Sanz Prophet has a very detailed and interesting review of an idea we proposed recently: Correlation-Based Allocation.

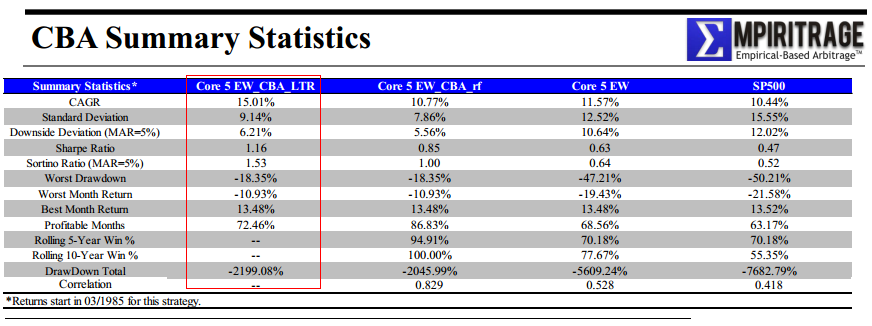

We propose a model that is designed to identify bull-market and bear-market regimes. We examine correlation between stocks and bonds as a signal. Our hypothesis is that negative correlation between long bonds and stocks represents a bear-market regime, and a positive, or non-existent correlation, reflects a bull market regime.

Correlation-Based Allocation (CBA) is a one-signal model that is simple-to-implement, robust, and historically generates a favorable risk/reward return profile.

As tested, the performance looked pretty good:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

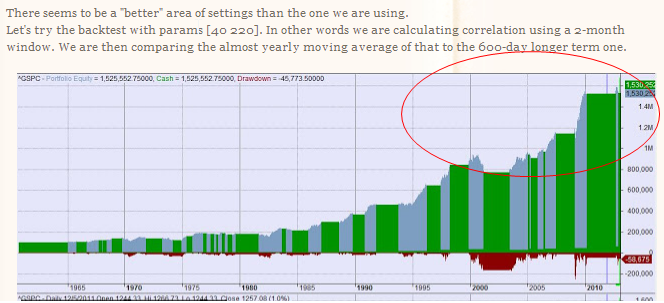

Sanz Prophet takes the CBA analysis to another level and conducts a thorough data-mining exercise to determine the optimal way of implementing CBA. Amazing and simultaneously humbling work–wish I had these skills!

http://sanzprophet.blogspot.tw/2013/01/cba-quick-test-drive.html

Here is a quick shot from the website’s analysis:

I’ll be adding Sanz Prophet to my RSS and added them onto our blogroll.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.