What We Do?

We are a research-intensive asset management firm with a focus on high-conviction value and momentum factor exposures, as opposed to “closet-index” factor exposures. More broadly, we seek to deliver “Affordable Alpha,” which means we want to deliver highly differentiated investment strategies at lower costs, thereby giving active investors a higher chance of winning, net of fees and taxes. We are able to deliver affordability because we relentlessly focus on perfecting efficient operations, minimize operating costs, and spend minimal resources on marketing and distribution.

We deliver our services via three channels:

- We manage Separately Managed Accounts (SMAs)

- We manage AA-branded ETFs (See our AA for Advisor site)

- We launch/manage non-AA-branded ETFs

Here are some links to documentation on our firm:

- Firm overview (PDF)

- Firm overview (website)

- Video overview of our firm

- “Compound Your Face Off” — Wes describing the firm’s ethos with Pat O’Shaughnessy

- Follow our research and ideas here

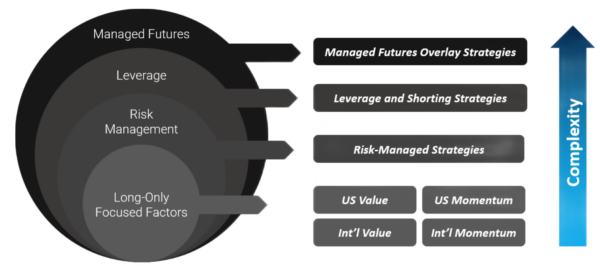

Visualizing our strategy complex:

We develop systematic processes (i.e., “Indexes”) that reflect our investment philosophy. We then manage portfolios that seek to closely replicate these index portfolios.

A PDF version of this is available here.

Why We Exist?

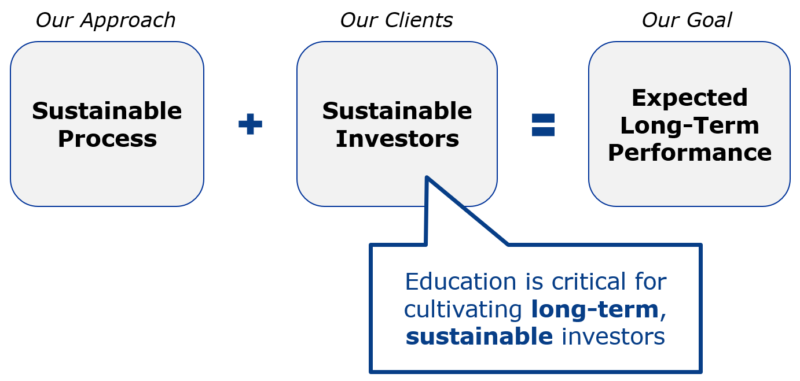

Our mission is to empower investors through education in order to develop sustainable investors. (1)

What are sustainable investors?

Sustainable investors are disciplined and have the capability to hold onto investments when others have “given up.”

Why does successful active investing require sustainable investors?

- Successful active strategies exploit a systematic bias and/or unique risk premium in the marketplace.

- In order for active strategies to beat an index, they must be different than a passive index.

Bottom line?

We build active investment strategies designed to help sustainable investors exploit their edge.

“Edge” is earned when sustainable investors invest in a sustainable active process

We maintain core beliefs that reinforce our mission and make investors more sustainable:

- We believe in Transparency, not black-boxes. We are committed to having investors understand what we are doing so they can stick with our systems through thick and thin.

- We believe in Systematic Decision-Making, not ad-hoc decision-making. Disciplined and repeatable processes are more reliable than discretionary judgment and give investors confidence that they understand what they are buying.

- We believe in Evidence-Based Investing, not story based-investing. Rigorous, data-driven research drives long-term expected investment success; stories drive sales. We focus on evidence and share our findings with our investors.

- We believe in Win-Wins, not unsustainable relationships. We are committed to a business model that prioritizes the client’s potential for success. Our strategies are often capacity constrained, which drives an element of scarcity. Therefore our services will never be “free,” but we will always strive to deliver the most affordable pricing possible. We call it Affordable Alpha.

A Primer on Alpha Architect

Here are materials related to our firm (established in 2010), which was seeded by a multi-billion dollar family office:

- Introduction to Alpha Architect (video)

- Firm Overview (Who we are)

- Value Proposition (What we do)

- Sustainable Active Framework (How we think)

- Bloomberg Audio Interview with Barry Ritholtz (Audio discussion related to our firm)

Here are foundation materials on our core investment processes:

- Focused Value Strategy: Quant Value Philosophy

- Focused Momentum Strategy: Quant Momentum Philosophy

- Trend Following Strategy: Downside Protection Model & 200yr out of sample

- Value Momentum and Trend Strategy: Combining the three ideas above into one package.

