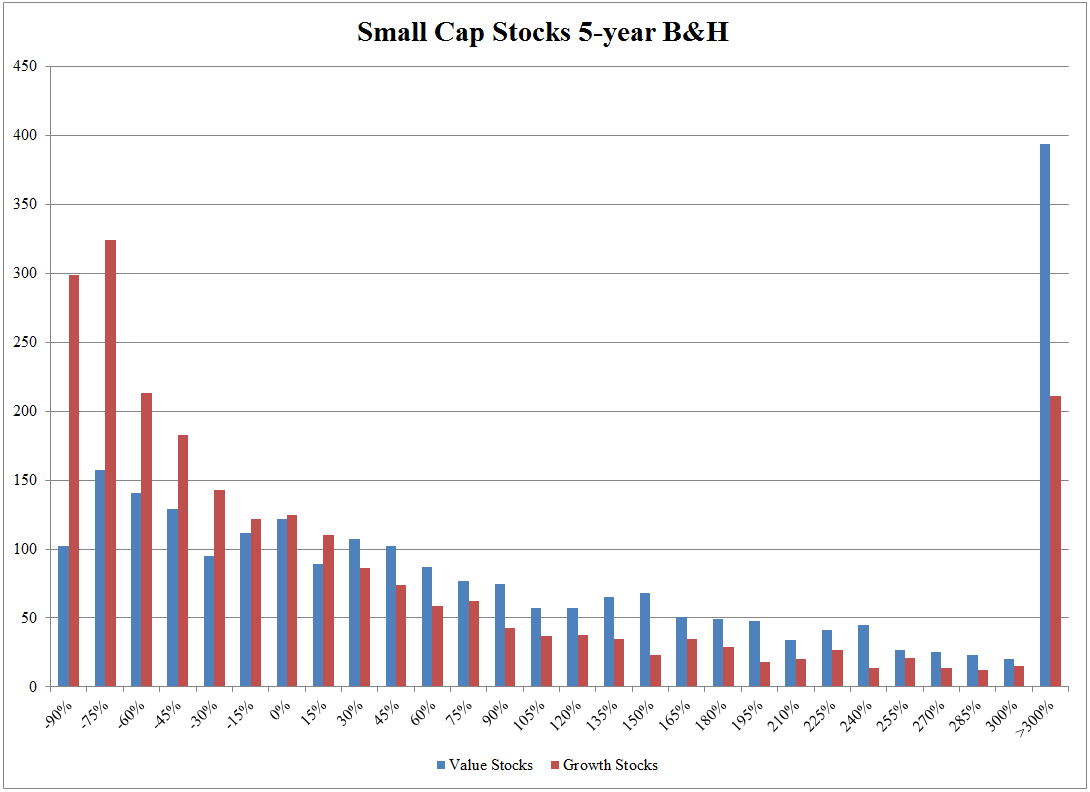

Long-Only Value Investing: Size Doesn’t Matter!

By Wesley Gray, PhD|June 15th, 2023|

Summary: no difference in average returns between large-cap and small-cap portfolios. There you have it. The small-cap sacred cow has been slaughtered.

