Sometimes its nice to reflect on some of the more esoteric articles being published in academic finance journals–good way to assess exactly how disconnected from the real-world the ivory tower has become.

The most absurd economic arguments assume humans are perfectly rational computers and not imperfect creatures that sometimes suffer from innate biases.

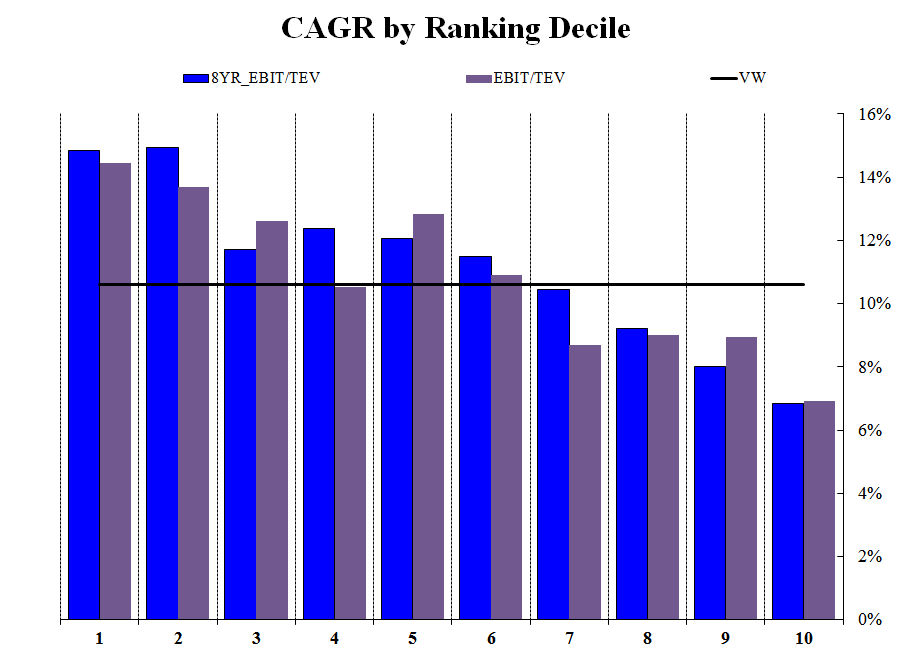

One of the most studied empirical observations from finance is that value stocks have higher returns than growth stocks. Below is a study I did of the EBIT/TEV factor from 1971-2010 for EBIT/TEV and for a “Shiller P/E-esque” Averge(8YR EBIT)/TEV. As everyone can witness, “value” has better returns than “growth.” Portfolios are value-weighted and the universe is all stocks with a market cap > 10% NYSE benchmark.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

And while everyone agrees that value stocks have had higher returns than growth stocks (a robust finding found in almost every market that has been studied), nobody seems to agree on whether or not value outperforms growth on a risk-adjusted basis.

“Normal” economists and fringe “behavioral” economists disagree on the value anomaly. Normal economists claim that value stocks are inherently riskier, whereas, the “wack-job” behavioral economists claim that value stocks outperform growth because investors are not perfectly rational.

And while this “value anomaly” debate has raged on for years, I was under the impression that Lakonishok, Shleifer, and Vishny (1994) put the argument to bed–behavioral economists finally won an argument. Moreover, out of sample evidence since the classic 1994 paper only reiterates that value does outperform growth, and it is very likely due to investor behavior and not systematic risk (unless of course you thought the internet bubble was rational asset pricing at its finest).

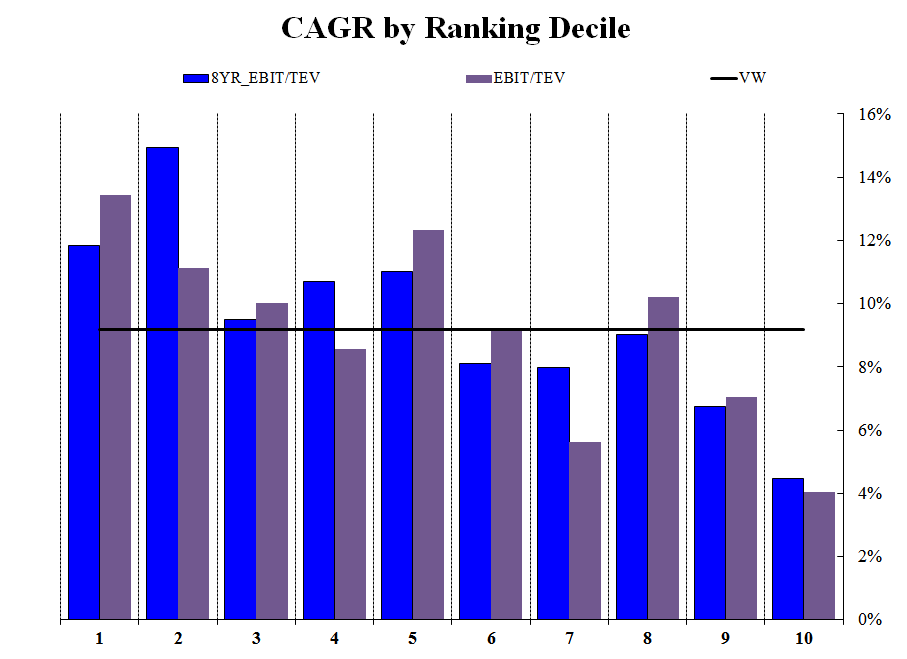

Here are the deciles since 1994:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

So on with the point of this post.

This morning I did some light reading–I looked at an article entitled, “Displacement Risk and Asset Returns,” which is a recent addition to the very prestigious Journal of Financial Economics. The only reason I read the paper is because it was written by one of my former advisors–Stavros Panageas–who is a great guy and really helped me a lot in grad school. That said, you can be a great guy and still come up with some “interesting” ideas.

Here is a link to the paper and the abstract (which doesn’t even cite Lakonishok, Shleifer, and Vishny (1994)):

Displacement Risk and Asset Returns

“We study asset-pricing implications of innovation in a general-equilibrium overlapping-generations economy. Innovation increases the competitive pressure on existing firms and workers, reducing the profits of existing firms and eroding the human capital of older workers. Due to the lack of inter-generational risk sharing, innovation creates asystematic risk factor, which we call “displacement risk.” This risk helps explain several empirical patterns, including the existence of the growth-value factor in returns, the value premium, and the high equity premium. We assess the magnitude of displacement risk using estimates of inter-cohort consumption differences across households and find support for the model.”

So let me synthesize the idea in this paper, and then I’ll let the audience decide if there is a disconnect from reality or not.

First, a set up of the concept:

- Value stocks have higher returns than growth stocks (empirical observation).

- Rational economic stories require that higher returning assets must have higher systematic risk (we need a story to explain this “anomaly”)

- Growth firms have higher innovation levels than value firms (empirical observation)

- Because growth firms derive value from future earnings associated with their high innovation, they earn higher valuation ratios (seems reasonable)

- Innovation creates a “displacement risk”, in other words, if you’re an old fogey who can’t figure out the latest technology, you’re gonna lose your job (got it.)

And now the conclusion:

- Growth firms, which are exposed to “innovation” create an excellent hedge for old fogey’s who can’t get a job when the world moves past them.

- So the old fogey’s buy growth stocks as a hedge against losing their jobs. And because growth stocks act as a hedge against losing their jobs, growth stocks rationally earn lower returns than value stocks. QED.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.