Core Research Categories

Click Here for Category Archive

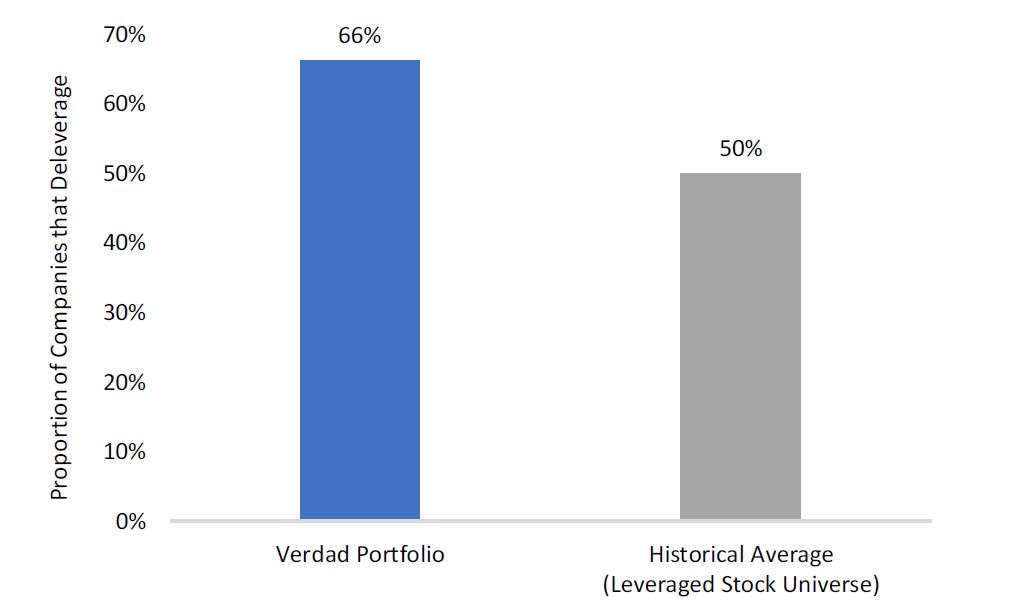

The Value Factor and Deleveraging

January 13th, 2023|

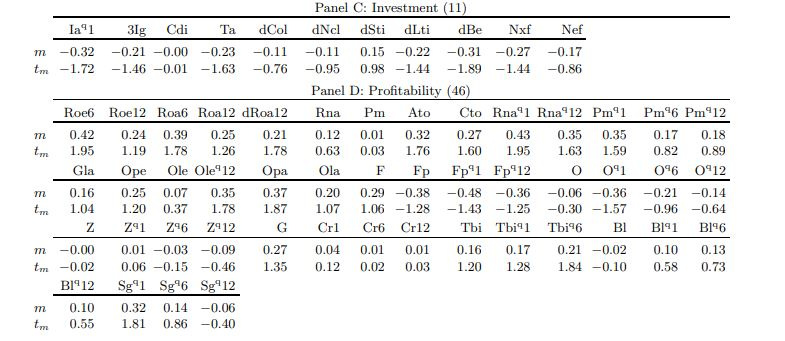

The Role of the Secular Decline in Interest Rates in Asset Pricing Anomalies

