Consulting Services for Professional Investors

Student and Professor, it’s a classic story. Dr. Basilico and Dr. Johnsen’s history goes back to the early 2000s when Elisabetta signed up for two “Quantitative Investments” classes taught by Tommi, a finance professor at the Daniels College of Business, University of Denver. Their passion for applied asset management research brought them together again, when Elisabetta was hired as a quantitative analyst at the pension fund where Tommi was a consultant. They teamed up with JP Tremblay of Standard&Poors to found the Denver based branch of QWAFAFEW, an association of like-minded quantitative finance professionals meeting monthly to share ideas around investing and the research behind those ideas.

As a team and as individuals, they are passionate about empowering investors through education and are experienced and skilled at research. They are proficient at turning academic insights into investment performance.

Below you can read some example case studies, which were implemented for actual clients.

Case Studies

Case Study #1

THE CLIENT: The pension fund of a large telecommunications firm.

THE REQUEST/MANDATE: Develop a Value, long-only, strategy based on the concepts embedded in behavioral finance implementable with minimum management costs.

THE SOLUTION: Developed, backtested and managed a “Value”/”Momentum” strategy using composite alpha scores for each factor. Optimized with low tracking error 1% to 1.5% using the Russell 1000 universe and benchmark. Positive and negative alpha scores were developed based on the well-published anomalies associated with Value and Glamour stocks. The behavioral regularity described above results in a clearly defined set of stocks with share prices that reflect unrealistic growth rates—too high for glamour stocks and too low for value stocks. This systematic bias has been documented as a persistent anomaly in the academic literature.

Case Study #2

THE CLIENT: An institutional investor located in the Midwest.

THE REQUEST/MANDATE: Design an exploratory study to investigate the feasibility and performance expectations for a low volatility, long-only equity, strategy.

THE SOLUTION: Empirical research shows that low-volatility stocks (e.g. Beta or LVOL) earn higher risk-adjusted returns than portfolios of high-volatility stocks. Features of the study design included the following process:

- Stocks were chosen from the top 1100 in the US based on market capitalization using the Compustat database.

- Three weighting schemes were examined: market cap, equal and score weighted.

- Two selection factors were examined: high vs. low Beta and high vs. low Standard Deviation of returns; both calculated over most recent sixty months.

- Monthly and quarterly rebalance periods were examined over the period January 1982-March 2011.

- Portfolios with low beta vs. low SD vs. Composite were backtested against the Russell 1000, assuming no taxes, costs, fees or slippage.

- Regression analysis conducted to determine source of excess returns using Fama-French factors.

Case Study #3

THE CLIENT: A wealth manager located in the Midwest.

THE REQUEST/MANDATE: Backtest a Growth Timing strategy suitable for wealth managers to implement, utilizing a proprietary stock selection methodology to identify exponential growth stocks.

THE SOLUTION: The timing model developed produced three signals indicating the probability of a positive or negative return for the proprietary stock selection process. The three estimates were produced from three econometric model that used the proprietary factors and macroeconomic factors to produce expected returns. Macroeconomic predictors included variables such as the default premium or spread in yields on BAA and AAA corporate bonds, the trend in income and equity fund flows, the VIX, the Treasury and Eurodollar spread, the E/P ratio for the SP500 Index.

Interaction variables were also calculated that represented the position of the proprietary E/P ratio to the SP500 E/P ratio.

