Exploiting Option Information in the Equity Market

Guido Baltussen, Bart Van Der Grient, Wilma De Groot, Erik Hennink and Weili Zhou

Key Points:

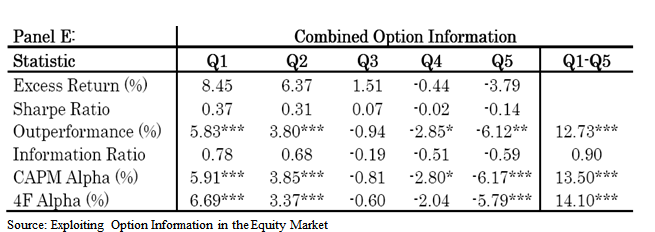

- Long/Short Value-Weighted alpha estimates of 118bp monthly. Sample covers data from 1996 to 2009.

- Values come from information diffusions between stocks and options.

Abstract:

Public option market information contains exploitable information for equity investors for an investable universe of liquid large-cap stocks. Strategies based on several option measures predict returns and alphas on the underlying stock. Transaction costs are an important factor given the high turnover of these strategies, but significant net alphas can be obtained when using a simple transaction cost reducing approach. These findings suggest that information diffuses from the option market into the underlying stock market.

Strategy Summary:

- Calculate OTM skew, ATM skew, Changes in ATM skew and Spreads of realized and implied volatility.

- Calculate z-scores for each variables. (Z-score of a variable is constructed by subtracting its cross-sectional median from the values of the variable and dividing by its median absolute deviation)

- Sort 1,250 largest stocks into quintile portfolios base on average z-scores.

- Construct a value-weighted portfolio by longing stocks in the first quintile and shorting stocks in the last quintile.

- Do a weekly rebalance and make money.

To juice up:

- Calculate Z-scores for each variable then sort stocks base on average Z-scores.

- Use decile portfolios instead of quintiles and earn monthly alpha of 1.1%;

- Use value-weighted portfolios and quintiles to earn monthly alpha of 1.18%.

Comments and Investment Implications

- Significant alphas exist after controlling various factors such as value, momentum, size and market; and in out-of-sample tests during bear, bull, volatile, and calm markets.

- Alphas can be significantly reduced when appling 7bp transaction cost in a sample of largest 1,250 US stocks. However, an annualized 7% net return could be achieved.

The full report is over at http://empiritrage.com/2012/04/12/applied-academic-research-april-2012/

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.