When Growth Beats Value: Removing Tail Risk From Global Equity Momentum Strategies

- Clare, Seaton, Smith, and Thomas

- A version of the paper can be found here.

- Want a summary of academic papers with alpha? Check out our Academic Research Recap Category!

Abstract:

We investigate the relationship between value, growth and momentum investment styles across a wide range of developed and emerging economy equity markets. As would be anticipated, value investing generally beats growth. We then determine whether the application of relative momentum or trend following filters can enhance the risk-adjusted performance for either value or growth investors. We find that both value and growth portfolios benefit from momentum filters but particularly the latter, though the application of such a filter still leaves investors with return volatility that is typical of equity markets along with negative skewness and with high maximum drawdowns. However, our results show that the use of a simple trend following filter typically delivers a much more favourable investment performance than relative momentum with considerably lower volatility and smaller drawdowns. Furthermore, the application of a simple trend following filter either on its own or in combination with a relative momentum filter, not only reduces the performance advantage of value over growth investing but actually reverses this advantage.

Alpha Highlight:

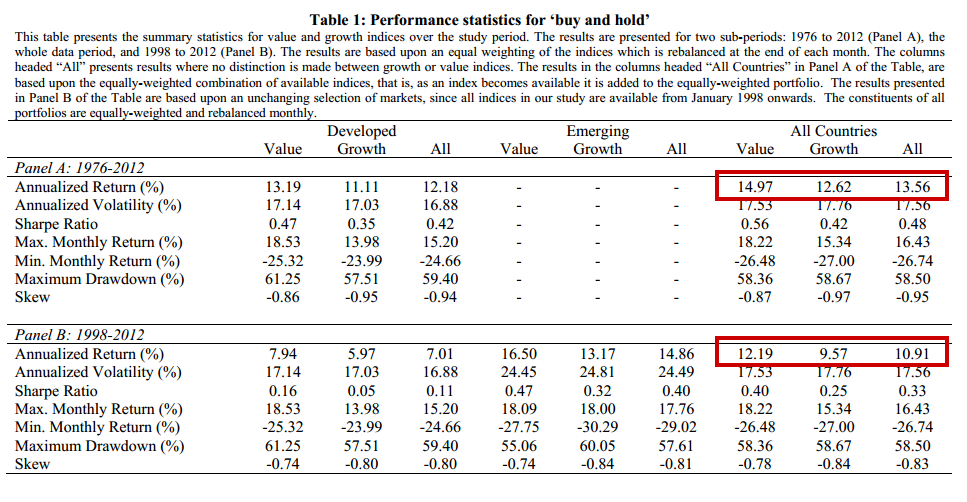

The authors first remind us that value beats growth:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

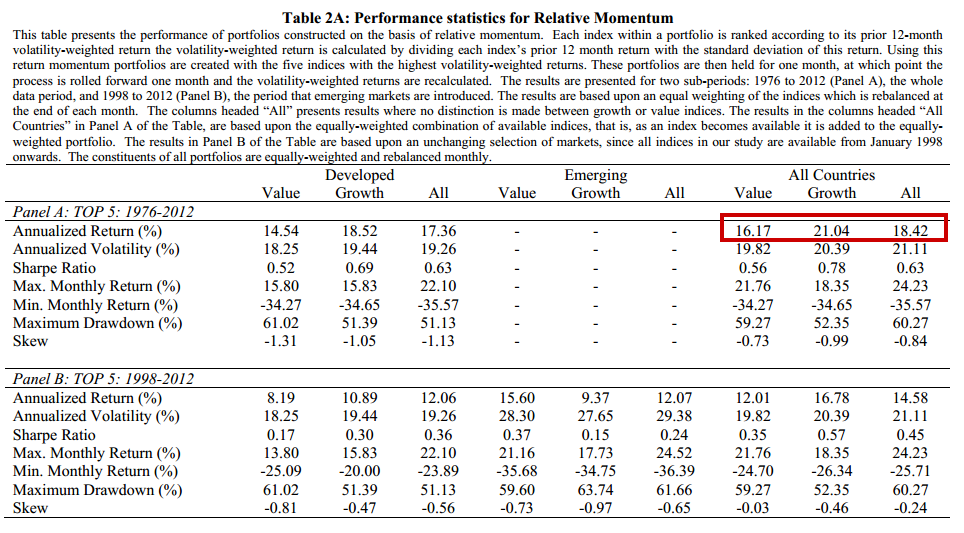

They also remind us that momentum works:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Next, they layer on Gary Antonacci’s dual momentum concepts and an MA trend-following rule (Meb’s good old fashioned moving average rule):

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.

Not bad!

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.