We Focus on Complex Problems

Your Experts

Elisabetta Basilico, PhD, CFA®

Quantitative Methods and Asset Allocation

Tommi Johnsen, PhD

Quantitative methods and Portfolio construction

Our Recent Research Ideas

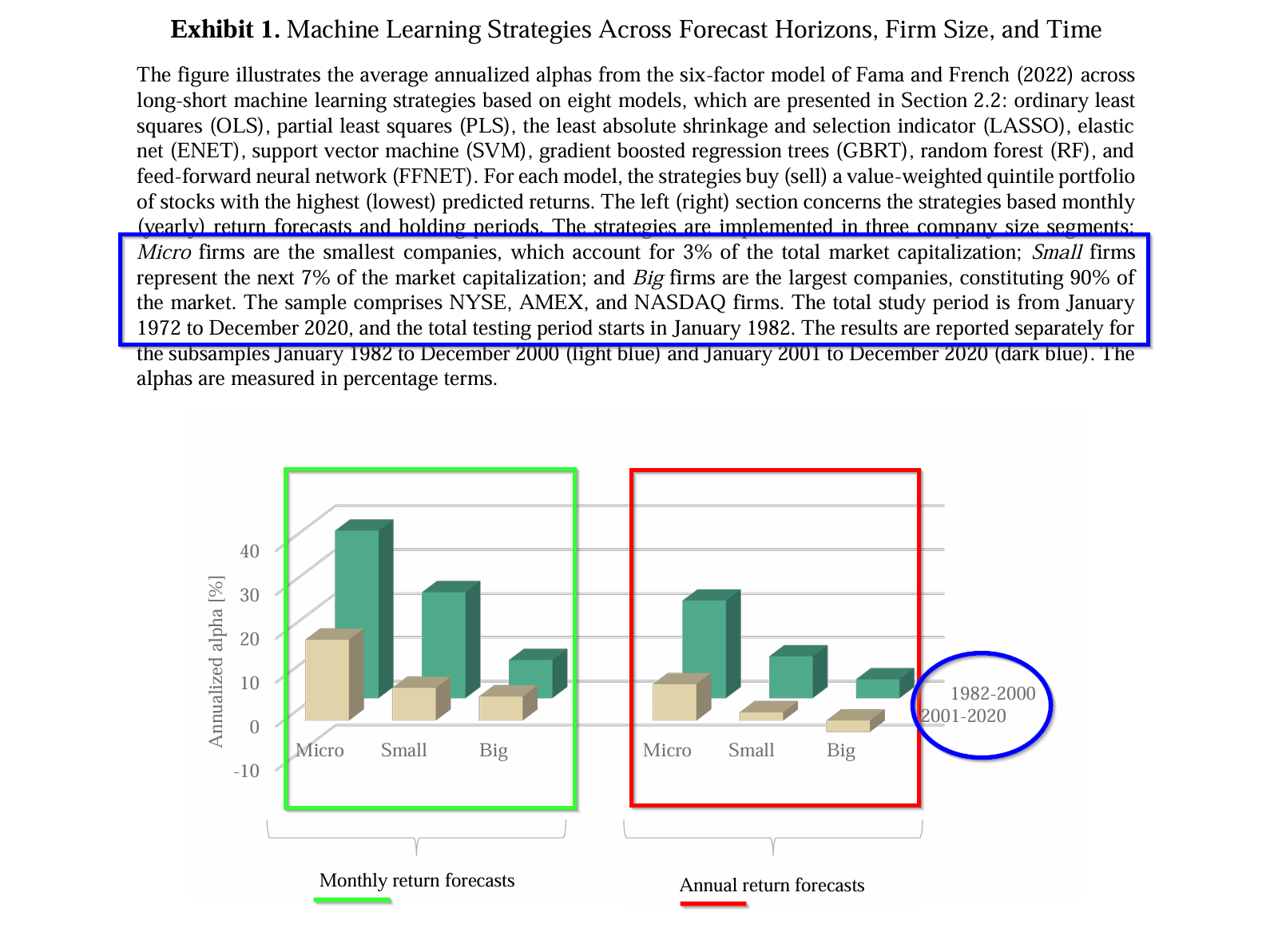

Can Machine Learning Improve Factor Returns? Not Really

