Warren Buffett once observed:

In business, I look for economic castles protected by unbreachable moats.

Here at Turnkey we have written extensively about economic moats, which are an important dimension of overall firm quality. A company with an economic moat has a sustainable competitive advantage that allows it to achieve superior returns on its investments, and to maintain margin strength for long periods of time.

Since we at Turnkey always look to the past for clues about investing in the present, we were recently reading a book written in 1967, “The Money Game,” by George Goodman (under the pseudonym, “Adam Smith”), which is about “image and reality and identity and anxiety and money.”

We were stunned to see the economic moat concept clearly laid out.

Any company whose earnings are growing consistently – or more important, are likely to grow consistently – has something unique about it. The competition can read these earnings records too, and fat earnings records are an invitation to come in and steal the cream. So a company that has something unique about it has something the competition cannot latch onto right away. Whatever it is that is unique is a glass wall around those profit margins.

Where Buffett referred to a castle’s moat, Goodman refers to a “glass wall.” In both cases, the core idea is the same: competitors can’t get inside the protective barrier.

Over the last few years we have looked at numerous modern companies with economic moats, such as Google, IBM, and Lockheed Martin, but 50 years ago the landscape was somewhat different.

Let’s travel back in time and take a look at some early interpretations of this timeless investment philosophy.

Take a look at those three Senior Sisters of Growth: Xerox, Polaroid, and IBM. A lot of people make copiers, but only Xerox makes copiers that copy on any kind of paper. Xerography has a ring of 500-odd patents woven around it, and there are plenty of executives with a Bruning or a Dennison copier who hand something to a secretary and say, “Here, xerox this.” Xerox has become a verb, and it dominates the field.

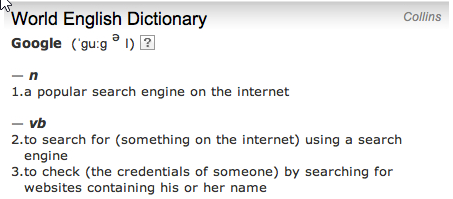

Sound familiar? We can think of another modern day firm with a well-recognized brand name whose name has become a verb: Google. Like Xerox did in the 60s, Google has a sizable patent portfolio, and last year it invested an additional $5.5 billion in new patents. Also like Xerox did in the 60s, Google dominates the field today.

A number of companies make films, but only one company – Polaroid – makes a film that produces a print for you in ten seconds, and once again there is a ring of patents all around the process. IBM dominates the computer field, which itself has had a spectacular growth. It was not the first company to make a computer by a long shot, nor is each computer necessarily the best technically in its area. What is unique about IBM is the breadth of its marketing competence. Customers do not want a particular piece of machinery, they want their inventories tallied or their problems solved, or what have you; and IBM’s salesmen have a vast and sophisticated array of goods to tailor to problems, and its servicemen are right around the corner.

We would point out that Warren Buffett invested in IBM as recently as early 2011. Yet even back in the 60s, IBM was diversified, had a large geographic footprint with significant sales force efficiency, and enjoyed manufacturing economies of scale, allowing it to provide products at a very low cost. These scale-related advantages, which persist in IBM today, gave the company bargaining power against suppliers and pricing power across its geographic markets, allowing it to earn high returns on capital, and maintain profits and margins when others might make losses.

What about the Avon Ladies?

What is unique about a company is not patents or products. Polaroid’s original patents have expired, and anybody who wants to turn out a 1948-type Polaroid picture, brown and fading, can do so. What is unique is always the same thing: it is people, the brains and talents of people. Sometimes these people produce patents, sometimes they produce a reputation for service; but always they produce something that cannot be easily duplicated by anyone else. In Avon Products, for example, what cannot be easily duplicated is its army of women selling Avon’s cosmetics door to door.

It’s clear that in the 1960s, it would have been difficult to recreate Avon’s army of women, but the same concept holds today. A modern example of the difficulty of recreating an existing economic moat might be the defense contractor Lockheed Martin, whose longstanding supply channels, specialized system expertise and reputation would be very difficult to reproduce by even an extremely well-financed new entrant. Want to compete with Lockheed on a bid for a new fighter jet program? Good luck with that.

In “The Money Game,” Goodman wondered whether you shouldn’t simply identify the companies with Something Unique (i.e., an economic moat), and simply buy and hold them. As it turns out, during the 60s, while a company’s economic moat was an important factor when considering an investment, even more critical then, as is still true today, was the price paid.

Even if, by some magic, you knew the future growth rate of the little darling you just discovered, you do not really know how the market will capitalize that growth. Sometimes the market will pay twenty times earnings for a company growing at an annual compounded rate of 30 percent; sometimes it will pay 60 times earnings for the same company. If IBM, Xerox, and Polaroid have that required Something Unique, could we not just buy them and lock them away? Companies which have had something unique do not always run head-on into disaster; more frequently they are simply debutantes who had a rosy glow of beauty for a time and have become respectable middle-aged matrons much like the matrons who were never belles at all. For a time, the market will continue to keep them at a premium; the memory of beauty will still be so strong that the gentlemen who were struck first by the beauty cannot see the lines and sags creeping in. As new gentlemen come in, though, there are new beauties to greet them, and memory is not enough to keep the matrons popular. Then they are vulnerable, because the multiples will come down.

Some modern readers will undoubtedly find this analogy to be outdated, but the underlying idea has stood the test of time. Look for quality, in the form of an economic moat, but only buy cheap.

About the Author: David Foulke

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.