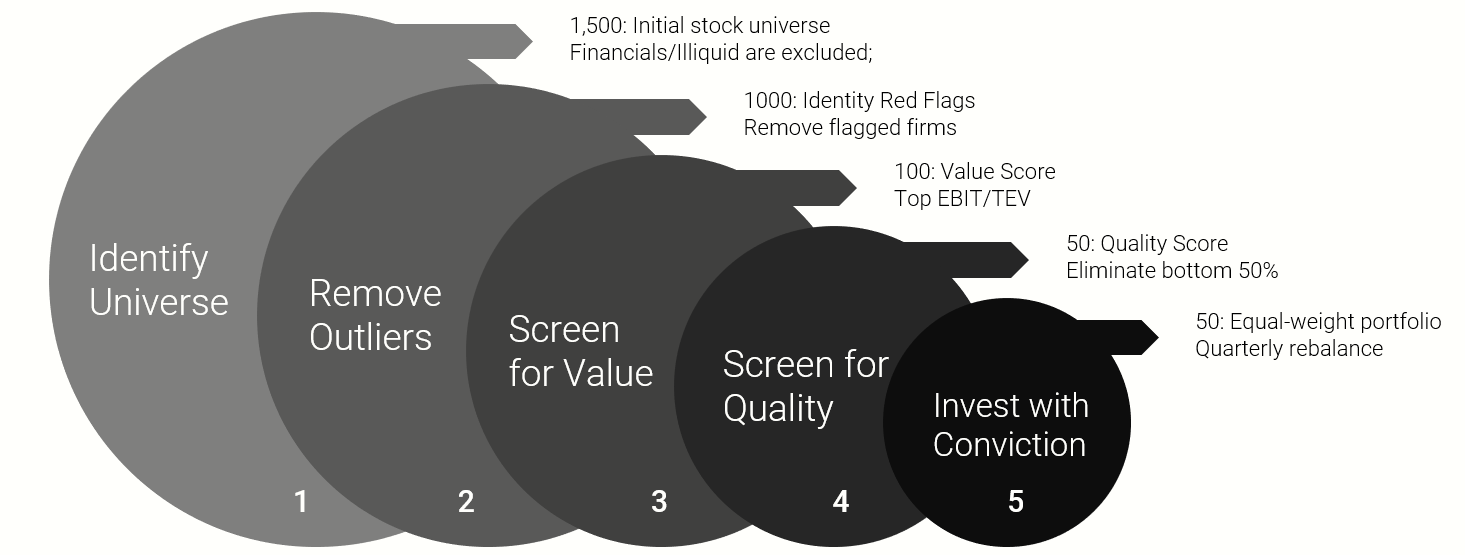

Quantitative Value Index (QV Index)

The Index seeks to buy the cheapest, highest quality value stocks

- Differentiated Value Exposure – The index focuses on enterprise multiples

- Factor Concentration – The Index is highly concentrated with limited constraints

- Excess Return Focused – The Index seeks higher returns and volatility than the general market

Read our white paper on the Quantitative Value philosophy

This example is provided for illustration purposes only.

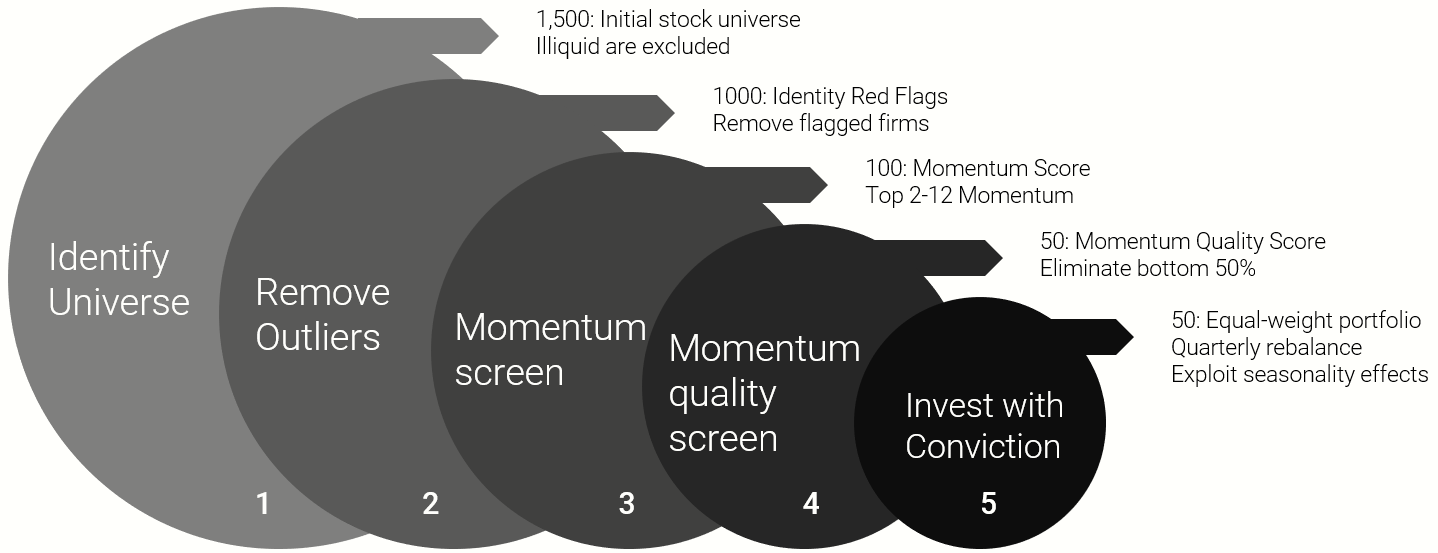

Quantitative Momentum (QM Index)

The index seeks to buy stocks with the highest quality momentum

- Differentiated Momentum Exposure – The index focuses on “smooth” momentum

- Factor Concentration – The Index is highly concentrated with limited constraints

- Excess Return Focused – The Index seeks higher returns and volatility than the general market

Read our white paper on the Quantitative Momentum philosophy

This example is provided for illustration purposes only.