By Tommi Johnsen, PhD|April 29th, 2024|

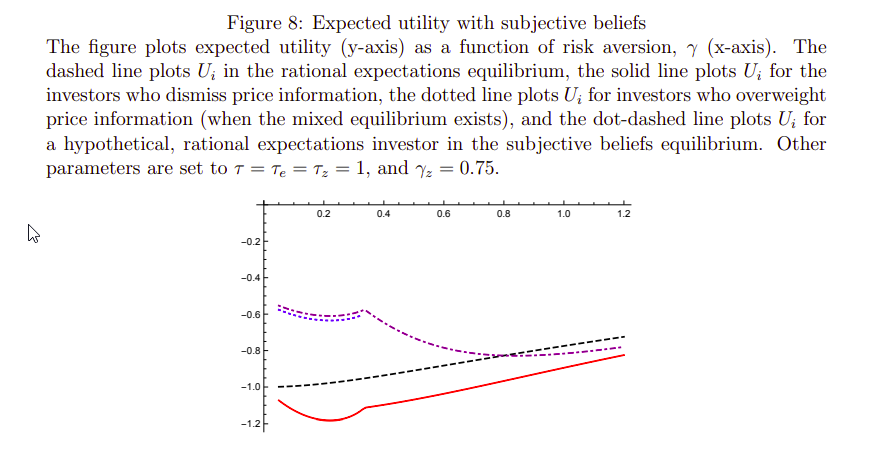

How investors form beliefs and make decisions

By Elisabetta Basilico, PhD, CFA|April 23rd, 2024|

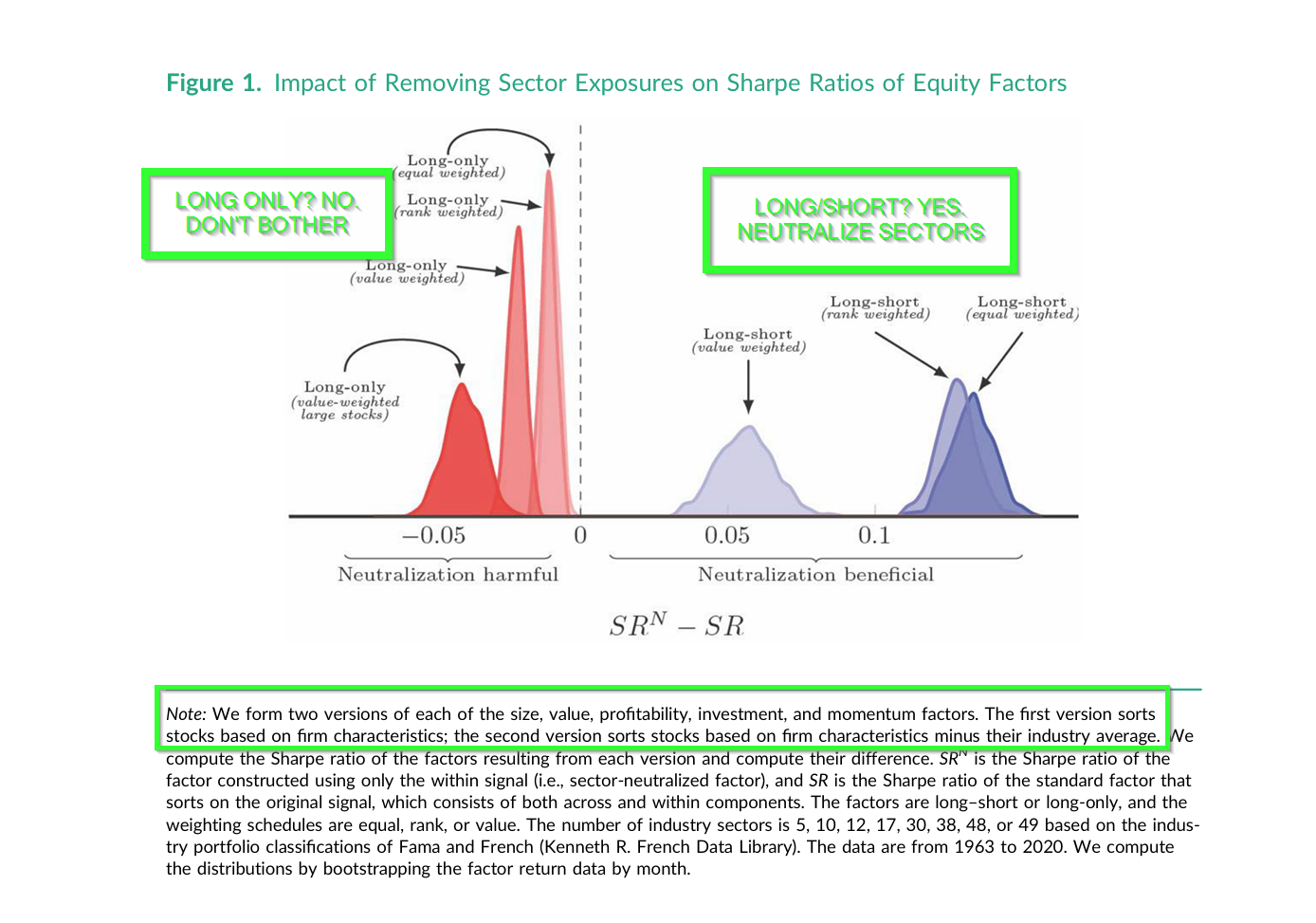

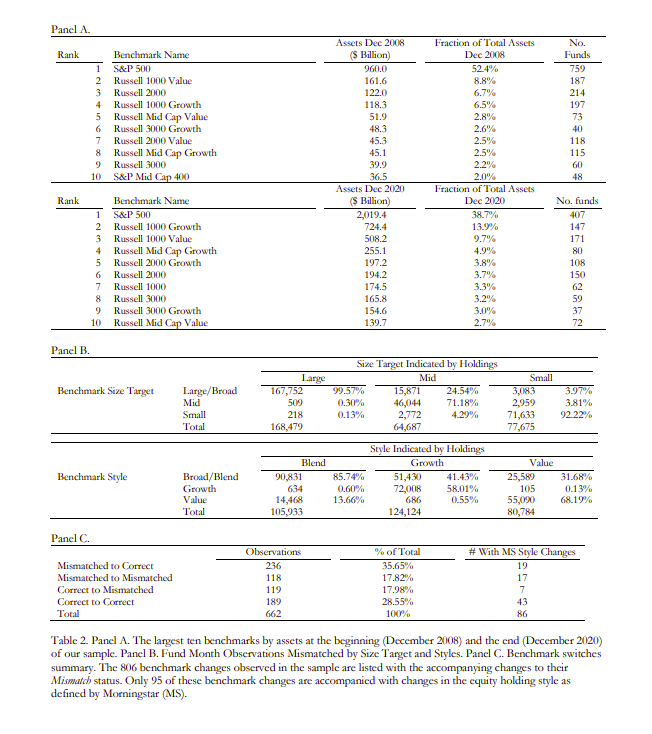

Is Sector Neutrality in Factor Investing a Mistake?

