Core Research Categories

Click Here for Category Archive

Momentum Everywhere, Including in Factors

July 14th, 2022|

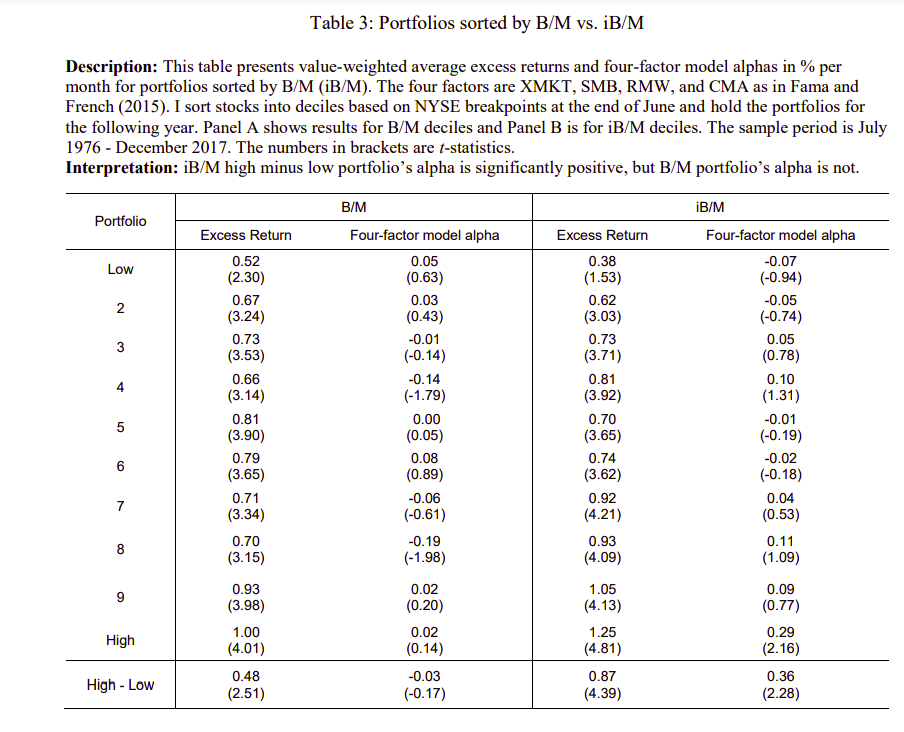

Does Intangible-Adjusted Book-to-Market Work?

