Sell Winners Too Early and Hold Losers Too Long

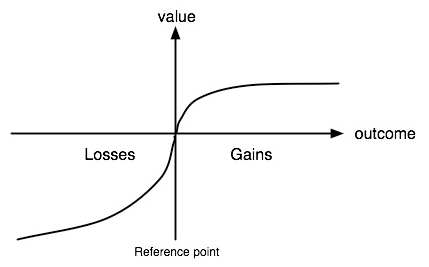

Researchers have explored the “disposition effect” for years, which describes how investors are more likely to sell a stock that has gone up in value than one that has gone down in value. We have a tendency to create mental accounts for each investment, and want to realize profits in every account and, simultaneously, under prospect theory, we are more inclined to avoid locking in losses than we are to letting our “winners run.”

Game: Hold or sell?

Imagine that you purchased Stock X for $50, which plunges to $40. There is an equal probability of stock gaining or failing by $10 in the future. Which of the two options would you choose?

- Option 1: Sell the stock now, and realize the loss of $10.

- Option 2: Continue holding the stock, knowing that you have a 50-50 chance of losing an additional $10 or breaking even.

Imagine that you purchased Stock Y for $50, which grows from $50 to to $60. There is an equal probability of stock gaining or falling from here, by an additional $10 in the future. What do you do?

- Option 1: Sell the stock now, and realize the gain of $10.

- Option 2: Continue holding the stock, knowing that you have a 50-50 chance of breaking even, or gaining an additional $10.

Empirical research has shown that most people choose Option 2 for the first question, and Option 1 for the second question. Yet the payouts and risk for both questions are identical: there should be no reason to choose different options.

Applications in Finance:

Suppose you own two stocks, consistent with the examples above: you purchased both stocks at $50, but Stock X has an embedded, or “paper,” loss of $10, while Stock Y has an embedded gain of $10. Assume you have no reason to believe one of the two stocks will perform better going forward, but you need to raise some money today to pay a tuition bill, and so you must sell one of them.

By now, it is obvious at this point that there is no basis for choosing to hold Stock X, with the bias-based hope that it will “come back.” There is, however, an additional consideration: Taxes.

Consider that if you want to “lock in” your gain on Stock Y, and sell it at a profit, you will realize a capital gain. By contrast, if you sell Stock X, with its embedded loss, you will reap a tax loss that can be used to offset taxable gains elsewhere in your portfolio. In the absence of a signal about future prospects for two given stocks, you choose which stock to sell in a way that minimizes your tax bill.

Andrea Frazzini has a great paper showing how disposition affects mutual fund managers:

This paper tests whether the tendency of investors to sell stocks in their portfolios that have gone up, not down, in value since purchase, known as the disposition effect, induce under-reaction to news, leading to return predictability and a post-announcement price drift. The disposition effect implies that stock prices under-react to bad news when more current holders are facing a capital loss, and under-react to good news when more current holders are facing a capital gain. I use a database of mutual funds holdings to construct a measure of reference prices for individual stocks. Using this new measure of capital gains, I show that post-event predictability is most severe where the disposition effect predicts the biggest under-reaction. Post-event drift is larger when the news and the capital gains overhang have the same sign, and the magnitude of the drift is directly related to the amount of unrealized capital gains (losses) experienced by the stock holders, prior to the event date. An event-driven equity strategy based on this effect yields monthly alphas of over 200 basis points.

References:

Shefrin H. & Statman M. (1985) “The disposition to sell winners too early and ride losers too long: theory and evidence,” The Journal of Finance, 40(3) ,777-790.

About the Author: Wesley Gray, PhD

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.