By Tommi Johnsen, PhD|April 15th, 2024|

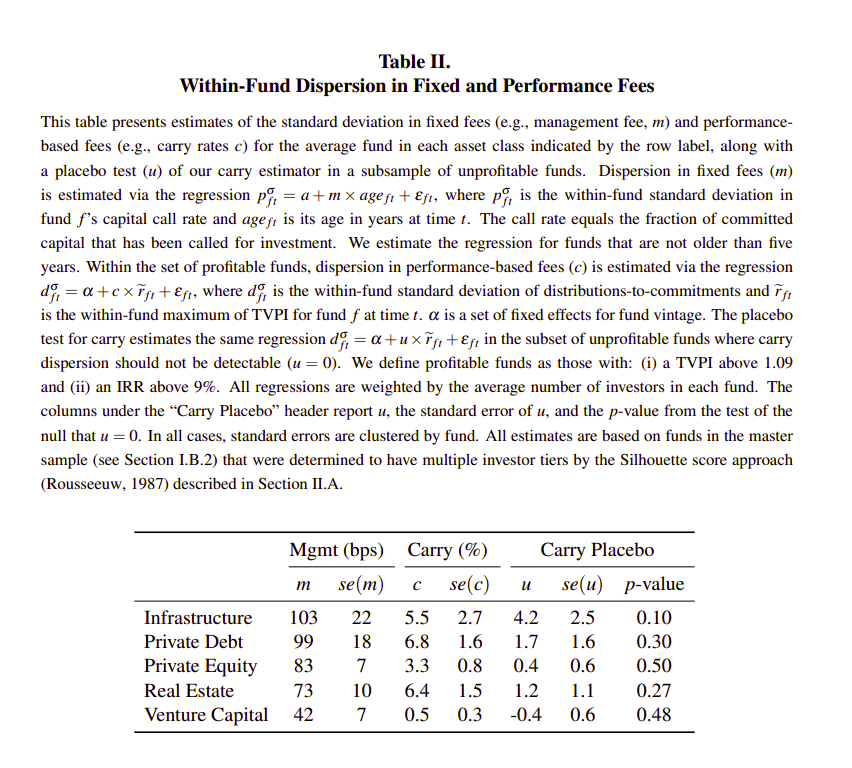

Fee Variation in Private Equity

By Elisabetta Basilico, PhD, CFA|April 8th, 2024|

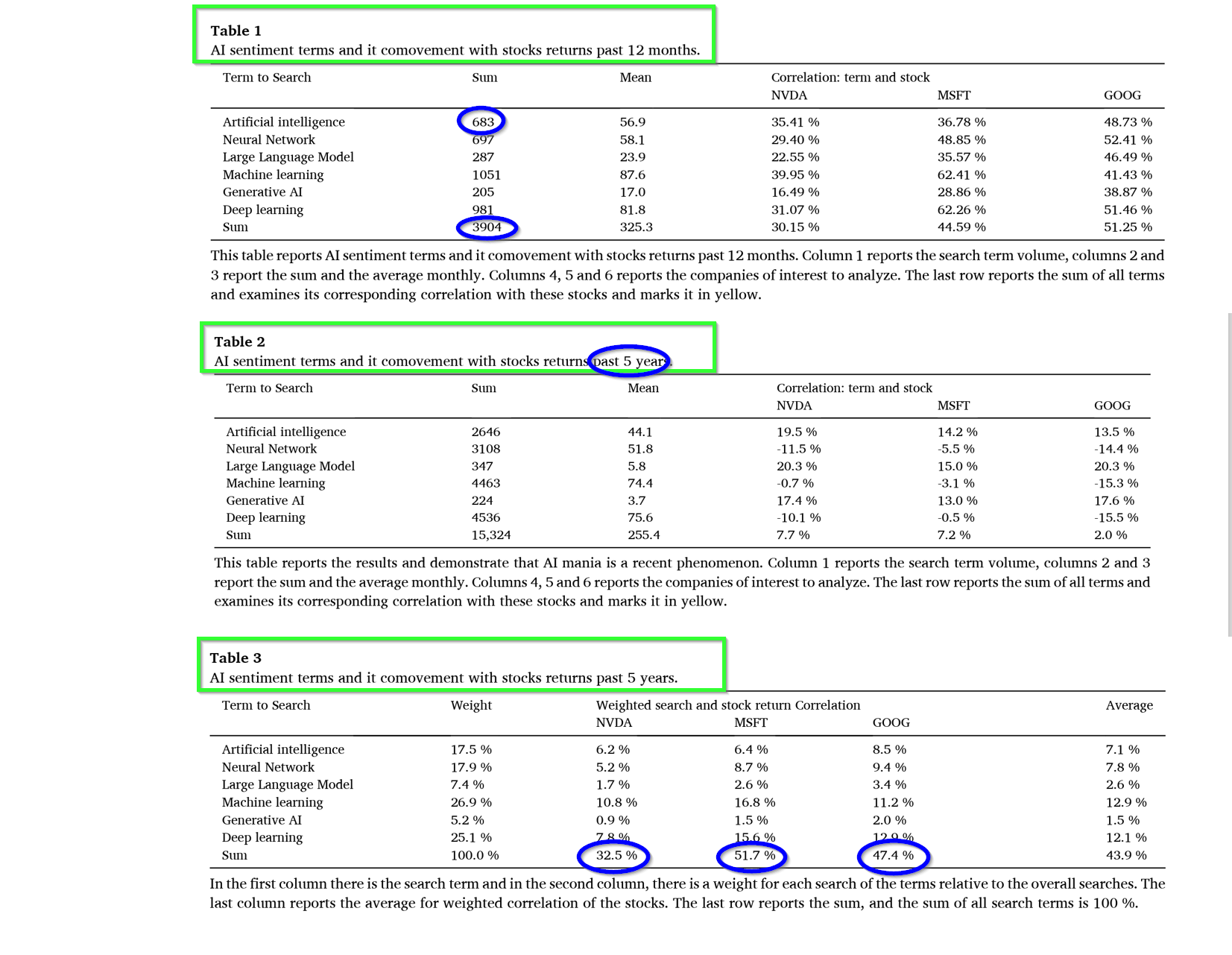

Valuing Artificial Intelligence (AI) Stocks

