Betting Against Beta or Demand for Lottery

- Bali, Brown, Murray, and Tang

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category!

Abstract:

Frazzini and Pedersen (2014) document that a betting against beta strategy that takes long (short) positions in low (high) beta stocks generates large abnormal returns of 6.6% per year, and attribute this phenomenon to funding liquidity risk. We investigate alternative explanations for this effect, and find that it is caused by demand for lottery-like assets, a behavioral phenomenon. Requiring betting against beta portfolios to be neutral to lottery demand eliminates the abnormal returns. Controlling for lottery-demand, multivariate analyses detect a theoretically consistent positive relation between beta and returns. Factor models that include our lottery-demand factor explain the abnormal returns of betting against beta portfolios. We conclude that the betting against beta phenomenon is driven by demand for lottery-like stocks.

Alpha Highlight:

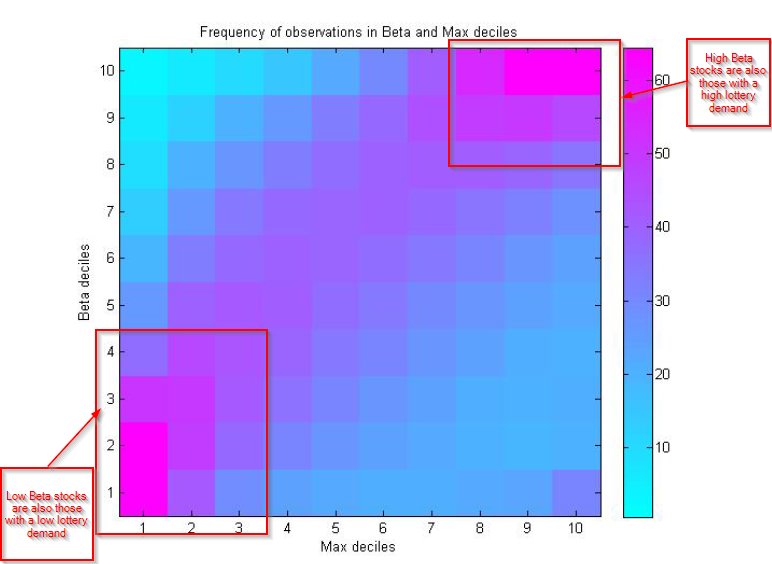

This paper documents that the betting against beta (BAB) strategy is mainly driven by investors demand for lottery-like stocks. The authors use the MAX measure, defined as the average of the highest five daily stock returns over the past month, to proxy for the lottery-demand of a stock. Figure 1 shows a heat map of the stocks that fall into portfolios measured by Beta and the MAX (lottery demand) measures:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

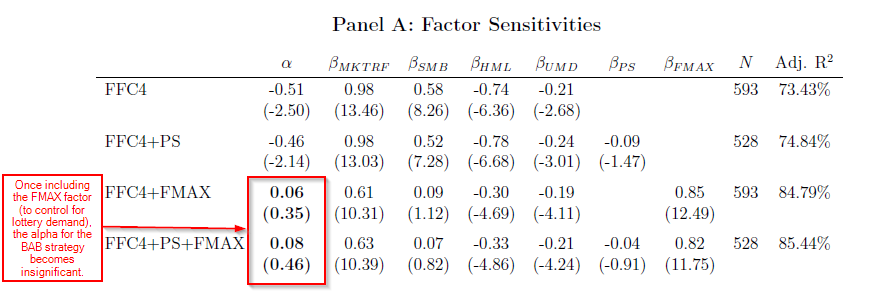

The above picture documents that high beta stocks also have a high lottery demand, while low beta stocks also have a low lottery demand. The authors then construct a measure, labeled FMAX, as a lottery-demand factor. The results are informative:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Once the authors control for the lottery-demand (FMAX factor), the alpha for the BAB strategy becomes insignificant!

Do you think lottery bias explains the BAB factor?

About the Author: Jack Vogel, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.