If you are unfamiliar with Valueinvestorsclub.com and you call yourself a “value investor,” you’ve been missing out on the greatest value communities of all time.

VIC has really made an impact on the investment landscape:

BusinessWeek Article

Barrons Article

Financial Times Article

Forbes Article

And if you don’t like the mainstream press, well, maybe you like the greatest finance blog of all time: Zerohedge.com

VIC “Terminal Short” Article posted on Zerohedge.com

“Bank Of America equity is worthless. CFC-related litigation is going from bad to worse, it can lead to violent erosion of shareholders’ equity which. Combined with the run on the bank that has slowly begun, the $53 trillion in derivatives, the lack of sustainable competitive advantages and the depleting political influence, I believe this is a terminal short.”

A natural question to ask regarding VIC is “DO THESE IDEAS ACTUALLY WORK?” In short, the answer is YES!

- Estimated annualized alpha runs anywhere from 6% to 24%+ a year, depending on how one slices and dices the data.

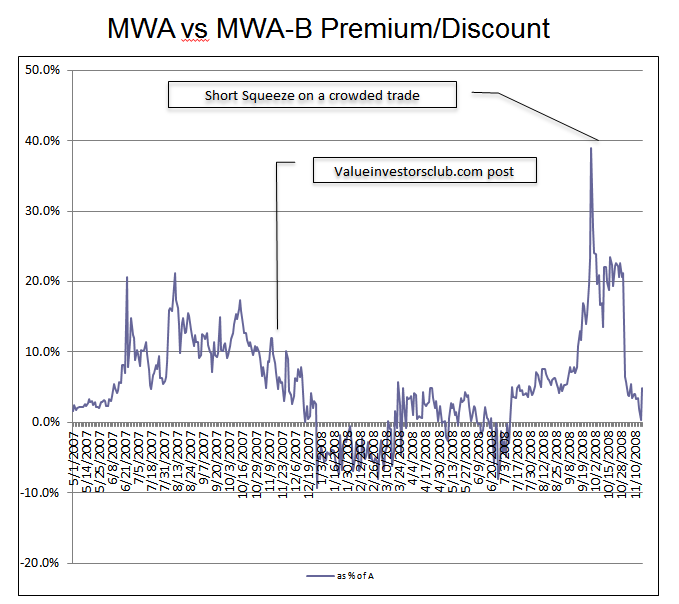

Of course, nobody is perfect. Here is a trade gone wrong:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

If you have a shorter memory, you’ll remember the infamous Porsche Volkswagen pair trade, which was originally posted on VIC:

What we’ve been working on

I’ve been hard at work with my coauthors Steve Crawford (Rice University) and Andy Kern updating our original paper addressing the question of whether or not VIC ideas work.

Our exanded and vastly improved study includes the following updates:

- Updated data through 2011

- Over 1500 additional ideas analyzed

- Completely reworked tests and analysis

- Revamped study on ratings and idea success

- and much, much, more…

If you simply can’t wait to dig into the full version of the academic paper, here is the link:

For those of you who just “want the answer,” here is some chart/table porn for your viewing pleasure:

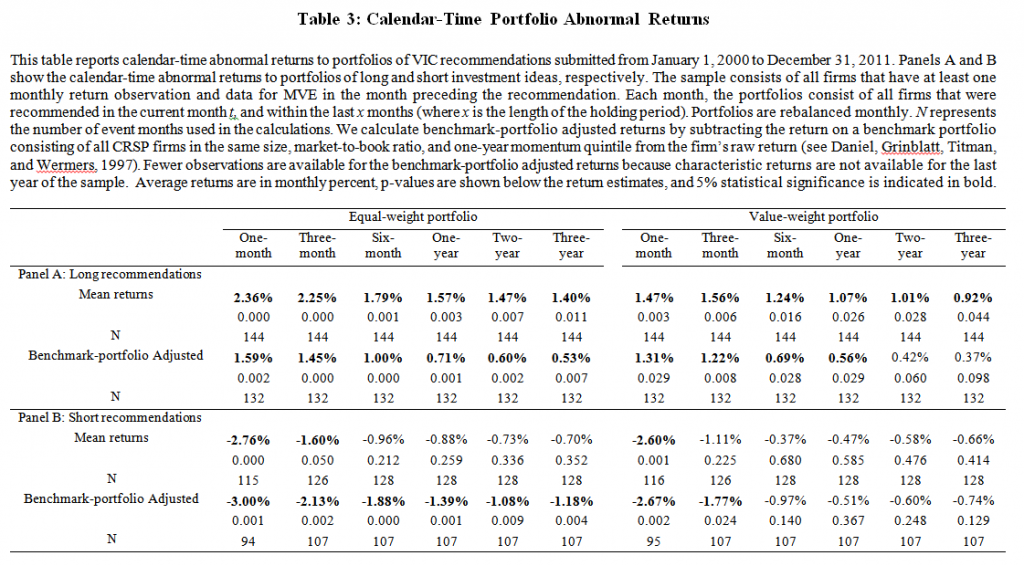

Point 1: VIC ideas work.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

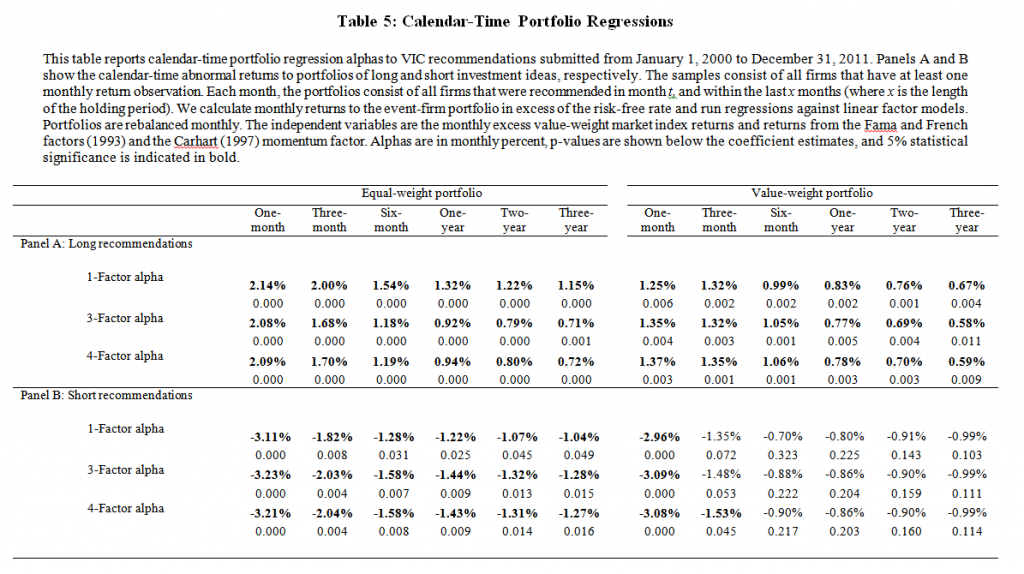

Point 2: VIC ideas work using different analytical techniques

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Point 3: Highly rated ideas work better than Low rated ideas

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

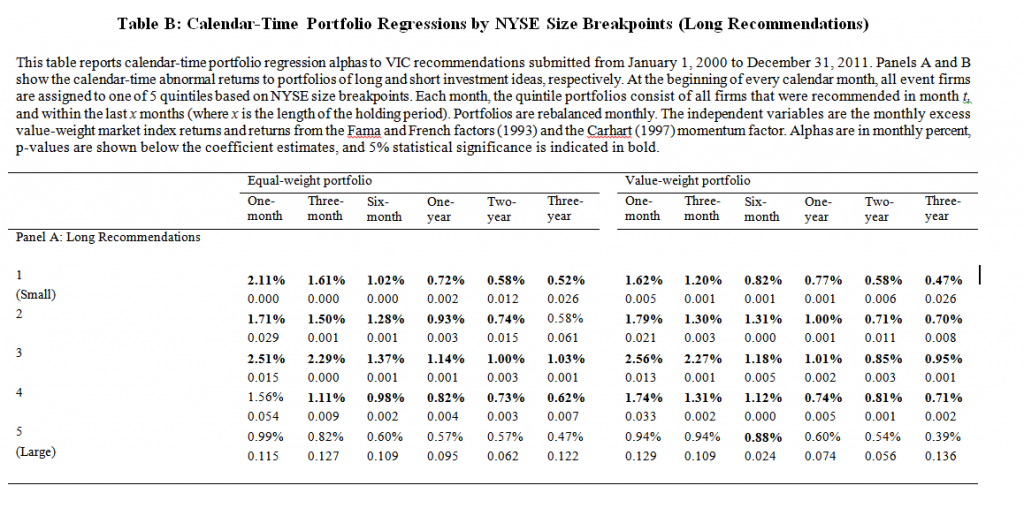

Point 4: Size Matters

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.