By Tommi Johnsen, PhD|April 1st, 2024|

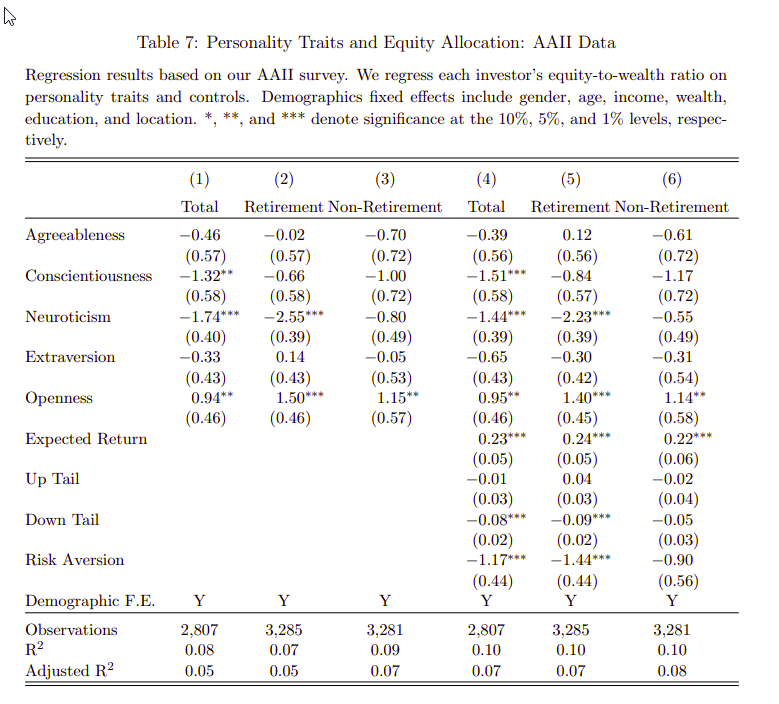

Personality Differences and Investment Decision-Making

By Elisabetta Basilico, PhD, CFA|March 25th, 2024|

Short Campaigns by Hedge Funds

By Tommi Johnsen, PhD|March 18th, 2024|