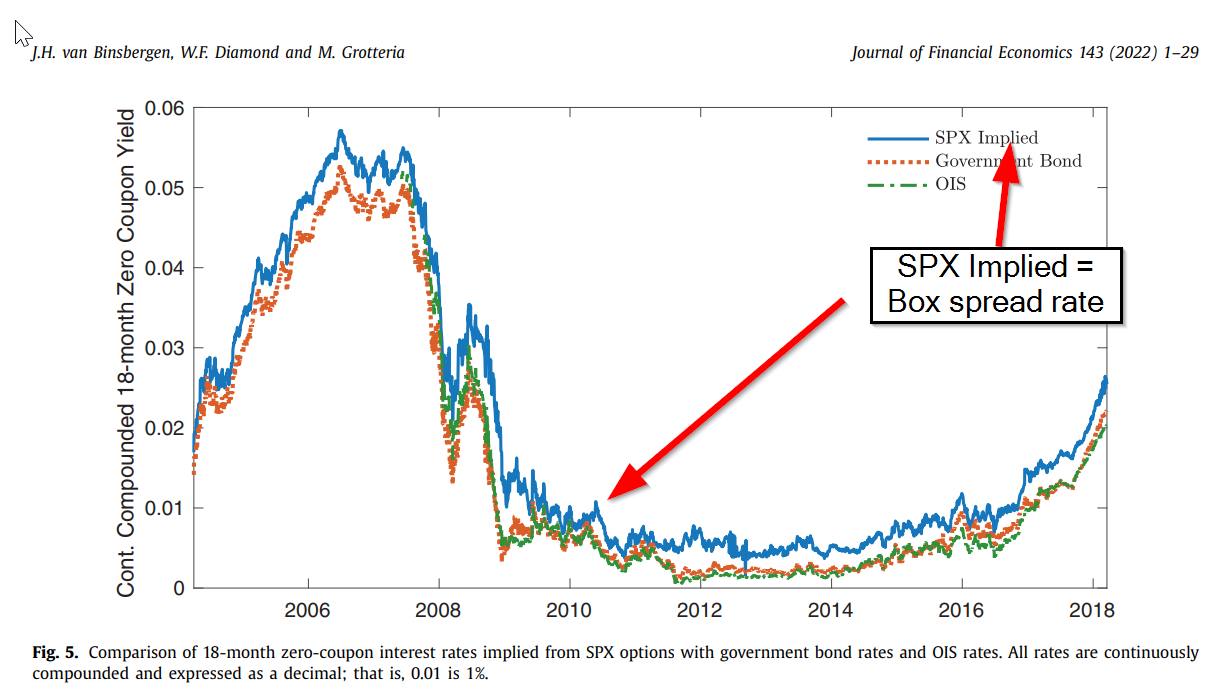

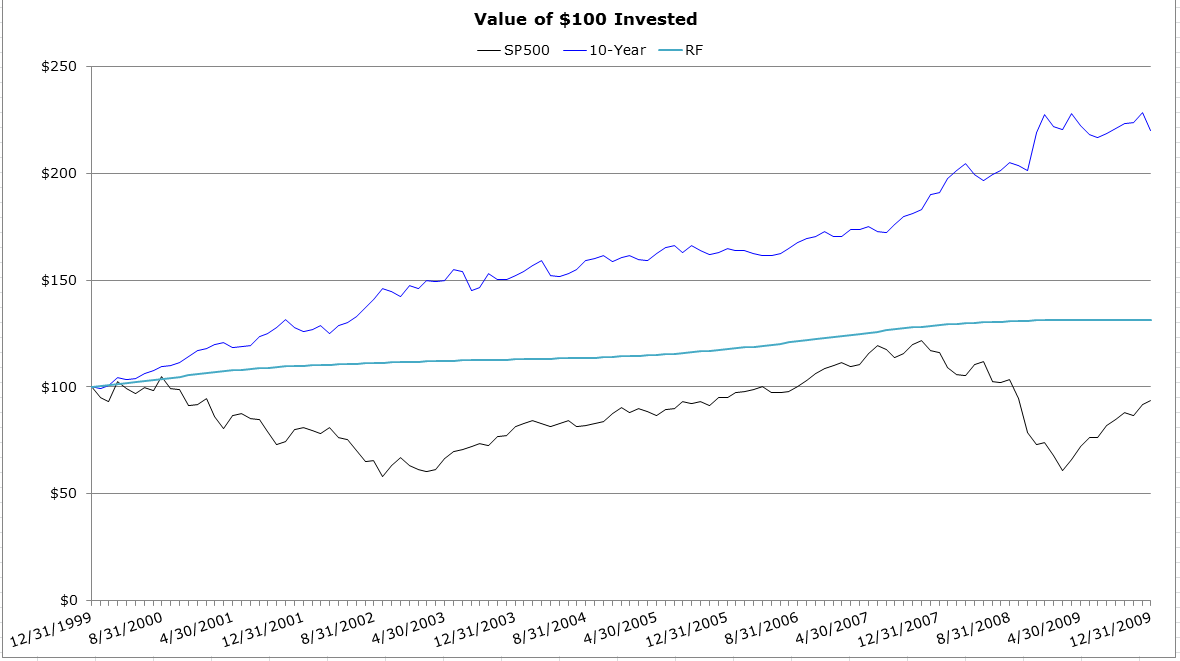

Box Spreads: An Alternative to Treasury Bills?

By Wesley Gray, PhD|May 10th, 2023|

Box spreads represent an opportunity to borrow and lend via the options market, at similar (and often better) rates than those that are available in the treasury bill market.

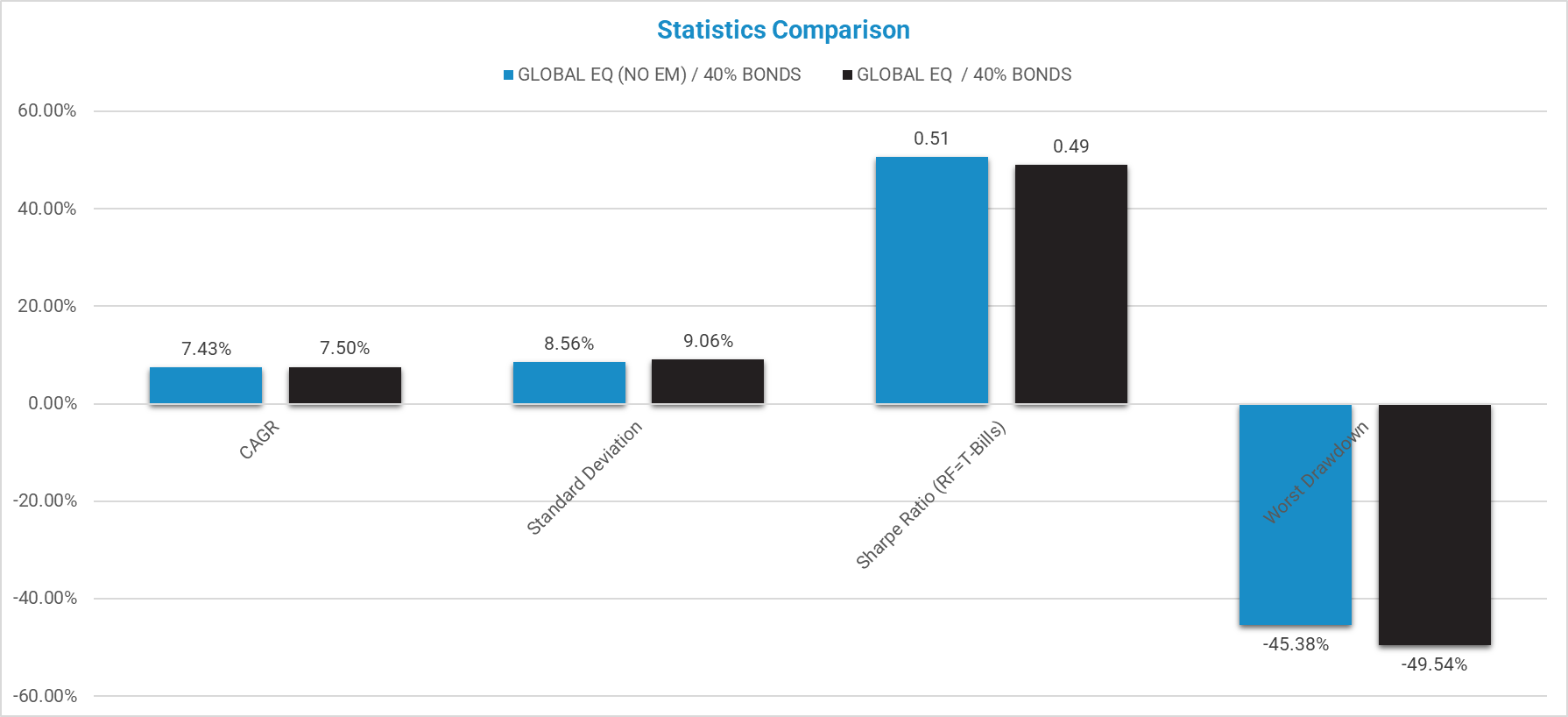

Does Emerging Markets Investing Make Sense?

By Wesley Gray, PhD|June 17th, 2022|

The analysis above suggests that portfolios that include or exclude emerging allocations are roughly the same. For some readers, this may be a surprise, but for many readers, this may not be "news." That said, even if the data don't strictly justify an Emerging allocation, the first principle of "stay diversified" might be enough to make an allocation.

Of course, the assumptions always matter.

How to Start an ETF? Resources and FAQ

By Pat Cleary|November 16th, 2021|

We get the following question at least 1x a day: "How do I start an ETF? Because we have so many requests for information on the topic of "How to Start an ETF?", Wes asked that I compile a list of materials on the topic and a "FAQ" to address all of your burning questions.

