The Chinese philosopher Sun Tzu counseled us to “know thine enemy.” At Alpha Architect we are always curious about anything that affects our financial decision making, since we believe the enemy is often us. Recently I did some reading about a curious branch of neuroeconomics that deals with shifting risk preferences: the implications are startling.

Since most on this site spend more time thinking about central bank regulation than central nervous system regulation, allow me to provide a brief overview of your body’s regulatory apparatus: the endocrine system. The endocrine system produces, stores, and manages hormones in your body that have a big impact on how you feel and behave. Likewise, your body can provide input to the endocrine system that tells it what it needs to do in a given situation.

The system can thus act as a feeback loop, with conditions driving internal chemistry, which then affect how we react to those conditions. So for example, if we see a grizzly bear, we all know that the body triggers the release of adrenalin into the bloodstream, producing the famous “fight or flight” response.

Our body produces many different chemicals which produce various responses. For instance, testosterone can generate mental and physical energy, while cortisol, produced in response to stress, decreases sensitivity to pain, and heightens our memory functions. Even subtle environmental cues can affect your body chemistry: dancing to the Turnkey PhD’s favorite Latin dance, the Argentine tango, has been shown to reduce cortisol levels in saliva.

John Coates is a neuroscientist at Cambridge University who has done research in the area of how the natural production of these steroid hormones can drive risk seeking or risk avoidance behavior. He believes hormones affect financial markets to a greater degree than is commonly believed. He and another neuroscientist, Joe Herbert, sampled the saliva of a group of London traders for the presence of testosterone and of cortisol, both before and after several trading days.

They found that higher levels of testosterone tended to be predictive of trading success:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

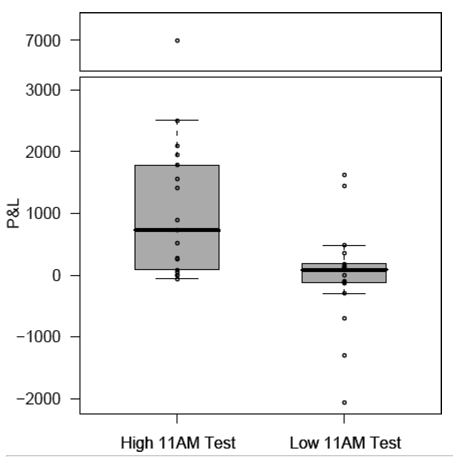

As you can see from the box and whisker plot above, the traders who had more testosterone at the beginning of a trading day were clearly more profitable than their counterparts who started with less testosterone. In a recent follow-on study, Coates determined that it was not a trader’s skill (as measured by the Sharpe ratio) that is enhanced by testosterone, but merely his willingness to assume risk. It should come as no surprise that testosterone appears to be correlated with risk-seeking behavior.

Coates has compared the testosterone-fueled successful trading outcomes to nature’s “winner effect,” whereby when an animal wins a fight, its testosterone levels are increased, giving it an advantage in the next contest. Coates extrapolates that, in a rising market, we might see a financial winner effect, with waves of irrational exuberance driven by the systematic and self-reinforcing ratcheting up of testosterone and risk taking by participants over time. Obviously, of course, if taken to extremes (or if the market turns), this can lead to dangerous outcomes. Indeed, in a separate study reviewed by Coates, testosterone was administered to subjects, who then demonstrated a preference for high variance, negative expected return decks of cards over low variance, positive return decks. Aye caramba!

Asked to describe an example of this enhanced risk-seeking effect, Coates replied:

“During the dot-com bubble, people who were working with me displayed all the classic symptoms of mania: They were euphoric, delusional, and overconfident; they couldn’t put a coherent sentence together; and they were unusually horny, judging from the number of lewd comments and the amount of porn that was showing up on their computer screens. No one had actually looked medically at what happened to traders when they were caught up in a bubble. But they were changing. It was like they were on drugs.”

Scientifically valid, no. Hopped up on testosterone, yes. So here we can see how a financial bubble, or any sustained positive upward market move, could potentially be maintained, or even accelerated by our internal chemistry.

Fascinating.

Now let’s turn to the cortisol results.

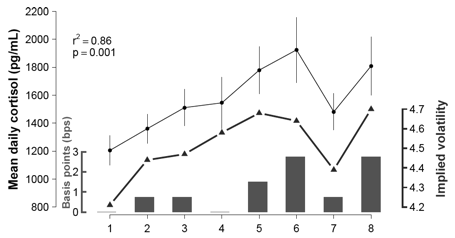

When Coates and Herbert designed their study, they thought maybe cortisol, created in response to stress, would be correlated with trading losses. They found no such relationship. Instead, they discovered two things. First, cortisol responded to the standard deviation of a trader’s P&L. So as the variance of a trader’s returns increased, so did his cortisol levels. But something else was going on in the data. They thought it must be some uncertainty the traders were dealing with, and this led to a second discovery: cortisol was produced in response to volatility in the markets. As it turns out, the traders had their biggest exposure to German markets. Below are cortisol levels for the traders as plotted against the implied volatility of options on German Bunds:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

The R-squared on the regression is 86%, a pretty impressive figure. It would seem the traders’ cortisol levels are consistently preparing them for big market moves. Now a little bit of cortisol can be helpful in many ways; it can aid in motivation, attention and memory. But chronic production of cortisol causes problems; it can produce anxiety, negative memories, and imaginary threats. Coates and Herbert concluded that the strong relationship between cortisol and volatility suggests that collective endocrine profiles may paradoxically then affect markets. How? Consider the condition of “learned helplessness.”

In a ghoulish experiment, dogs who were given a repeated adverse stimulus (okay, it was an electric shock) that they could not avoid, eventually stopped trying to escape, and subsequently exhibited signs of clinical depression. The same thing can happen in bear markets. Persistently elevated cortisol levels could cause market participants to mimic learned helplessness, potentially contributing to a market’s downward move, as fatigued and immobile traders stay on the sidelines.

We can see that testosterone and cortisol are the body’s signs for market risk and return. When they are present at elevated rates for prolonged periods, they can cause traders to make irrational choices that can exaggerate market trends.

What is the true underlying role of biology in financial markets? Behavioral economics offers some tantalizing clues, but neuroeconomics provide some perhaps even more profound possibilities. Maybe the better question is: what is the extent to which these powerful hormones affect our financial lives? While the jury is still out–pending more research–I am going to say hormones have a significant effect. Envision a market with up and down moves reinforced by a rich tide of hormones coursing through the systems of tens of millions of traders. Financial literature abounds with statistical examples of how multiple sigma events continue to defy implied Gaussian probability distributions. Is it really such a farfetched notion that the collective endocrine system of market participants could be a principal driver of these extreme moves to both the upside and the downside? Armed with an intuitive sense of how our bodies can affect our financial decisions, we can see yet another endogenous roadblock that impedes us from making rational investing choices, and exacerbates market manias and panics.

About the Author: David Foulke

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.