November 10th, 2022|

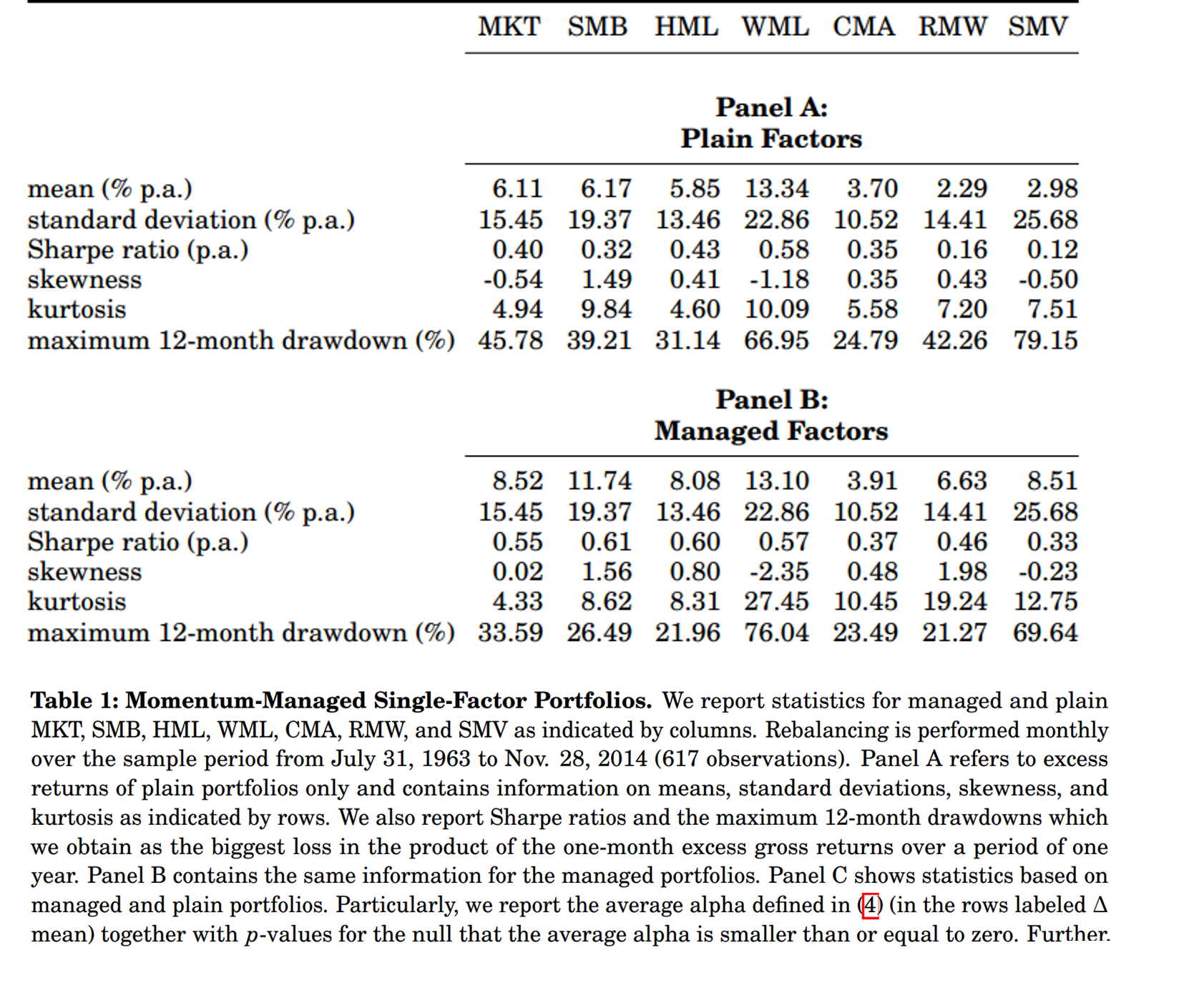

Momentum Everywhere, Including in Factors

July 14th, 2022|

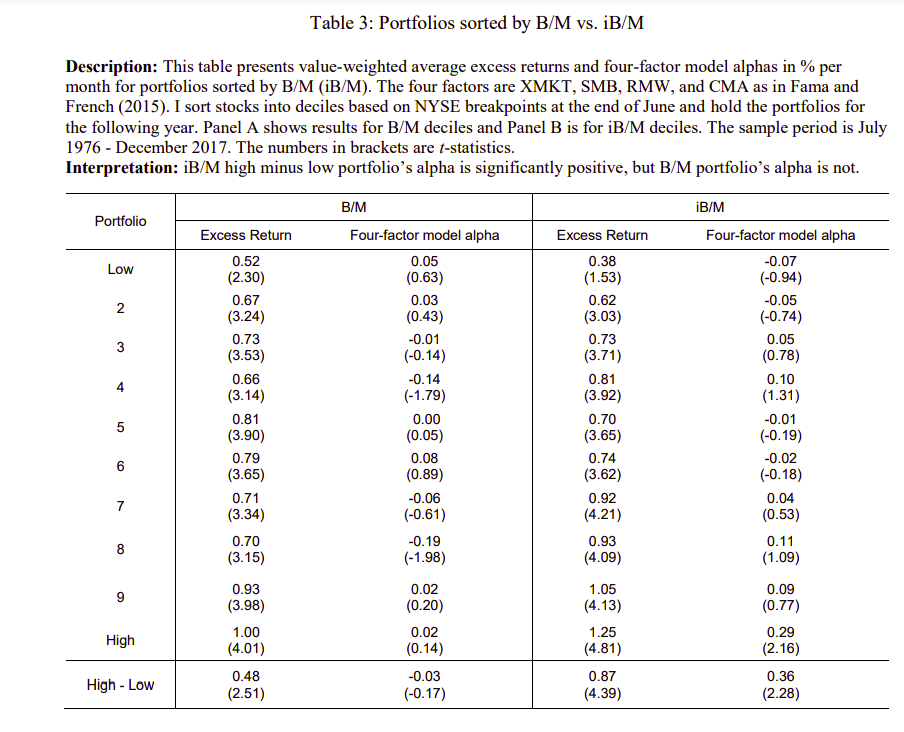

Does Intangible-Adjusted Book-to-Market Work?