- Asset Allocation Strategy: Robust Asset Allocation Philosophy

A Primer on Investing

We are all managing a family office.

Practically speaking, virtually any family that manages its investments—independent of the size of the investment pool—could be considered a family office in a broader sense. The difference is mainly semantic. For example, the term individual investor is often a reference to the head of a household who manages a family’s assets. This “individual investor” is a de facto family office—no matter whether this individual investor manages a $10,000 portfolio or a $10,000,000,000 portfolio. The general goal is the same for all investors: 1) establish a mission for your portfolio, 2) devise and execute a plan to achieve that mission, and 3) monitor and assess the plan. We all put our pants on one leg at a time, and the same is true when it comes to managing an investment portfolio.

You might be skeptical that you can ever achieve a level of knowledge that will make you a successful investor. Case in point: we have over a thousand blog posts related to financial market research. One could spend a lifetime trying to understand all of these materials. But here is the good news: you don’t need to understand everything; you just need to be intellectually curious, and willing to put some time in to learn some basic principles and concepts.

Perhaps you are skeptical that you can achieve a deep understanding of financial markets. After all, legions of professionals have probably told you repeatedly that you cannot. We are here to tell you that you should be skeptical of financial professionals in general, and as an individual, you can understand financial markets. We have been lucky to work with and learn from some superb investors, and the people that manage their organizations. What matters in investing are: avoiding psychology traps, staying disciplined to a process, and considering more non-traditional characteristics of an investment (i.e., don’t solely focus on risk/reward metrics). These simple concepts apply to everyone, not just the ultra-wealthy.

Basic building blocks for managing a portfolio

Below we outline the basic building blocks of traditional portfolio management, which consist of the following three concepts:

- Asset Allocation (i.e., figure out the big picture contributions to various asset classes)

- Security Selection (i.e., figure out how to own the securities within an asset class)

- Risk Management (i.e., figure out how to prevent catastrophic draw-downs in the portfolio–arguably related to #1)

Asset Allocation

Asset allocation is all about determining how to divvy up your portfolio across various classes of investment opportunities in order to achieve your portfolio mission. Simple, but not easy.

We begin the basic asset allocation discussion by identifying the basic building blocks, which can provide high-level diversification. We divide asset classes into three broad categories: (1) equities, (2) real assets, and (3) fixed-income investments.

- Equities are ownership interests in operating businesses and provide exposure to earnings growth and dividend income.

- Real assets are tangible, physical assets whose intrinsic value is related to their utility, which enables them to be exchanged for other products or services. These are typically represented by real estate and commodities. Real assets may generate cash flow and have traditionally been viewed as a means of providing protection against inflation. The reason why is that real assets tend to preserve their real value, regardless of the nominal value of the money in which they are denominated.

- Fixed income relates to investments that generate a return based on stable periodic payments at regular intervals with a return of principal at maturity. Fixed income investments, or bonds, typically provide income and have low historical volatility.

Figuring out how to allocate your capital across these different asset classes can get complex really fast. Harry Markowitz pioneered research in the 1950s that highlighted the benefits of diversifying across multiple asset classes, but there has been substantial debate over the ensuing decades on the best way to maximize these benefits. Since investors can generate varying rates of return and assume alternative levels of risk by combining quantities of asset classes in different ways, this debate has focused on the development of theoretical models that have provided insight into an array of weighting methodologies.

It turns out that these various approaches to asset allocation might be more complicated than they need to be. Research suggests that simple, “rule-of-thumb” allocations, such as equal-weighting across big muscle movement asset classes, do just fine. These simple allocation schemes have the added benefit of preventing an investor from suffering brain damage from overthinking — a very real benefit as it relates to avoiding psychology traps and staying disciplined to a process.

Here are some additional materials one can read on asset allocation to get up and running:

- Robust asset allocation (outlines some basics)

- Beware of geeks bearing formulas (highlights the trouble with complex asset allocation strategies)

- Our “asset allocation” blog post category (a repository of research we’ve highlighted that relates to asset allocation)

In addition, we recommend the following books:

Security Selection

Once one has a handle on broad asset allocation concepts, the next step is to understand how, or indeed whether, to select specific securities within each asset class. Many argue that individual security selection is a fool’s game and one should focus exclusively on passive index allocations. We agree, to an extent. Active investing is only appropriate for limited segments of the investing public. Successful active investing requires discipline and a long-horizon, qualities that are difficult to maintain in financial markets. But assuming one has the basic qualities for potential success in active investing, the next challenge is to determine a reasonable way that one can effectively pursue active investment strategies.

