Ken French has a wonderful paper called the Cost of Active Investing.

He presented the paper at the 2008 AFA Presidential Address.

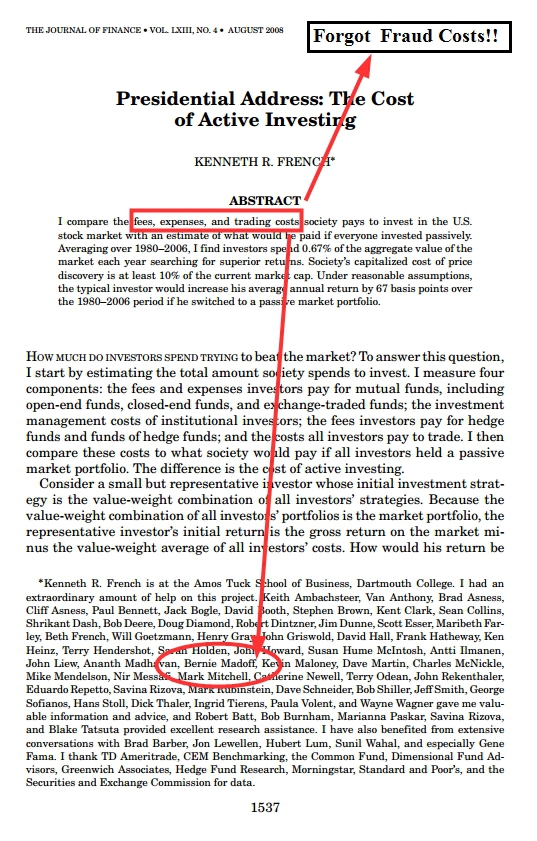

I compare the fees, expenses, and trading costs society pays to invest in the U.S. stock market with an estimate of what would be paid if everyone invested passively. Averaging over 1980 to 2006, I find investors spend 0.67% of the aggregate value of the market each year searching for superior returns. Society’s capitalized cost of price discovery is at least 10% of the current market cap. Under reasonable assumptions, the typical investor would increase his average annual return by 67 basis points over the 1980 to 2006 period if he switched to a passive market portfolio.

What is amazing is that Bernie Madoff is credited for helping Prof. French complete the study!

Ironic. Madoff provided investors with the most costly form of active investing one could ever imagine–fraud!

Thanks to Doug Pugliese for pointing this out–keen eye…

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1105775

Prof. French starts around 8min.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.