July 6th, 2022|

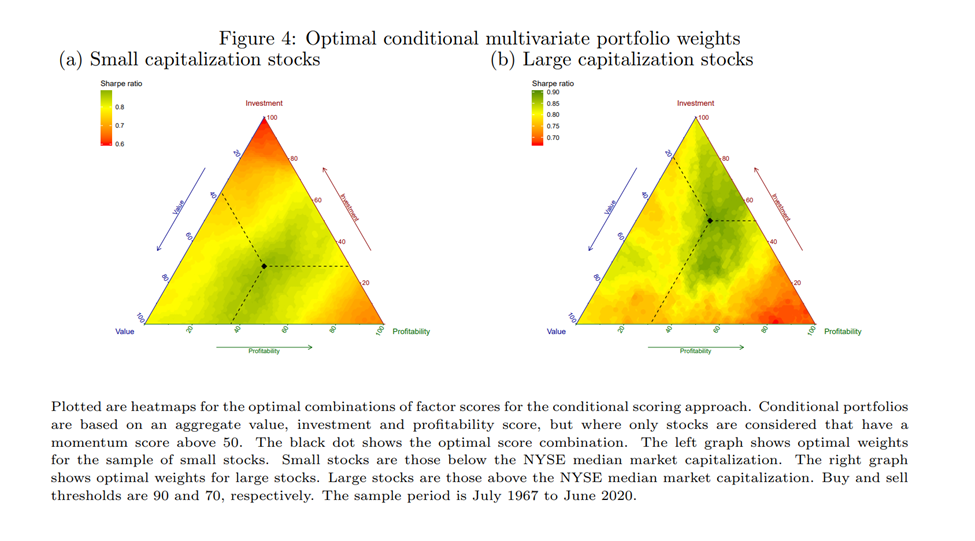

Combining Factors in Multifactor Portfolios

June 30th, 2022|

Click Here for Category Archive

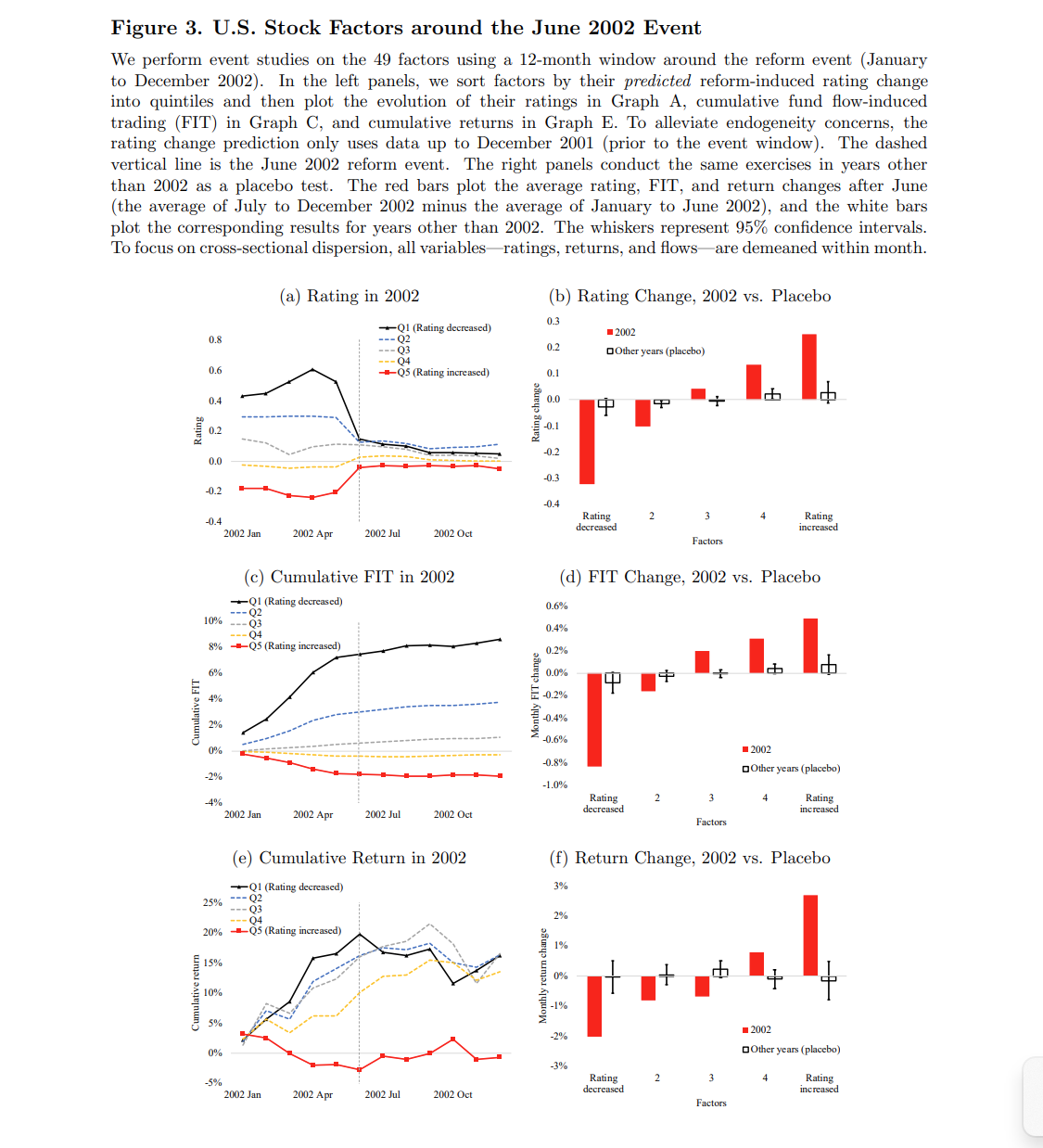

Investor demand, rating reform and equity returns

August 7th, 2023|

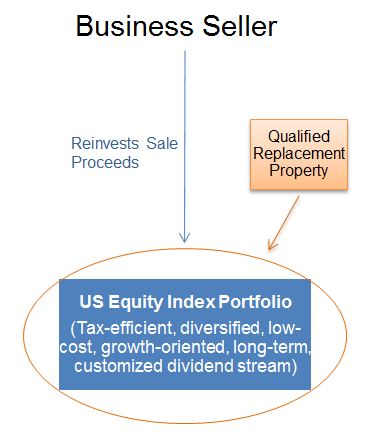

Doug Discusses 1042 QRP and ESOP Transactions

August 3rd, 2023|

