Investing in High Dividend Yield Stocks: a Sucker Bet? Maybe Not This Time Around

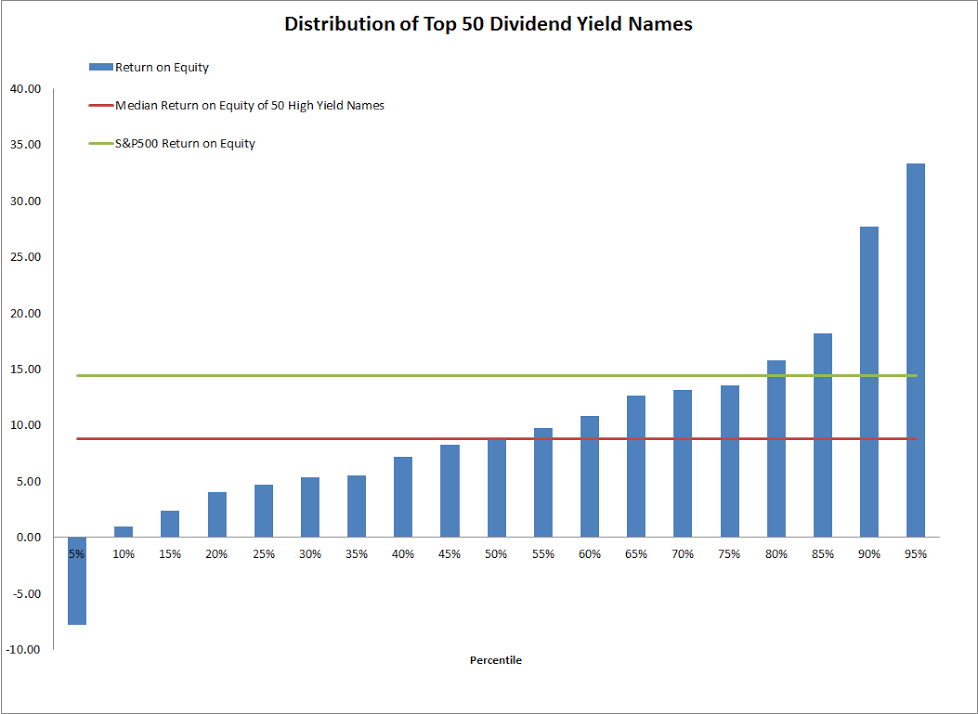

Beware of any investment that has the word, "yield," embedded in the title. This is especially important for "dividend yield" strategies. Because the term makes investors salivate, marketing-focused asset managers leverage this knowledge to sell unsuspecting [...]