Momentum Strategies

- Chan, Jegadeesh and Lakonishok

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category.

Abstract:

We examine whether the predictability of future returns from past returns is due to the market’s underreaction to information, in particular to past earnings news. Past return and past earnings surprise each predict large drifts in future returns after controlling for the other. Market risk, size, and book-to-market effects do not explain the drifts. There is little evidence of subsequent reversals in the returns of stocks with high price and earnings momentum. Security analysts’ earnings forecasts also respond sluggishly to past news, especially in the case of stocks with the worst past performance. The results suggest a market that responds only gradually to new information.

Alpha Highlight:

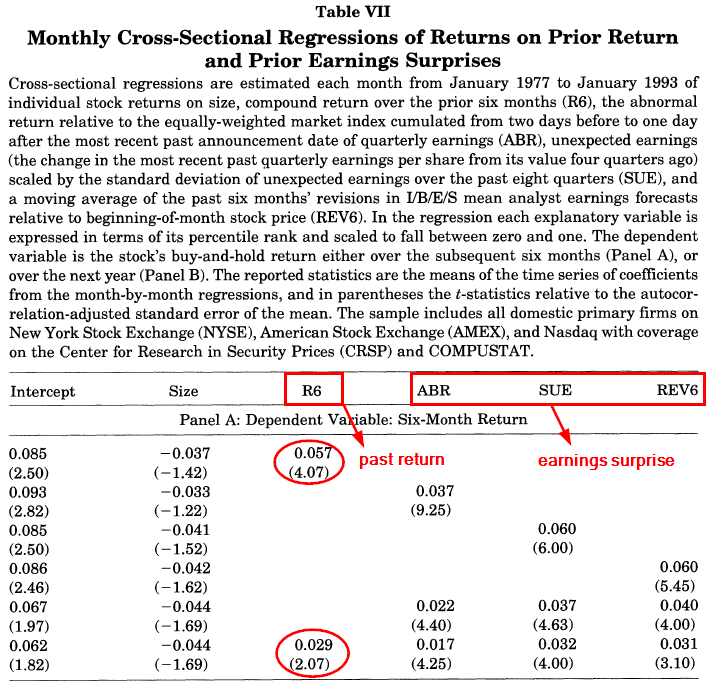

In 1993, Jegadeesh and Titman observed that a stock’s past return has marginal predictive power for its future return, which is widely known as “momentum.” In this paper, Chan, Jegadeesh and Lakonishok (1996) further show that momentum may be explained by market’s underreaction to earning-related information as well. So the authors try to disentangle the sources of momentum premia based on these two separate factors: past return and earnings surprise.

Paper first evaluates two momentum strategies:

- Price Momentum: formed based on the past 6-month returns;

- Earning Momentum: formed based on past earnings surprises.*

*Earnings surprise is measured three ways: standardized unexpected earnings, abnormal returns around announcements of earnings, and revisions in analysts’ forecasts of earnings.

Key Findings:

First, they find out that both momentum strategies are profitable and they are not subsumed by each other. Specifically, when past large, positive returns are not validated by positive earnings surprises, the price will then encounter a stronger correction in the future.

In other words, when both prices and earnings are moving in the same direction, the momentum premiums will be the highest.

So, both past return and earnings surprise have predictive power for the post-formation drifts in returns.

The Table below shows the results of a cross-sectional regressions of returns: the coefficient on past return is 5.7%. When introducing past earnings surprises, the coefficient decreases to 2.9%, but is still significant.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are un-managed, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Then the authors study the overlap between price and earnings momentum. They find that price momentum effect tends to concentrate around earnings announcements. About 41% of the price momentum premium in the first six months occurs around announcement dates of earnings.

The Paper hypothesizes that these two momentum strategies draw upon the market’s under reaction to different pieces of information.

Earnings momentum benefits from short-term under reaction to short-term earnings. Price momentum benefits from under reaction to a broader information set, including profitability.

About the Author: Jack Vogel, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.