July 6th, 2022|

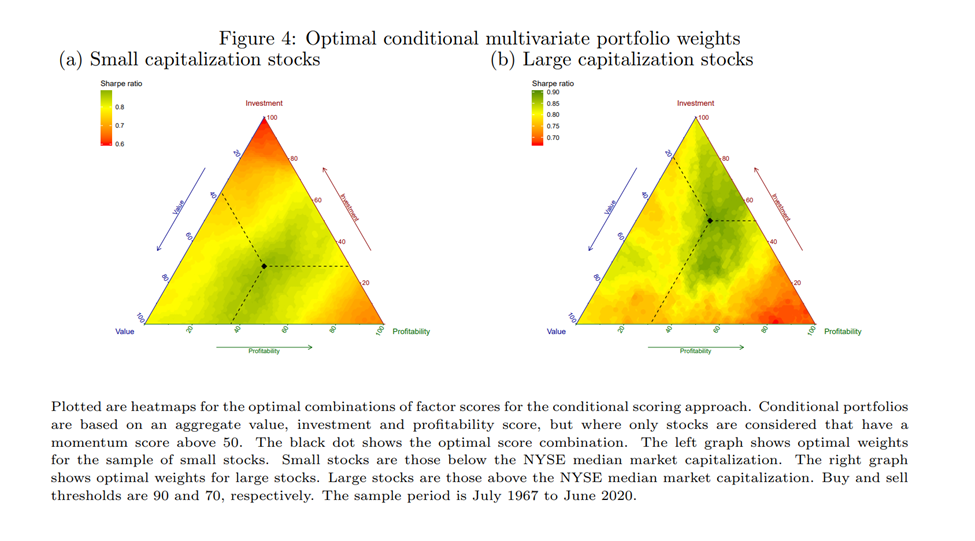

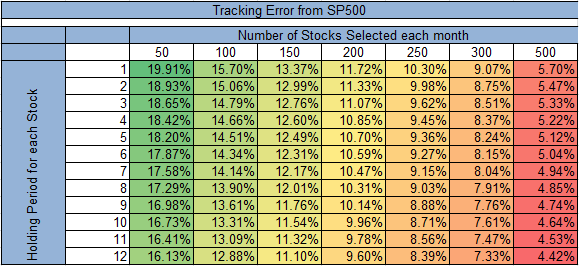

Combining Factors in Multifactor Portfolios

June 30th, 2022|

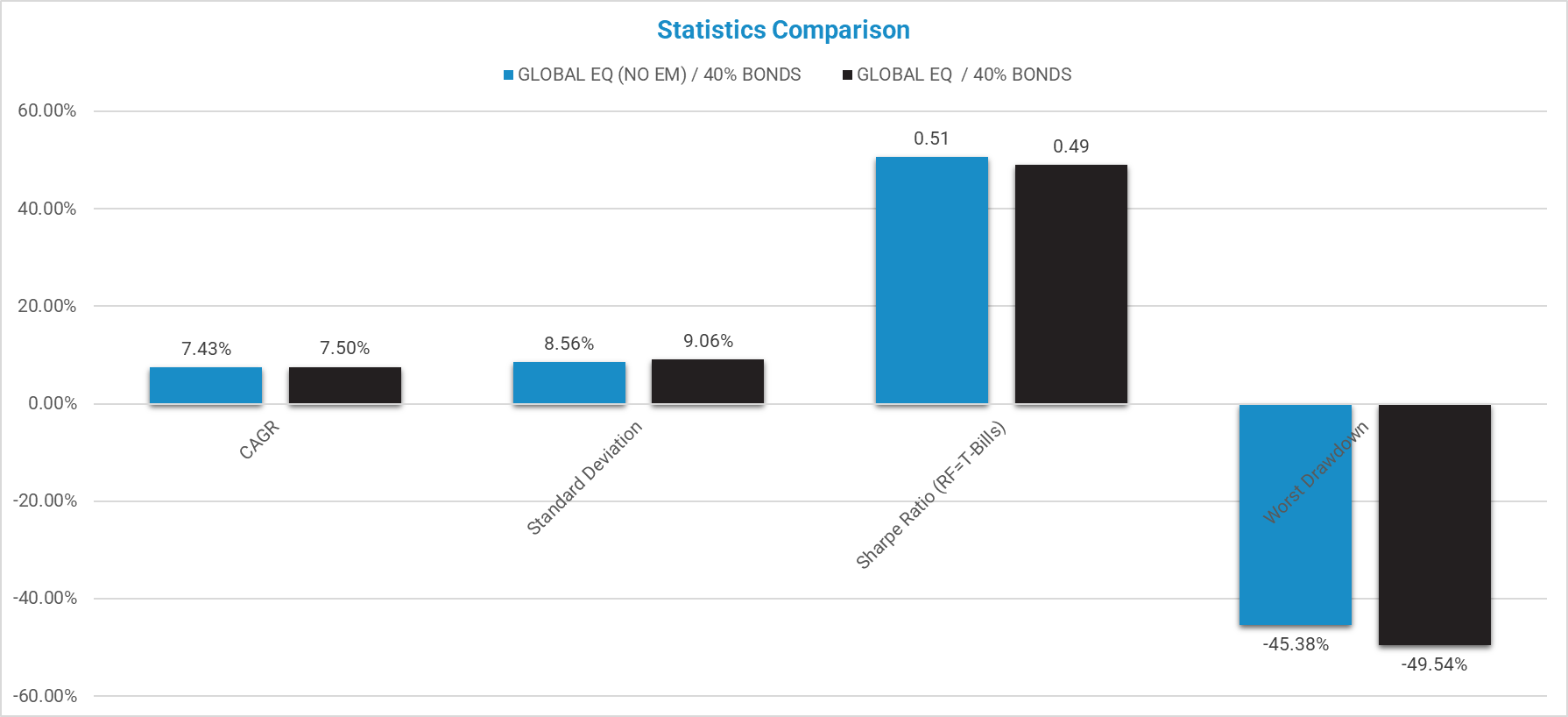

Does Emerging Markets Investing Make Sense?

