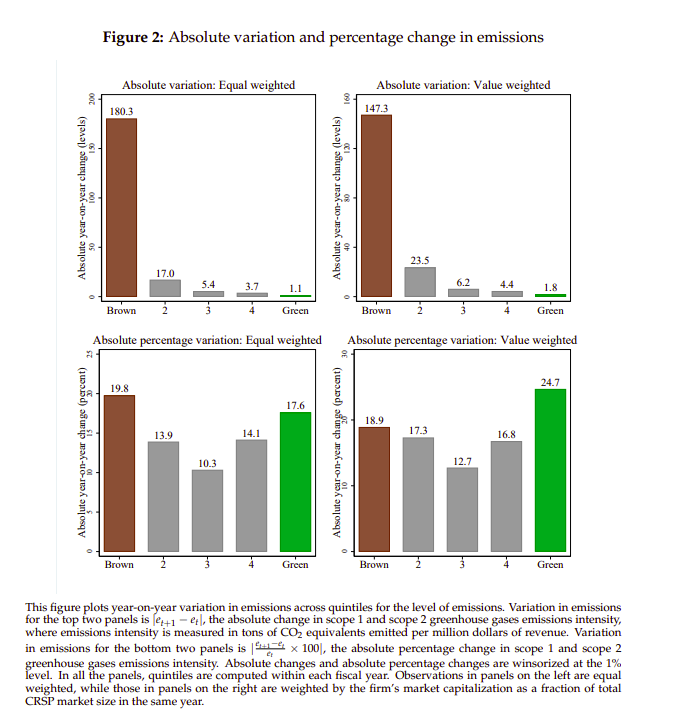

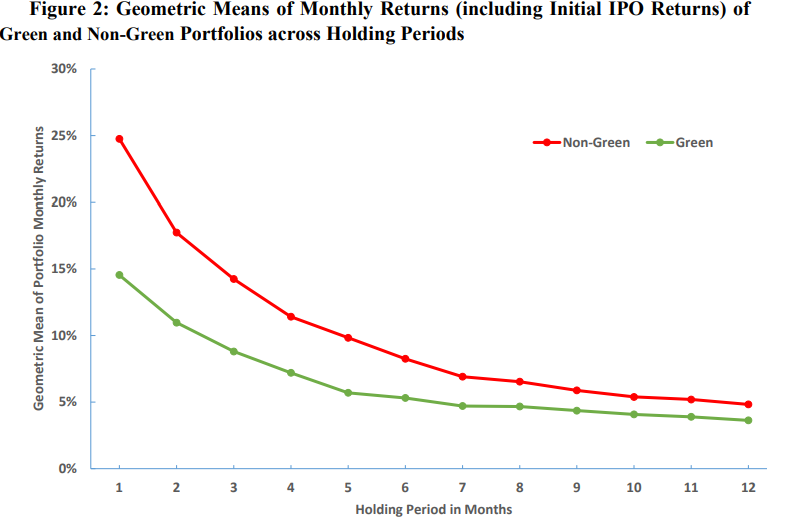

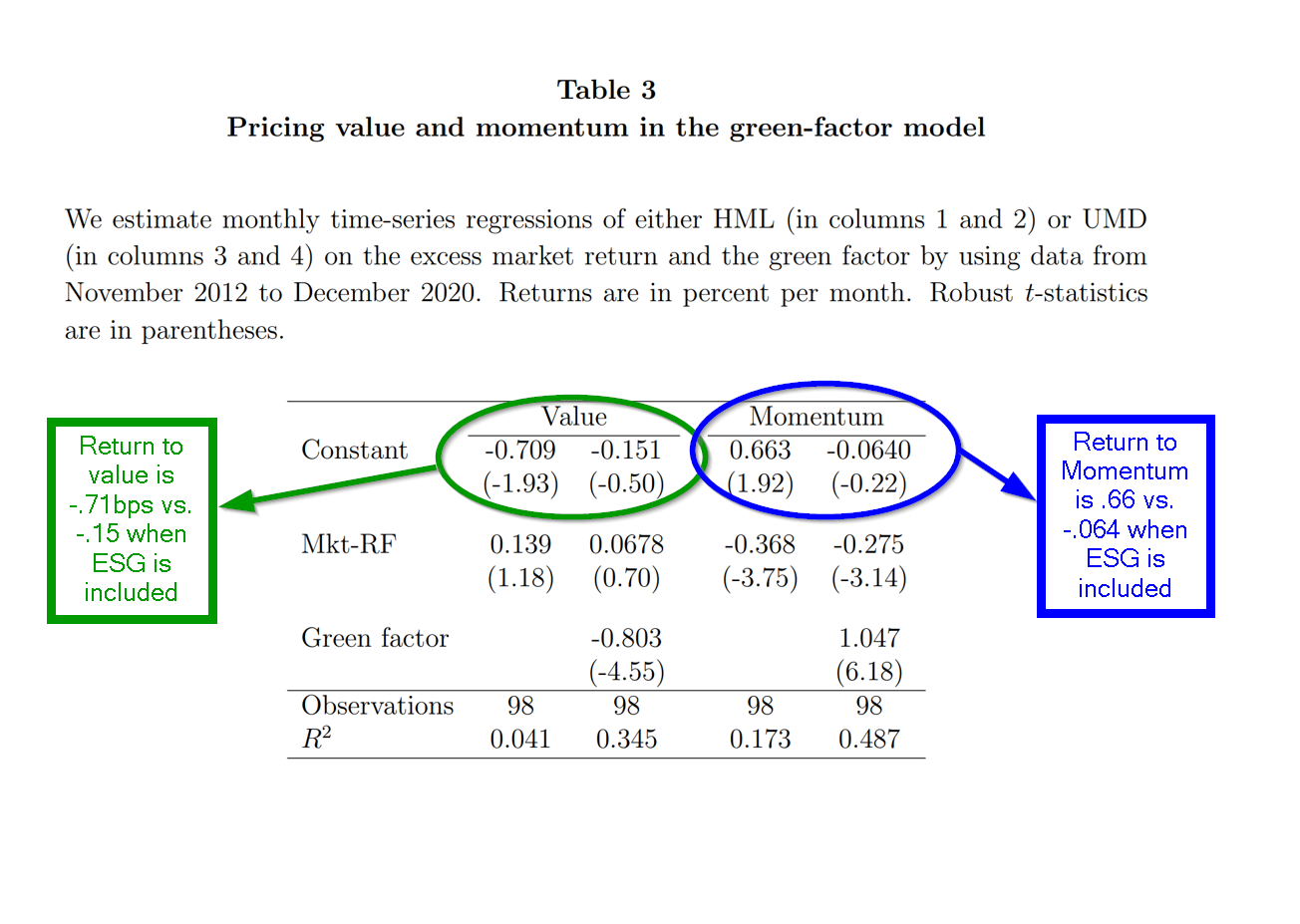

The article introduces a concept called "impact elasticity," which measures how a firm's environmental impact changes in response to shifts in its cost of capital (the "E" in "ESG"). It finds that the dominant sustainable investing strategy, which favors green firms and punishes brown firms by altering their cost of capital, can be counterproductive.