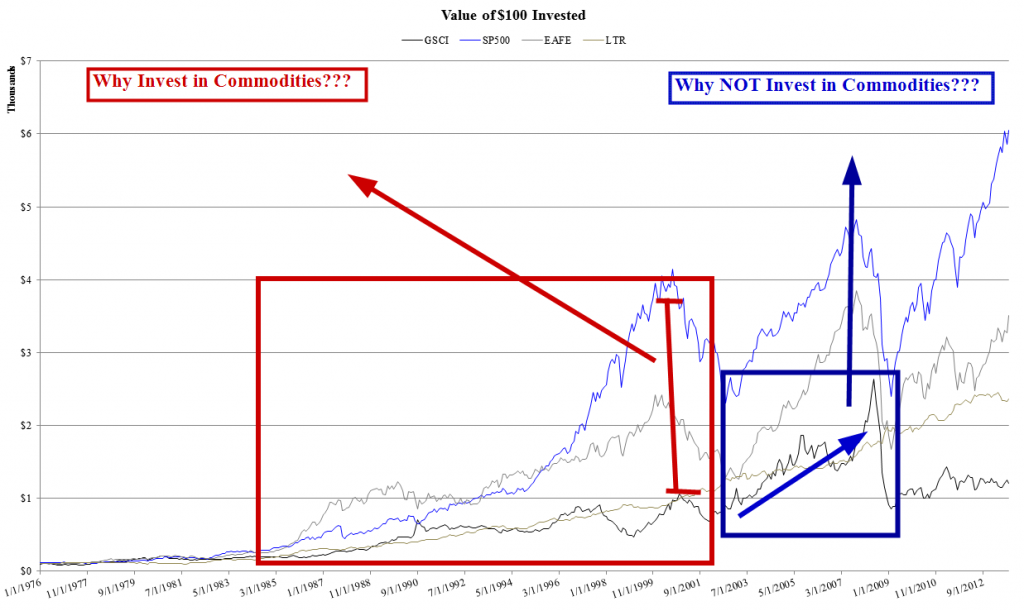

Commodities are an interesting asset class. A classic case of “Wall Street Trend following:” Sell products that have recently done extremely well.

Prior to the massive commodity runup commodities were a speculator’s game–Why invest in commodities? Are commodities even an asset class?

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Then in the early 2000’s commodities went on a raging bull market. All the sudden every endowment/pension on the planet needed exposure to the “ultimate uncorrelated alpha.”

That worked out well in 2008…D’oh! But the concept survived and commodities are still an integral allocation piece for most allocations.

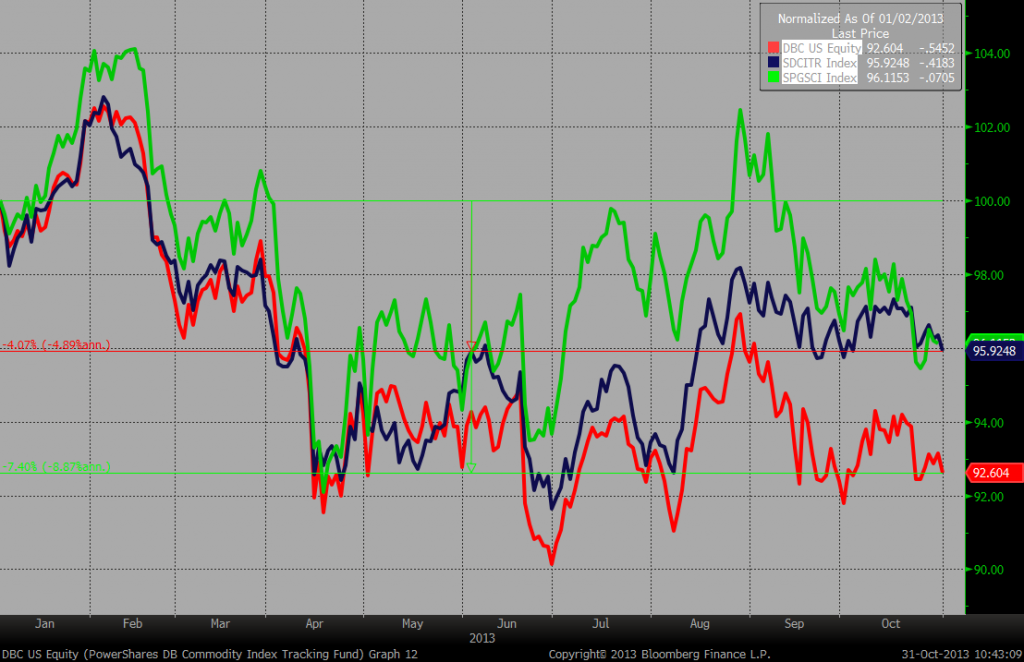

Below I present some results for 3 key competitors in the space:

- SPGSCI–Goldman Sachs Commodity Index. (original product)

- DBC–DB PowerShares Commodity Index. (GSCI but with better “roll” control)

- SDCITR–Summer Haven Dynamic Commodity Index. (the “academic” attempt)

Here’s the performance YTD. Looks like the vampire squid and the ivory tower are neck and neck.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.