On the Performance of Cyclically Adjusted Valuation Measures

- Wesley Gray (me) and Jack Vogel

- A version of the paper can be found here, or http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2329948

- Want a summary of academic papers with alpha? Check out our free Academic Alpha Database!

Abstract:

We confirm the effectiveness of using cyclically-adjusted valuation metrics to identify high performing stocks. The Shiller P/E, or cyclically-adjusted price-to-earnings (CAPE) ratio, is not the optimal way to implement a cyclically-adjusted value measure. At the margin, the cyclically-adjusted book-to-market (CA-BM) is a better measure to predict returns. We find that more frequent rebalancing and momentum can enhance strategies based on cyclically-adjusted valuation metrics.

Data Sources:

CRSP/COMPUSTAT.

Alpha Highlight:

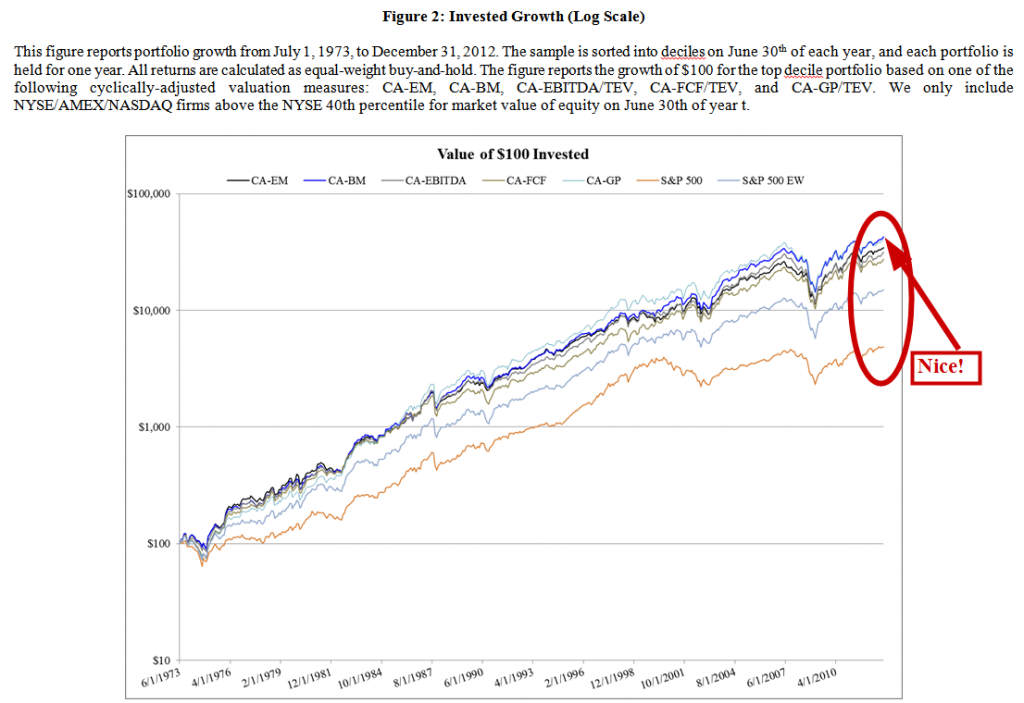

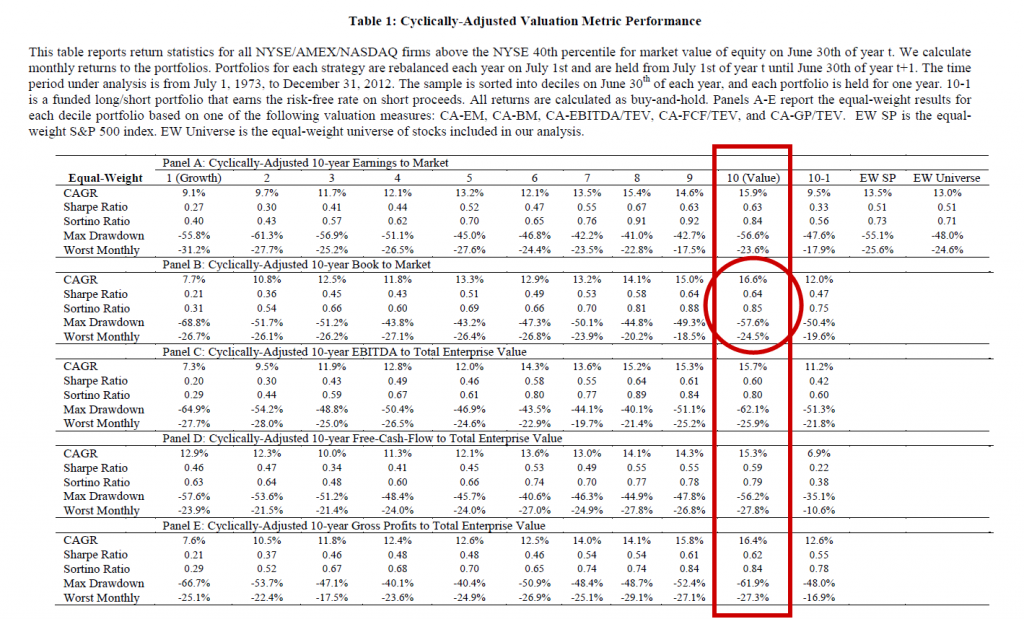

Cyclically-adjusted valuation metrics, or measures that sort stocks on 10-year average real earnings (or Book, EBITDA, FCF, GP, etc.) divided by the current real price (or total enterprise value in some cases), can be used to identify cheap securities. Annually rebalanced portfolios that purchase the top 10% cheapest securties based on these long-term valuation measures have outperformed the S&P 500 and the equal-weight S&P 500 over time.

[Click to enlarge] The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

[Click to enlarge] The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Strategy Summary:

- Sort all stocks on your favorite cyclically-adjusted measure.

- Buy the cheapest 10%, equal-weight.

- Rebalance annually.

Commentary:

- Many market commentators and participants are infatuated with cyclically-adjusted valuation metrics. There is no evidence that we are familiar with to suggest that these metrics are any better at sorting stocks than simple trailing twelve month measures.

- Adding momentum and more frequent rebalancing can enhance these ratio’s ability to identify winners and losers.

Time to dump CAPE and fire up CA-BM?

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.