June 17th, 2022|

Click Here for Category Archive

2023 Democratize Quant Conference Recap and Materials

May 23rd, 2023|

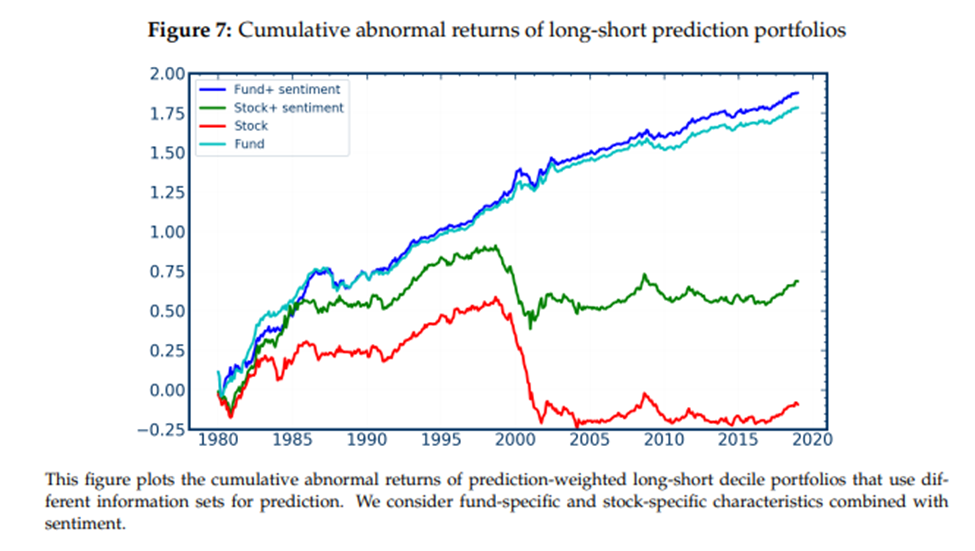

