Introduction to Finance: Class 3

Bonds & Interest Rates

What are bonds? What is an interest rate?

Check this out:

Introduction to Bonds Video

Interest Rates Video

Key Concepts:

- Bonds

- Bond Basics

- Why Bonds?

- Bond Terminology

- Type of Bonds

- Mechanics of Bond Valuation

- Factors that Influence Bond Returns

- Real and Nominal Returns

- Bond Ratings

Bonds

Bond Basics

- When a corporation wishes to borrow money from the public (not from banks) on a long-term basis, it does so by selling (issuing) debt securities called bonds

- A typical bond has a fairly simple structure

- You loan a company some money

- The company pays you interest every period

- The company repays amount it borrowed at end of loan

- Debt Financing

- Differences between Debt & Equity Financing

- Debt

- Not an ownership interest

- Creditors do not have voting rights

- Interest is considered a cost of doing business and is tax deductible

- Creditors have legal recourse if interest or principal payments are missed

- Excess debt can lead to financial distress and bankruptcy

- Equity

- Ownership interest

- Common stockholders vote for the board of directors and other issues

- Dividends are not considered a cost of doing business and are not tax deductible

- Dividends are not a liability of the firm, and stockholders have no legal recourse if dividends are not paid

- An all equity firm can not go bankrupt merely due to debt since it has no debt

- Debt

- Differences between Debt & Equity Financing

Why Bonds?

Companies may issue bonds to finance operations. Most companies can borrow from banks, but view direct borrowing from a bank as more restrictive and expensive than selling debt on the open market through a bond issue. —Source

- Restrictive Covenants of Borrowing from Banks:

- Companies can’t issue any more debt until the bank loan is completely paid off

- Companies can’t participate in any share offerings until the bank loan is paid off

- Companies can’t acquire any companies until the bank loan is paid off

Covenants are rules placed on debt that are designed to stabilize corporate performance and reduce the risk to which a bank is exposed when it gives a large loan to a company. —Source

Solution to overcome covenants: Issue bonds!

Bond Terminology

- Face Value (or Par Value): principal amount repaid at end of loan

- Coupon: regular interest payment

- Coupon Rate: coupons per year quoted as percentage of face value

- Maturity: time until face value is paid (usually in years)

- Price: present value of expected future cash flows discounted at the market rate of interest

- Yield to maturity (YTM):

- Required market rate of return on similar bonds

- Rate that equates bond’s discounted cash flows with its price

- Quoted similar to annual percentage rate (APR)

- Bond Indenture: Contract between the company and the bondholders includes

- The basic terms of the bonds

- The total amount of bonds issued

- A description of property used as security, if applicable

- Call provisions

- Details of protective covenants

Type of Bonds

- Pure Discount Bonds

- Coupon = $0

- Always sell for less than par

- Present value < Future value

- Greatest price volatility

- video

- Level-Coupon Bonds

- Level Coupon; Principal repaid at maturity

- Consols

- Level Coupon; Unlimited maturity

- Government Bonds

- Treasury Securities

- Federal government debt

- T-bills – pure discount bonds with original maturity of one year or less

- T-notes – coupon debt with original maturity between one and ten years

- T-bonds – coupon debt with original maturity greater than ten years

- Municipal Securities

- Debt of state and local governments

- Varying degrees of default risk, rated similar to corporate debt

- Interest received is tax-exempt at the federal level

- Treasury Securities

- More bonds here

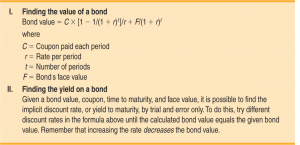

Mechanics of Bond Valuations

- How do we value bonds?

- Bonds are valued like any other bundle of cash flows

- We need to need to know:

- # periods until maturity

- Face value

- Coupon rate

- Yield to maturity

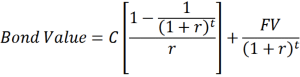

- Bond Value = PV of coupons + PV of face value

- Bond Value = PV annuity + PV of lump sum

r = per-period yield to maturity

t = number of periods until maturity

FV = face value

Bond Value: Example

- On May 11, 2009, Microsoft issued bonds for the first time

- Debt Investors Snap Up $3.75 Billion Offering, Giving Software Giant More Financial Firepower

- Microsoft issued three series of bonds:

- $2 billion of 2.95% Bonds due 2014

- $1 billion of 4.20% Bonds due 2019

- $750 million of 5.20% Bonds due 2039

- All bonds have a face value of $2000

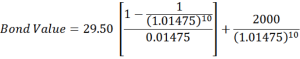

- What is the value of each of Microsoft’s 2.95% 2014 bonds at issuance if the yield to maturity is 2.95%?

