Book-to-Market Equity, Distress Risk, and Stock Returns, by Griffin and Lemmon (2002 Journal of Finance) investigate the relationship between value premiums and distress risk. There are two schools of thought on the value premium, or the large spread in realized returns between cheap stocks and expensive stocks.

On the one hand there is the “risk-based” story for the value premium, which suggests that value stocks are subject to higher risk of distress. On the other hand, the “mispricing story,” as it relates to the value premium, suggests that investors overreact to recent bad news and undervalue cheap stocks, and overreact to recent good news and overvalue expensive stocks. This paper investigates the alternative hypotheses and lets the data speak.

Bottomline: The spread in returns between cheap and expensive firms, given they are classified as “high distress,” is almost double the traditional value premium. And much of the return is driven by expectation changes around earnings announcements (that is, the market is “surprised” by how well the cheap high distress firms do). A win for value investing.

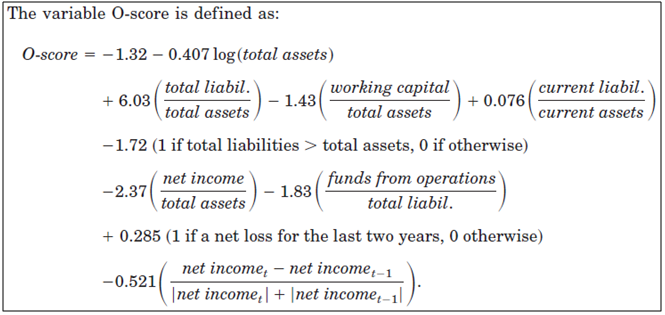

Highest distress risk, as proxied by Ohlson’s (1980) O-score, which is described below:

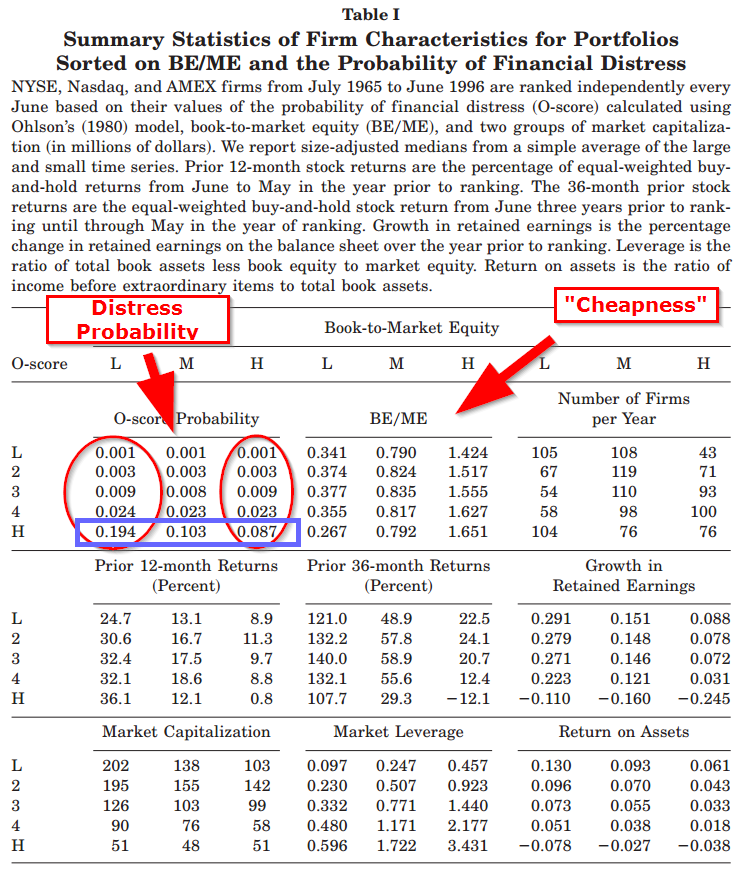

According to O-Score metrics, growth stocks (e.g., low B/M) have similar distress risk when compared with cheap stocks (e.g., high B/M). In the extreme distress category (marked in blue below), cheap stocks are much less distressed than the expensive stocks. This empirical finding is puzzling for the “risk-based” argument for the value premium, since expensive stocks are actually more distressed, on average, than cheap stocks, in the extreme distress category. Weird.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

But perhaps the most extreme distress firms have odd return patterns that can explain this anomaly through the lens of rational asset pricing?

Not exactly…

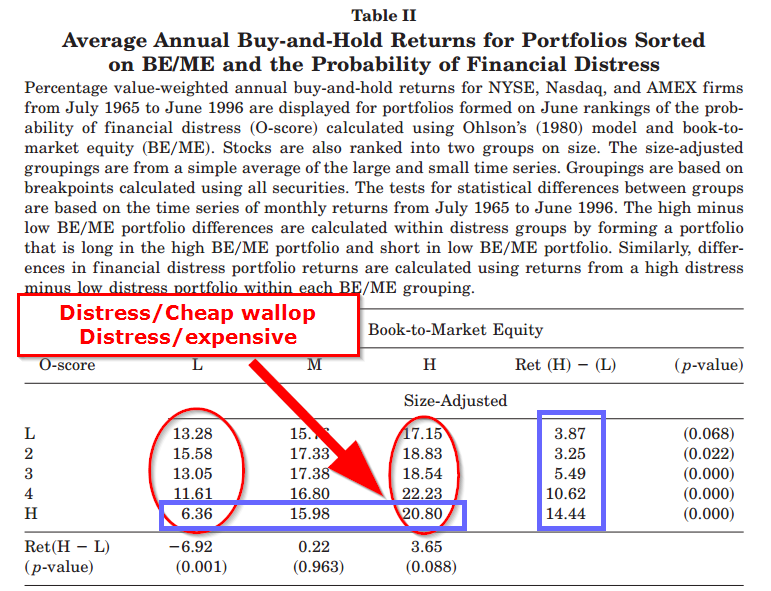

In the table below the authors tabulate the annual B&H returns associated with various cuts on distress and value. Value investing always wins, even after controlling for distress. And value investing REALLY wins among the most distressed firms. Oddly enough, expensive firms that are distressed earn 14.44% LESS than cheap firms that are distressed. So given equivalent distress levels, or “risk,” we should see similar returns…

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Time to avoid the noise and get back to value investing!

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.