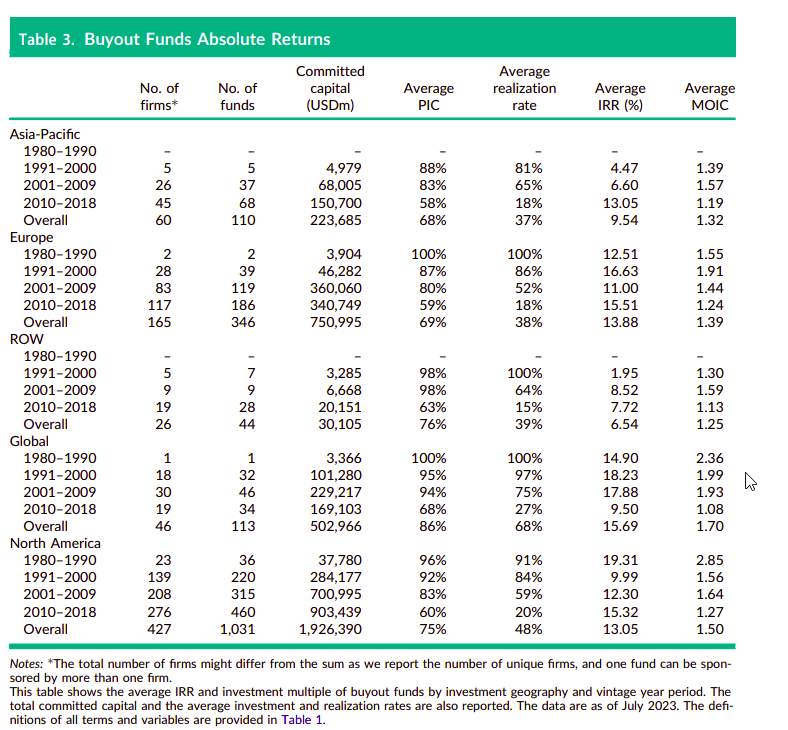

Private Equity Performance Around the Globe

By Elisabetta Basilico, PhD, CFA|March 11th, 2024|

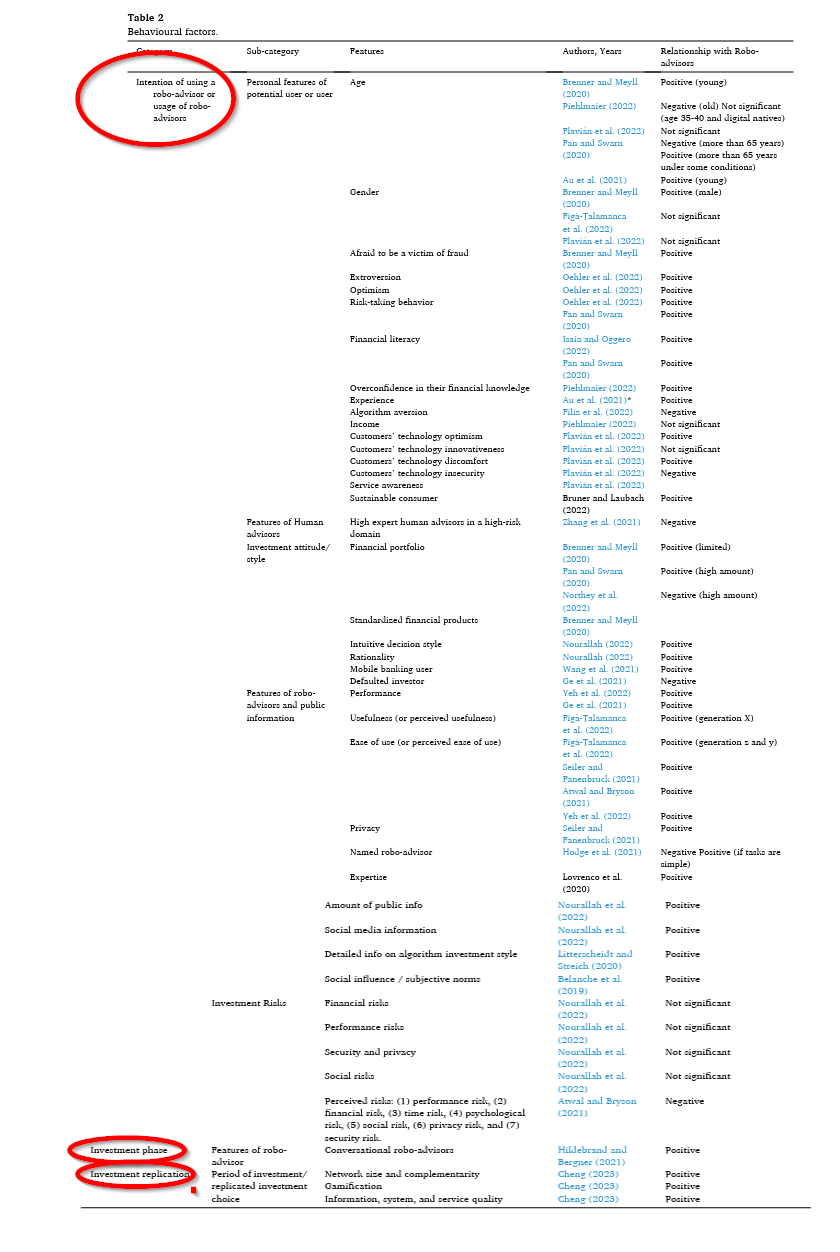

Robo-advisors: A well-researched topic

By Tommi Johnsen, PhD|March 4th, 2024|