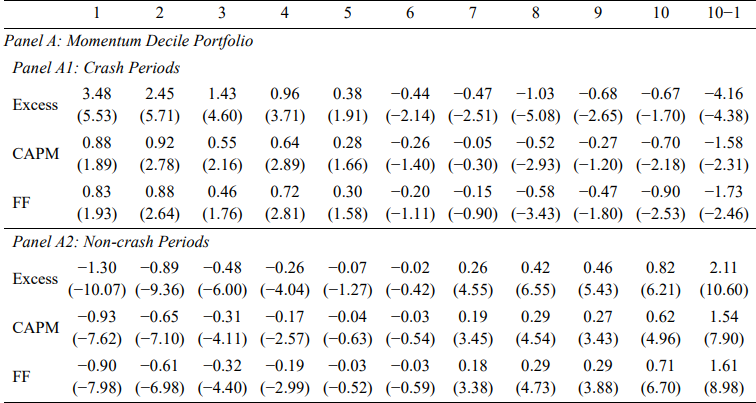

Reducing the Risk of Momentum Crashes

July 21st, 2023|

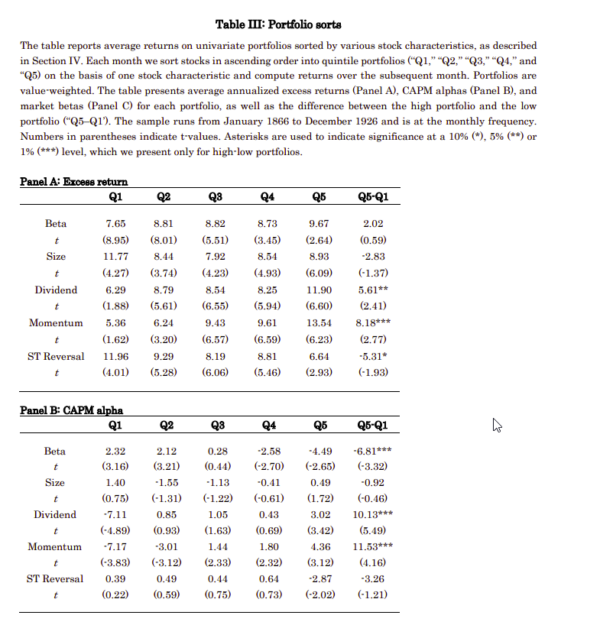

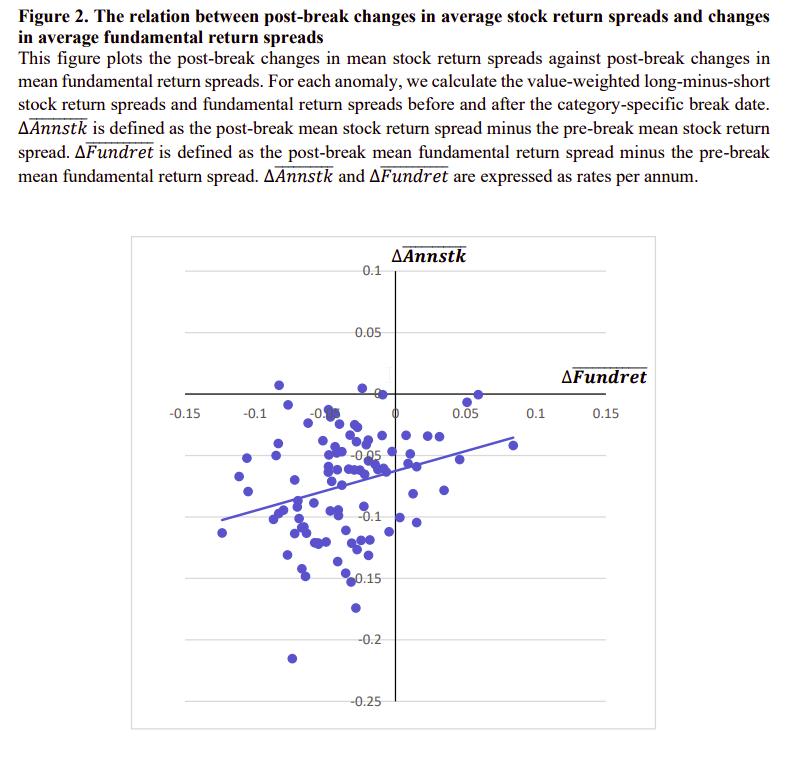

Fundamentals and the Attenuation of Anomalies

June 22nd, 2023|

Industry classification and the momentum factor

June 12th, 2023|

2023 Democratize Quant Conference Recap and Materials

May 23rd, 2023|