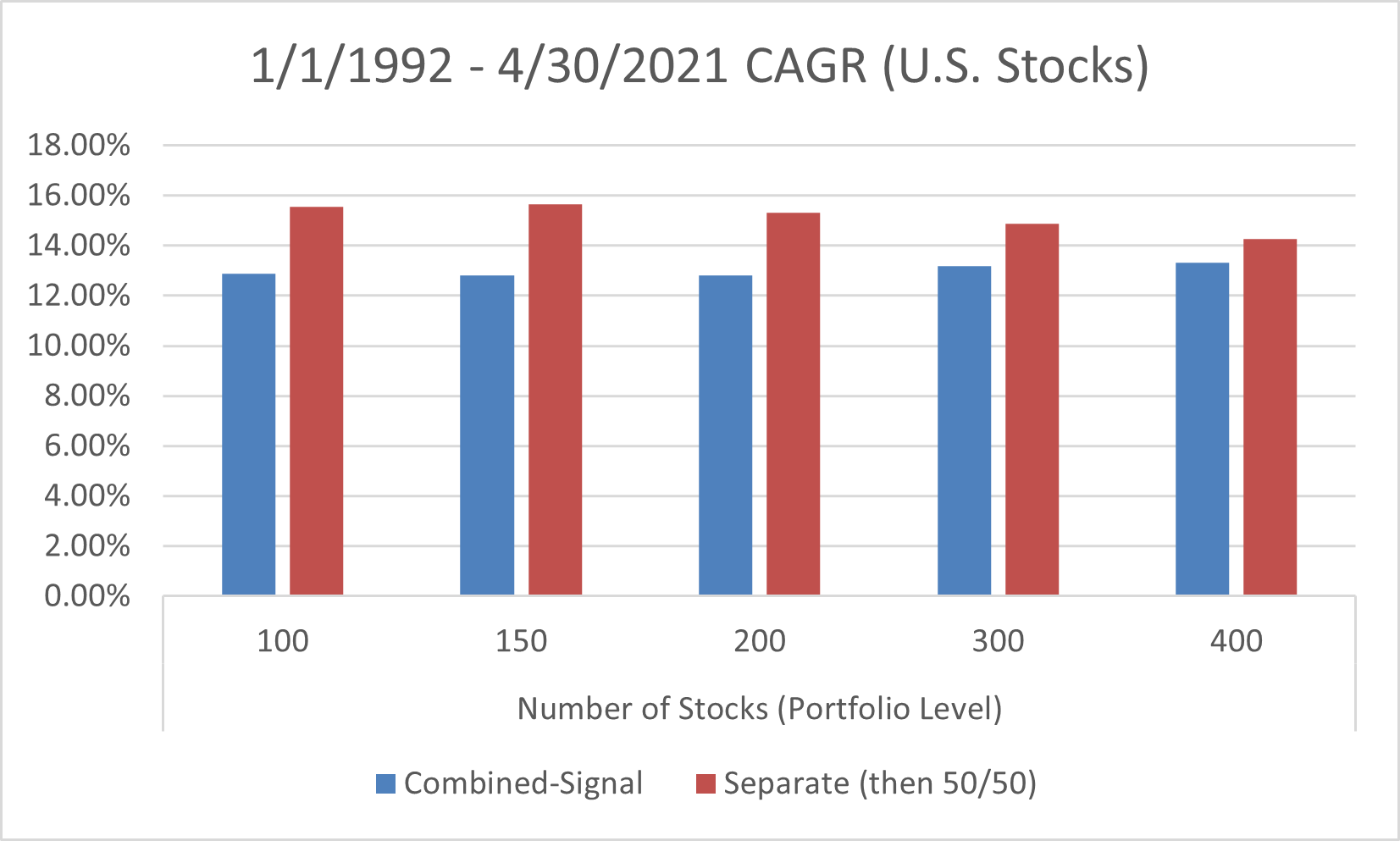

Value and Momentum Investing: Combine or Separate?

By Jack Vogel, PhD|May 25th, 2021|

When it comes to Value and Momentum investing we often get asked the following set of questions: Should [...]

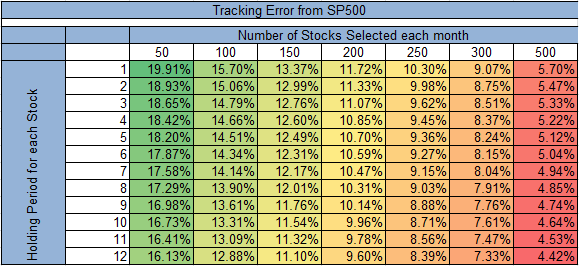

How Portfolio Construction Impacts the Reliability of Outcomes

By Jack Vogel, PhD|April 16th, 2021|

We are proponents of focused (i.e., 50 stock) long-only value and momentum factor strategies.[ref]Please note that in the [...]

A Short Research Library Outlining Why Traditional Stock Picking is Challenging

By Wesley Gray, PhD|December 2nd, 2020|

There are no "right" answers when it comes to financial markets. There are generally trade-offs to all decisions. [...]

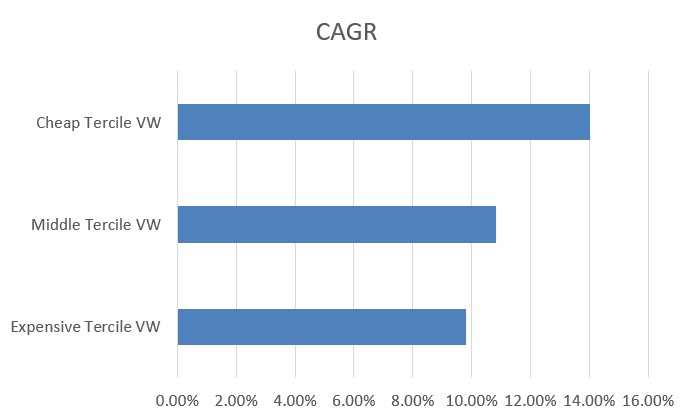

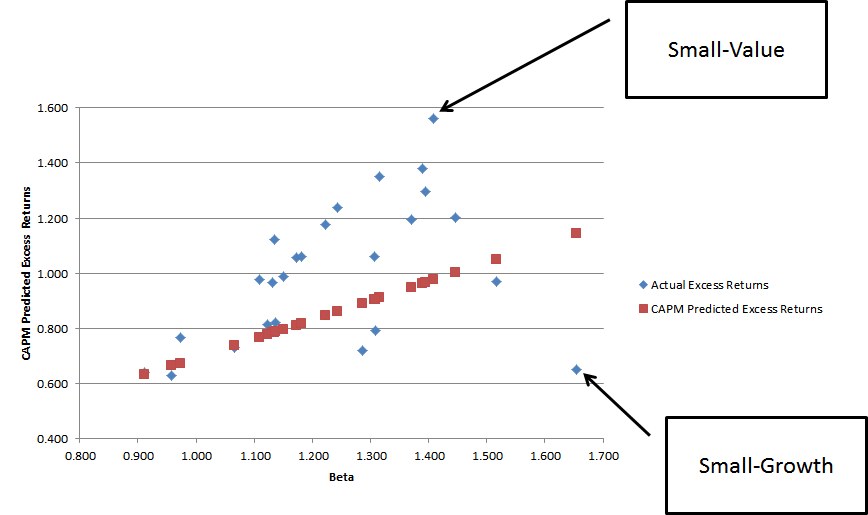

Value Investing: An Examination of the 1,000 Largest Firms

By Jack Vogel, PhD|August 18th, 2020|

Among stock investors, a common strategy/belief held is Value investing -- buying stocks that are relatively cheaper on [...]

