The Devil in HML’s Details

Cliff Asness and Andrea Frazzni

Key Points:

- Using a more real-time estimate for book-to-market (B/M) matters.

- Alphas from using a more real-time B/M have an alpha of over 300bps after controlling for risk factors AND a stale B/M ratio.

First the authors describe the “traditional” way of calculating value factors from B/M:

A low B/P means the opposite. In calculating B/P for each stock and forming a value strategy this method updates value once a year on June 30th using book and price as of the prior yearend’s December 31st, and then holds those values constant until rebalanced the following June 30th. In other words, both the book and price data used to form B/P and value portfolios are always between 6 to 18 months old.

Then the authors discuss their more sensible approach:

Most of this paper focuses on whether we really should lag price in this construction of valuation ratios. Unlike book value we know with certainty that June 30th’s price is available on the June 30th rebalance date, so we have a choice of computing valuation ratios based on fiscal year end or current prices. We show that using more up to date price is superior to the standard method of using prices at fiscal yearend for proxying for true book-to-price, and superior in five- factor model regressions. In other words, the standard method of constructing HML can be improved by using more timely price data.

I don’t know about our readers out there, but this paper screams “Thanks, Captain Obvious.”

Now, just because something is obvious, doesn’t take away from the fact that Asness and Frazzini are geniuses for investigating this phenomenon in a systematic way so everyone can appreciate it.

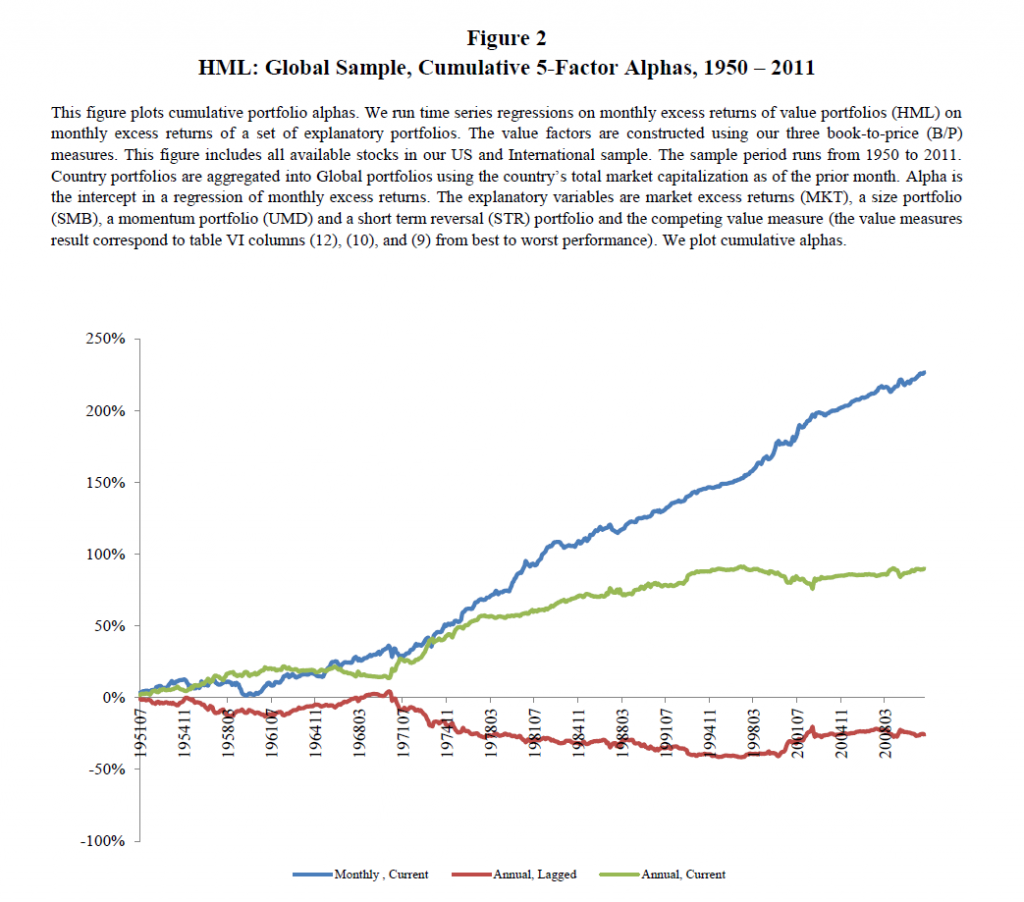

Here is a nice chart showing the differences in the HML value factor calculated using more recent data vs. stale data.

Strategy Summary

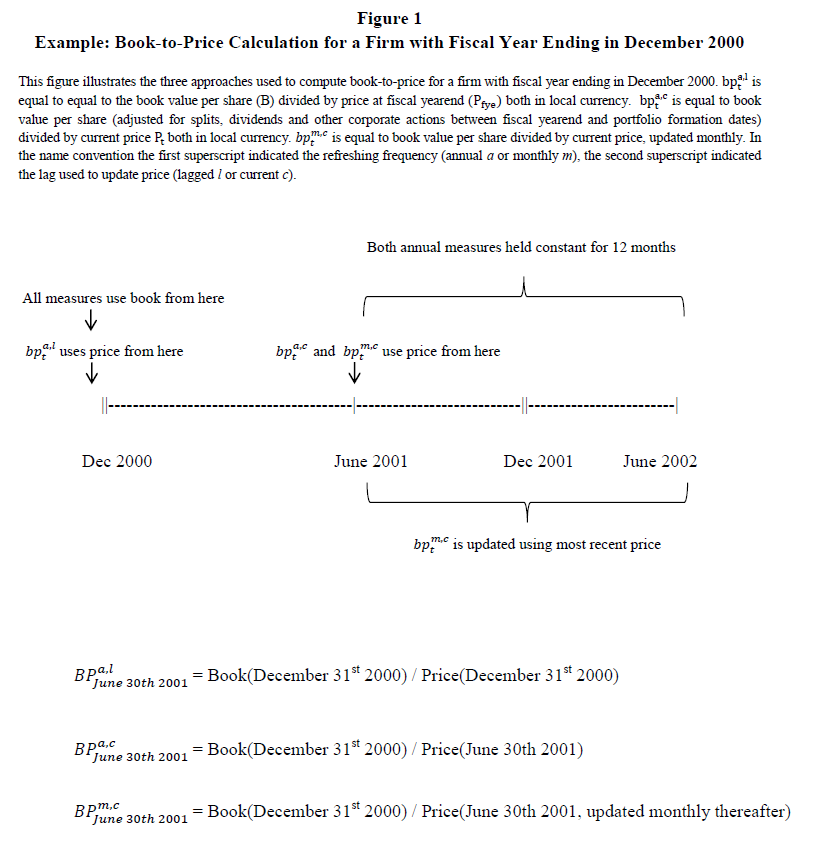

The authors have a nice figure outlining the three different ways they calculate B/M ratios: monthly updates, annual updates (June 30th price), and lagged annual (dec 31st price for stocks picked on June 30).

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Comments and Investment Implications

- This is a must read for anyone doing research on value factors or anyone actually trying to make money trading value factors.

- The details always matter.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.