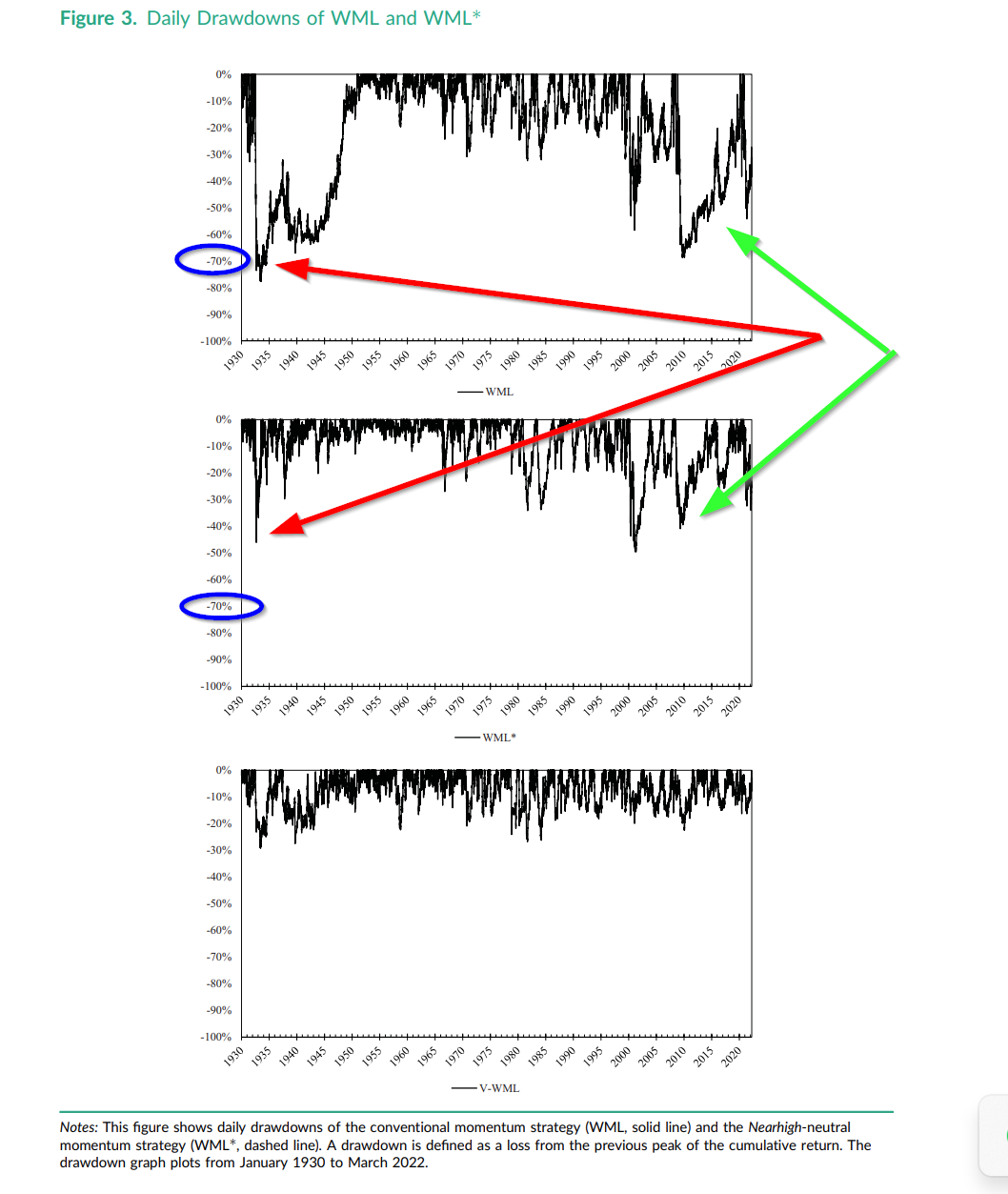

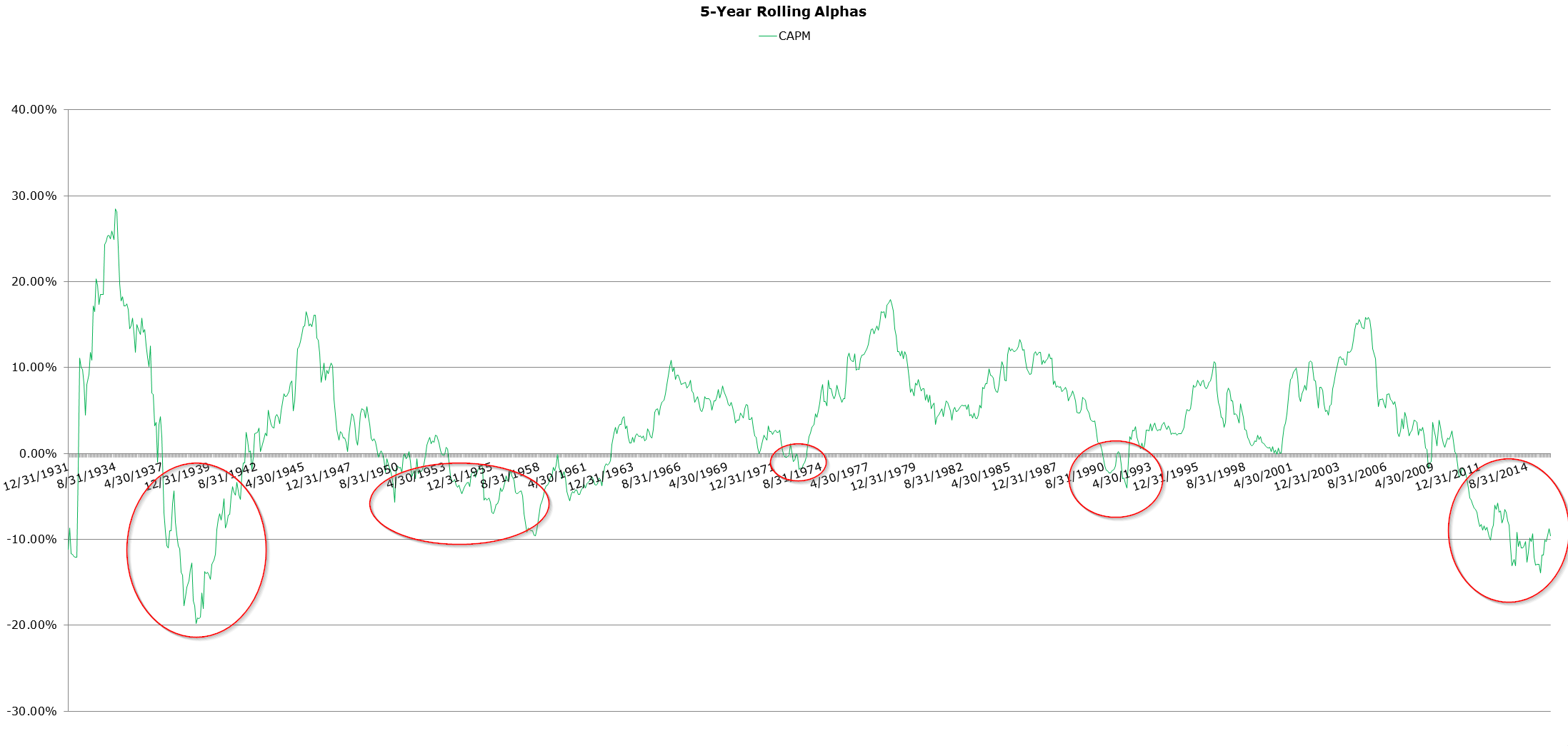

Reducing the Impact of Momentum Crashes

May 15th, 2023|

Democratize Quant 2023 is Live. Sign-up!