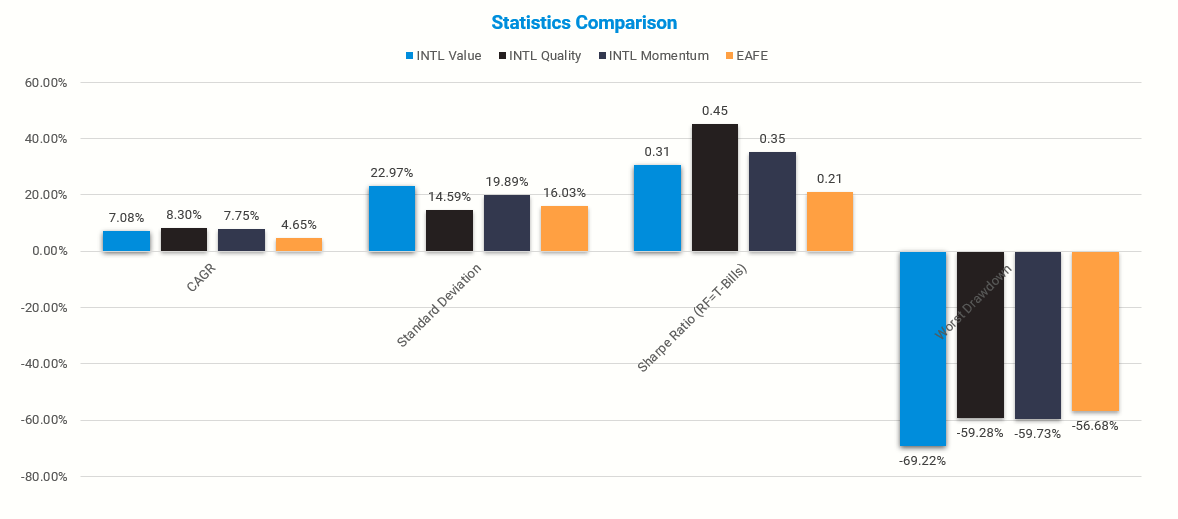

Value Factor Diversification: Is Quality Better Than Momentum?

By Wesley Gray, PhD|June 26th, 2020|

What if your portfolio was only based on one idea? Something like “stocks always go up” or “value [...]

ETF-prenuers: An Introduction to ETF White Label Services

By Wesley Gray, PhD|June 24th, 2020|

Interested in starting an ETF? Interested in converting a managed account, hedge fund, or mutual fund into an [...]

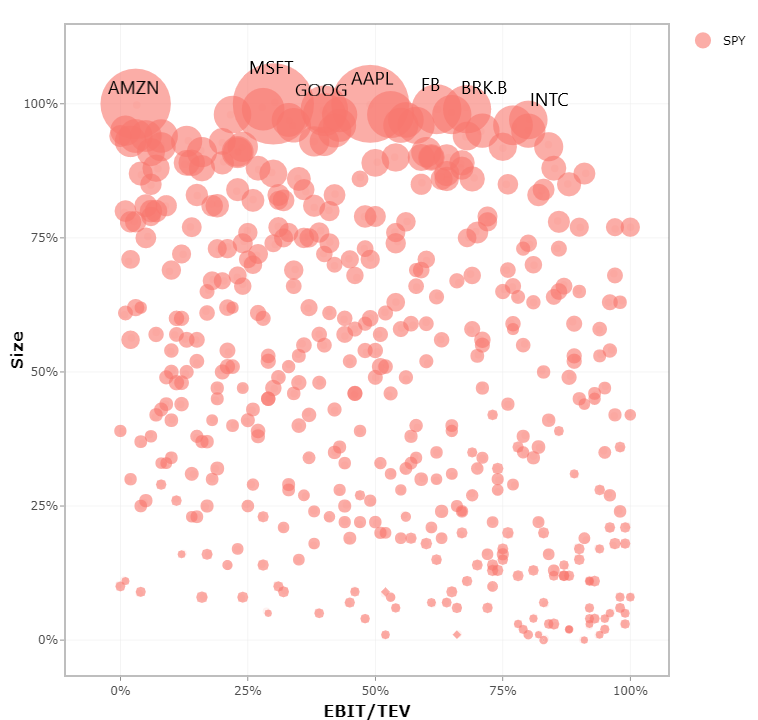

What’s the Story Behind EBIT/TEV?

By Ryan Kirlin|May 1st, 2020|

A common question we receive at Alpha Architect is the following: "Why do you focus on EBIT/TEV as [...]