- C = semiannual coupon = face value x semiannual coupon rate

- C = $2000 x (2.95% / 2) = $29.5

- r = semiannual market rate = YTM / coupon payments per year

- r = 2.95% / 2 = 1.475%

- t = periods until maturity = years until maturity x coupon per year

- t = 5 x 2 = 10

- Face value = $2000

- Value of Microsoft’s 2.95% 2014 bonds with YTM=2.95%

- C = semiannual coupon = face value x semiannual coupon rate

Bond Value = $2000

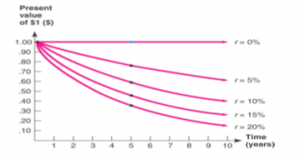

Bond Valuation and Changing Rates

- What happens to bond value when market rate changes

- Remember, as interest rate increases, PV of CF decreases

- So, as interest rates increase, bond prices decrease (& vice versa)

Bond Valuation: Market Rate Increases

- Suppose that one year after Microsoft issues its bonds, the market rate for similar bonds has risen to 4%

- What is value of each of Microsoft’s 2.95% 2014 bond?

- Coupon and face remain unchanged

- Semiannual periods until maturity = 4 x 2 = 8

- Per-period market rate = 4% / 2 = 2%

Bond Valuation: Discount Bonds

- Why are the Microsoft bonds trading at a “discount”?

- Microsoft bonds pay (2.95% coupon) less than what the market demands (4% YTM) for similar bonds

- By only paying $1,923.08 and receiving $29.50 semiannual coupons and $2,000 face value, investors earn the required 4%

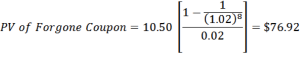

- Investors giving up $10.50 in coupon each period: $2,000 x (4% / 2) = $40 required > $29.50 received

- PV of giving up $10.50 every six months at market rate:

- $76.92 exactly equals discount of Microsoft bonds (2,000-1,923.08)

Discount and Premium Bonds

- If YTM = coupon rate, then bond value = face value

- If YTM > coupon rate, then bond value < face value

- Value below par = “discount” bond

- If YTM < coupon rate, then bond value > face value

- Value above par = “premium” bond

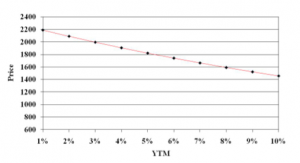

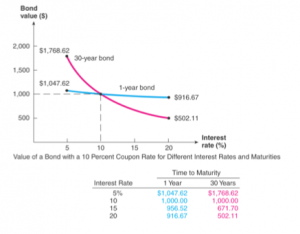

Relation between Bond Value and Yield to Maturity

Interest Rate Risk

- Change in price due to changes in interest rates

- Interest rates up, bond price down!

- Long-term bonds have more interest rate risk than short-term bonds

- More-distant cash flows are more adversely affected by an increase in interest rates

- Lower coupon rate bonds have more interest rate risk than higher coupon rate bonds

- More of the bond’s value is deferred to maturity (thus, for a longer time) if the coupons are small

Computing Yield to Maturity

- The yield to maturity is the rate that sets the present value of the bond’s future cash flows equal to its market value

- Solve for r in following equation

- YTM quoted like APR: YTM = r x coupon periods per yr

Yield to Maturity with Semiannual Coupons

- Suppose a bond with a 10% coupon rate and semiannual coupons, has a face value of $1,000, 20 years to maturity and is selling for $1,197.93.

- Is the YTM more or less than 10%?

- YTM = 8%

- What is the semiannual coupon payment?

- Semiannual coupon = $1,000 x (10% / 2) = $50

- How many periods are there?

- Periods to maturity = 20 x 2 = 40

- Is the YTM more or less than 10%?