April 26th, 2023|

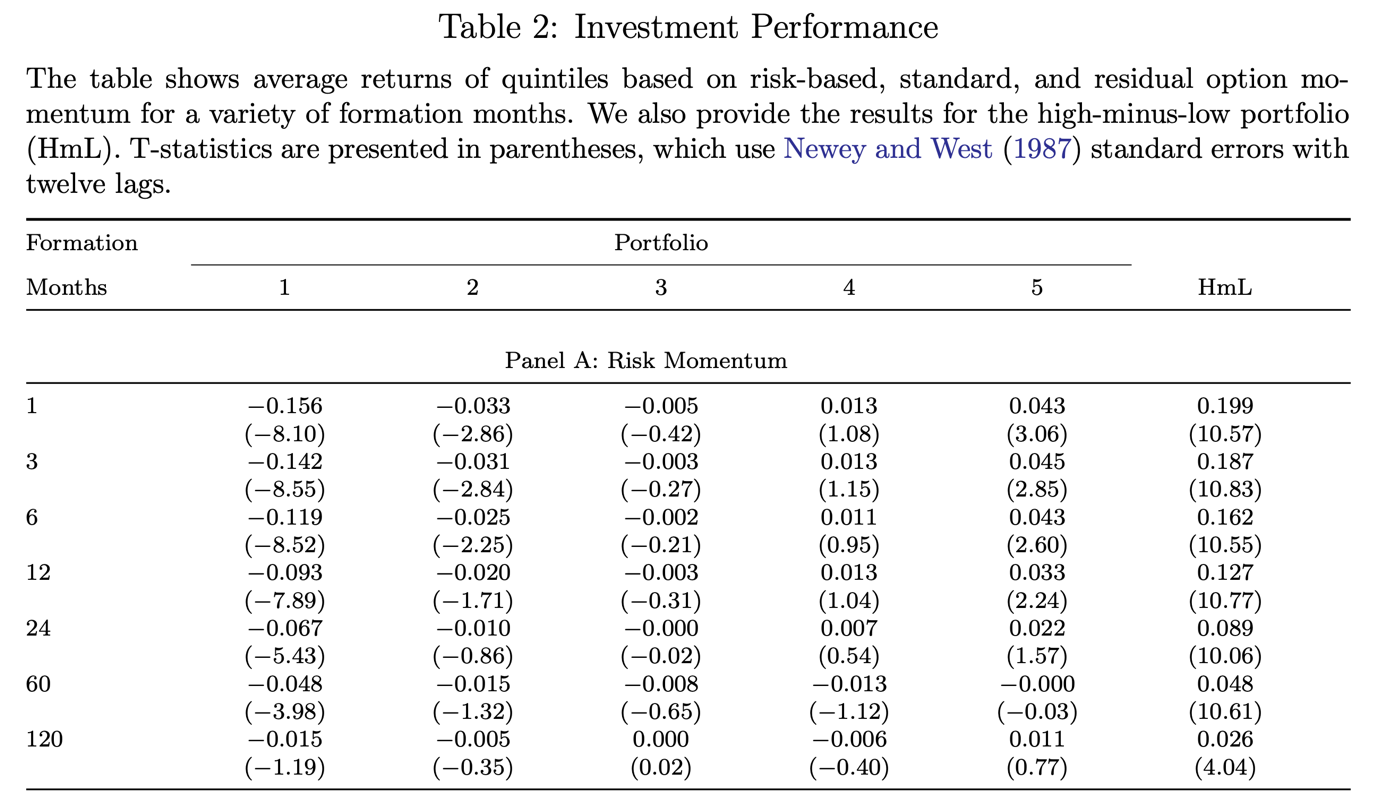

Novel explanations for risk-based option momentum

April 25th, 2023|

How factor exposure changes over time: a study of Information Decay

April 17th, 2023|

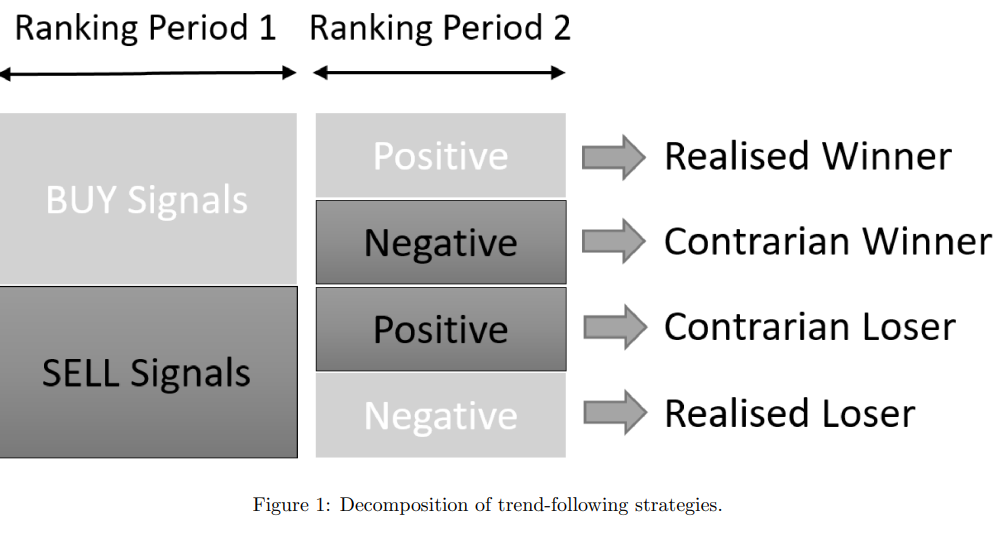