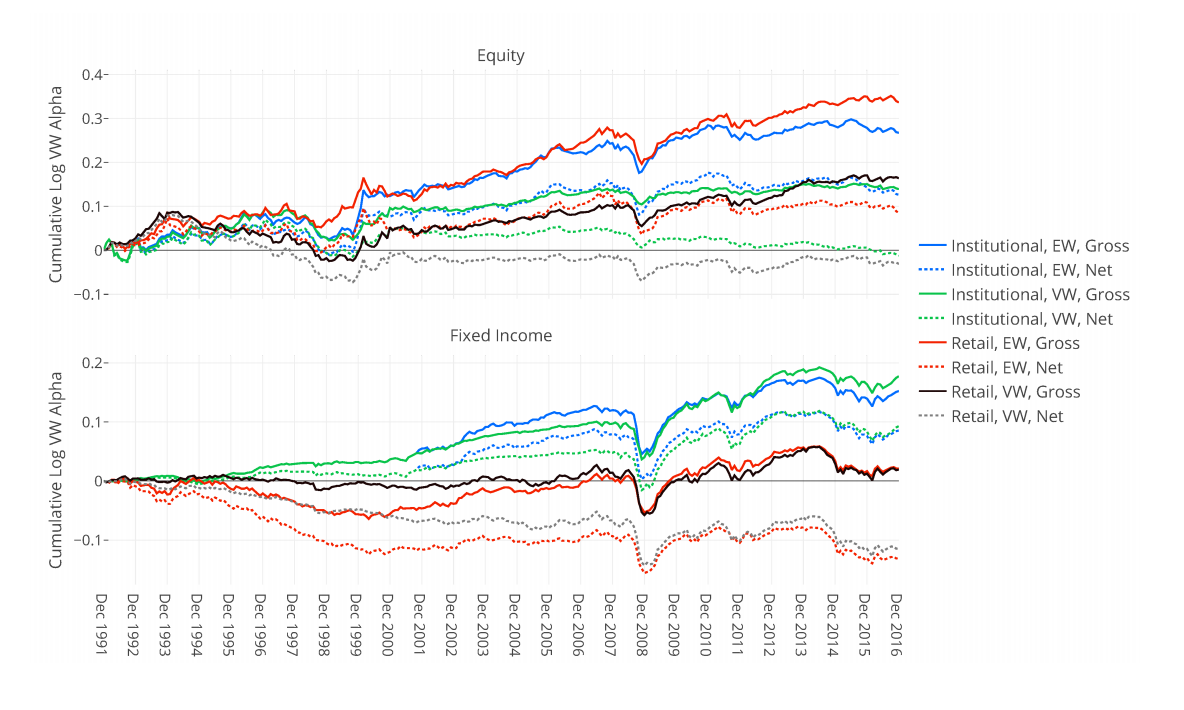

Is Passive Investing Better than Active Investing?A Critical Review.

By Geoff Warren|January 2nd, 2020|

The broad thrust of this paper is that Sharpe’s proposition is not water-tight upon closer examination, and certainly should not be received as gospel.

