Alliances and Return Predictability

- Cao, Chordia, and Lin

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category!

Abstract:

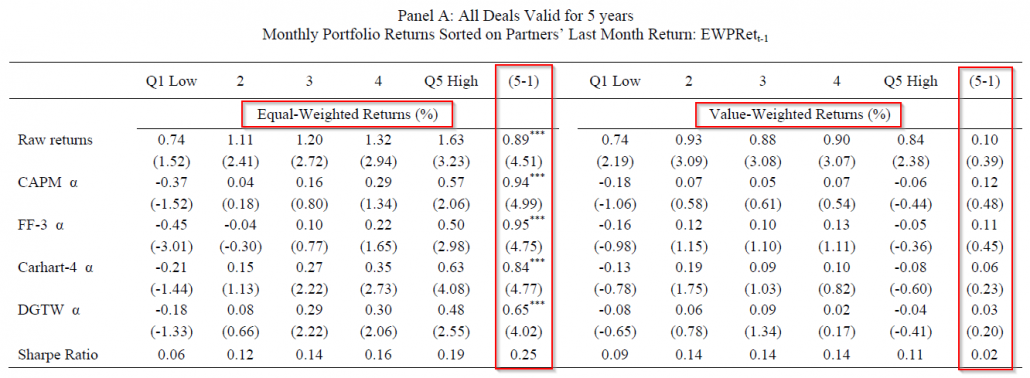

A trading strategy designed to exploit the information contained in the returns of alliance partners, yields economically and statistically significant returns. A long-short portfolio sorted on lagged returns of strategic alliance partners provides a return of 89 basis points per month that is robust to a number of specifications. Increased correlation in returns after the formation of alliances is driven by increased economic links and the increased probability of mergers amongst alliance partners. Investor inattention and limits to arbitrage may be the source of underreaction of a firm’s returns to that of its partners’.

Alpha Highlight:

Identify firms with alliances (described in paper – basically firms working together on a deal). Each month, sort firms based on the last month’s return for their alliance partners. Go long firms whose partners had high returns, and short firms whose partners had low returns.

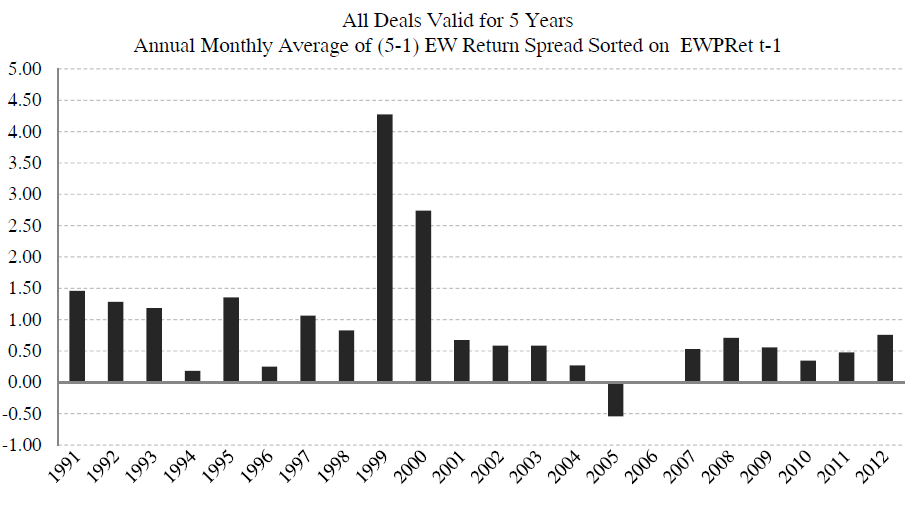

Results by year:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

However, the weighting matters (equal weight returns are much stronger than value weight returns). Authors find results do not hold for largest firms (top quintile based on size – Panel B of Table III)

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

From these results, there appears to be an underreaction to the performance of an alliance partner. However, as with most anomalies, this result does not hold for the largest firms.

Overall, an interesting idea, but may be difficult to implement – shorting small stocks can get hairy!

About the Author: Jack Vogel, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.