Click Here for Category Archive

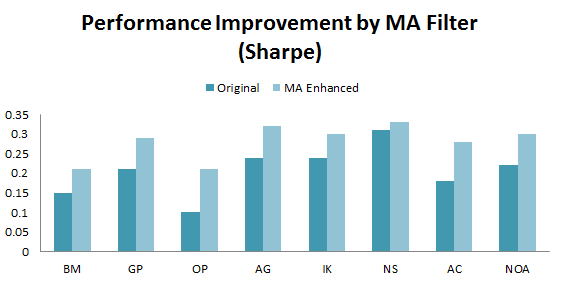

Using Trend-Following Rules to Enhance Factor Performance

January 4th, 2017|

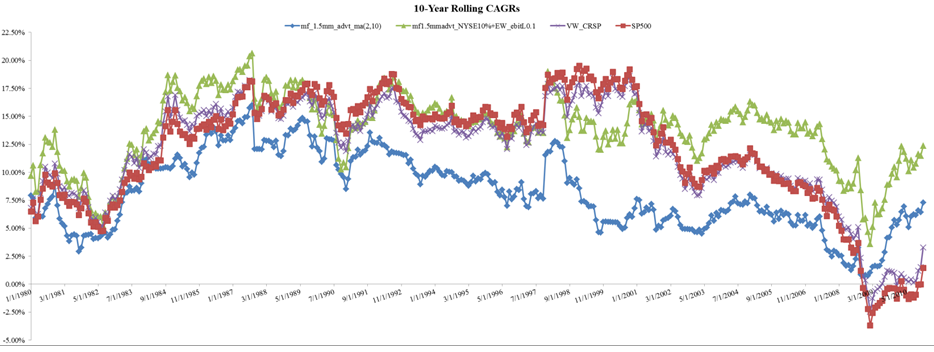

Magic Formula and MA Rules: A Bad Combo!

November 27th, 2011|

What is the correct benchmark for trend following?

October 16th, 2018|

How large is the tracking error created by trend following?