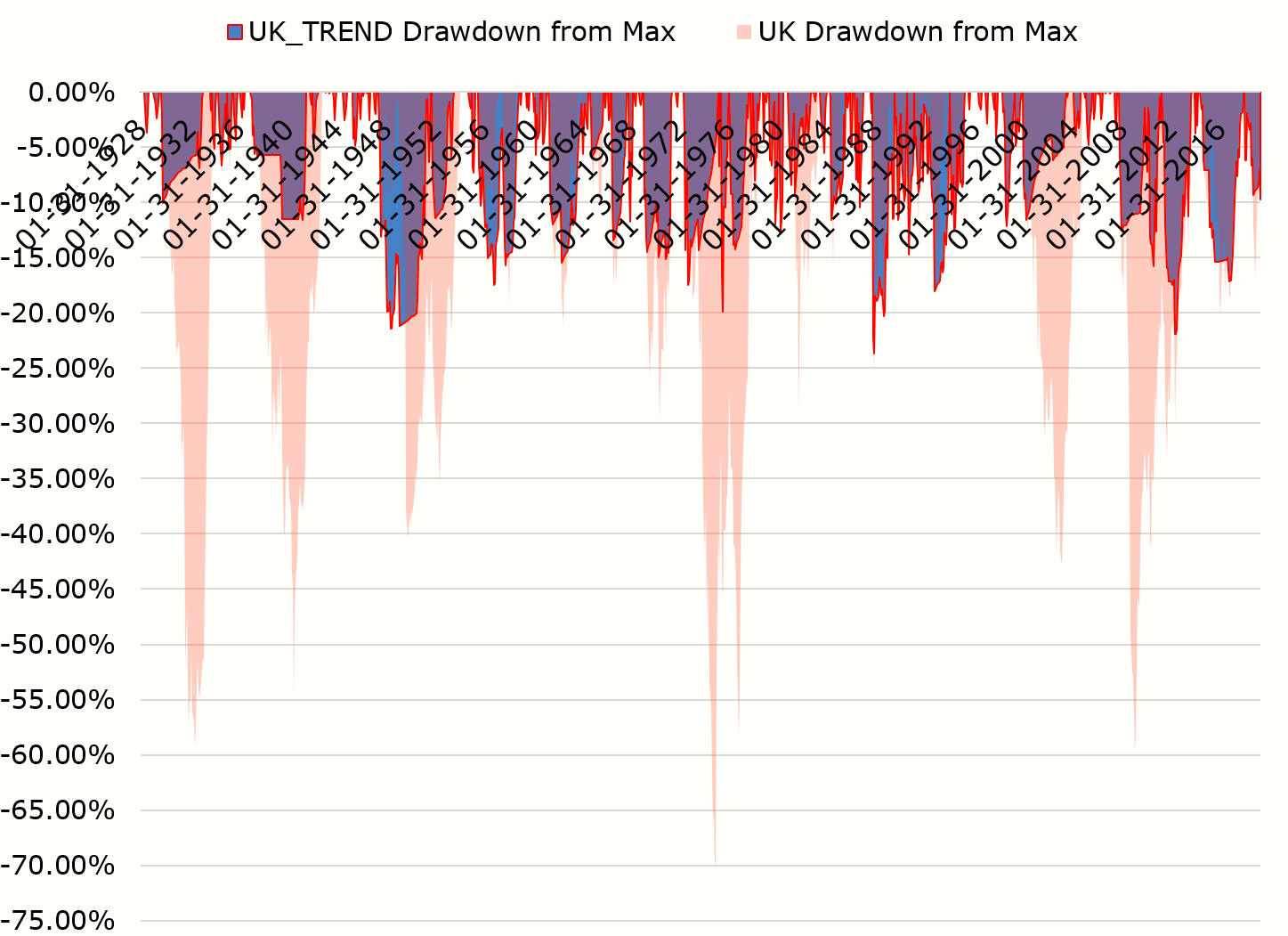

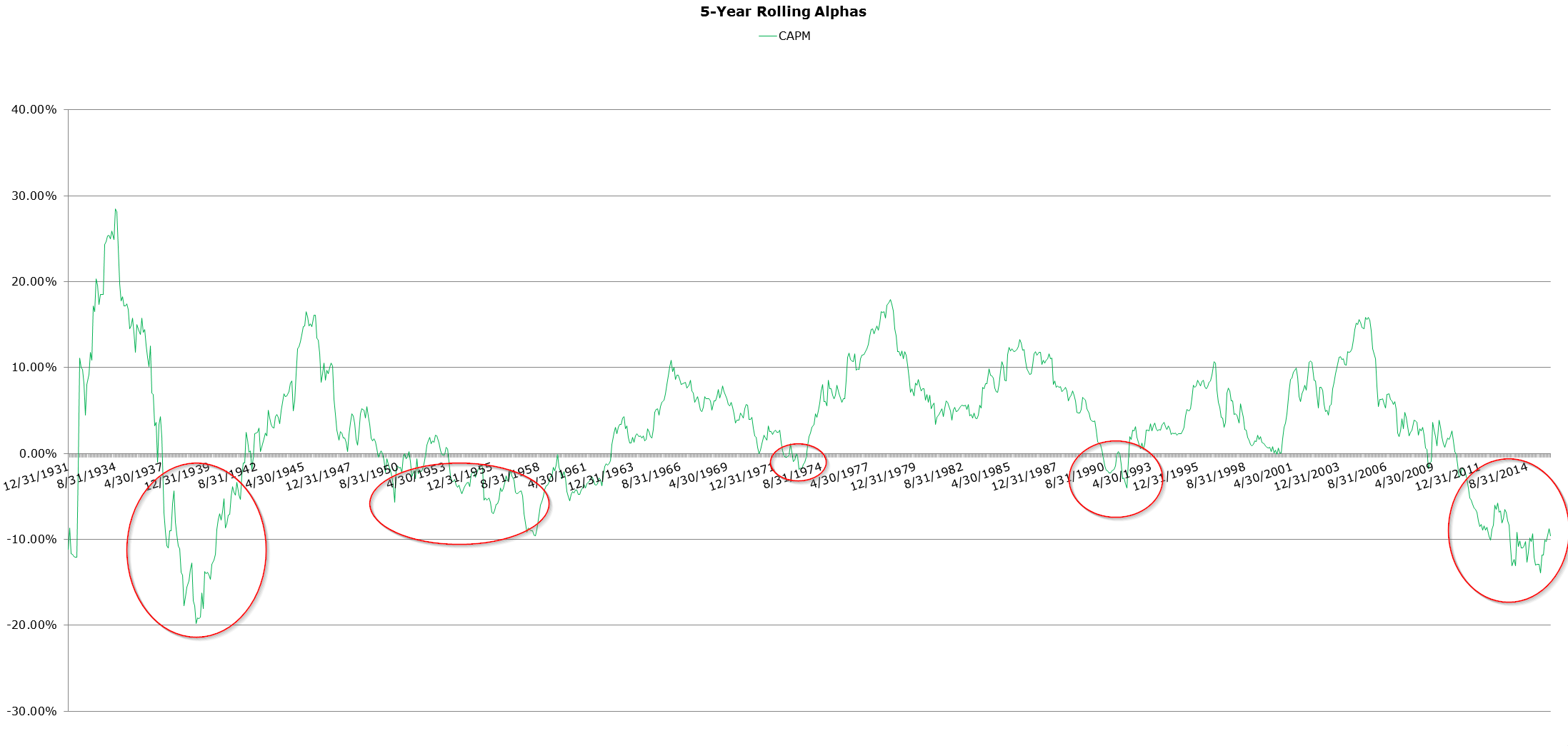

Trend Following: The Epitome of No Pain, No Gain

By Wesley Gray, PhD|June 26th, 2019|

One of the recurring themes we see in our research is the concept of "no pain; no gain." [...]

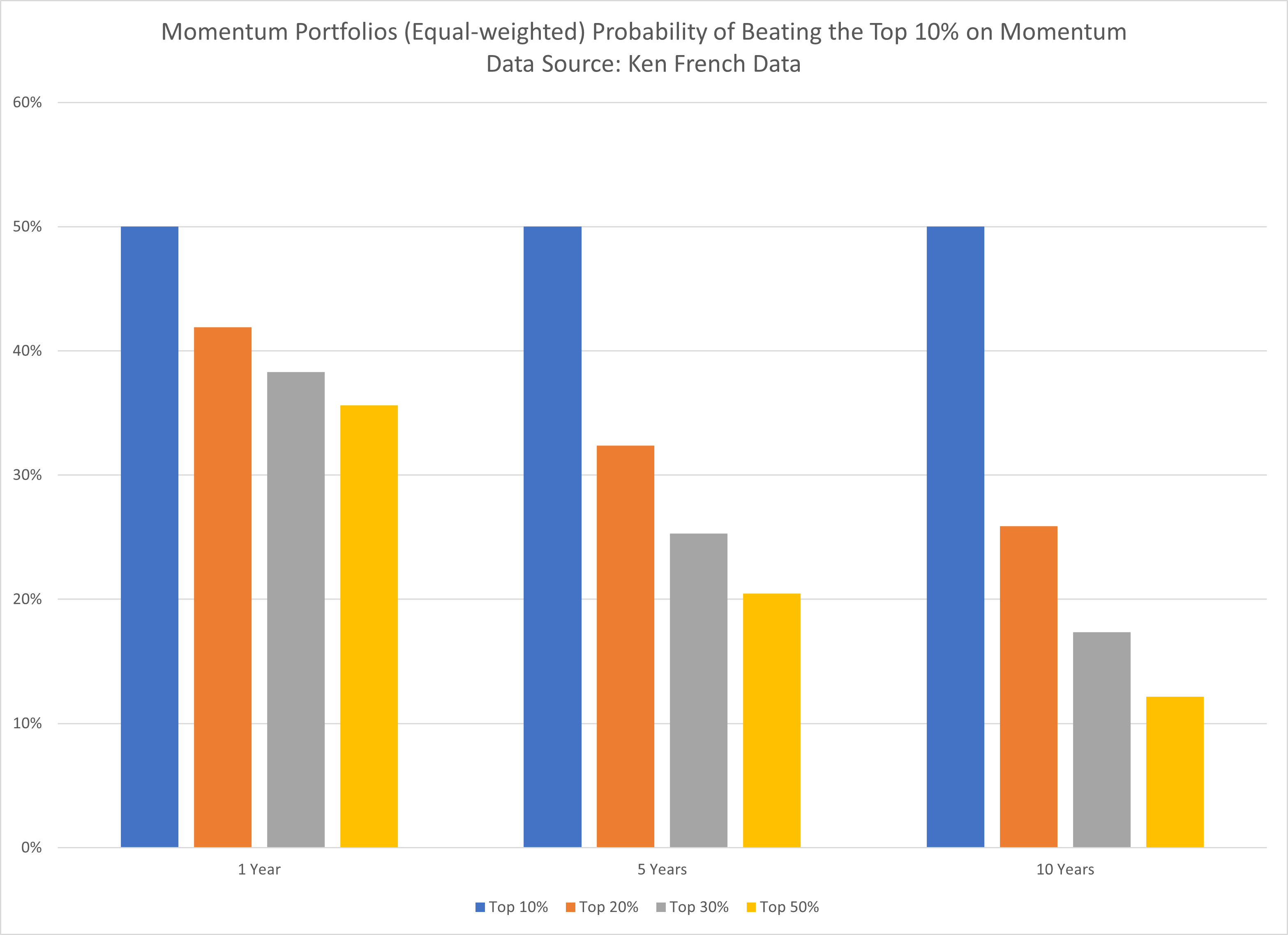

Momentum Investing, Like Value Investing, is Simple, but NOT Easy

By Wesley Gray, PhD|September 18th, 2018|

We've covered momentum investing extensively over the years, to include 94 posts, a book on the subject, and [...]

