An intra-week efficiency analysis of bookie-quoted NFL betting lines in NYC

- Thomas W. Miller Jr. and David E. Rapach

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category!

Abstract:

We analyze the intra-week evolution of bookie-quoted National Football League betting lines in NewYork City and its implications for market efficiency. Our unique data set includes three sequential lines: (i) an outlaw line set by a single agent at the beginning of the week; (ii) Tuesday’s opening line shaped by bets from a group of eight to ten agents; and (iii) a game-time closing line shaped by the wider public. While forecast encompassing tests show that information content increases during the betting week, consistent with a reasonably well-functioning market, we also uncover significant evidence of pricing inefficiencies relating to sentiment measures. In addition, actual bets made by a number of professional gamblers appear profitable, pointing to the existence of superior analysts.

Data Sources:

Larry Merchant data collection during the 1972 NFL season.

Alpha Highlight:

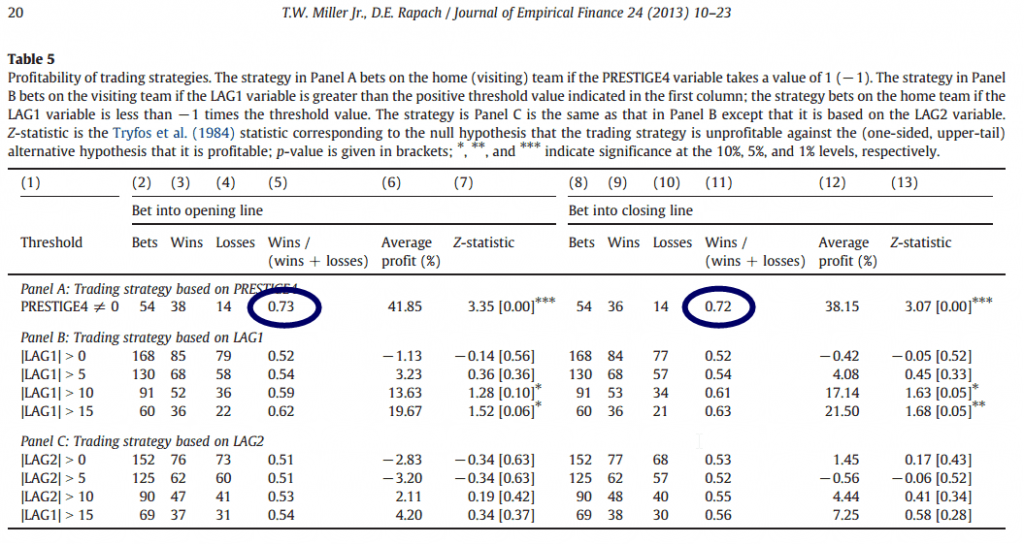

Table 5 highlights the profitability of various betting strategies:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Strategy Summary:

- Paper examines the betting line for NFL games in the 1972 season and the the particular bets of five individuals.

- There is one “noise trader” and four “expert gamblers.”

- There are three betting lines that are examined. The outlaw line is produced by one person in Vegas and is generally not seen by the public. The opening line is the betting line that is first released to the public, while the closing line is the last line the public sees before each game begins.

- The prestige 4 teams were identified before the season as the Green Bay Packers, Miami Dolphins, Pittsburgh Steelers, and Washington Redskins. In 1972, the Dolphins went undefeated and won the Super Bowl.

- Paper finds the following:

- Information content of the betting line increases as the week, as a well-functioning market would.

- This is tested by examining the outlaw line, opening line, and the closing line.

- There appears to be pricing inefficiencies for the four “prestige teams” and teams with the “hot hand.”

- The 4 prestige teams have lines set too low (high) when one of them is the home (visiting) team.

- Public places too much emphasis on whether or not teams covered the previous week (or two weeks ago).

- A profitable strategy exists to take advantage of these pricing inefficiencies.

- This would be to bet on the prestige teams (and to a lesser extent bet on teams with large beat/loss of the spread from the week before – Table 5).

- The “expert gamblers” have significant profits, which means that superior analysts may exist.

- Information content of the betting line increases as the week, as a well-functioning market would.

Strategy Commentary:

- Only examines one NFL season and the bets placed by five people.

- The paper claims there are “pricing inefficiencies” related to sentiment.

- Oddsmakers in Vegas will most likely move the line in any direction in order to eliminate any exposure to specific games. Remember that Vegas generally gets (1/2)*(1/11) of all bets on a game as long as there is an equal amount of money on each side of the bet. So it would be in the best interest of Vegas to price games “inefficiently” if gamblers have behavioral biases (which they most likely do).

Who’s going to win it this year? Broncos look good…Cowboys are going to win the NFC Least…Patriots are always strong…

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.