October 25th, 2018|

How to Use Trend Following within a Portfolio

December 4th, 2018|

Click Here for Category Archive

1042 Qualified Replacement Property: An Overview of ESOP Rollover Strategies

December 28th, 2016|

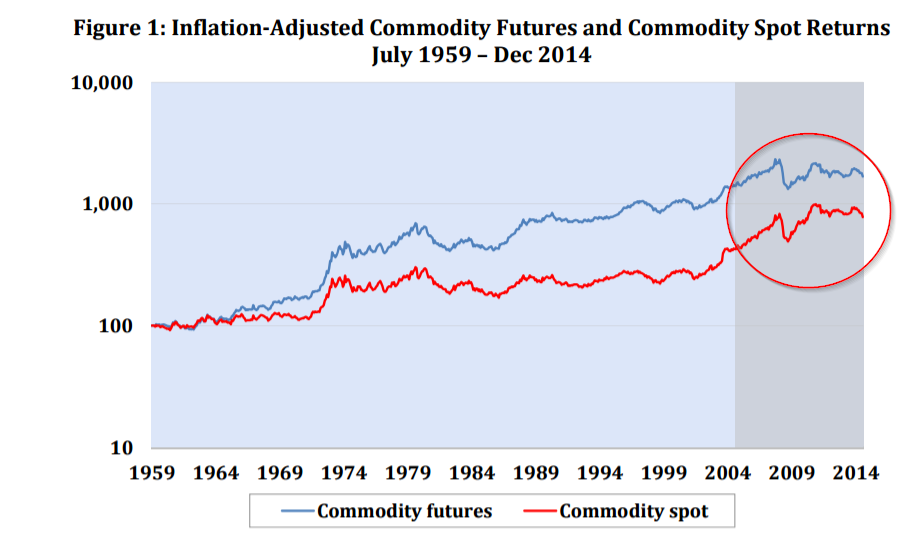

Commodity Futures Investing: Complex and Unique

December 21st, 2016|

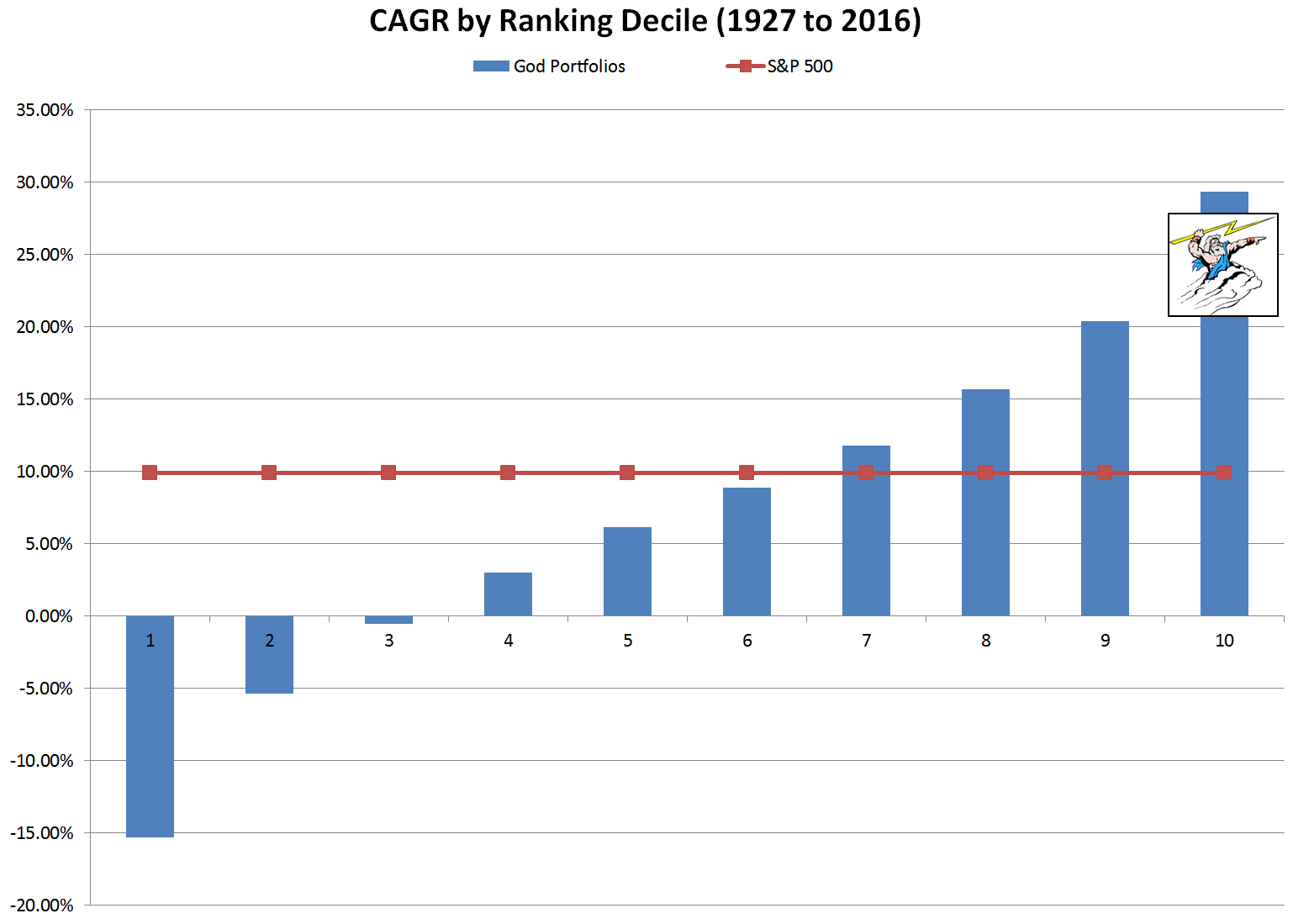

