Professor Novy-Marx does some really great research. We’ve highlighted his work on a few occasions. His specific work on the gross profits factor has influenced a lot of my own research.

Novy-Marx has a really interesting piece discussing “data-mining:”

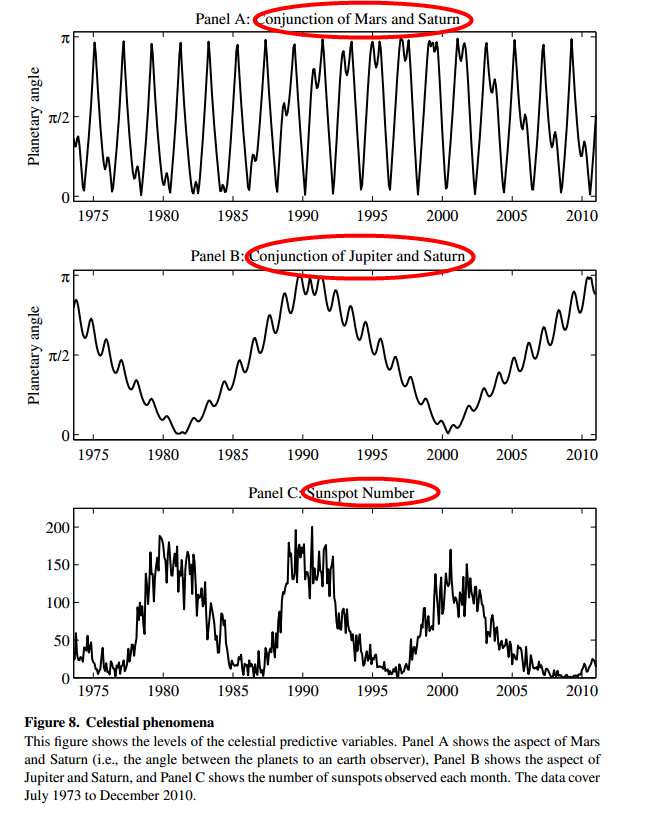

Ferson, Sarkissian and Simin (2003) warn that persistence in expected returns generates spurious regression bias in predictive regressions of stock returns, even though stock returns are themselves only weakly auto correlated. Despite this fact a growing literature attempts to explain the performance of stock market anomalies with highly persistent investor sentiment. The data suggest, however, that the potential misspecification bias may be large. Predictive regressions of real returns on simulated regressors are too likely to reject the null of independence, and it is far too easy to find real variables that have “significant power” predicting returns. Standard OLS predictive regressions find that the party of the U.S. President, cold weather in Manhattan, global warming, the El Nino phenomenon, atmospheric pressure in the Arctic, the conjunctions of the planets, and sunspots, all have “significant power” predicting the performance of anomalies. These issues appear particularly acute for anomalies prominent in the sentiment literature, including those formed on the basis of size, distress, asset growth, investment, profitability, and idiosyncratic volatility.

Some of the more intriguing time series that apparently predict when anomalies will perform the best (I highlighted the titles for effect):

Anyway, in the end Fama is probably going to end up being right and all of us will go down in flames trying to trade crazy quantitative strategies or value strategies that are supposed to make us 15-20% a year. But at least we’ll have fun along the way!

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.