· · · · ·

1. Test Your Knowledge (answers found below)- A. Suppose that two years after Microsoft issues its bonds, the market yield to maturity for similar bonds has fallen to 1%

- What is value of each of Microsoft’s 2.95% 2014 bond?

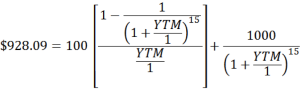

- B. Consider a bond with a 10% annual coupon rate, 15 years to maturity, and a par value of $1,000. The current price is $928.09.

- Will the yield be more or less than 10%?

- What is the yield to maturity?

Factors that Influence Bond Returns

- Real Rates

- When real rate is high all interest rates will tend to be high

- Inflation

- Investors demand compensation for expected erosion in buying power (“inflation premium”)

- Interest Rate Risk

- Investors demand compensation for bearing risk that interest rates will change in future (“interest rate risk premium”)

- Credit/Default Risk

- Investors demand “default risk premium” for risk that issuer will not be able to make all promised payments

- Taxes

- Investors demand “taxability premium” on taxable bonds

- Liquidity

- After investors buy bonds from company, they may want to sell them to another investor

- Many bonds do not trade very frequently

- Since investors prefer liquid assets (those that are easy to sell), they demand a “liquidity premium” for less liquid bonds

Real and Nominal Returns

- Nominal rate of return is the percent change in the number of dollars you have

- Real rate of return is the percent change in buying power

- The ex ante nominal rate of interest includes our desired real rate of return plus an adjustment for expected inflation

- The Fisher Effect defines the relationship between real rates, nominal rates, and inflation

- (1 + R) = (1 + r)(1 + h)

- R = nominal rate

- r = real rate

- h = expected inflation rate

- (1 + R) = (1 + r)(1 + h)

- Approximation

- R = r + h

Nominal vs. Real Return: Example

- If we require a 10% real return and we expect inflation to be 8%, what is the nominal rate?

- R = (1+r)(1+h) – 1

- R = (1.1)(1.08) – 1

- R = .188 = 18.8%

- Approximation: R = r + h

- Approximation: R = 10% + 8% = 18%

- Because the real return and expected inflation are relatively high, there is a significant difference between the actual Fisher Effect and the approximation.

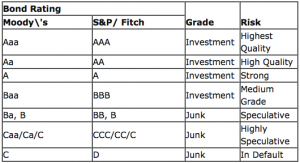

Bond Ratings

A bond rating is a grade given to a bond that indicates its credit quality. Private independent rating services provide these evaluations of a bond issuer’s financial strength or its ability to pay a bond’s principal and interest in a timely fashion. Bond ratings are expressed as letters ranging from “AAA,” which is the highest grade, to “C” or “D” (“junk”), which is the lowest grade.

—Source

- High Grade

- Moody’s Aaa and S&P AAA – capacity to pay is extremely strong

- Moody’s Aa and S&P AA – capacity to pay is very strong

- Medium Grade

- Moody’s A and S&P A – capacity to pay is strong, but more susceptible to changes in circumstances

- Moody’s Baa and S&P BBB – capacity to pay is adequate, adverse conditions will have more impact on the firm’s ability to pay

- Low Grade

- Moody’s Ba and B

- S&P BB and B

- Considered possible that the capacity to pay will degenerate.

- Very Low Grade

- Moody’s C (and below) and S&P C (and below)

- income bonds with no interest being paid, or

- in default with principal and interest in arrears

- Moody’s C (and below) and S&P C (and below)

Wrap-Up

- Bonds used by firms to finance projects

- Bonds valued using time value of money techniques

- Yield to maturity is market rate required on similar bonds

- Bond Return = Real return + Inflation premium + Interest rate risk premium + Default risk premium + Taxability premium + Liquidity premium

· · · · ·

Solutions

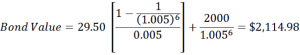

1.A

- Semiannual periods until maturity = 3 x 2 = 6

- Per-period market rate = 1% / 2 = 0.5%

1.B

- Market Value < Face Value à Discount bond

- Discount Bond → YTM > Coupon (10%)

- YTM = 11%

For more classes:

Education Series

About the Author: Victoria Tran

—

Important Disclosures

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Third party information may become outdated or otherwise superseded without notice. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency has approved, determined the accuracy, or confirmed the adequacy of this article.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

Join thousands of other readers and subscribe to our blog.