Even God would get fired as an Active Investor

February 2nd, 2016|

The Quantitative Momentum Investing Philosophy

December 1st, 2015|

How to Use Factor Funds in a Diversified Portfolio

September 30th, 2015|

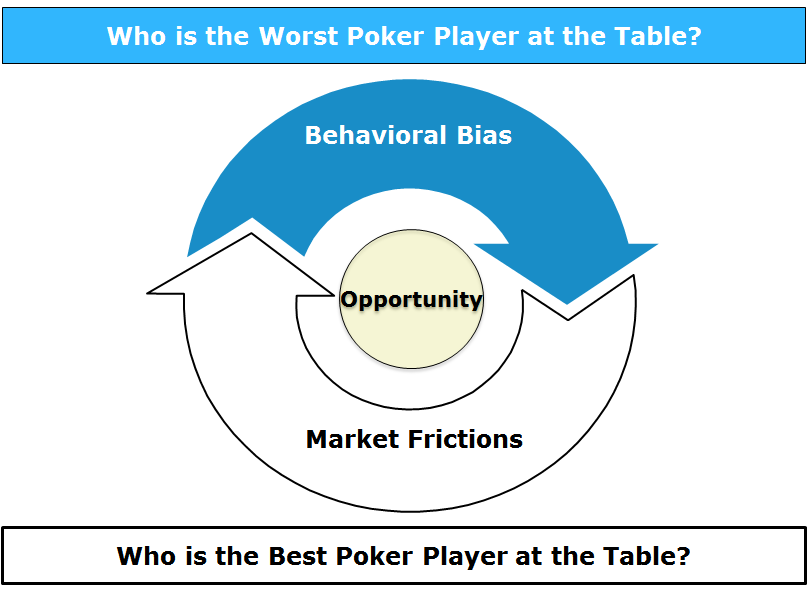

The Sustainable Active Investing Framework: Simple, But Not Easy

August 17th, 2015|