A timely piece on S&P 500 put option prices. The authors find that S&P 500 put options get too expensive during wild times because of 2 effects:

- Demand for insurance sky rockets (investor utility demands safety)

- Supply for insurance becomes restricted (credit constraints cripple market makers)

The lesson seems to be straight forward: buy insurance when you don’t “feel” like you need it; avoid buying insurance when you “feel” like you need it (ie. insurance prices can become more expensive–and move away from theoretical prices–in market downturns).

The Supply and Demand of S&P 500 Put Options

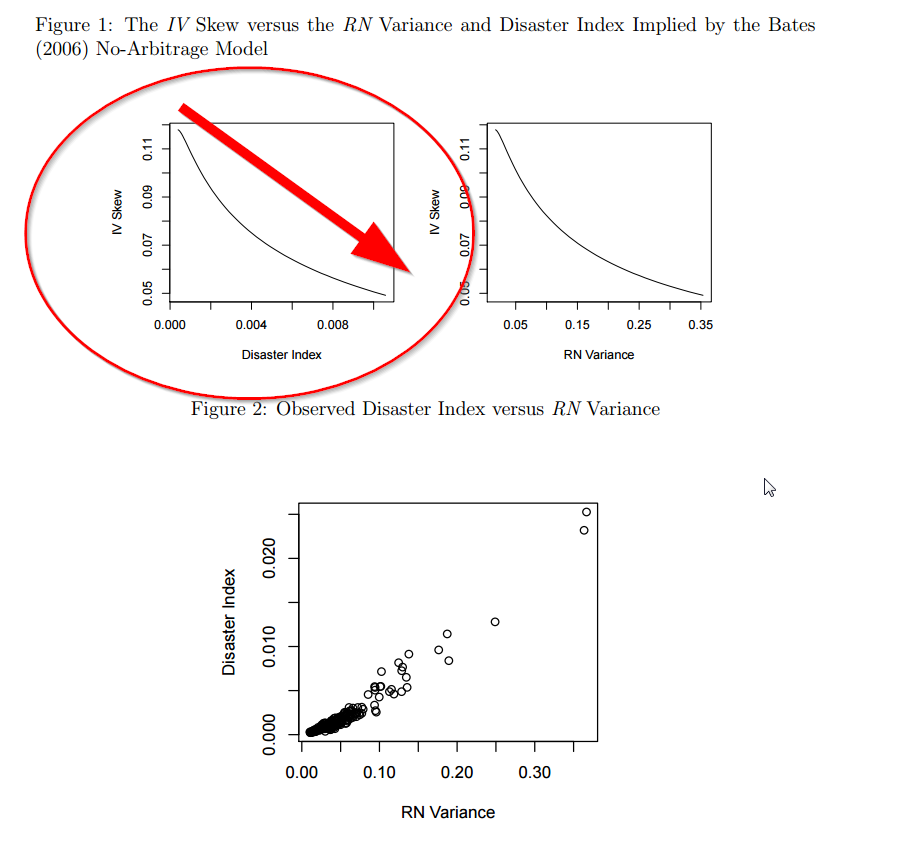

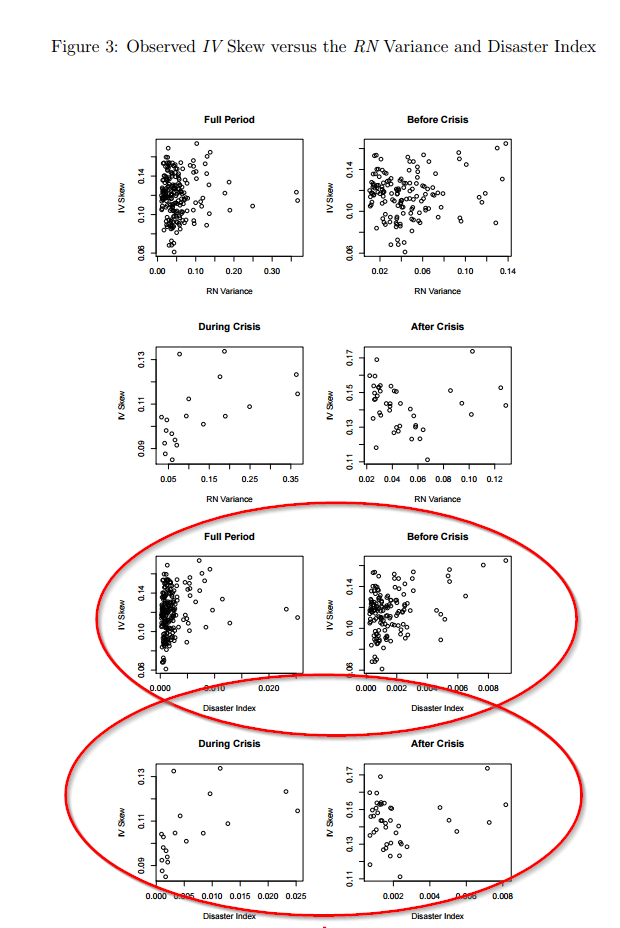

We document that the skew of S&P500 index puts is non-decreasing in the disaster index and risk-neutral variance, contrary to the implications of no-arbitrage models. Our model resolves the puzzle by recognizing that, as the disaster risk increases, customers demand more puts as insurance while market makers become more credit constrained in writing puts. The skew steepens because the credit constraint is more sensitive to out-of-the-money puts. Consistent with the data, the model also predicts that the skew is increasing in the broker-dealers’ liability-to-asset ratio; and the net buy of puts is decreasing in the disaster index, variance, put price, and liability-to-asset ratio.

Here are the theoretical IV Skew and Disaster Index results:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are un-managed, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

And here are the empirical results:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.