After a 226 year dry spell (!), a woman will finally serve as the president of the NYSE (article). Stacey Cunningham, the new NYSE president, is an inspirational figure and her presence in a top Wall Street position will certainly signal to talented women that working on Wall Street is not a “men-only” club. One example of this powerful signal helps tell the story of our interviewee: Lauren Simmons, a 23-year-old equity trader at the NYSE. Lauren is the youngest and the only full-time female trader on the floor. She also joins a short list of women who have signed their names on the NYSE constitution book, next to John D. Rockefeller !

With Lauren, I share the fact that I too started my career on a trading floor, the Chicago Mercantile Exchange! While I discovered trading was not my cup of tea, it was an incredible experience, which taught me from the very beginning I had to toughen up in order to survive in the finance sector.

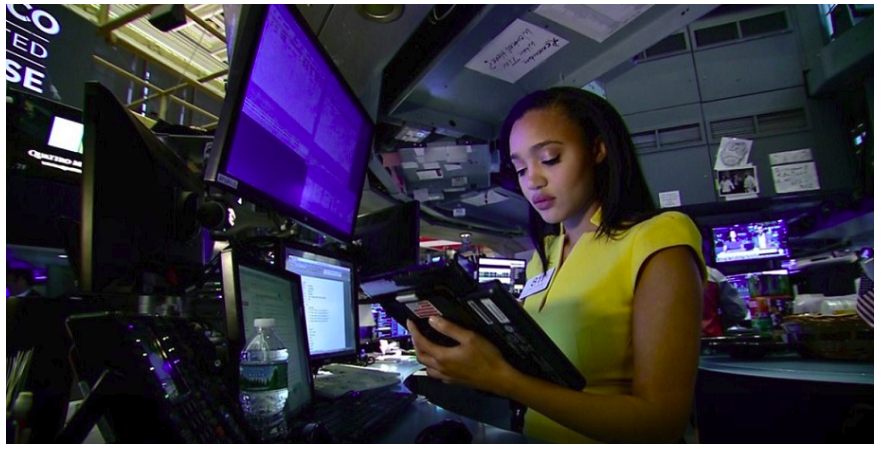

Lauren Simmons on the floor of the NYSE (Photo: BBC video screenshot)

What Contributed to Lauren’s Success?

We asked Lauren to tell us the things that contributed most to her success.

She expressed three basic themes that characterize her professional career:

- Theme #1: COURAGE

- Theme #2: A LOVE FOR NUMBERS

- Theme #3: CONFIDENCE

Lauren did not take the traditional route to a finance career. She graduated with a major in Genetics and a minor in Statistics from Kennesaw State University in Georgia and shortly after, in 2017, started her career at Rosenblatt Securities trading equities on the floor of the NYSE. I think it takes some courage to start off your career in what is known as a busy and loud “boys club”!

The male-dominated environment at the NYSE was not a new experience for her because of her coursework in college and high school she was often the only female in her classes. And, when asked what helped her the most at her current job, she refers back to those math-intense classes, especially those in statistics. After all, numbers are a universal language and math just resonated with her.

Her daily routine starts at 6 AM with reading the news on what is going on in the world from a micro and macro perspective. After, she contacts her clients and strategizes as to the best approaches to trading on their behalf.

When asked about the best moment in her experience as a female trader, she recounted the confidence she felt when she learned that she could have her own voice and be treated fairly in the “boys club.”

Her worst moments occurred when she questioned her own ability to survive the work environment in which she found herself, even though she had the required skills and knowledge to succeed. Those were useful reminders that counteracted the self-doubt.

Closing Thoughts from Lauren

Back to some personal tips for our female audience who want to pursue a quantitative finance career. Lauren recommends learning to be more comfortable in “uncomfortable situations.” You need to get out of your comfort zone to grow and improve yourself. Also, she thinks parents and teachers should instill confidence in girls from a very young age. That was her mom’s strategy, pushing and supporting her to study STEM subjects and it worked fantastically with her!

Thank you, Lauren: it has been a great pleasure and we wish you continued success!

Elisabetta & Tommi

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.