The Negative Impact of Crowding on Active Fund Performance

By Larry Swedroe|July 26th, 2024|Larry Swedroe, Research Insights, Other Insights, Behavioral Finance|

The shrinking pool of public companies across which active funds can diversify their holdings, increases the risk of crowding, which the research we reviewed shows negatively impacts performance. That provides yet another reason for investors to choose to avoid playing the loser’s game of active management.

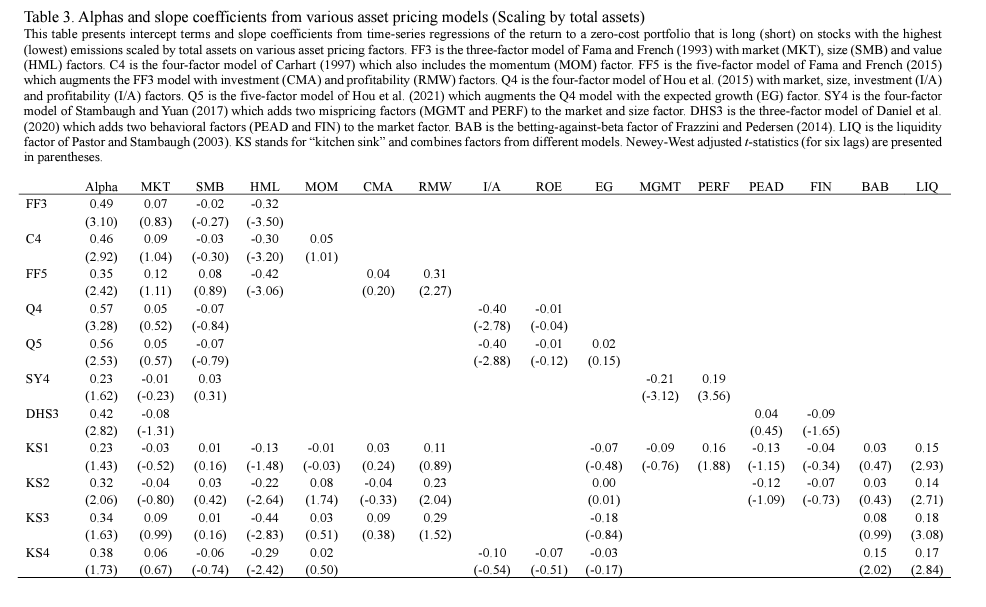

Using Bayesian Solutions to Resolve the Factor Zoo

By Tommi Johnsen, PhD|July 22nd, 2024|Empirical Methods, Factor Investing, Research Insights, Academic Research Insight|

We propose a novel framework for analyzing linear asset pricing models: simple, robust, and applicable to high-dimensional problems.

The Impact of Amortizing Volatility across Private Investments

By Larry Swedroe|July 19th, 2024|Private Equity, Volatility (e.g., VIX), Larry Swedroe, Research Insights, Guest Posts, Other Insights|

The amortization of volatility should be of concern for private capital asset classes. In order to properly budget for beta risks, it is critical that investors in private assets understand the amount of systemic (beta) risk that will “wash” into their private portfolios.

Crypto owners know Crypto…but not finance

By Elisabetta Basilico, PhD, CFA|July 15th, 2024|Research Insights, Basilico and Johnsen, Academic Research Insight, Other Insights, Behavioral Finance|

We find that a significant share of Canadian Bitcoin owners have low crypto knowledge and low financial literacy. We also find gender differences in crypto literacy among Bitcoin owners, with female owners scoring lower in Bitcoin knowledge than male owners.

Explaining the Performance of Low-Priced Stocks: The Penny Stock Anomaly

By Larry Swedroe|July 12th, 2024|Research Insights, Larry Swedroe, Factor Investing, Guest Posts, Other Insights, Size Investing Research|

An efficient way to improve the expected performance of an equity strategy would be to systematically exclude penny stocks, as well with high asset growth and extreme past returns, especially if they have low profitability (and exclude funds that don’t screen out such stocks).

Global Factor Performance: July 2024

By Wesley Gray, PhD|July 8th, 2024|Index Updates, Factor Investing, Research Insights, Tool Updates, Tactical Asset Allocation Research|

The following factor performance modules have been updated on our Index [...]

Overconfidence May Lead to Poor Emergency Planning

By Tommi Johnsen, PhD|July 8th, 2024|Financial Planning, Research Insights, Basilico and Johnsen, Academic Research Insight|

How does the perception of the need to hold emergency cash relate to overconfidence in one's degree of financial literacy? The answer is surprising.

Polluters Provide Higher Returns than Non-Polluters

By Larry Swedroe|July 5th, 2024|ESG, Larry Swedroe, Research Insights, Guest Posts, Other Insights|

Atilgan, Demirtas, and Gunaydin found that there has been a pollution premium for US stocks and that the premium translated into superior investment performance.