Why you should trust the investment process (even though it’s hard)

By Jack Vogel, PhD|June 21st, 2018|

In this article, we discuss why trusting an investment process can be very hard, and how you should [...]

Do factor portfolios survive transaction costs?

By Jack Vogel, PhD|November 28th, 2017|

Factor investing, and the associated intellectual battles, have raged for decades in academic finance journals. However, now that [...]

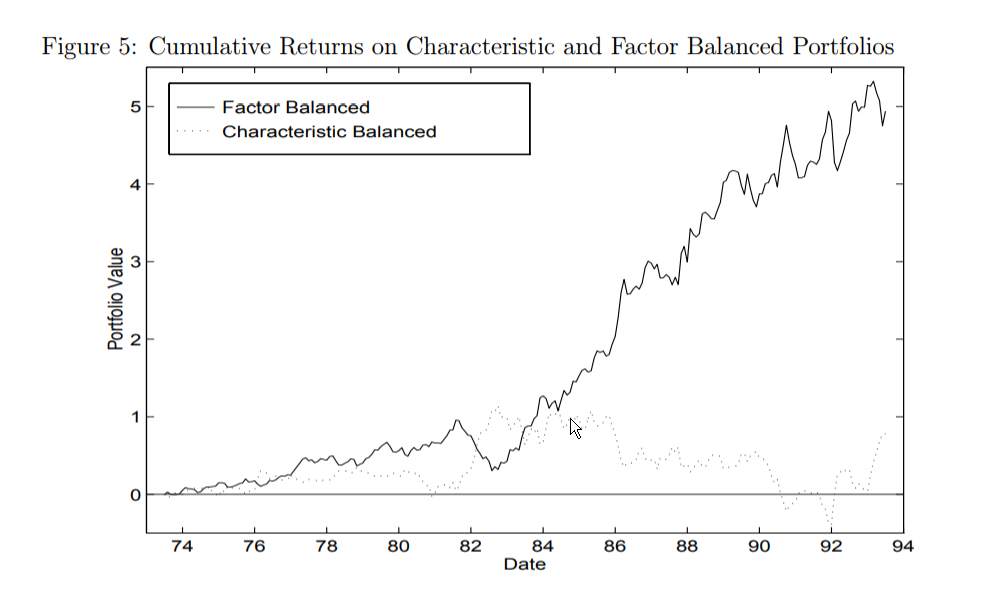

Do Portfolio Factors or Characteristics Drive Expected Returns?

By Jack Vogel, PhD|October 31st, 2017|

This article examines a somewhat overlooked, but important, discussion that raged among academic researchers on the source of the value investing premium in the late 1990s and early 2000s—the topic: factors vs characteristics.

Reconciling Individual Stock Returns and Factor Portfolio Returns

By Jack Vogel, PhD|October 6th, 2017|

Those in the financial media have recently been writing multiple stories on a fascinating working paper, "Do Stocks [...]

Factor Investing: Evidence Based Insights

By Jack Vogel, PhD|June 22nd, 2017|

I will be talking on the Factor Investing panel at the upcoming Evidence-Based Investing Conference in Dana Point, [...]

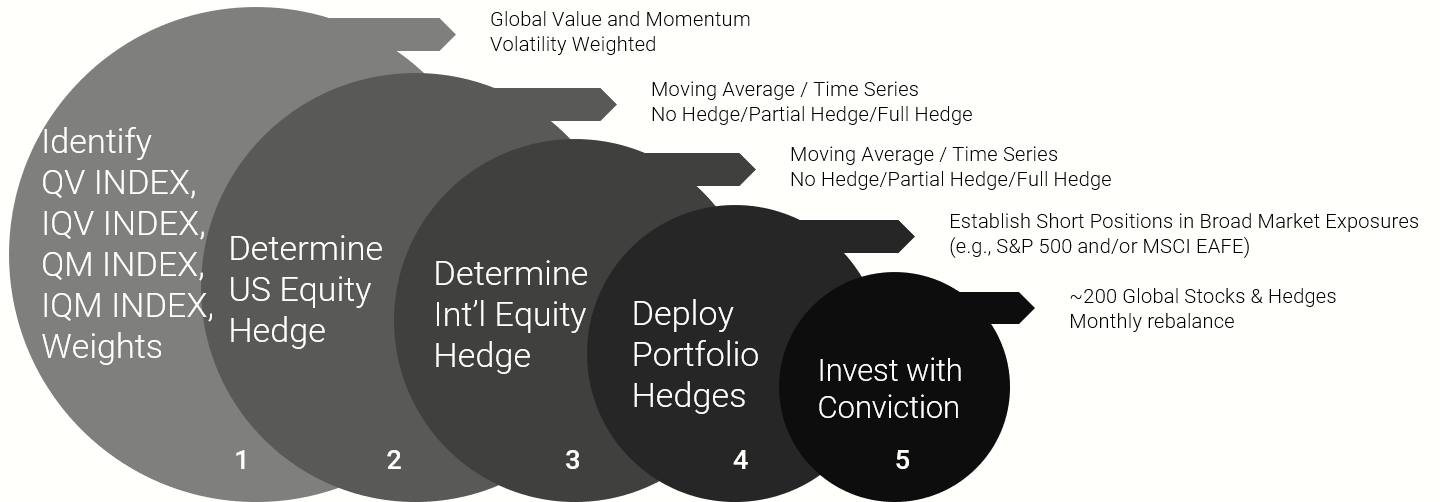

The Global Value Momentum Trend Philosophy

By Wesley Gray, PhD|June 6th, 2017|

Our Global Value Momentum Trend Index ("GVMT" or "GVMT Index") is a globally diversified equity strategy that leverages [...]

“Alternative” Facts about Formulaic Value Investing

By Wesley Gray, PhD|April 22nd, 2017|

A paper, "Facts about Formulaic Value Investing," is making the rounds and professes to plunge a dagger directly [...]

Factor Investing is More Art, and Less Science

By Wesley Gray, PhD|February 3rd, 2017|

Albert Einstein is reported to have said the following: The more I learn, the more I realize how [...]