There are literally hundreds of peer-reviewed academic papers written on “anomalies,” or strategies that purport to beat the market on a risk-adjusted basis. Anomaly chasing has become so popular that academics have written papers making fun of other academics. John Cochrane calls the literature on anomalies a “zoo of new factors.” So how can you differentiate among them? Of all the anomalies documented in academic literature, the two most durable strategies identified, which stand head and shoulders above the others, are value and momentum strategies.

Value Strategies: Buy Cheap Stuff

The value investing philosophy, established by Warren Buffett’s mentor Benjamin Graham, is based on buying securities at prices that are low relative to their intrinsic value, as determined by their fundamentals. What are fundamentals? Fundamentals are traditional accounting measures, such as earnings, cash flow, and the book value of equity. While Graham intuitively grasped the effectiveness of buying stocks at low prices to fundamentals, academics began to explore the concept with more rigorous analysis. The empirical evidence is clear: buying cheap stuff has earned higher returns than buying expensive stuff. But why? Researchers have addressed this question by exploring several possible mechanisms for why cheap stuff earns higher returns than expensive stuff. Smart people argue it is due to enhanced risk and other smart people argue it is due to market mispricing. We believe it is probably a mix of both elements.

Here are some additional materials one can read on value investing:

- Value investing simulations

- Our quantitative value philosophy

- Facts, Fiction, and Value Investing

- Our “value investing” blog post category (a repository of research we’ve highlighted that relates to value investing)

In addition, we recommend the following books:

- Quantitative Value (Larry Swedroe review)

- The Intelligent Investor

- The Little Book that Beats the Market

Momentum Strategies: Buy Strong Stuff

Momentum (or specifically “relative strength momentum”), refers to the tendency of investments that have done relatively well in the recent past to continue doing well in the future. In other words, the strong get stronger. As with value, the concept of momentum in securities markets has been around for a long time. In fact, Robert Levy published a paper in 1967 called, “Relative Strength as a Criterion for Investment Selection.” Mr. Levy outlines his conclusion: “The profits attainable by purchasing the historically strongest stocks are superior to the profits from random selection.” After a dark age of momentum research from 1970 to 1990, an interruption that occurred due to a preference for the efficient market hypothesis paradigm that prevailed, with the passage of time, academics inevitably returned to a study of the effect in earnest. Beginning in 1993, hundreds of papers on the subject appeared in the academic literature. As with value, the empirical evidence is clear: buying relatively strong stuff has earned higher returns than buying relatively weak stuff. Here again, also as with value, there is a debate over whether momentum strategy outperformance is due to extra risk or mispricing. We think reality lies in the middle: momentum returns are driven both by extra risk and also by mispricing.

Here are some additional materials one can read on momentum investing:

- Momentum investing simulations

- Our quantitative momentum philosophy

- Facts, Fiction, and Momentum Investing

- Our “momentum investing” blog post category (a repository of research we’ve highlighted that relates to momentum)

In addition, we recommend the following books (not many, as much of the best readings are in academic journals):

Risk Management (Based on Trend-Following)

The typical risk management approach by most investors is to diversify (see asset allocation above). This is a good first step. However, even well-diversified portfolios that own thousands of securities can suffer large drawdowns, or reductions in value, in crisis (e.g., the 2008 Financial Crisis). We recommend that disciplined investors concerned about large losses at least consider market timing and “crisis alpha” type instruments. More information about these can be found below.

In general, while efforts to time the market should be viewed with skepticism, certain risk-management techniques that have been explored in academia that appear to reduce risk, without significantly impacting long-run returns. In particular, trend-following strategies. For example, the application of simple moving average rules has been demonstrated to protect investors from large market drawdowns, which is defined as the peak-to-trough decline experienced by an investor. We also think “crisis alpha” instruments, or assets/strategies that act like insurance during a crisis, are interesting tools investors should consider (e.g., managed futures).

Here are some additional materials one can read on risk management to get up and running:

- Downside protection model (outlines some basics)

- The world’s longest trend-following backtest

- The hated. The feared. The amazing. The US Treasury Bond.

- Crisis alpha and Managed Futures

- Our “tactical asset allocation” blog post category (a repository of research we’ve highlighted that relates to asset allocation)

In addition, we recommend the following books:

References[+]

| ↑1 | See our piece on sustainable active investing and our other piece on the incentives created via delegated asset management |

|---|

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.