Combining Reversals with Time-Series Momentum Strategies

April 7th, 2023|

Click Here for Category Archive

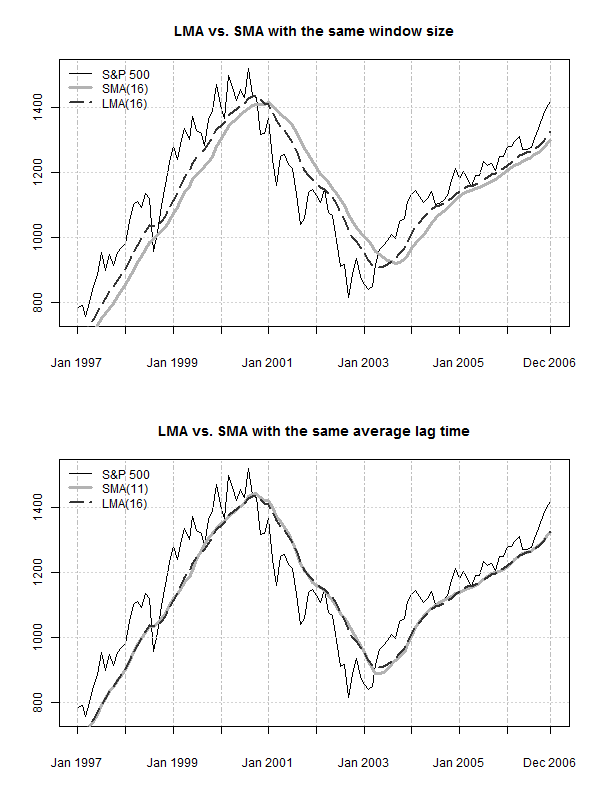

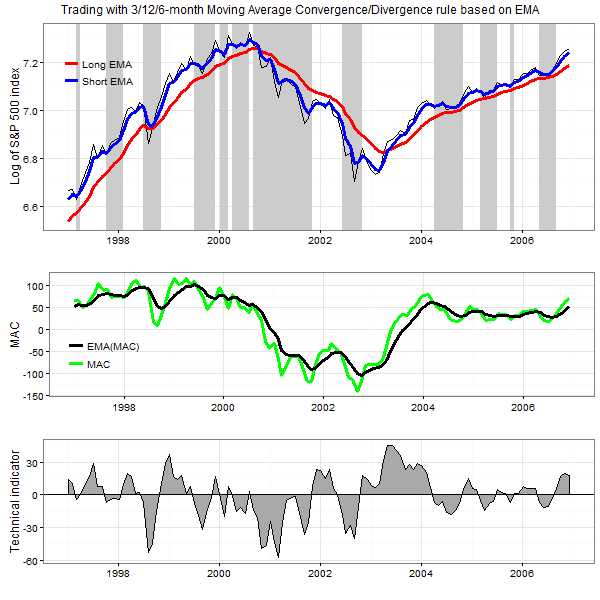

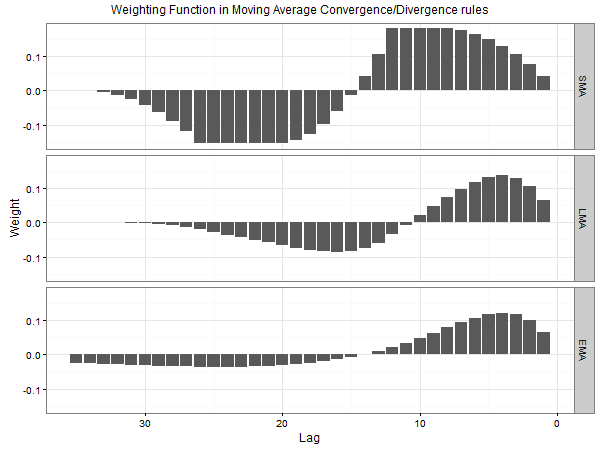

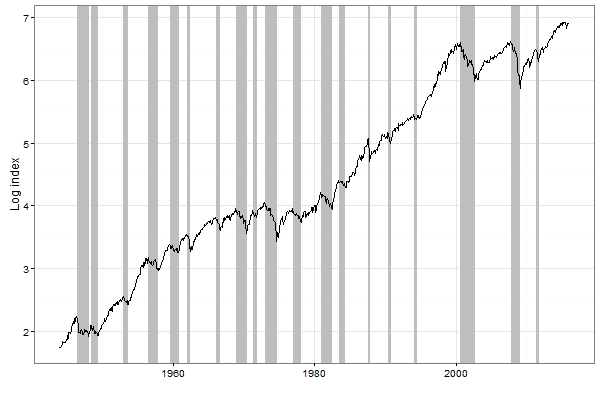

TREND-FOLLOWING WITH VALERIY ZAKAMULIN: TECHNICAL TRADING RULES (PART 3)

August 11th, 2017|

Trend-Following: Testing the Profitability of Trading Rules (Part 6)

August 25th, 2017|

Trend-Following with Valeriy Zakamulin: Trading the S&P 500 Index (Part 7)