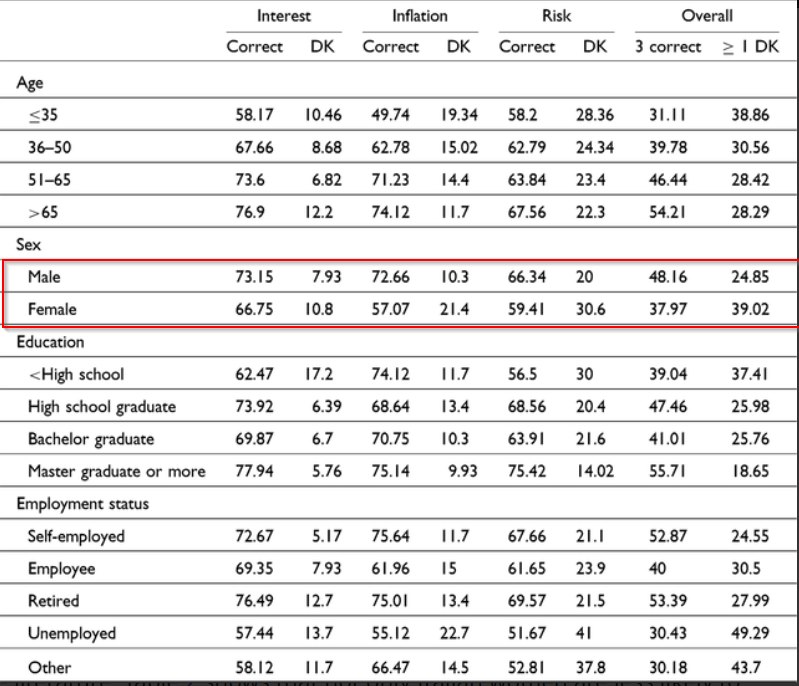

Financial Literacy and Financial Resilience: Evidence from Italy

By Elisabetta Basilico, PhD, CFA|February 26th, 2024|

Can ChatGPT Improve Your Stock Picks?

By Tommi Johnsen, PhD|February 12th, 2024|