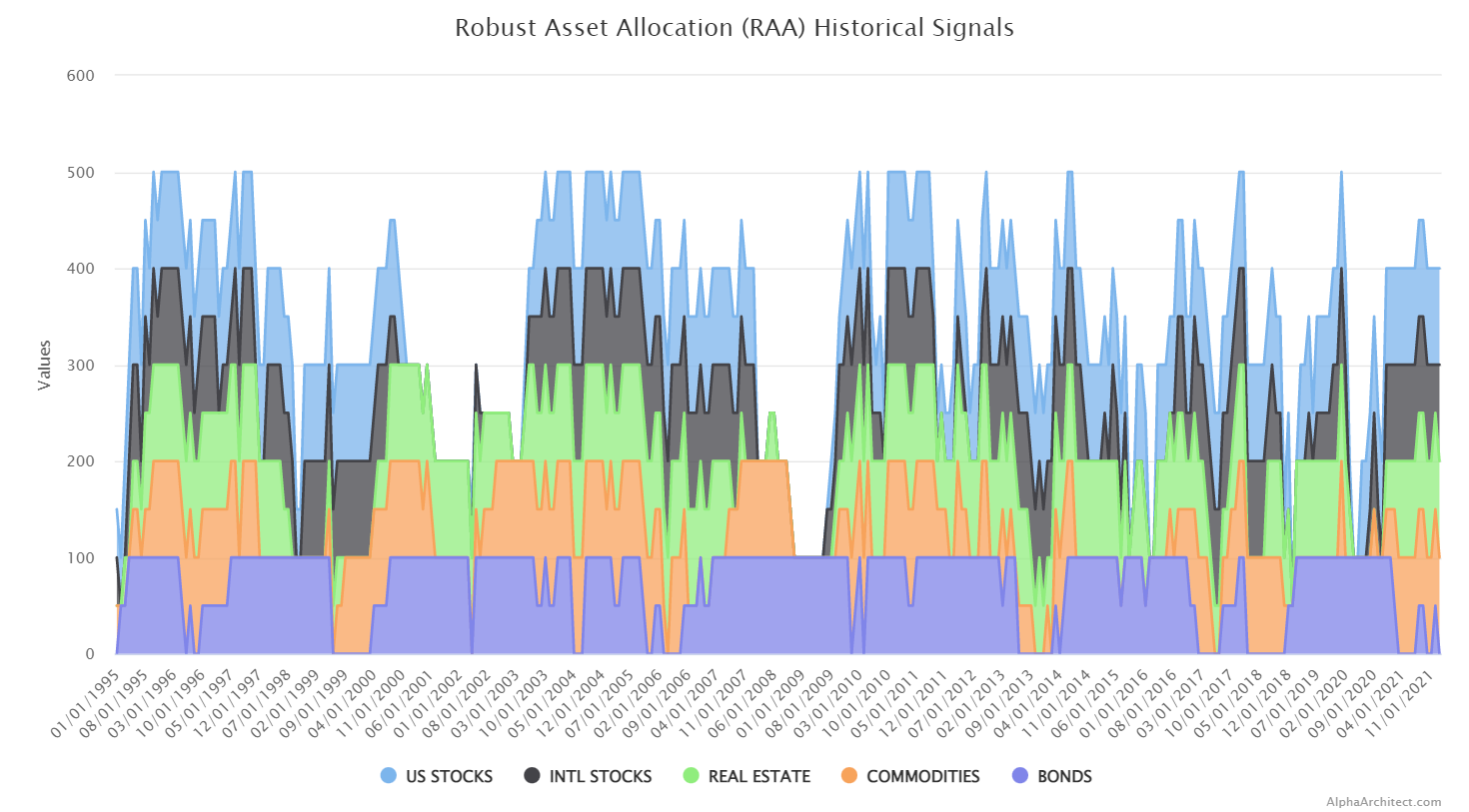

DIY Trend-Following Allocations: July 2024

By Ryan Kirlin|July 1st, 2024|Index Updates, Research Insights, Tool Updates, Tactical Asset Allocation Research|

Full exposure to domestic equities. Full exposure to international equities. Partial exposure to REITs. Full exposure to commodities. Partial exposure to intermediate-term bonds.

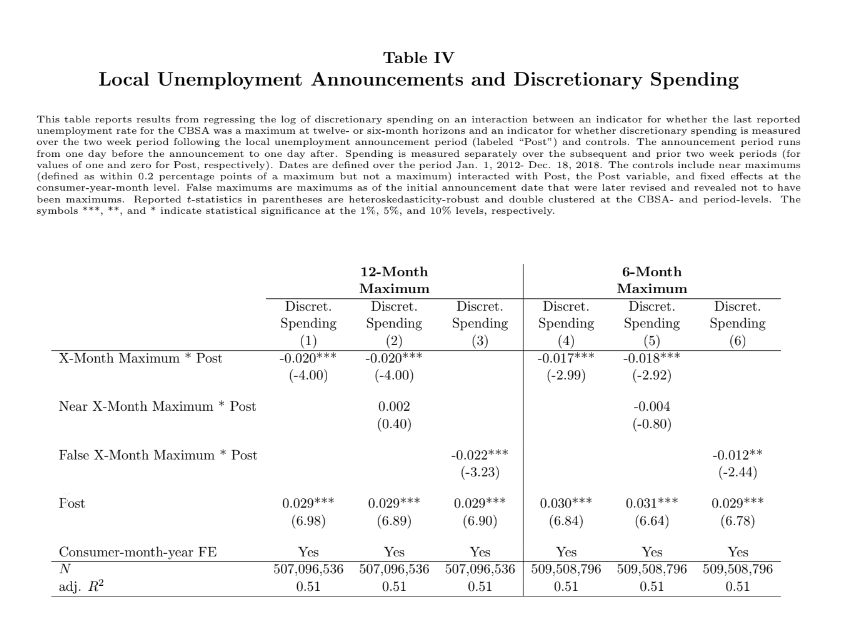

How do macroeconomic announcements impact household spending?

By Elisabetta Basilico, PhD, CFA|July 1st, 2024|Research Insights, Basilico and Johnsen, Academic Research Insight, Other Insights, Behavioral Finance|

What are the primary factors contributing to the steep and persistent decline in U.S. consumption growth during the Great Financial Crisis of 2008-2009?