September 1st, 2017|

Click Here for Category Archive

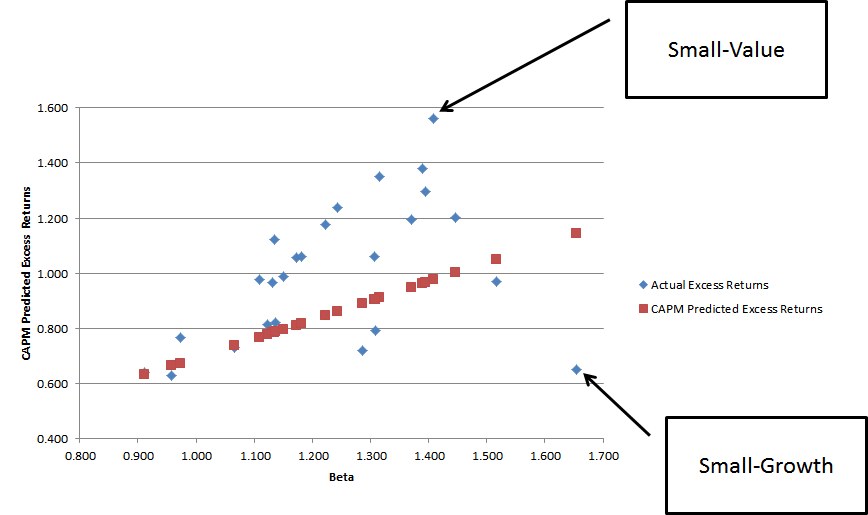

Factor Investing: Evidence Based Insights

June 22nd, 2017|

The Global Value Momentum Trend Philosophy

June 6th, 2017|

“Alternative” Facts about Formulaic Value Investing

April 22nd, 2017|

Factor Investing is More Art, and Less Science

February 3rd, 2017|

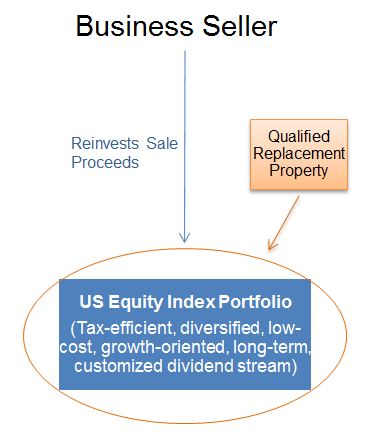

1042 Qualified Replacement Property: An Overview of ESOP Rollover Strategies

December 28th, 2016|

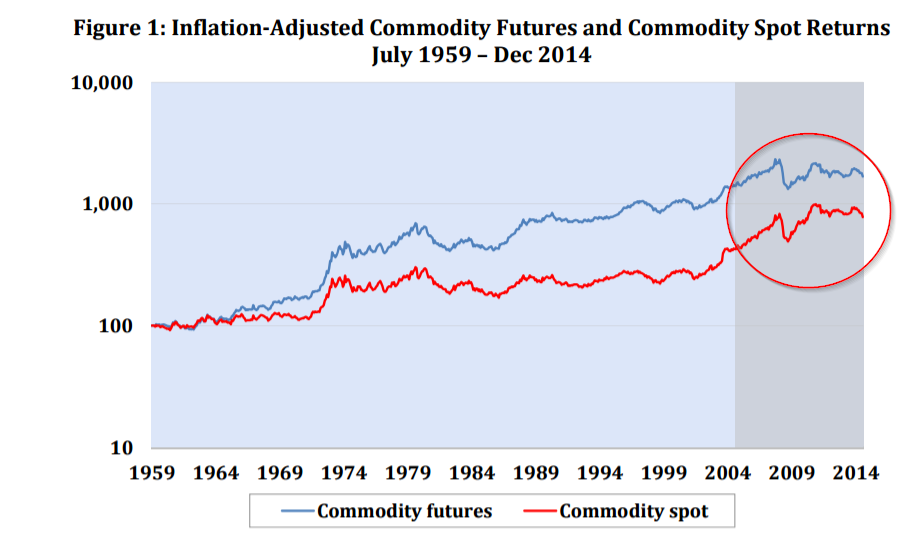

Commodity Futures Investing: Complex and Unique

December 21st, 2016|