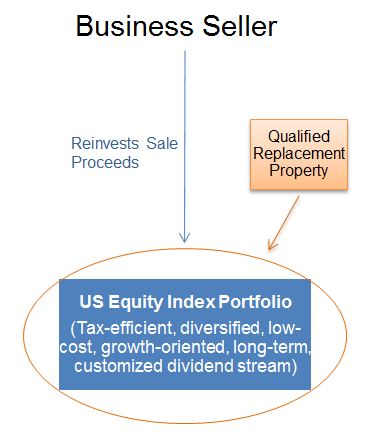

1042 Qualified Replacement Property: An Overview of ESOP Rollover Strategies

By Doug Pugliese|December 28th, 2016|

Executive Summary Employee Stock Ownership Plans (“ESOP”) offer a variety of liquidity, tax and operating benefits to business [...]

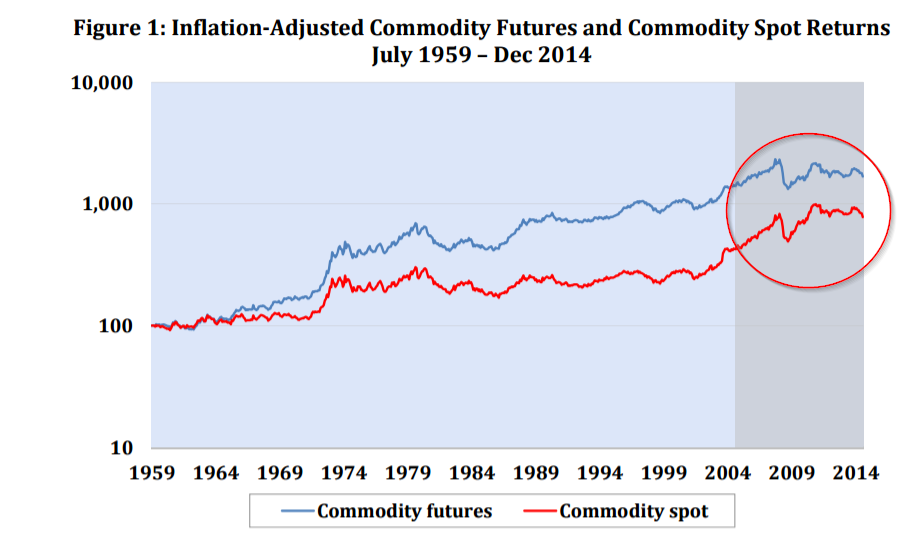

Commodity Futures Investing: Complex and Unique

By Wesley Gray, PhD|December 21st, 2016|

Commodity futures investing is arguably the most misunderstood asset class in the financial marketplace. We want to change that [...]

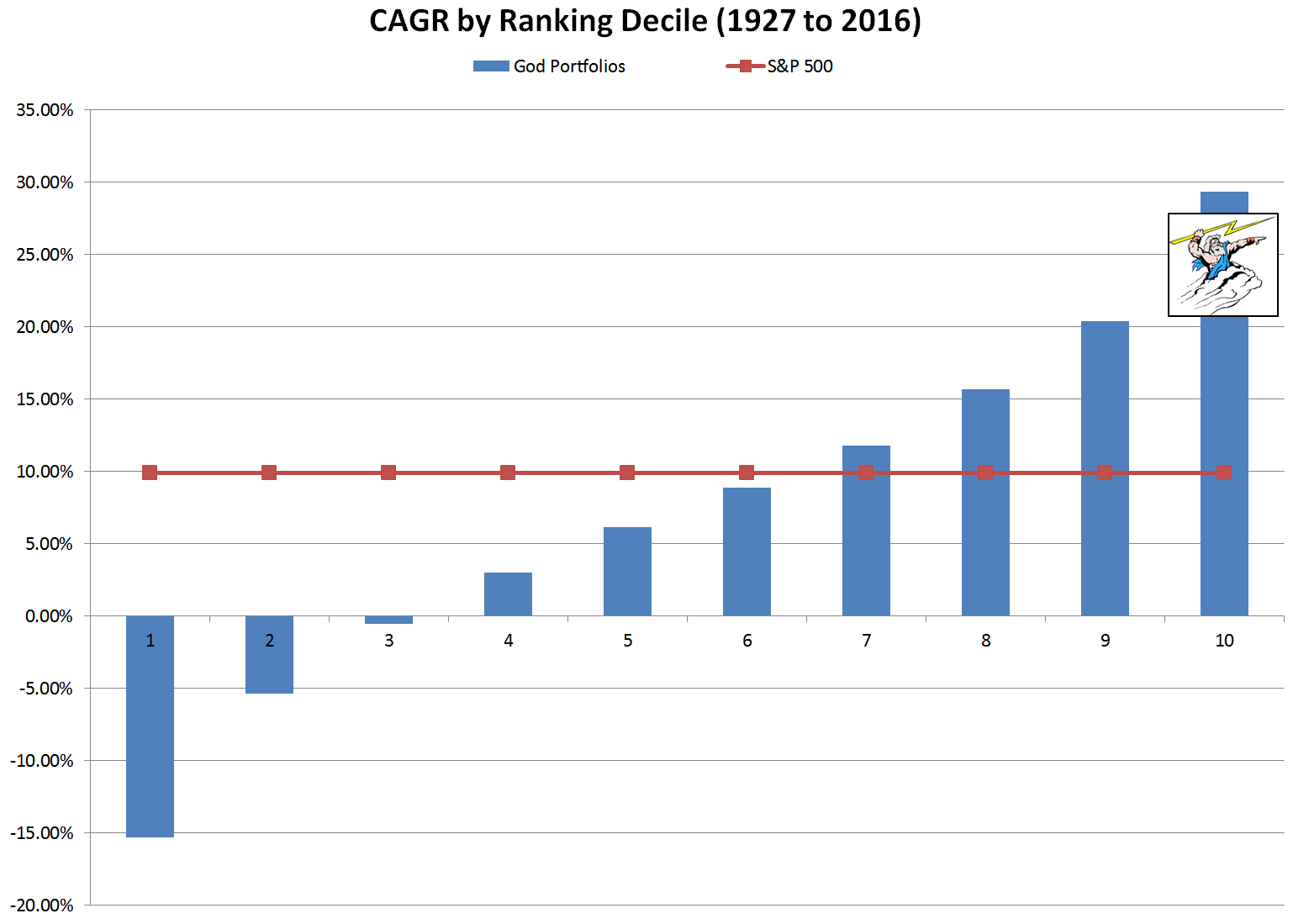

Even God would get fired as an Active Investor

By Wesley Gray, PhD|February 2nd, 2016|

Perfect foresight has great returns, but gut-wrenching drawdowns. In other words, an active investor who was clairvoyant (i.e. [...]